Data Center UPS Market Size

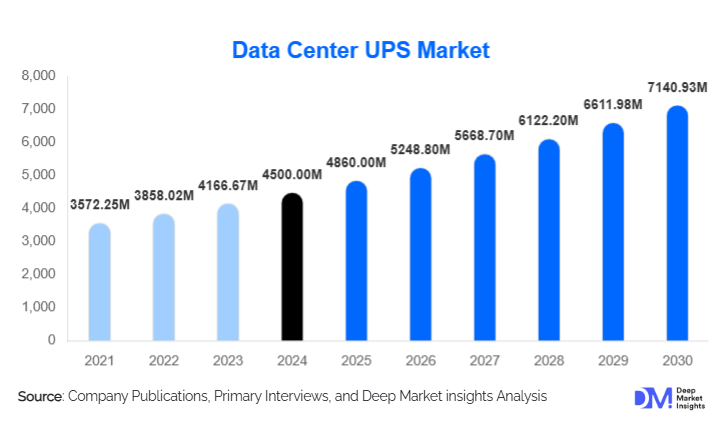

According to Deep Market Insights, the global Data Center UPS Market size was valued at USD 4,500 million in 2024 and is projected to grow from USD 4,860.00 million in 2025 to reach USD 7,140.93 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). Market growth is driven by surging global data-center construction, increasing adoption of cloud computing, and growing demand for uninterrupted power protection in high-density computing environments. The rising penetration of hyperscale and edge data centers, along with rapid digital transformation across industries, is fueling investments in next-generation UPS systems with higher efficiency and improved sustainability.

Key Market Insights

- Centralized UPS systems dominate the market, accounting for approximately 65.8% share in 2024, driven by large-scale data-center deployments demanding unified power management.

- Online double-conversion UPS systems lead by product type, representing over 44.6% of global revenues, as they provide maximum reliability for mission-critical workloads.

- Hyperscale and cloud data-centers comprise nearly half of total demand, with cloud operators investing heavily in multi-megawatt UPS infrastructure.

- Asia-Pacific is the fastest-growing region, forecast to expand at a 9–10% CAGR, driven by rapid digitalization and data-localization mandates in India, China, and Southeast Asia.

- Lithium-ion battery adoption is accelerating, reducing maintenance costs and improving power-backup efficiency over traditional VRLA systems.

- Edge computing and micro-data-center installations are creating new demand for compact, modular UPS systems with flexible scalability.

What are the latest trends in the Data Center UPS Market?

Shift Toward Modular and Scalable UPS Architectures

Data-center operators are rapidly transitioning from monolithic UPS designs to modular architectures that offer flexibility, redundancy, and simplified maintenance. Modular UPS units enable hot-swappable capacity expansion and reduce downtime during upgrades, a critical factor for hyperscale and colocation providers. This shift supports a lower total cost of ownership (TCO) and enhanced energy efficiency. Modularization also aligns with the distributed nature of modern edge facilities, where space and energy constraints demand compact yet resilient backup systems.

Integration of Lithium-Ion and Energy-Storage Technologies

Lithium-ion batteries are replacing VRLA batteries across new data-center projects due to their longer lifespan, smaller footprint, and higher thermal tolerance. Moreover, integration of UPS systems with on-site renewable energy and energy-storage solutions allows data centers to optimize grid interaction and energy cost management. The emergence of grid-interactive UPS designs, capable of supporting peak-shaving and frequency-regulation functions, is transforming UPS systems from passive backup devices into active energy assets.

AI-Enabled Predictive Maintenance and Remote Monitoring

Advanced analytics and AI-powered monitoring tools are being deployed to predict failures and optimize maintenance schedules in real-time. Intelligent UPS platforms provide visibility across multiple facilities, minimizing downtime and enabling proactive asset management. Integration of IoT sensors and cloud-based diagnostics enhances operational reliability, particularly for large enterprises and hyperscale operators managing distributed data-center networks.

