DNA-Based Customized Vitamin Formulations Market Size

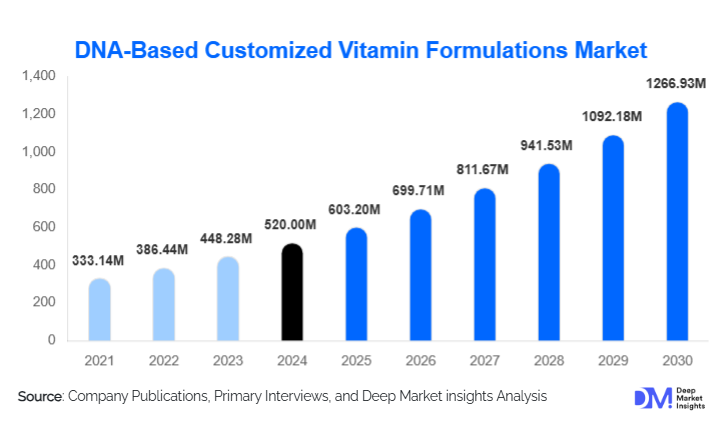

According to Deep Market Insights, the global DNA-based customized vitamin formulations market size was valued at USD 520 million in 2024 and is projected to grow from USD 603.20 million in 2025 to reach USD 1,266.93 million by 2030, expanding at a CAGR of 16.0% during the forecast period (2025–2030). Market growth is primarily driven by the rising adoption of genomic testing, increasing consumer shift toward personalized nutrition, and the expansion of direct-to-consumer (DTC) subscription models that integrate genetic insights with tailored supplement formulations.

Key Market Insights

- SNP-based genetic testing remains the dominant technology, accounting for 57.8% of the market due to its affordability, accessibility, and strong nutrigenomic relevance.

- Vitamin deficiency assessment is the leading application segment, representing 43.5% of global demand, as consumers seek personalized solutions for nutrient optimization.

- Direct-to-consumer (DTC) platforms hold the majority share, capturing 53.6% of the market through subscription-based custom vitamin packs and at-home test kits.

- North America leads the global market with a 44.2% share, driven by strong adoption of DNA testing and high consumer spending on personalized wellness.

- Asia-Pacific is the fastest-growing region due to rising middle-class incomes, expanding digital health ecosystems, and increased affordability of genetic testing.

- Integration of multi-omics, AI analytics, and wearable data is redefining personalization by enabling adaptive, continuous micronutrient optimization.

What are the latest trends in the DNA-based customized vitamin market?

Expansion of Multi-Omics Personalized Nutrition

Companies are moving beyond single-modality DNA testing toward integrated multi-omics platforms that combine genomics, microbiome sequencing, metabolomics, and lifestyle data. This creates hyper-personalized supplement formulations tailored to multiple biological layers. Sophisticated algorithms analyze genetic predispositions alongside gut function and real-time metabolic markers to refine vitamin dosages. This trend is accelerating partnerships between genomics companies, biotech labs, and digital health startups. The approach enhances efficacy, expands product differentiation, and appeals to advanced health users seeking precision wellness.

AI-Driven Supplement Personalization & Adaptive Formulations

Artificial intelligence is becoming central to nutrient interpretation, enabling continuous and dynamic vitamin personalization. AI engines ingest genetic data, wearable metrics (sleep, HRV, activity), and follow-up biomarker tests to automatically adjust nutrient levels in monthly supplement packs. Consumers receive real-time health insights via apps and dashboards. This technology-forward approach is attracting younger and tech-savvy consumers, boosting subscription retention rates. Companies are increasingly investing in predictive analytics, automated formulation systems, and digital triage tools that enhance customer engagement and supplement precision.

What are the key drivers in the DNA-based customized vitamin formulations market?

Growing Consumer Demand for Personalized Wellness

Consumers are shifting from generic multivitamins toward individualized solutions that reflect their unique biology. Rising awareness of nutrigenomics, greater access to educational content, and the popularity of at-home DNA kits are fueling market demand. Personalized vitamin regimens are perceived as more effective, targeted, and aligned with preventive health trends. This demand is particularly strong among millennials and health-conscious adults seeking science-backed wellness solutions. Subscription-based models further enhance convenience and long-term engagement.

Declining Genetic Testing Costs and Digital Health Expansion

The cost of SNP and NGS-based testing has dropped significantly over the past decade, enabling broader adoption of DNA-informed nutrition. As genetic kits become mainstream, companies can scale personal vitamin programs across global markets at competitive price points. Meanwhile, digital health platforms enhance user experience through app-based recommendations, automated supplement delivery, and ongoing biomarker monitoring. This convergence of affordable genomics and digital health ecosystems is a major accelerator for industry growth.

What are the restraints for the global market?

Regulatory Uncertainty and Scientific Validation Gaps

The regulatory environment for nutrigenomics-based supplements varies significantly across regions, creating compliance challenges. Many markets lack standard guidelines for genetic health claims, resulting in skepticism among healthcare professionals and consumers. Without rigorous clinical validation, companies may struggle to expand into medical or insurance-supported channels. This restraint affects market credibility and slows adoption among risk-averse users.

Data Privacy Concerns and Genetic Information Sensitivity

Genetic data is highly sensitive, and concerns about storage, usage, and sharing can deter consumers. High-profile data breaches in the broader genomics space have heightened caution, pushing companies to invest heavily in encryption, secure cloud infrastructure, and transparent consent frameworks. Despite these efforts, privacy fears remain a significant barrier, particularly in regions with strict data protection laws such as the EU (GDPR).

