Dough Maker Market Size

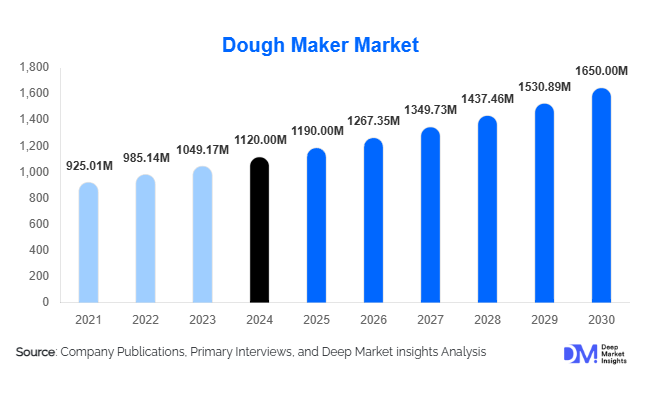

According to Deep Market Insights, the global dough maker market size was valued at USD 1,120 million in 2024 and is projected to grow from USD 1,190 million in 2025 to reach USD 1,650 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The dough maker market growth is primarily driven by rising home-baking trends, increasing adoption in commercial bakeries, and technological innovations such as programmable and IoT-enabled appliances that enhance convenience and efficiency for both residential and commercial users.

Key Market Insights

- Residential adoption is rising globally, fueled by the popularity of DIY baking, convenience-focused cooking, and social media influence encouraging home baking culture.

- Commercial bakery and foodservice demand is growing, particularly in urban areas, driving the market for high-capacity and programmable dough makers capable of handling large-volume production.

- North America dominates the dough maker market, with the U.S. and Canada leading demand due to high disposable income and preference for modern kitchen appliances.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class income, urbanization, and the spread of western-style bakeries in India, China, and Japan.

- Technological adoption, including programmable modes, smart appliance integration, and multifunctional kneading features, is reshaping consumer preferences and driving premium product sales.

- Online retail is emerging as a key distribution channel, offering consumers easy access to product comparisons, reviews, and doorstep delivery, especially in mature and emerging markets.

Latest Market Trends

Smart and Programmable Dough Makers Gaining Popularity

Consumers are increasingly preferring programmable dough makers that allow precise control over kneading, rising, and baking processes. IoT-enabled models allow app-based monitoring and customizable recipes, catering to tech-savvy users seeking convenience and consistency in home baking. Commercial bakeries are also adopting smart units for high-volume production and operational efficiency. Manufacturers are enhancing their offerings with features such as multiple dough programs, timer-based automation, and energy-efficient designs. This trend supports both premium residential adoption and productivity-focused commercial usage, creating opportunities for innovation-led growth.

Home Baking Culture Driving Demand

The growing popularity of home baking is a major driver for dough maker adoption, fueled by lifestyle trends, social media content, and DIY cooking shows. Consumers increasingly value fresh, homemade bread, pizza, and pastry products, which boost sales of residential dough makers. Customizable baking experiences and compact designs further appeal to urban households. During festive seasons and holidays, demand surges significantly, with product innovation, recipe guides, and bundled accessories creating additional engagement and consumer loyalty.

Dough Maker Market Drivers

Rising Home Baking Trends

Social media, cooking shows, and lifestyle content have encouraged more households to bake at home. Consumers are seeking appliances that reduce manual labor while ensuring consistent dough quality. Dough makers provide an ideal solution, supporting a variety of recipes such as bread, pizza, pastries, and specialty doughs, thereby expanding residential demand globally.

Growth of Commercial Bakeries and the Foodservice Industry

The expansion of cafes, hotels, and bakery chains globally has created strong demand for commercial-grade dough makers capable of high-volume production. Urbanization, rising disposable income, and changing dietary preferences support the adoption of efficient, programmable units in both developed and emerging markets. New entrants in the commercial space are increasingly relying on modern dough makers for consistent product quality and operational efficiency.

Technological Advancements and Smart Appliances

Programmable dough makers, IoT-enabled devices, and multifunctional kneading features are attracting tech-savvy and health-conscious consumers. Smart appliances allow remote monitoring, recipe customization, and automated baking cycles. Energy-efficient designs are also gaining traction, supporting consumer preferences for sustainable kitchen solutions.

Market Restraints

High Cost of Commercial Models

Industrial-grade dough makers involve substantial upfront investment, which can deter small-scale bakeries or start-ups from adoption. The high price point limits market penetration in price-sensitive regions and constrains overall growth in emerging markets.

Volatility in Raw Material Costs

Fluctuating prices for stainless steel, electronic components, and motors directly impact the cost and profit margins of dough maker manufacturers. These variations can lead to higher consumer prices and may slow adoption rates, particularly in developing regions.

