E-Reader Market Size

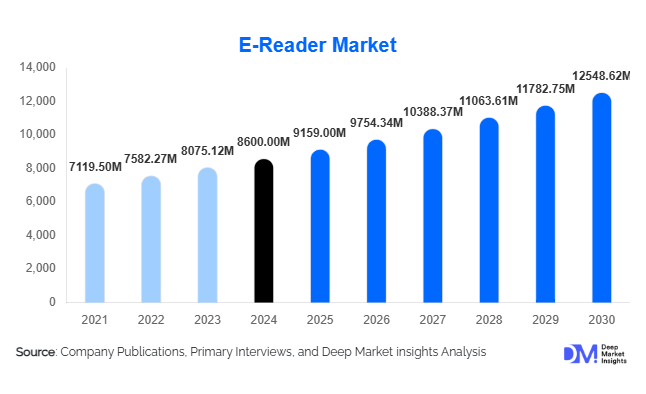

According to Deep Market Insights, the global e-reader market size was valued at USD 8,600.00 million in 2024 and is projected to grow from USD 9,159.00 million in 2025 to reach USD 12,548.62 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by the rising adoption of digital reading content, growing demand for distraction-free reading devices, institutional and educational procurement, and technological advancements such as color e-ink displays and note-taking capabilities.

Key Market Insights

- E-ink technology dominates the market, offering eye-friendly reading and extended battery life, making it the preferred choice for dedicated readers.

- 6–8 inch screen size devices hold the majority share globally, balancing portability, readability, and affordability.

- North America currently leads in market share due to high digital content adoption, established e-reader ecosystems, and strong consumer preference for leisure reading.

- Asia-Pacific is the fastest-growing region, driven by rising digital literacy, education-focused device procurement, and emerging middle-class demand in China and India.

- Online retail dominates distribution, offering consumers direct access to devices, bundled content, and promotional offers.

- Technological innovation, including color e-ink, stylus-enabled note-taking, and cloud synchronization, is reshaping user experiences and expanding premium market segments.

Latest Market Trends

Color E-Ink and Large Screen Devices

Manufacturers are increasingly introducing devices with color e-ink displays and larger screens (above 8 inches) to cater to niche applications such as graphic novels, PDFs, and professional reading. These innovations allow e-readers to extend beyond traditional leisure reading and appeal to academic, professional, and enterprise users. Devices with stylus support and enhanced annotation capabilities are also gaining traction, driving higher-value segments and differentiating dedicated e-readers from tablets and smartphones.

Institutional and Education Adoption

The education sector has emerged as a key growth driver for the e-reader market. Schools, universities, and educational institutions are procuring devices for students to reduce print costs, enable interactive learning, and support remote education initiatives. Bulk procurement contracts and partnerships with content providers are creating stable demand, especially in emerging markets. Governments are also supporting digital literacy initiatives, which further strengthen the adoption of e-readers in institutional channels.

E-Reader Market Drivers

Rising Digital Content Consumption

The proliferation of e-books, digital magazines, and subscription reading services has fueled demand for dedicated reading devices. E-readers offer an optimized reading experience with minimal eye strain and long battery life, which tablets and smartphones cannot fully replicate. Expanding content platforms and localized e-book catalogs further encourage adoption across regions and age groups.

Technological Advancements and Device Innovation

Color e-ink displays, larger form factors, stylus-enabled annotation, front-lighting, and cloud-based synchronization have enhanced the utility of e-readers. These features enable professional, educational, and leisure applications, allowing manufacturers to capture higher-margin segments and maintain market relevance in the face of tablet competition.

Institutional and Corporate Procurement

Educational institutions and corporate organizations are increasingly adopting e-readers for digital textbooks, training manuals, and reference materials. Such bulk procurement initiatives ensure steady demand and promote the development of devices with specialized features, including note-taking and cloud integration.

Market Restraints

Competition from Tablets and Smartphones

Multifunctional tablets and smartphones serve as substitutes for e-readers, offering digital reading apps alongside other functionalities. Consumers seeking all-in-one devices often choose tablets or phones over single-purpose e-readers, limiting growth in some consumer segments.

Limited Content and Language Support in Emerging Markets

In regions with lower e-book availability or inadequate local language content, the adoption of dedicated e-readers remains constrained. Market growth in these areas depends on the expansion of content libraries, localization, and partnerships with publishers.

E-Reader Market Opportunities

Education and Institutional Expansion

The growing need for digital learning tools and cost-efficient educational solutions presents a substantial opportunity. Manufacturers can focus on developing devices tailored for students, with annotation, stylus support, and large-screen options. Partnerships with e-textbook providers and government initiatives promoting digital literacy can further accelerate adoption in this segment.

Emerging Market Penetration

Asia-Pacific, Latin America, and parts of the Middle East and Africa present high-growth opportunities. Rising digital literacy, expanding broadband access, and government-backed education programs are driving demand. Affordable devices localized for regional content and languages can capture significant market share in these emerging regions.