What are the key opportunities in the DNA-based customized vitamin industry?

Integration with Clinical Nutrition and Preventive Healthcare

Healthcare institutions and practitioners are increasingly exploring genomics to enhance preventive care. DNA-guided vitamin optimization for metabolic health, nutrient deficiencies, aging, and chronic disease prevention creates a strong opportunity for clinical partnerships. As insurers begin evaluating coverage for preventive genomic services, companies offering clinically validated formulations may unlock high-volume, high-trust channels beyond DTC models.

Expansion into Emerging Markets with Localized Genomic Panels

Asia-Pacific, Latin America, and the Middle East present substantial growth opportunities as genetic testing becomes more affordable. Localized SNP panels tailored to region-specific traits can improve accuracy and market relevance. Governments are investing heavily in genomics infrastructure, while rising middle-class health awareness supports demand for personalized nutrition. These dynamics position emerging markets as high-growth regions for DTC subscription models and clinical deployments.

Product Type Insights

SNP-based DNA tests dominate due to affordability, validated nutrigenomic markers, and compatibility with DTC models. NGS and microarray technologies are expanding their footprint, offering deeper genetic insights suitable for advanced personalization tiers. Subscription-based custom vitamin packs remain the most popular product format, delivering monthly nutrient sachets tailored to individual genetic profiles. Companies are also introducing premium formulations that integrate antioxidants, longevity compounds, and gut-supportive nutrients based on multi-omics data. One-off DNA testing bundled with periodic supplement purchases is popular among price-sensitive consumers.

Application Insights

Vitamin deficiency assessment leads the market as consumers seek targeted solutions for micronutrient optimization. Metabolic health applications are growing rapidly, driven by rising rates of obesity, diabetes, and metabolic syndrome. Athletic performance-based formulations are gaining adoption among fitness enthusiasts and sports professionals who utilize genetic insights to tailor recovery, endurance, and nutrient utilization. Longevity and anti-aging applications are emerging as a high-value niche, integrating genomic markers related to oxidative stress, methylation, and inflammation.

Distribution Channel Insights

DTC platforms dominate the market through online portals, app-based assessments, and subscription vitamin packs delivered directly to consumers. Healthcare provider channels are gaining traction, particularly in preventive and functional medicine clinics adopting genomics-informed nutrition. Retail pharmacies and specialty nutrition stores play a smaller but expanding role as major brands launch test kits and personalized vitamin lines. Membership-based wellness clubs and digital health ecosystems are emerging distribution avenues that offer continuity programs and multi-omics add-ons.

End-User Insights

General wellness consumers represent the largest end-user segment, prioritizing personalized nutrition for daily health optimization. Clinical users—including individuals with metabolic or micronutrient-related conditions—form a rapidly expanding segment as healthcare adoption grows. Athletes and fitness-focused users embrace DNA-based vitamin formulations for performance optimization, recovery enhancement, and injury prevention. Older adults increasingly value genomic insights to support aging, cognitive health, and chronic disease prevention.

| By Test Type | By Formulation Type | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market with a 44.2% share, supported by high adoption of genetic testing, mature digital health ecosystems, and significant investment in personalized nutrition startups. The U.S. leads global subscription volumes, while Canada shows strong growth in preventive genomic care. Consumer readiness to adopt DNA-driven solutions and favorable reimbursement trials create sustained momentum.

Europe

Europe demonstrates strong uptake, especially in Germany, the U.K., and France, driven by health literacy, rising interest in nutrigenomics, and structured regulatory frameworks. European consumers are highly receptive to personalized wellness programs, supporting rapid market penetration. Strict data protection regulations foster trust, while clinical-genomic integration accelerates in advanced healthcare systems.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by expanding middle-class populations, affordable genetic testing, and rising lifestyle disease burdens. China and India are high-opportunity markets for DTC subscription models. Japan and South Korea exhibit strong demand for high-precision and longevity-focused formulations. Increasing digital health engagement and local genomic initiatives further enable growth.

Latin America

Latin America shows emerging demand, particularly in Brazil and Mexico, where urban consumers are adopting personalized nutrition at increasing rates. Limited local genomic infrastructure has created opportunities for imported test kits and supplements. Growing preventive health awareness and an expanding wellness industry support steady market development.

Middle East & Africa

The Middle East, led by the UAE, Saudi Arabia, and Qatar, is becoming a premium market for personalized nutrition due to high-income populations and strong adoption of luxury wellness technologies. Africa is in the early stages, with South Africa showing the most traction, driven by urban wellness trends and expansions of genomic testing labs. Government-led genomics initiatives and rising demand for preventive care will support long-term growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the DNA-Based Customized Vitamin Market

- 23andMe, Inc.

- Nestlé Health Science (Persona Nutrition)

- Viome Life Sciences

- Prenetics (DNAfit)

- Nutrigenomix Inc.

- GenoPalate

- InsideTracker

Recent Developments

- In May 2025, Viome announced the expansion of its multi-omics platform, integrating metatranscriptomic data to deliver next-generation personalized vitamin formulations.

- In April 2025, Nestlé Health Science strengthened its Persona Nutrition operations with new AI-powered micronutrient personalization models for subscription customers.

- In February 2025, Prenetics (DNAfit) launched a clinical genomics partnership to bring prescription-grade personalized vitamin formulations into preventive healthcare clinics.