Data Center Renovation Market Size

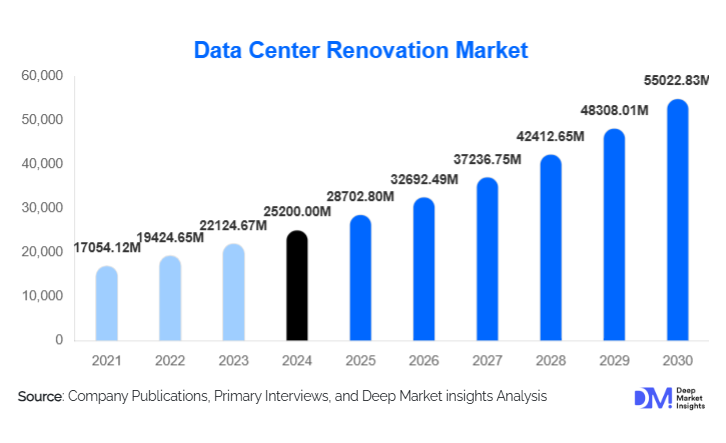

According to Deep Market Insights, the global data center renovation market size was valued at USD 25,200.00 million in 2024 and is projected to grow from USD 28,702.80 million in 2025 to reach USD 55,022.83 million by 2030, expanding at a CAGR of 13.9% during the forecast period (2025–2030). Market growth is primarily driven by rising modernization requirements among aging data centers, increasing power and cooling demands from AI and high-density workloads, and accelerating sustainability mandates that push operators toward energy-efficient retrofits rather than greenfield development.

Key Market Insights

- Modernization and infrastructure upgrades dominate renovation spending, as operators replace aging mechanical, electrical, and structural systems to handle higher compute loads.

- Power system renovation led by infrastructure component share, driven by demand for UPS upgrades, modular power distribution, and enhanced grid resilience.

- North America remains the largest regional market, supported by extensive legacy data center footprints and aggressive sustainability and AI-readiness investments.

- Asia-Pacific is the fastest-growing region, buoyed by cloud adoption, hyperscale expansion, and large-scale modernization projects in China, India, and Southeast Asia.

- Hyperscale and colocation operators account for the highest renovation spending, prioritizing liquid cooling, power upgrades, and modular retrofits.

- Technological integration, including digital twins, AI-powered energy optimization, and advanced DCIM systems, is reshaping renovation strategies globally.

What are the latest trends in the data center renovation market?

Energy-Efficient and Sustainability-Driven Retrofits Accelerate

Data center operators are increasingly prioritizing renovation strategies that improve energy efficiency, reduce carbon emissions, and support long-term sustainability mandates. Upgrades such as liquid cooling, heat-reuse systems, high-efficiency UPS units, and AI-based power optimization are becoming central to renovation projects. Many operators are adopting modular retrofit solutions to reduce downtime while enhancing scalability. Enterprises and hyperscalers are also aligning renovations with ESG goals, integrating renewable energy systems, low-GWP cooling solutions, and sustainability certifications into facility upgrades. These eco-focused retrofits not only lower operating costs but also help meet tightening regional energy regulations.

AI-Ready & High-Density Infrastructure Upgrades

The explosive growth of AI, machine learning, and high-performance computing (HPC) workloads is driving a new wave of high-density renovation projects. Traditional facilities, often designed for far lower rack densities, are being upgraded with reinforced flooring, high-capacity power distribution, advanced cabling, and specialized cooling systems. Many legacy data centers are undergoing significant mechanical and electrical retrofits to support densities exceeding 30–50 kW per rack. Digital twin simulations, immersion cooling systems, and GPU-optimized rack designs are being adopted to maximize efficiency and performance. This shift is transforming renovation from simple modernization into strategic AI enablement.

What are the key drivers in the data center renovation market?

Growing Demand for Modernization of Aging Facilities

More than half of global data centers are over a decade old, making renovation essential for maintaining performance, reliability, and compliance. Facilities built 10–15 years ago often lack the electrical and mechanical capacity required for contemporary workloads. As enterprises migrate to hybrid and cloud-driven architectures, renovation allows them to extend the lifecycle of existing infrastructure while supporting new technology demands. Renovation also offers cost advantages over constructing new data centers, making it the preferred approach for operators managing rising data consumption and digital transformation.

Increasing Focus on Energy Efficiency and Sustainability

Energy efficiency has become a priority due to rising power costs, carbon accountability, and government regulations. Renovations focused on sustainable cooling, optimized airflow, high-efficiency electrical systems, and DCIM-driven energy management are gaining traction worldwide. Many facilities seek to reduce PUE (Power Usage Effectiveness) to meet environmental standards and corporate sustainability targets. Government incentives for green infrastructure, combined with pressure to reduce environmental impacts, are pushing operators toward eco-friendly renovation solutions, strengthening market momentum.

What are the restraints for the global market?

Operational Disruption Risks During Retrofit

Renovating an active data center presents significant challenges due to the risk of service disruption, downtime, or equipment failure. Ensuring uninterrupted operations during upgrades, particularly of cooling or power systems, requires complex planning, specialized engineering expertise, and phased execution. These risks can delay or deter renovation projects, particularly among smaller operators with limited redundancy. Mission-critical environments with 24/7 uptime requirements find it especially challenging to schedule renovations without affecting service levels, adding complexity and cost.

