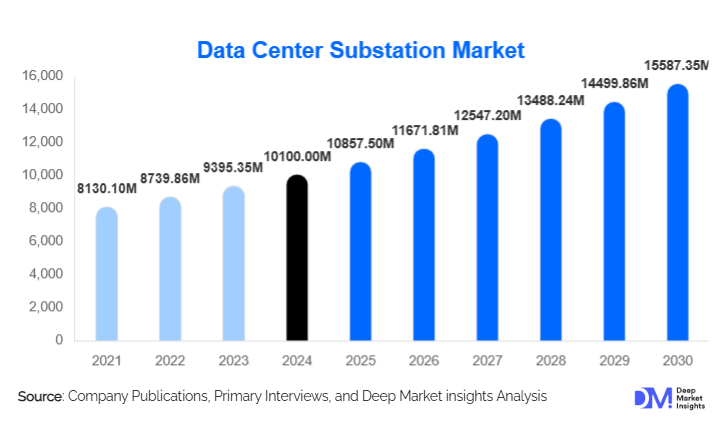

Data Center Substation Market Size

According to Deep Market Insights, the global data center substation market size was valued at USD 10,100.00 million in 2024 and is projected to grow from USD 10,857.50 million in 2025 to reach USD 15,587.35 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). This solid growth is underpinned by rising demand for reliable, high-capacity power infrastructure in hyperscale, edge, and enterprise data centers, fueled by trends such as AI/ML, 5G, and cloud adoption.

Key Market Insights

- Switchgear dominates the component segment, accounting for the largest share due to its critical role in protection, control, and reliability of data center substations.

- Voltages above 500 kV lead in the voltage category, driven by hyperscale data centers’ need for high-voltage feeds to minimize transmission losses and support large loads.

- Mineral oil-filled cooling/insulation remains widely used, though interest is growing in ester/synthetic fluids for a better environmental profile.

- Greenfield deployment is the largest build type, as many new data centers require purpose-built substations from scratch rather than retrofits.

- Hyperscale data centers are the biggest end-users because of their high and constant power demand.

- North America is the leading region, contributing a significant share of the global market thanks to its dense data center ecosystem and large cloud investments.

What are the latest trends in the Data Center Substation Market?

Modular & Prefabricated Substation Designs

One of the most significant trends is the adoption of modular or prefabricated substations. These factory-built units, often containerized, enable faster deployment, lower construction risk, and simplified commissioning. For data center operators, this means they can scale power delivery more predictably, reduce on-site labor costs, and adapt to changing power demand, especially in greenfield and edge scenarios.

Digital Substations & Predictive Analytics

Digitalization is making its way into substations via sensors, SCADA systems, and real-time monitoring tools. Operators are leveraging predictive maintenance powered by analytics to anticipate failures, optimize protection settings, and improve uptime. This not only enhances reliability but also reduces operating costs by minimizing unplanned outages and maintenance overhead.

Renewable Integration & Two-Way Energy Flow

The integration of renewable energy sources and energy storage is becoming more common at data center substations. Modern substation architectures increasingly support bidirectional power flow, enabling data centers to draw from or feed back into the grid. This capability supports sustainability goals, demand response, and potentially lower energy costs.

What are the key drivers in the Data Center Substation Market?

Surging Data Growth & Cloud Adoption

The exponential rise in data generation, propelled by streaming, enterprise computing, and digital services, is driving demand for more and larger data centers. These facilities need robust substations to provide high-capacity, resilient power delivery, making substations foundational for supporting the cloud infrastructure that underpins modern digital services.

AI, 5G, and Edge Computing Expansion

AI workloads and 5G-based edge computing are reshaping data center power needs. Edge data centers, in particular, require local substations due to their distributed nature and constraints on grid access. These trends are pushing substation design toward more compact, efficient, and flexible architectures that can handle variable loads with high reliability.

Sustainability & Resilience Pressure

Data centers are facing increasing pressure to reduce their carbon footprints. By integrating renewables, energy storage, and smart power distribution at the substation level, operators can improve sustainability and resilience. Substations that support these capabilities become a strategic part of a data center’s design, not just a supporting asset.