What are the key drivers in the Data Center UPS Market?

Rapid Expansion of Hyperscale and Cloud Data-Centers

Global demand for cloud computing, AI, and digital services has triggered massive construction of hyperscale data centers. Each new facility requires multi-megawatt UPS capacity to ensure continuous operations. Hyperscale operators such as AWS, Microsoft Azure, and Google Cloud are driving bulk procurement of high-capacity UPS systems, contributing to over 49% of total market demand in 2024. The global surge in AI and high-performance computing (HPC) workloads is also amplifying this need for stable power delivery.

Growing Adoption of Edge Computing

Telecom operators and enterprises deploying 5G and IoT networks require localized data-processing nodes. Edge and micro-data-centers rely heavily on small-form-factor UPS systems to maintain power continuity at remote sites. The distributed nature of edge computing is creating a new class of modular UPS solutions with higher deployment volumes, fueling market expansion, particularly in emerging economies.

Focus on Energy Efficiency and Sustainability

Rising energy costs and stricter environmental regulations are pushing operators toward UPS systems with high-efficiency ratings (>96%) and low standby losses. Manufacturers are innovating with transformer-less designs, smart-eco modes, and lithium-ion integration to improve overall power-use effectiveness (PUE). These solutions align with global corporate sustainability goals and data-center operators’ net-zero commitments, further stimulating demand.

What are the restraints for the global market?

High Capital and Maintenance Costs

The initial investment required for advanced UPS systems and periodic battery replacements remains a major barrier, especially for small and mid-size data centers. Large-scale installations can involve millions of dollars in UPS and battery CapEx, discouraging faster adoption among budget-constrained operators.

Supply-Chain and Component Constraints

Global shortages in semiconductor components, power electronics, and lithium raw materials have periodically disrupted production and extended lead times for UPS systems. These bottlenecks, along with regional import tariffs and regulatory delays, may limit near-term capacity expansion in developing markets.

What are the key opportunities in the Data Center UPS Industry?

Sustainability-Driven Retrofit and Upgrade Programs

Thousands of legacy data centers globally still rely on outdated VRLA-based UPS units with low efficiency. The industry is witnessing a strong wave of modernization projects replacing older systems with energy-efficient, lithium-ion-based, and grid-interactive UPS models. This retrofit opportunity presents a significant recurring revenue stream for OEMs and service providers.

Emerging Market Expansion and Localization

Governments in Asia-Pacific, the Middle East, and Africa are actively promoting local data-center ecosystems through policy incentives and digital-infrastructure investments. This drives strong regional demand for UPS systems while opening opportunities for manufacturers to localize assembly and maintenance operations. “Make in India” and “Made in China 2025” initiatives are encouraging domestic manufacturing of UPS components, batteries, and power electronics.

Integration with Smart Grids and Energy Management Platforms

UPS systems are evolving into intelligent grid-support assets capable of participating in demand-response programs and renewable integration. Future UPS architectures will not only provide backup but also dynamically stabilize grid performance. Vendors focusing on software-defined UPS management and interoperability with smart-grid systems will capture emerging value pools in energy-intelligent data centers.

Product Type Insights

Online double-conversion UPS systems dominate the market, accounting for roughly 44.6% of global revenues in 2024. They deliver continuous, clean power suitable for mission-critical IT loads. Line-interactive UPS units serve mid-tier or enterprise data centers, offering cost-efficiency with moderate protection. Standby (offline) UPS systems are confined to smaller edge facilities and network closets. Demand for modular, hot-swappable UPS designs is rising across all categories, enabling flexible scalability and simplified maintenance. Rotary and flywheel UPS solutions, though niche, are gaining adoption in ultra-high-availability environments requiring short-duration bridging before generator kick-in.

