Decorative Coatings Market Size

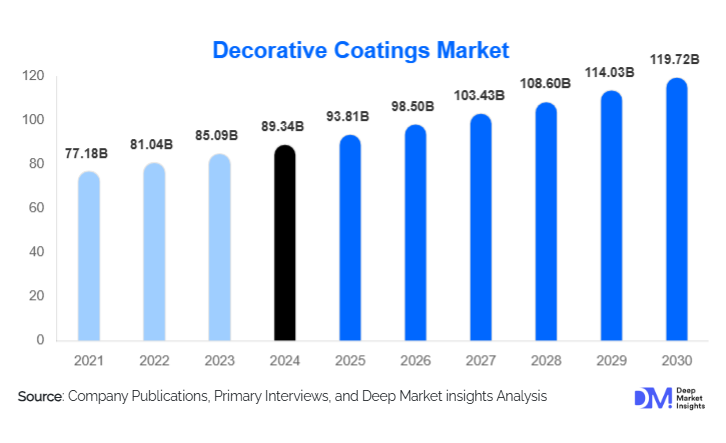

According to Deep Market Insights, the global decorative coatings market size was valued at USD 89.34 billion in 2024 and is projected to grow from USD 93.81 billion in 2025 to reach USD 119.72 billion by 2030, expanding at a CAGR of 5% during the forecast period (2025–2030). The decorative coatings market growth is primarily driven by rapid urbanization, rising home renovation activities, and accelerating demand for eco-friendly, low-VOC architectural coatings across residential and commercial construction.

Key Market Insights

- Water-based decorative coatings dominate the market, driven by stringent environmental regulations and rising consumer preference for low-odor, low-VOC formulations.

- Acrylic-based coatings lead the resin segment, supported by strong durability, color retention, and versatility for interior and exterior applications.

- Asia-Pacific accounts for the largest share of global demand, fueled by massive construction spending in China, India, and Southeast Asia.

- Premium and value-added decorative coatings, such as anti-microbial, UV-resistant, and textured finishes, are gaining traction among residential and commercial buyers.

- Digital tinting systems, color-matching tools, and smart coatings are transforming the consumer experience and operational efficiency for retailers.

- Renovation-driven demand in mature markets like North America and Europe continues to support steady volume growth.

What are the latest trends in the decorative coatings market?

Sustainable and Low-VOC Coatings Becoming Mainstream

Environmental regulations and growing eco-awareness among consumers are accelerating the shift toward low-VOC and water-based decorative coatings. Manufacturers are investing in advanced waterborne technologies, bio-based binders, and odor-free formulations to meet sustainability targets. Eco-certified decorative paints are becoming a preferred choice among residential homeowners, commercial developers, and government projects, particularly in Europe and North America. Green building initiatives and stricter compliance requirements (e.g., REACH, EPA guidelines) are further reinforcing this trend. The rise of LEED-certified construction is also boosting demand for sustainable decorative finishes.

Specialty and Functional Decorative Coatings Rising in Popularity

Demand is increasing for decorative coatings that offer value-added functionalities, including anti-microbial protection, stain resistance, self-cleaning ability, heat-reflectivity, and enhanced durability. These coatings are being widely adopted in hospitals, schools, hospitality, and high-traffic commercial spaces. Textured decorative finishes, metallic effects, and designer wall paints are trending among residential consumers seeking personalized and premium aesthetics. This shift toward high-performance and visually unique solutions is enabling manufacturers to command higher margins within the decorative segment.

What are the key drivers in the decorative coatings market?

Growing Construction and Renovation Activities

Global urbanization, expansion of housing infrastructure, and substantial renovation cycles in developed markets are key growth drivers. Homeowners increasingly prioritize interior aesthetics, moisture resistance, and long-lasting finishes, leading to consistent demand for premium decorative coatings. Government-backed affordable housing programs and massive infrastructure investments in emerging economies further amplify volume growth. The rising trend of residential remodeling and DIY upgrades in the U.S. and Europe contributes significantly to recurring decorative paint consumption.

Technological Advancements and Product Innovation

Innovations in resin chemistry, digital tinting, and smart coatings are strengthening the market. Improved acrylics, polyurethane hybrids, and functional additives enhance longevity, washability, and weather resistance. Digital tools allow consumers to visualize colors and finishes before purchase, improving decision-making and reducing waste. Manufacturers are also adopting automation, energy-efficient production, and advanced dispersion technologies to improve consistency and reduce carbon footprint, enabling them to stay competitive and compliant with evolving standards.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuating prices of key raw materials such as titanium dioxide, solvents, pigments, and resins significantly impact production costs. Since decorative coatings are produced in large volumes with tight margins, sudden price spikes can negatively affect profitability, especially for small and medium-sized manufacturers. Dependence on petrochemical-derived materials further exposes the industry to supply-chain disruptions and geopolitical instability.

Strict Environmental Regulations and Compliance Costs

While regulations drive innovation, they also pose challenges for manufacturers. Complying with VOC limits, hazardous chemical restrictions, labeling rules, and multiple regional certifications increases operational costs. Many developing markets lack harmonized regulations, complicating export strategies. Small producers often struggle to invest in the advanced technologies required for producing environmentally compliant coatings, limiting their competitiveness in premium segments.

