Decorated Apparel Market Size

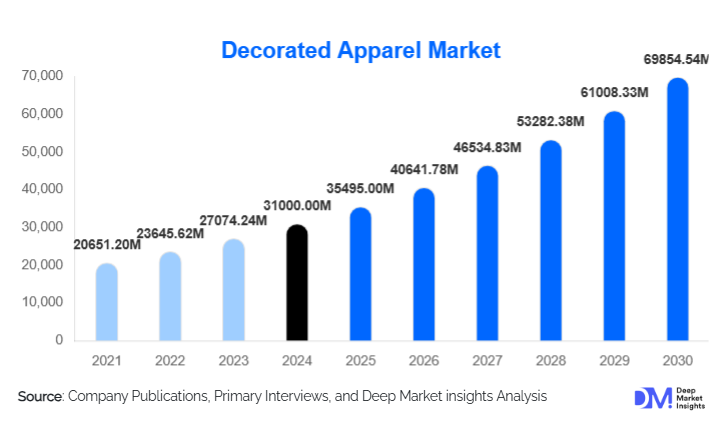

According to Deep Market Insights, the global Decorated Apparel Market size was valued at USD 31,000 million in 2024 and is projected to grow from USD 35,495 million in 2025 to reach USD 69,854.54 million by 2030, expanding at a CAGR of 14.50% during the forecast period (2025–2030). The decorated apparel market growth is primarily driven by rising demand for customised, branded, and personalised garments, expanding sports and athleisure sectors, growth in promotional and corporate wear, and the emergence of advanced decoration technologies (digital printing, embroidery automation, on-demand production).

Key Market Insights

- Personalisation and branding continue to redefine apparel decoration, as consumers, corporates and sports teams increasingly favour customised garments over generic mass-produced apparel.

- Advances in decoration technologies and automation, including direct-to-garment (DTG) digital printing, digital transfers, laser engraving, and automated embroidery, are reducing turnaround times and minimum order sizes, enabling broader adoption.

- Asia-Pacific dominates production and consumption, with manufacturing hubs (China, India, Vietnam) and rising domestic demand pushing the region to the largest market share globally.

- Online customisation and direct-to-consumer channels are gaining traction, enabling smaller batch runs, personalised design, and fast-fulfilment models, bypassing traditional bulk decoration services.

- Promotional, corporate, institutional, and sports end-uses remain core applications, providing stability and scale to the decorated apparel market volume and revenue streams.

- Sustainability and eco-friendly decoration processes (water-based inks, low-waste printing, eco-fabrics) increasingly influence the decorated apparel value chain and brand positioning.

What are the latest trends in the decorated apparel market?

Micro-customisation and Short-Run Production Models

Decoration service providers and apparel brands are increasingly offering micro-runs and highly customised garments, monograms, limited-edition drops, influencer-collaborations, event-specific graphics, made feasible by digital printing, automated embroidery, and on-demand manufacturing. These models significantly reduce inventory risk, enable rapid design changes, and appeal to consumers seeking unique garments. As a result, smaller-batch decorated apparel orders are rising, especially in e-commerce and direct-to-consumer channels.

Sustainability and Eco-Decoration Driving Purchase Decisions

Environmental pressures and consumer expectations are reshaping the decorated apparel segment. Decorators and apparel producers are adopting low-impact inks, zero-waste finishing processes, recyclable transfers, and sustainable base garments. Brands are positioning decorated apparel as not only stylish or branded but also eco-responsible, which is becoming a differentiator, particularly in developed markets and among younger consumer cohorts.

What are the key drivers in the decorated apparel market?

Rising Demand for Custom & Branded Apparel

Consumers, corporates, teams, and promotional campaigns all drive demand for decorated apparel. The desire for apparel with logos, names, unique graphics, identity markers, and limited-edition prints fuels growth. This trend extends beyond just fashion: organisations increasingly use decorated garments for branding, uniforms, and marketing, creating steady volume. As younger generations prioritise self-expression and brand affiliation, decorated apparel becomes a tool for identity, boosting market growth.