Dough Maker Market Opportunities

IoT-Enabled and Smart Appliances

Smart dough makers that integrate with mobile apps, programmable cycles, and cloud-based recipes offer opportunities for premium product adoption. Companies can create value-added services, such as subscription-based recipes, app-linked cooking tips, and remote appliance monitoring, thereby generating recurring revenue streams and enhancing customer engagement.

Expansion into Emerging Markets

Rising urbanization and disposable income in countries such as India, China, Brazil, and Mexico provide a significant opportunity for growth. Tailoring products to local preferences, including smaller capacity units for home use and cost-efficient commercial models, can increase adoption rates and revenue potential. These regions also offer high growth potential for both residential and commercial segments due to a growing culture of home baking and café proliferation.

Sustainable and Energy-Efficient Models

Increasing consumer awareness of energy consumption and sustainability is encouraging manufacturers to develop eco-friendly dough makers. Products with lower power consumption, recyclable materials, and energy certifications are likely to gain a competitive edge. Green initiatives also enhance brand perception and align with global environmental trends, expanding market appeal.

Product Type Insights

Automatic dough makers dominate the market with a share of 42% in 2024, driven by ease of use, consistency, and versatility. Semi-automatic units remain relevant for small commercial operations, while high-capacity commercial models cater to large bakeries and foodservice providers. The trend toward multifunctional, programmable, and smart units is shaping consumer and commercial adoption globally.

Application Insights

Residential use remains the largest application segment with 50% market share, driven by home-baking trends, convenience, and social media influence. Commercial use, including restaurants, cafes, and bakery chains, accounts for a growing share due to the need for high-volume dough production. Institutional applications such as schools, hospitals, and catering services are niche but steadily expanding. Export-driven demand from regions lacking domestic production, including parts of Africa and the Middle East, is further contributing to market growth.

Distribution Channel Insights

Online retail, including e-commerce and D2C platforms, accounts for 35% of the market and is the fastest-growing channel, offering consumers easy access, comparison options, and doorstep delivery. Offline retail remains critical in developed markets with strong brand presence and physical retail preference. Direct B2B sales dominate commercial-grade dough makers, enabling manufacturers to supply bakeries and foodservice chains efficiently. Digital marketing and social media promotions increasingly influence buying decisions, particularly in the residential segment.

End-Use Insights

Residential consumers drive the largest portion of demand, seeking convenience, energy efficiency, and variety in baking applications. Commercial bakeries, hotels, and restaurants require high-capacity, programmable machines to improve productivity. Institutional buyers, including catering services, are exploring specialized models. Emerging uses, such as small-scale artisan bakeries and home-based businesses, are expanding market reach. Export demand is increasing for high-quality dough makers in regions with limited local production.

| By Product Type | By Technology | By Capacity | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 32% of the global market, with the U.S. and Canada leading residential and commercial adoption. High disposable income, modern kitchen trends, and lifestyle-focused baking support strong demand. Technologically advanced models and e-commerce growth further enhance market penetration.

Europe

Europe accounts for 28% of the market, led by Germany, France, and the U.K. Strong bakery culture, premium appliance adoption, and energy-efficiency awareness drive both residential and commercial sales. Demand for programmable and multifunctional dough makers is particularly high.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a 7.5% CAGR, led by India, China, and Japan. Rapid urbanization, rising middle-class income, and the adoption of western-style baking in homes and commercial settings support growth. Online retail and social media influence are accelerating consumer adoption.

Latin America

Brazil and Mexico are key markets, with increasing demand from urban households and growing café culture. Outbound import demand is driven by quality and brand preference. Market share is around 10% in 2024.

Middle East & Africa

The Middle East, led by the UAE, Saudi Arabia, and Qatar, is adopting imported premium dough makers, particularly for luxury residential and commercial use. Africa’s demand is niche but growing in urban centers and institutional buyers, driven by imported industrial-grade units.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Dough Maker Market

- Panasonic

- Breville

- Cuisinart

- Kenwood

- Hamilton Beach

- Moulinex

- KitchenAid

- Sencor

- Morphy Richards

- Russell Hobbs

- Severin

- Oster

- Tristar

- Ariete

- Sunbeam

Recent Developments

- In March 2025, Breville launched a new IoT-enabled programmable dough maker in North America, offering remote app control and cloud recipe integration.

- In February 2025, Panasonic introduced energy-efficient commercial dough makers in Europe, reducing power consumption by 20% for bakery chains.

- In January 2025, KitchenAid expanded its small-capacity dough maker line in Asia-Pacific, targeting urban home bakers and leveraging online retail channels.