High Capital Expenditure and Skilled Labor Shortage

Although renovation is generally more cost-effective than new construction, advanced cooling systems, modular power upgrades, and structural enhancements require significant investment. The need for highly skilled engineers capable of executing live-site retrofits increases labor costs and can lead to project delays. Emerging markets, in particular, face shortages of professionals skilled in complex MEP and AI-ready retrofitting. This capital and labor challenge limits renovation accessibility for smaller and mid-size operators, slowing market growth in cost-sensitive regions.

What are the key opportunities in the data center renovation industry?

Advanced Cooling and High-Density Retrofits

The shift toward AI and HPC presents a fast-growing opportunity for vendors specializing in liquid cooling, immersion cooling, and modular thermal management systems. Data centers built only for air-cooled infrastructures now require complete thermal upgrades to support AI servers and GPU clusters. Companies offering plug-and-play liquid cooling, predictive thermal analytics, and hybrid cooling retrofits can capture rapid demand from hyperscalers and enterprise AI deployments. This segment is expected to expand significantly through 2030 as AI workloads become mainstream.

Edge Data Center Modernization

With rapid 5G rollout, IoT expansion, and rising latency-sensitive applications, organizations are upgrading small and mid-size edge data centers. Renovations include modular expansions, enhanced physical security, cooling upgrades, and standardized remote monitoring. Telcos and enterprises are increasingly investing in edge-ready retrofits to support distributed cloud architectures. This creates strong opportunities for integrators offering compact, scalable, and energy-efficient retrofit solutions optimized for edge deployment.

Product Type Insights

Infrastructure renovation leads the market, accounting for the largest share due to the need for structural enhancements, cabling upgrades, raised floor reinforcement, and layout optimization. These upgrades enable better airflow, higher-density support, and compliance with modern safety and reliability standards. Electrical renovation is also expanding rapidly as operators upgrade UPS systems, switchgear, PDUs, and backup power to support greater power draw and redundancy. Meanwhile, mechanical renovation, including cooling modernization, is becoming a critical category due to AI-driven thermal requirements, making cooling upgrades one of the fastest-growing renovation types.

Application Insights

Modernization for high-density and AI workloads is the fastest-growing application category, driven by demand for GPU-optimized infrastructure and advanced cooling. Energy-efficiency upgrades constitute another major application, focused on reducing PUE and enhancing sustainability. Capacity expansion renovations are common among colocation providers seeking to support growing enterprise demand. Security system enhancements, including surveillance, biometric access, and fire suppression upgrades, are also increasing, particularly in government and BFSI data centers.

Distribution Channel Insights

Direct contracting by data center operators dominates the renovation market, as hyperscalers and colocation providers work directly with OEMs and engineering firms. System integrators play a critical role in delivering complex electrical and mechanical retrofits, especially in legacy enterprise environments. Third-party service providers are expanding, offering turnkey modernization packages that include assessment, design, and installation. Online procurement platforms are increasingly used for modular upgrades such as PDUs, racks, and cooling units, although large-scale projects remain offline and contract-based.

End-User Insights

Hyperscale and cloud providers account for the highest share of renovation spending due to their large footprints and rapid adoption of AI-ready infrastructure. Colocation providers represent a fast-growing segment as they upgrade facilities to support higher rack densities and hybrid cloud clients. Enterprise data centers across BFSI, healthcare, and telecom are investing in modernization to maintain compliance and support digital transformation. Government and public sector data centers also contribute substantially, focusing on security, reliability, and capacity upgrades.

| By Renovation Type | By Data Center Type | By Application | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest market for data center renovation, driven by a vast installed base of aging facilities, growing AI adoption, and stringent sustainability targets. U.S. hyperscalers are leading investments in power system modernization, liquid cooling retrofits, and digital twin-based energy optimization. The region benefits from advanced engineering ecosystems and strong regulatory incentives for green retrofits.

Europe

Europe is undergoing strong renovation growth due to strict environmental legislation, rising energy costs, and large-scale modernization initiatives in the U.K., Germany, and the Nordics. Operators in this region prioritize sustainable cooling, heat-recovery systems, and renewable energy integration. EU-wide carbon reduction initiatives have made eco-retrofits a key investment area.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by rapid hyperscale expansion, cloud adoption, and modernization of older enterprise data centers. China and India are experiencing major retrofitting initiatives to meet AI infrastructure demand. Japan, Singapore, and Australia are mature markets focused on sustainability upgrades and high-density retrofits.

Latin America

Latin America is gradually expanding its renovation market as Brazil, Mexico, and Chile upgrade data centers to support cloud and colocation growth. Power system upgrades and cooling enhancements dominate renovation spending due to high regional energy costs and increasing digital services adoption.

Middle East & Africa

MEA is emerging as a promising region for renovation with strong investments in digital infrastructure in the UAE, Saudi Arabia, and South Africa. Operators are prioritizing energy-efficient retrofits and capacity expansion to support growing cloud and edge deployments. Significant government-backed digital transformation initiatives further support the region’s modernization activities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Data Center Renovation Market

Recent Developments

- In 2025, Schneider Electric expanded its digital twin-enabled renovation solutions to support AI-ready power and cooling retrofits for hyperscale operators.

- In 2025, Vertiv introduced a new line of modular liquid cooling retrofits designed for existing enterprise and colocation facilities.

- In 2024, ABB launched high-efficiency UPS systems aimed at reducing energy consumption in legacy data centers undergoing modernization.