Application Insights

Hyperscale and cloud data-centers represent the largest application segment, capturing nearly 49.4% of market share in 2024. These facilities demand large, redundant UPS capacity to ensure uptime for global digital services. Colocation data-centers follow, supported by enterprise outsourcing trends and high tenant diversity. Enterprise and edge data-centers collectively account for around one-third of installations, with edge deployments driving the highest growth rate due to 5G and IoT expansion. The healthcare, BFSI, and government sectors are emerging end-users deploying secure, regional data-centers that further boost UPS consumption.

Distribution Channel Insights

Sales occur primarily through direct OEM contracts and system integrators serving hyperscale and enterprise clients. Value-added resellers and regional distributors cater to small-scale and retrofit projects. Increasingly, manufacturers are adopting digital sales platforms and remote configuration tools that allow customers to design, quote, and monitor UPS systems online. Lifecycle-service agreements are becoming a major recurring revenue channel, covering installation, remote monitoring, and predictive-maintenance services throughout the equipment lifespan.

End-Use Industry Insights

End-use demand is led by IT & Telecom and Cloud Service Providers, accounting for over half of global UPS installations. BFSI and Healthcare sectors are witnessing strong growth as they expand mission-critical data centers for digital transactions and patient data security. Government and public-sector IT infrastructure projects across emerging economies also contribute significantly to market expansion. The manufacturing and retail sectors are deploying smaller on-premises or hybrid data centers, increasing the adoption of low-capacity UPS units. Export-driven demand from UPS manufacturers in China, India, and Eastern Europe is also rising as these regions become global production hubs supplying to hyperscale operators worldwide.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America held the largest market share of approximately 35% in 2024, with the U.S. as the primary contributor. High cloud penetration, strong presence of hyperscale operators, and stringent data-availability standards drive continuous demand. The region’s mature grid infrastructure and high rate of technology adoption further support steady replacement cycles for efficient UPS systems.

Europe

Europe accounted for around 23–25% of global revenues in 2024. The U.K., Germany, and France lead market adoption, driven by colocation growth and sustainability mandates under EU energy-efficiency regulations. European data centers are early adopters of lithium-ion UPS systems and eco-mode technologies, positioning the region at the forefront of green data center initiatives.

Asia-Pacific

The Asia-Pacific region is the fastest-growing market, expanding at a 9–10% CAGR through 2030. China and India are the powerhouses of growth, supported by national digital infrastructure programs and data-sovereignty regulations. Japan, Australia, and Southeast Asia also contribute through hyperscale expansions and cloud localization. APAC is projected to increase its global share from 30% in 2024 to over 35% by 2030.

Middle East & Africa

MEA markets are developing rapidly, led by Saudi Arabia and the UAE, where smart-city and cloud-region projects are spurring demand for large-scale UPS installations. Africa’s emerging data-center ecosystem, concentrated in South Africa, Kenya, and Nigeria, is experiencing strong investment inflows, albeit from a smaller base.

Latin America

Latin America represents a smaller share (~7–8%) of the global market, with Brazil and Mexico leading deployments. Cloud adoption, telecom modernization, and financial-sector digitalization are key growth drivers. However, infrastructural and economic challenges moderate near-term expansion compared to APAC and MEA.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Data Center UPS Market

- Schneider Electric SE

- Eaton Corporation plc

- ABB Ltd

- Vertiv Holdings Co.

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Huawei Technologies Co., Ltd.

- Siemens AG

- Delta Electronics, Inc.

- Ametek, Inc.

- Legrand SA

- Fuji Electric Co., Ltd.

- CyberPower Systems, Inc.

- Socomec Group

- Riello Elettronica S.p.A.

Recent Developments

- May 2025 – Vertiv announced new high-density lithium-ion UPS systems optimized for AI-data-center workloads, enhancing energy efficiency by 15% over previous models.

- April 2025 – Schneider Electric launched its EcoStruxure UPS Galaxy VL Series with modular scalability up to 1.5 MW, targeting hyperscale and colocation facilities.

- February 2025 – Eaton expanded manufacturing capacity in India under the “Make in India” initiative to serve regional and export UPS demand across APAC.