What are the restraints for the global market?

High Capital Expenditure Requirements

Substation infrastructure demands substantial upfront investment. Components such as transformers and switchgear, coupled with design, construction, and commissioning costs, make CapEx a significant barrier, especially for smaller data center operators or edge deployments where ROI timelines may be uncertain.

Regulatory & Grid Connection Challenges

Building or upgrading substations often involves complex regulatory, permitting, and grid-interconnection processes. Delays or uncertainties in approvals, environmental clearances, and coordination with utility providers can slow down deployment, add cost, and introduce project risk.

What are the key opportunities in the Data Center Substation Market?

Edge & Micro Data Center Substations

The rapid proliferation of edge computing facilities presents a major opportunity. These smaller, distributed data centers require purpose-built, modular substations. Suppliers that can deliver compact, scalable, prefabricated substations tailored to edge sites will have a significant advantage as enterprises and cloud providers deploy edge infrastructure globally.

Smart & Digital Substations for Predictive Maintenance

As data centers demand ever-higher uptime and reliability, digital substations that support real-time monitoring, analytics, and predictive maintenance will be in high demand. Vendors that offer sensor-rich equipment, AI-based diagnostics, and remote control capabilities can help operators minimize downtime, optimize operations, and reduce maintenance costs.

Green Energy–Enabled Substations

There is growing demand for substation solutions that integrate smoothly with on-site renewables, energy storage, and grid flexibility tools. Suppliers can tap this by providing advanced substation architectures that support two-way power flow, microgrid operations, and sustainable power delivery, enabling data centers to meet both economic and environmental targets.

Product Type Insights

Luxury safaris continue to dominate the global safari tourism market, driven by rising demand from affluent travelers seeking exclusivity, personalized services, and sustainability-focused accommodations. High-value offerings such as private game drives, architect-designed eco-lodges, and curated itineraries with private guides and chefs reinforce the premium segment's leadership.

Mid-range safaris attract a broad base of mainstream travelers through balanced value propositions, semi-luxury camps, guided tours, and reliable transport options that deliver comfort and immersive wildlife engagement at accessible prices. Budget safaris are gaining momentum, especially among younger travelers and backpackers, supported by group tours, shared accommodations, and overland adventures that lower overall travel costs.

Application Insights

Wildlife-focused safaris remain the core application segment, driven by strong global interest in the Big Five, gorilla trekking, and cheetah conservation experiences. Photographic safaris represent one of the fastest-growing applications, supported by social media-driven travel behavior, professional photography workshops, and demand for curated content creation experiences.

Cultural safaris that integrate wildlife encounters with indigenous traditions, community visits, and experiential storytelling are expanding market appeal across diverse traveler groups. Eco-volunteering safaris, including habitat restoration, animal tracking, and anti-poaching program participation, are increasingly preferred by travelers seeking meaningful, purpose-driven tourism.

Distribution Channel Insights

Online booking platforms, including OTAs and D2C websites, dominate the safari distribution landscape due to transparent pricing, real-time reviews, and convenient comparison tools. Specialist travel agencies remain highly influential in luxury, photographic, and conservation-focused safaris, particularly for affluent clients requiring tailored itineraries.

Direct lodge bookings are rising sharply as safari operators adopt enhanced digital strategies, interactive platforms, dynamic pricing, and targeted marketing that increase direct engagement with travelers. Subscription-based travel memberships and exclusive safari clubs are emerging as new channels, offering seasonal access and loyalty benefits to repeat travelers.

Traveler Type Insights

Group travelers constitute a major share of the market, driven by cost-efficient packaged itineraries, predictable schedules, and social travel experiences. Budget-conscious tourists and first-time safari-goers particularly favor organized group tours.

Solo travelers, often younger demographics or digital nomads, are increasingly choosing flexible itineraries focused on cultural immersion, short-term experiences, and adventure activities. Couples and honeymooners represent a high-value segment, preferring secluded lodges, private game drives, romantic dining setups, and customized services.

