Data Center Infrastructure Management (DCIM) Market Size

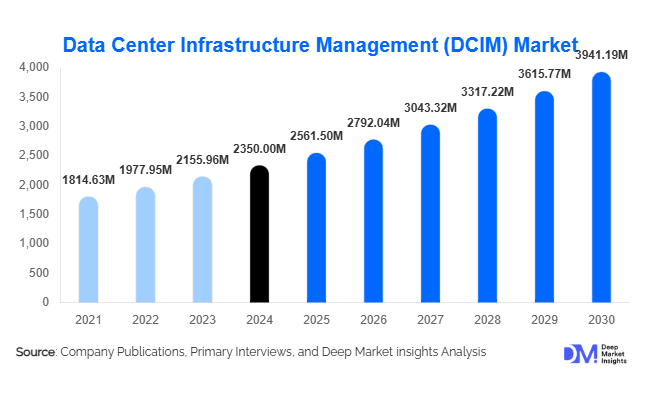

According to Deep Market Insights, the global Data Center Infrastructure Management (DCIM) market size was valued at USD 2,350 million in 2024 and is projected to grow from USD 2,561.50 million in 2025 to reach USD 3,941.19 million by 2030, expanding at a CAGR of 9.0% during the forecast period (2025–2030). The DCIM market growth is primarily driven by increasing demand for operational efficiency, energy optimization, real-time asset monitoring, and compliance management across enterprise and hyperscale data centers worldwide.

Key Market Insights

- Software solutions dominate the DCIM market, with predictive analytics, asset management, and energy monitoring becoming essential for real-time operational visibility.

- Energy & power management solutions lead the solution segment, as enterprises prioritize reducing energy costs, achieving sustainability targets, and enhancing Power Usage Effectiveness (PUE).

- Cloud-based DCIM deployment is growing faster than on-premises solutions, providing scalability, flexibility, and remote monitoring capabilities for multi-location data centers.

- Large enterprises account for the majority of DCIM adoption, driven by complex, high-capacity data center operations requiring integrated monitoring and compliance reporting.

- IT & telecom sectors represent the largest end-use segment, fueled by hyperscale data center expansion, cloud services, and 5G infrastructure rollout.

- Asia-Pacific is emerging as the fastest-growing regional market, led by China, India, and Japan, due to rapid digitalization, government-backed smart data center initiatives, and cloud adoption.

Latest Market Trends

AI and IoT Integration in DCIM

DCIM solutions are increasingly integrating artificial intelligence (AI) and IoT-enabled sensors to optimize energy consumption, predict equipment failures, and automate workflows. Predictive maintenance modules allow data centers to minimize downtime, reduce operational costs, and maximize asset lifespan. Integration of AI provides actionable insights, enabling enterprises to make strategic decisions beyond traditional monitoring. IoT-enabled DCIM solutions allow continuous real-time monitoring of temperature, humidity, airflow, and power consumption, improving overall operational efficiency.

Cloud-Native and SaaS Adoption

Cloud-based DCIM deployment models are gaining momentum, providing enterprises with flexibility, lower upfront costs, and centralized monitoring across multiple locations. SaaS-based DCIM allows subscription-driven access, reducing capital expenditure while offering rapid scalability. Enterprises are leveraging cloud-native solutions to integrate analytics dashboards, remote alerts, and predictive insights into operational processes. The trend aligns with the global shift toward hybrid and distributed data centers, particularly in emerging economies.

DCIM Market Drivers

Increasing Digitalization and Cloud Expansion

As businesses expand digital operations and migrate workloads to the cloud, the need for intelligent monitoring of IT infrastructure grows. Hyperscale and multi-cloud environments require DCIM solutions to optimize power, cooling, and asset allocation, driving strong adoption globally. The rise of AI-driven applications, big data, and IoT-connected devices further increases DCIM demand.

Operational Efficiency and Energy Optimization

Enterprises adopt DCIM to reduce operational expenditure (OPEX) by monitoring energy consumption, optimizing cooling systems, and preventing unplanned downtime. Energy efficiency measures, predictive maintenance, and capacity planning allow organizations to cut costs and improve sustainability metrics, positioning DCIM as a strategic tool for enterprise resilience.

Regulatory Compliance and Sustainability Pressures

Stricter environmental regulations and corporate sustainability mandates drive the adoption of DCIM solutions that monitor energy usage, carbon emissions, and regulatory compliance. Enterprises leverage DCIM to maintain ESG reporting standards, enhance operational transparency, and ensure alignment with global energy efficiency protocols.

