Electronic Shelf Labels (ESL) Market Size

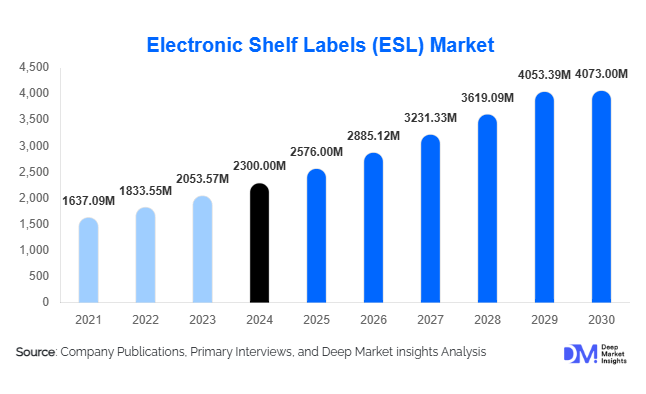

According to Deep Market Insights, the global electronic shelf labels market size was valued at USD 2,300 million in 2024 and is projected to grow from USD 2,576 million in 2025 to reach USD 4,073 million by 2030, expanding at a CAGR of 12.0% during the forecast period (2025–2030). The rapid adoption of automation in retail environments, demand for dynamic pricing, and the rise of omnichannel retail models are driving robust growth in the ESL market worldwide.

Key Market Insights

- Retail automation and digitalization are the primary forces propelling ESL adoption, enabling real-time price updates and inventory optimization.

- Europe leads the global ESL market, driven by high retail technology penetration in countries like France, Germany, and the U.K.

- Asia-Pacific is the fastest-growing region, with strong uptake in China, Japan, and South Korea supported by smart retail infrastructure.

- Full-graphic and e-paper ESL technologies are gaining momentum due to their superior visibility, energy efficiency, and multi-color display capabilities.

- Partnerships between retailers and ESL providers are expanding, with major chains integrating IoT and AI-based ESL systems for improved analytics and customer engagement.

- Cost reductions in e-ink and wireless communication modules are enhancing affordability and scalability across small and mid-sized retail outlets.

Latest Market Trends

Smart Retail and IoT Integration

Integration of electronic shelf labels with Internet of Things (IoT) platforms is transforming retail operations. ESL systems now communicate directly with inventory databases, point-of-sale systems, and pricing engines, enabling synchronized updates across multiple stores. IoT-enabled ESLs also collect customer engagement data, helping retailers refine marketing strategies and optimize product placement. These developments are positioning ESLs as a critical component of the connected retail ecosystem.

E-Paper and Energy-Efficient Displays Driving Sustainability

Retailers are increasingly adopting e-paper ESLs that consume minimal energy and support multi-year battery life. This sustainability-focused approach aligns with global efforts to reduce operational waste and carbon emissions. E-paper displays also enhance customer experience by offering crisp visibility under varied lighting conditions. Manufacturers are investing heavily in recyclable materials and low-energy communication technologies such as Bluetooth Low Energy (BLE) and NFC to further enhance eco-friendly deployments.

Electronic Shelf Labels Market Drivers

Rising Demand for Real-Time Price Automation

Retailers are under pressure to maintain competitive pricing amid fluctuating supply chains and online retail competition. ESL systems enable instant price synchronization across thousands of products, reducing manual errors and labor costs. The ability to implement dynamic pricing based on demand, time, or competitor pricing data is creating new value streams for supermarkets, convenience stores, and hypermarkets.

Growth of Omnichannel and Smart Store Concepts

The retail industry’s shift toward omnichannel models—where physical and digital stores integrate seamlessly—is fueling ESL adoption. ESLs serve as a bridge between online and offline channels by linking with mobile apps, digital shopping carts, and QR-based promotions. Smart stores are increasingly deploying ESLs as part of broader digital transformation initiatives to deliver interactive, data-driven, and efficient shopping experiences.

Market Restraints

High Initial Deployment Costs

Despite long-term operational benefits, the high upfront cost of hardware, installation, and integration limits ESL adoption, especially among small retailers. Upgrading legacy infrastructure and ensuring wireless connectivity across large store networks remain cost-intensive challenges, particularly in developing regions with constrained technology budgets.

Data Security and Integration Complexities

The integration of ESLs with enterprise systems exposes retailers to potential cybersecurity vulnerabilities. Data breaches or unauthorized access to pricing systems could disrupt retail operations. Additionally, integrating ESL solutions with multiple retail management software platforms often requires significant customization, slowing down large-scale deployments.

Electronic Shelf Labels Market Opportunities

AI-Driven Price Optimization

The integration of artificial intelligence and machine learning with ESL platforms offers opportunities for predictive pricing, demand forecasting, and customer behavior analytics. AI-enabled ESLs can automatically adjust prices based on real-time factors such as sales velocity, stock levels, and competitor activity. This data-centric approach is expected to become a key differentiator for large retail chains seeking margin optimization and improved customer retention.

Expansion into Non-Retail Sectors

Beyond traditional retail, ESL technology is finding new applications in industrial warehouses, healthcare facilities, and logistics hubs. Hospitals use ESLs for digital labeling of patient rooms and medications, while warehouses deploy them for dynamic inventory tracking. These cross-sector opportunities are expected to open new revenue streams for ESL manufacturers and software providers.