What are the key opportunities in the decorative coatings industry?

Rapid Growth in Emerging Markets

Asia-Pacific, Latin America, and parts of Africa offer high-growth opportunities due to rising disposable incomes, expanding urban housing, and government infrastructure programs. Emerging middle-class homeowners are increasingly adopting high-quality decorative paints for both interior and exterior applications. Entry-level premium and mid-tier decorative coatings are particularly attractive segments for new entrants and expanding global brands.

Premiumization and Smart Coating Technologies

Value-added products such as antimicrobial, eco-friendly, and technologically enhanced decorative coatings provide attractive margins and strong consumer appeal. Smart coatings that offer features like temperature regulation, air purification, and stain resistance are gaining attention in both residential and commercial segments. Manufacturers capable of developing differentiated, high-performance decorative systems can establish strong competitive advantages and tap into the growing premium consumer base.

Product Type Insights

Emulsion paints dominate the decorative coatings market, driven by their versatility, low odor, fast drying, and suitability for both interior and exterior applications. Enamels and primers maintain strong demand in wood and metal decorative applications. Specialty coatings, including textured, metallic, pearlescent, and designer finishes, are rapidly gaining traction as consumers seek customized aesthetics. Wood coatings are expanding in premium housing and furniture applications, fueled by growing preference for natural and elegant finishes.

Application Insights

Residential interior applications constitute the largest share of the decorative coatings market, supported by ongoing remodeling, repainting cycles, and rising aesthetic preferences. Exterior applications remain equally vital in regions requiring strong weather and UV protection. Commercial and institutional users, including offices, schools, hospitals, hospitality, and retail, increasingly demand durable, easy-to-clean, antimicrobial, and low-VOC decorative systems. The DIY segment is growing in developed markets as consumers pursue affordable and creative home improvement projects.

Distribution Channel Insights

Specialty paint stores and retail outlets remain dominant distribution channels, supported by extensive tinting systems and in-store assistance. Home improvement centers and hardware chains account for a significant share in North America and Europe. E-commerce and online D2C channels are expanding rapidly, driven by the convenience of online color visualization tools, reviews, and direct delivery. Manufacturers are enhancing their digital presence with mobile apps, virtual color try-on, and personalized recommendations. B2B distribution continues to thrive through contractors, builders, and professional painters.

End-Use Industry Insights

The construction industry represents the largest end-use segment, as decorative coatings are essential for both new buildings and renovation. Residential construction drives the majority of demand, particularly in emerging economies. Commercial buildings, including offices, educational institutions, hospitality, and retail, increasingly prefer durable, washable, and low-VOC coatings. The renovation industry in mature markets contributes a substantial recurring revenue stream due to frequent repainting cycles. Infrastructure initiatives such as smart cities and public facilities also boost decorative paint consumption globally.

| By Resin Type | By Technology | By Product Type | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds a significant share of the decorative coatings market, led by the U.S. Strong demand from home renovation, DIY culture, and commercial construction supports growth. Homeowners increasingly prefer premium, eco-friendly coatings with improved washability and stain resistance. The region also leads in digital tinting adoption and online paint purchase trends.

Europe

Europe is driven by stringent VOC regulations, sustainability mandates, and mature yet renovation-intensive markets. Countries like Germany, the U.K., and France show strong demand for low-VOC and eco-certified decorative paints. Consumers prioritize product quality, matte finishes, and long-lasting premium coatings. Green building certifications are accelerating the adoption of sustainable decorative solutions.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, accounting for over one-third of global demand. China and India dominate due to rapid urban development, large housing markets, and major infrastructure spending. Rising middle-class income and lifestyle upgrades drive strong interest in premium decorative coatings. Southeast Asia and Australia also contribute significantly through residential and commercial construction.

Latin America

Latin America is experiencing steady decorative coatings growth, particularly in Brazil and Mexico. Urbanization, economic recovery, and increasing home ownership are supporting demand. The region leans toward mid-range and value-priced products, with growing interest in premium finishes among affluent consumers.

Middle East & Africa

MEA sees rising demand from large-scale infrastructure development and expanding residential communities. GCC nations such as the UAE and Saudi Arabia favor premium, weather-resistant decorative coatings suited to harsh climates. Africa’s growing urban population and housing construction create long-term opportunities for affordable decorative coatings.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Decorative Coatings Market

- PPG Industries

- The Sherwin-Williams Company

- AkzoNobel N.V.

- Nippon Paint Holdings

- Asian Paints

- Kansai Paint

- RPM International

- Jotun Group

- Hempel A/S

- Berger Paints

Recent Developments

- In 2024, leading manufacturers expanded waterborne and low-VOC product lines to align with tightening global environmental standards.

- In 2025, several companies invested in new production facilities across India and Southeast Asia to meet growing regional demand.

- In 2025, global decorative coatings brands introduced advanced antimicrobial and stain-resistant interior paints targeting healthcare, hospitality, and residential segments.