Premium and Technologically Advanced Devices

Devices with color e-ink, stylus-enabled annotation, large screens, and cloud synchronization appeal to professional, academic, and leisure users seeking high-end experiences. Manufacturers can leverage technological differentiation to create premium offerings, maintain higher margins, and counter competition from multifunctional tablets.

Product Type Insights

E-ink devices dominate the e-reader market, accounting for approximately 70% of the 2024 market. Their ultra-low power consumption, extended battery life, and eye-friendly reading experience make them the preferred choice for long-form reading, driving mainstream adoption. Color e-ink devices, while representing a smaller share, are increasingly gaining traction in premium and education segments due to the ability to display comics, textbooks, diagrams, and other interactive content, appealing to users willing to pay higher ASPs. Hybrid LCD/LED devices cater primarily to niche professional and graphic content use cases, offering multi-media support, though weaker battery performance limits mass adoption.

Screen Size Insights

6–8-inch devices hold the largest market share (67.7% of 2024 revenue), providing the optimal balance between portability, reading comfort, and cost-effectiveness. Devices smaller than 6 inches are preferred for casual reading and commuters seeking lightweight, impulse-purchase options. Larger devices (>8 inches) are increasingly adopted in education and professional settings for PDFs, textbooks, and content annotation. Ultra-large screens (10 inches) are emerging as alternatives to small tablets, especially for interactive learning and professional document review.

Distribution Channel Insights

Online retail dominates the market, capturing around 65% of market value, driven by wide reach, dynamic pricing, and bundled content offers. Offline retail remains significant in emerging regions where first-time buyers seek hands-on evaluation. Institutional procurement, including schools, universities, and libraries, is steadily increasing due to predictable volume contracts, long product lifecycles, and government or NGO-driven digital literacy initiatives. Direct-to-consumer sales allow manufacturers to maintain higher margins and control ecosystem integration.

End-Use Insights

Individual consumers for leisure reading account for the largest demand, representing roughly 60% of the 2024 market. The fastest-growing end-use segments are education and corporate/professional adoption, driven by curriculum adoption, enterprise document distribution, and digital training programs. Institutional and enterprise demand is expected to grow at an 8–10% CAGR, outpacing the moderate 4–5% CAGR of the consumer segment. Libraries and public institutions are increasingly procuring devices for long-term digital content lending programs.

| By Product Type | By Screen Size | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest market, holding 30% of global revenue in 2024, with the U.S. and Canada leading adoption. Drivers include high per-capita e-book consumption, mature retail and online distribution channels, strong brand awareness, and early adoption of digital reading devices. Institutional adoption, subscription-based reading services, and advanced digital ecosystems further reinforce growth, particularly among leisure readers and academic institutions.

Europe

Europe accounts for 25% of the market, led by the U.K., Germany, and France. Key growth drivers are strong library and public institution procurement programs, regulatory frameworks promoting accessibility, and extensive multilingual e-book catalogs that encourage device use across multiple languages. Consumers increasingly adopt e-readers for sustainability reasons, preferring digital content over printed material. Institutional and education procurement is a steady growth engine.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and South Korea. The rise of a digital-savvy middle class, economy pricing models for price-sensitive consumers, and localized content availability are major growth drivers. Government-backed educational initiatives and institutional adoption further fuel expansion. The availability of affordable devices in budget and mid-tier segments accelerates penetration in schools, libraries, and households.

Latin America

Latin America, including Brazil, Argentina, and Mexico, represents 5–10% of the market. Regional growth is driven by expanding online retail channels, improving digital payment infrastructure, and increased awareness of digital reading. Budget and mid-tier devices dominate due to price sensitivity, while institutional adoption in education and corporate sectors is emerging gradually. Growth is supported by rising digital literacy and the expansion of local content platforms.

Middle East & Africa

MEA accounts for 5% of the global e-reader market. Growth is gradual but steady, driven by education projects, NGO and library initiatives, and shipments of low-cost devices. Connectivity improvements, infrastructure development, and government-backed digital literacy programs are unlocking adoption potential. Institutional demand from schools and universities is the primary driver, while consumer uptake remains limited due to content availability and higher costs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the E-Reader Market

- Amazon (Kindle)

- Rakuten Kobo

- Barnes & Noble

- PocketBook International

- Onyx International

- Sony Corporation

- Xiaomi Corporation

- Hanvon Technology

- Tolino Alliance

- Bookeen

- Aluratek Inc.

- Ematic Corporation

- Bigme

- Boox (by Onyx)

- Others

Recent Developments

- In March 2025, Amazon launched a new Kindle model with color e-ink and stylus support, targeting academic and professional users.

- In April 2025, Kobo introduced a series of large-screen e-readers optimized for graphic novels and PDFs, expanding its premium device portfolio.

- In June 2025, Onyx International announced partnerships with multiple universities in the Asia-Pacific to supply note-taking e-readers for educational programs.