Product Type Insights

Full-graphic ESLs dominate the market due to their high-resolution, multi-color displays that enable dynamic content and graphical representation. These ESLs enhance customer engagement by providing detailed product information, promotional content, and visually appealing displays, making them particularly popular in premium retail environments. Segmented ESLs remain widely used in cost-sensitive retail segments where minimal information display is sufficient, combining affordability with easy integration into existing systems. E-paper ESLs are witnessing the fastest growth, fueled by low power consumption, long battery life, and enhanced readability, making them ideal for supermarkets, convenience stores, and high-volume retail environments with frequent pricing updates. Their sustainability credentials also align with the increasing environmental focus in global retail markets.

Communication Technology Insights

Radio Frequency (RF) technology holds the largest market share, offering reliable long-range communication suitable for large retail stores and multi-store deployments. Bluetooth Low Energy (BLE) and Near Field Communication (NFC) are rapidly gaining traction due to their flexibility, mobile connectivity, and low energy consumption, allowing retailers to implement battery-operated ESLs with minimal maintenance. Infrared (IR) technology, while cost-effective, is limited by its short range and line-of-sight requirements, and is therefore more suited for specialized applications such as secure displays in small areas.

Application Insights

Hypermarkets and supermarkets account for the majority of ESL installations, driven by the need to efficiently manage large product assortments and frequent price updates. High customer footfall and complex inventory management create a strong requirement for automated pricing and real-time promotional displays. Convenience stores are increasingly deploying ESLs to enable rapid pricing updates and dynamic promotions, supporting competitive positioning and enhancing operational efficiency. Specialty stores and pharmacies utilize ESLs for detailed product information, compliance labeling, and improved customer interaction, aligning with their focus on product differentiation and quality. Industrial and logistics sectors are emerging as growing applications for ESLs, with dynamic inventory tracking, asset management, and operational optimization driving adoption beyond traditional retail environments.

| By Product Type | By Communication Technology | By Application | By Display Size |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe dominates the global ESL market, with strong adoption in France, Germany, and the Nordics. The region’s growth is driven by established retail infrastructure, a focus on digital transformation, and strong sustainability initiatives. Retailers are increasingly deploying full-graphic and e-paper ESLs to reduce operational costs, minimize environmental impact, and enhance customer engagement. Leading chains such as Carrefour, Tesco, and Metro AG are expanding ESL integration across hundreds of locations, combining energy-efficient e-paper displays with AI-driven pricing solutions. Strict regulatory support for digitalization and environmental compliance further reinforces ESL adoption as a standard practice across European retail formats.

Asia-Pacific

Asia-Pacific is expected to witness the fastest growth through 2030, driven by rapid urbanization, technological advancement, and the expansion of organized retail in China, India, Japan, and South Korea. Government-backed digital economy initiatives and growing e-commerce ecosystems are accelerating smart retail adoption, particularly for e-paper ESLs in hypermarkets and supermarkets. The rising middle-class population, increasing disposable income, and demand for dynamic in-store promotions fuel ESL deployments. Additionally, retail modernization in India and Southeast Asia, coupled with cost-effective solutions such as segmented LCD and basic e-paper ESLs, provides a compelling proposition for retailers seeking to optimize operations and improve customer experience.

North America

North America is experiencing strong ESL adoption, supported by the presence of major retail chains such as Walmart, Kroger, and Target, which are driving large-scale digital store transformations. High technological adoption rates, robust IT infrastructure, and a focus on operational efficiency accelerate the integration of full-graphic and BLE/NFC-enabled ESLs. Retailers leverage AI-powered ESLs for predictive pricing, dynamic promotions, and customer engagement analytics. Hypermarkets and supermarkets benefit from real-time pricing updates and inventory optimization, while specialty stores and convenience chains adopt ESLs to enhance product transparency and improve shopper experience.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is investing heavily in smart retail infrastructure, integrating ESLs in modern malls, hypermarkets, and luxury retail outlets. High-income populations, government-backed smart city initiatives, and retail modernization are key drivers for ESL adoption. In Africa, markets such as South Africa and Kenya are gradually embracing ESL solutions, especially in urban retail formats, supported by the expansion of organized retail, rising consumer awareness, and demand for operational efficiency in high-footfall stores.

Latin America

Latin America is witnessing steady ESL adoption, with Brazil, Mexico, and Chile leading the market. Organized retail expansion, growing urban populations, and the increasing need for automated pricing and promotional management drive adoption. Hypermarkets and convenience stores are investing in segmented LCD and e-paper ESLs to manage diverse product categories efficiently, reduce pricing errors, and enhance in-store customer engagement despite infrastructure and cost challenges.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Electronic Shelf Labels Market

- SES-imagotag SA

- Pricer AB

- E Ink Holdings Inc.

- Displaydata Ltd.

- Zkong Network

- Opticon Sensors Europe B.V.

- Hanshow Technology Co., Ltd.

- SoluM Co., Ltd.

Recent Developments

- In June 2025, SES-imagotag launched a next-generation AI-driven ESL system featuring in-store analytics and dynamic promotional pricing automation.

- In April 2025, Pricer AB announced a partnership with a major European supermarket chain to deploy over 20 million ESL units across 500 stores by 2027.

- In February 2025, Zkong introduced cloud-based ESL management software enabling real-time synchronization across international retail networks.

- In January 2025, E Ink Holdings unveiled new color e-paper ESL displays designed to enhance visibility and reduce energy consumption by 30% compared to previous models.