Technological Innovation in Decoration Techniques

New print and embroidery technologies enable faster turnaround, greater flexibility, and smaller minimum order quantities. Digital printing (DTG/DTF), automated embroidery machines, laser finishing, and digital transfer systems have made decoration more accessible and cost-effective. These developments expand the served market (including small brands, e-commerce, and on-demand customisation), thereby accelerating revenue growth.

Growth of Sports, Athleisure & Promotional Apparel

The expanding sportswear, athleisure, and promotional segments are significant growth engines for decorated apparel. Teams, clubs, schools, and events frequently use branded apparel. Additionally, the casualisation of workwear and the rising demand for corporate-branded uniforms contribute to bulk orders. As the line between fashion and performance wear blurs, decorated elements (logos, prints, names) have greater prominence, giving impetus to the overall market.

Restraint: Raw Material & Decoration Input Cost Volatility

The cost of base garments, inks, threads, transfer films, and decoration consumables is subject to volatility. Rising cotton or synthetic fibre prices, increasing labour costs in manufacturing hubs, and supply-chain disruptions can squeeze margins for decorators and manufacturers. These factors may dampen growth potential for price-sensitive segments.

Restraint: Sustainability & Regulatory Compliance Challenges

Decorated apparel production involves inks, chemical coatings, wash processes, waste-water, and finishing treatments. With tightening environmental regulations and higher consumer expectations for sustainability, companies face increased costs and operational burden. Smaller decorators may struggle to upgrade equipment or comply, limiting their growth ability.

What are the key opportunities in the decorated apparel industry?

Expansion in Emerging Markets and Export Manufacturers

Emerging economies in Asia-Pacific (India, Vietnam, Bangladesh), Latin America, and Africa present considerable upside for decorated apparel. Rising middle-class incomes, increasing brand awareness, expanding sports and event economies, and growing promotional apparel penetration all support demand. At the same time, these regions are strengthening manufacturing capacity for export markets, creating opportunities for decorators and apparel companies to serve global brands via cost-effective supply chains. Firms that establish local production or partner with regional decorators are well-positioned to benefit.

Technology-Enabled On-Demand Customisation and Short-Run Models

The shift towards on-demand production, personalised apparel, and e-commerce customisation is a prime opportunity. Decorators and brands that invest in digital printing, automated embroidery, software-enabled customisation platforms, and logistics integration (fast delivery, easy design tools) will capture the rising tide of personalised decorated apparel. Moreover, the ability to service small batch, high-margin orders opens new revenue streams beyond bulk traditional orders.

Value-Added Services in Corporate, Sports & Promotional Segments

The corporate uniform, sports team wear, and promotional apparel segments are growing and becoming more value-added. Beyond just decoration, suppliers can offer services such as design support, inventory management, restock programs, smart-decoration (reflective, performance fabrics), and sustainable apparel branding. Decorators that position themselves as full-service partners (design-to-delivery) for institutional clients can lock in stable demand and higher margins, differentiating from commodity decoration providers.

Decoration Technique Insights

Screen printing dominates the decorated apparel market, accounting for approximately 38% of global revenue in 2024. Its cost-efficiency for bulk orders, versatility across materials, and ability to produce vivid, long-lasting designs make it the preferred technique for promotional merchandise, sportswear, and corporate uniforms. However, digital printing technologies, including Direct-to-Garment (DTG), Direct-to-Film (DTF), and sublimation, are growing at a CAGR of over 15%, driven by demand for short-run customization and eco-friendly water-based inks. Embroidery remains a premium segment, popular in corporate and institutional wear due to its durability and high-quality finish. Meanwhile, heat transfer and vinyl printing are increasingly used by small businesses and e-commerce platforms for low-volume personalized apparel, while laser etching and appliqué methods cater to luxury and niche fashion brands emphasizing texture and fine detailing.

Apparel Type Insights

T-shirts and tops represent the largest apparel category, capturing nearly 42% of the market in 2024. Their dominance stems from wide consumer appeal across demographics, low production costs, and suitability for all major decoration techniques. Hoodies and sweatshirts form the second-largest segment, bolstered by the surge in athleisure and casualwear trends. Caps and headwear are gaining traction in promotional branding, especially for sports and corporate events. Jackets and outerwear are witnessing growing demand in North America and Europe, where corporate branding and team apparel are common. Meanwhile, corporate uniforms and sportswear are forecast to expand rapidly through 2030 as organizations and clubs increasingly seek branded apparel for identity reinforcement and marketing purposes.