Family travelers are steadily expanding in number, influenced by rising demand for child-friendly programs, multi-generational accommodations, and educational wildlife experiences that ensure safety and engagement for younger participants.

Age Group Insights

Travelers aged 31–50 years dominate the market, supported by higher disposable income and a strong preference for immersive, experiential travel. This group tends to choose mid-range and luxury safaris with premium comfort and adventure balance.

The 18–30 age group drives growth in budget and adventure categories, relying heavily on digital research and prioritizing unique experiences such as walking safaris, eco-volunteering, and overland expeditions.

Older travelers aged 51–65 years contribute significantly to premium safari bookings, favoring guided and wellness-integrated itineraries with minimal physical strain. The 65+ segment, though smaller, is a lucrative niche for high-comfort safaris with enhanced accessibility and medical support options.

| By Component Type | By Voltage Level | By Insulation / Cooling Medium | By Deployment Type | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest outbound market for safari tourism, driven by strong interest in African destinations such as Kenya, Tanzania, and South Africa. Key drivers include high disposable income levels, growing demand for luxury and conservation-oriented travel, and extensive air connectivity to Africa.

Rising preferences for customized itineraries, wildlife photography trips, and eco-certified lodges further support outbound growth from the U.S. and Canada.

Europe

Europe is experiencing robust outbound growth, supported by a strong cultural affinity for sustainable travel and ethical tourism. Travelers from the U.K., Germany, France, and the Nordics exhibit high demand for eco-lodges, carbon-neutral safari operations, and community-oriented experiences.

Younger European demographics are fueling the adoption of budget and adventure safaris, while established air connectivity and deep travel ties between Europe and Africa reinforce long-term market expansion.

Asia-Pacific

Asia-Pacific is rapidly emerging as a key growth engine for safari tourism, driven by increasing affluence, expanding outbound tourism, and social media influence across China, India, Japan, and Australia.

Chinese travelers show a strong preference for luxury and group-centric packages, while Indian travelers gravitate toward mid-range offerings blending wildlife with cultural immersion. Mature markets such as Japan and Australia maintain steady demand for photographic, adventure, and conservation-focused safaris. Improving air connectivity between Asia and East Africa further accelerates the region's growth.

Latin America

Safari tourism is gradually gaining traction in Latin America, especially in Brazil, Argentina, and Mexico. Outbound travelers from this region typically favor adventure-driven experiences and increasingly show interest in family-friendly safari packages.

Specialized operators are targeting the region with customized itineraries emphasizing conservation, exclusive wildlife encounters, and premium long-haul travel options, key factors driving early-stage market expansion.

Middle East & Africa

Africa remains the global hub of safari tourism, supported by unparalleled biodiversity, mature safari infrastructure, and significant government investment in tourism-led conservation. Key destinations include Kenya, Tanzania, Botswana, Namibia, Zambia, and South Africa.

The Middle East, led by the UAE, Saudi Arabia, and Qatar, is becoming a major outbound market, driven by high-income populations, strong interest in luxury travel, and increasing direct air connections to African safari destinations. Additionally, intra-African tourism is rising, with regional travelers from South Africa, Nigeria, and Kenya contributing to strong domestic and cross-border safari activity.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Safari Tourism Market

- Abercrombie & Kent

- Micato Safaris

- Wilderness Safaris

- Singita

- Natural Habitat Adventures

- Gamewatchers Safaris

- Great Plains Conservation

Recent Developments

- May 2025: Wilderness Safaris expanded its eco-lodge portfolio in Botswana with new solar-powered, community-operated camps focused on conservation-driven tourism.

- April 2025: Intrepid Travel launched a series of small-group safaris in Tanzania featuring carbon-offset programs and curated cultural experiences with Maasai communities.

- February 2025: Singita introduced a wellness-focused safari lodge in South Africa, integrating yoga, meditation, and holistic therapies with wildlife experiences.