End-Use Industry Insights

Corporate and institutional apparel lead the end-use segment, accounting for around 33% of the global market in 2024. Businesses across industries, from hospitality and healthcare to logistics, are increasingly adopting decorated uniforms to promote brand recognition and team unity. Sports and athleisure apparel follow closely, fueled by fitness culture, fan merchandise, and endorsements from professional teams. The promotional and event merchandising segment remains a significant growth driver, driven by corporate giveaways, music festivals, and brand collaborations. Retail and fashion brands are leveraging decoration techniques for limited-edition product drops, while e-commerce custom-order platforms like Printful, Teespring, and Custom Ink have revolutionized direct-to-consumer personalization, expanding accessibility for individual buyers and small creators worldwide.

Distribution Channel Insights

Offline retail continues to dominate, representing roughly 52% of market share in 2024 due to established B2B networks, corporate contracts, and bulk orders. However, online customization platforms are the fastest-growing channel, projected to record a CAGR of 14.5% through 2030. The rise of on-demand manufacturing and automated fulfillment models allows consumers to create custom apparel with minimal inventory risk. Corporate direct sales also remain crucial, with apparel decorators offering enterprise-level branding services. Third-party e-commerce marketplaces such as Amazon Merch and Etsy further support small businesses, facilitating the global reach of customized products through low-cost entry and integrated logistics solutions.

| By Decoration Technique | By Apparel Type | By End Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the decorated apparel market, approximately 34% in 2024, driven by strong demand in the United States for custom corporate wear, sports apparel, and promotional merchandise. The region’s thriving small business ecosystem and rapid adoption of digital printing technologies support consistent growth. Canada contributes significantly through a growing base of eco-conscious apparel decorators emphasizing sustainable materials and water-based inks.

Europe

Europe represents around 28% of the market, led by the United Kingdom, Germany, and France. Sustainability and circular fashion trends are influencing market dynamics, with European decorators adopting organic cotton, recycled polyester, and energy-efficient printing techniques. Corporate uniform branding and fashion collaborations continue to be major contributors, while online customization platforms are rapidly gaining market share among SMEs and creative entrepreneurs.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR of 16.2% between 2025 and 2030. China, India, Bangladesh, and Vietnam dominate production due to strong textile manufacturing bases and low labor costs. Rising domestic demand from youth-driven fashion brands and e-commerce platforms is further accelerating growth. Japan and South Korea lead innovation in textile printing technology, while Australia’s demand is fueled by sportswear and outdoor lifestyle segments.

Latin America

Latin America is witnessing steady expansion, led by Brazil and Mexico. Growing promotional campaigns, sports team branding, and regional e-commerce participation are stimulating local decorated apparel demand. The region is also becoming an attractive outsourcing hub for North American companies due to proximity and improved production infrastructure.

Middle East & Africa

The Middle East and Africa account for a smaller share but exhibit promising potential, particularly in the UAE, Saudi Arabia, and South Africa. Rapid growth in corporate sectors, tourism, and event merchandising is fueling demand. Localized apparel production and government incentives for SME manufacturing are expected to drive long-term market development in these regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Decorated Apparel Market

- Gildan Activewear Inc.

- Hanesbrands Inc.

- Fruit of the Loom, Inc. (Berkshire Hathaway Inc.)

- Delta Apparel Inc.

- Advance Printwear Ltd.

- Russell Athletic Co.

- Threads (UK) Ltd.

- Vantage Apparel LLC

- Bayside Apparel Manufacturing Co.

- TeeJunction Inc.

Recent Developments

- In August 2025, Gildan Activewear announced the expansion of its sustainable printing operations in Honduras, focusing on waterless dyeing and energy-efficient production lines.

- In July 2025, Hanesbrands launched its new digital customization platform for corporate clients, enabling real-time logo placement and on-demand embroidery orders.

- In March 2025, Delta Apparel introduced a recycled polyester product line integrated with sublimation printing, supporting its sustainability roadmap toward 2030.