Market Restraints

High Initial Investment Costs

On-premises DCIM solutions require significant upfront CAPEX for software, sensors, and integration with legacy infrastructure. This creates adoption barriers for SMEs and cost-sensitive organizations. Budget constraints can slow market penetration in emerging regions despite growing demand.

Complex Integration with Legacy Systems

Implementing DCIM in heterogeneous data centers with multiple legacy systems and vendor equipment can be challenging. Integration complexity, interoperability issues, and a lack of standardized protocols may delay deployment and reduce ROI, restraining growth in certain enterprises.

DCIM Market Opportunities

Expansion in Emerging Economies

Rapid digital transformation and government-backed smart city initiatives in Asia-Pacific, Latin America, and the Middle East create significant growth opportunities. Countries like India, China, and Brazil are investing heavily in data center infrastructure, requiring scalable and cost-effective DCIM solutions. New entrants and established players can capitalize on these expanding markets.

AI and Predictive Analytics Integration

Incorporating AI and machine learning into DCIM platforms allows predictive maintenance, energy optimization, and automated resource allocation. Providers developing intelligent, analytics-driven solutions can differentiate themselves while helping clients achieve operational excellence and sustainability goals.

Green Data Centers and Compliance Solutions

Regulatory focus on energy efficiency, carbon emissions, and ESG compliance drives demand for DCIM solutions, enabling green data center operations. Vendors offering modules for carbon monitoring, compliance reporting, and energy audits can help enterprises meet sustainability targets, reduce operating costs, and gain market differentiation.

Product Type Insights

Software solutions continue to dominate the global DCIM market, accounting for the largest share due to their critical role in energy monitoring, predictive analytics, and comprehensive asset management. These solutions enable real-time visibility into data center performance, reduce operational downtime, and facilitate proactive maintenance strategies. Service offerings, including consulting, implementation, and ongoing maintenance, complement software adoption, ensuring optimal integration and efficiency of DCIM systems. Among solution types, energy & power management solutions lead market demand as enterprises face rising energy costs and increasingly stringent sustainability requirements. These solutions help organizations optimize power usage, reduce PUE (Power Usage Effectiveness), and comply with global energy efficiency standards. Additionally, cloud-based DCIM deployment is outpacing on-premises solutions due to scalability, lower upfront costs, and the ability to manage multi-site operations remotely. The shift toward cloud DCIM is further accelerated by growing hybrid and edge data center infrastructures and the need for real-time analytics across distributed facilities.

Application Insights

DCIM solutions are deployed across diverse applications, with primary adoption in IT & telecom, BFSI, healthcare, government, and energy sectors. The IT & telecom sector represents the largest application segment, driven by hyperscale data center expansions, cloud services, and the rollout of 5G networks, which require continuous monitoring and optimization of assets, power, and cooling systems. BFSI and healthcare sectors are increasingly adopting DCIM to ensure uninterrupted uptime, regulatory compliance, and robust disaster recovery capabilities, especially as these sectors become highly digitalized. Emerging applications such as edge computing facilities, retail e-commerce platforms, and hybrid cloud environments are further broadening the scope of DCIM, creating opportunities for vendors to integrate AI, IoT, and predictive analytics functionalities tailored for specialized operational needs.

Distribution Channel Insights

Direct enterprise sales dominate DCIM adoption, particularly among large organizations seeking end-to-end solutions and customized service offerings. Managed service providers and consulting firms are also playing a significant role, offering implementation, integration, and maintenance support. Cloud-based SaaS solutions are increasingly marketed through subscription models, providing flexible and cost-effective options for SMEs and rapidly growing enterprises. Digital channels, including vendor websites, online platforms, and interactive demos, enable transparent pricing and real-time support, streamlining the purchasing process. Additionally, technology-driven marketing strategies, such as webinars, AI-powered product demonstrations, and social media campaigns, are influencing enterprise decision-making, particularly in emerging markets where awareness of DCIM solutions is still growing.

End-User Insights

Large enterprises are the primary end-users of DCIM solutions, driven by the complexity of multi-location data centers, hybrid cloud operations, and stringent uptime requirements. SMEs are increasingly adopting cloud-based DCIM solutions due to affordability, scalability, and operational efficiency. Among industries, IT & telecom continues to drive the highest demand, followed by BFSI and healthcare sectors, due to their dependence on high availability, data security, and regulatory compliance. Emerging industries, including energy utilities, retail, and e-commerce, are also contributing to market expansion, leveraging DCIM to optimize resource utilization and monitor energy consumption across distributed infrastructures. Export-driven demand from Asia-Pacific and Latin America is rising, as enterprises deploy DCIM to support outsourced and hyperscale data center operations, reflecting growing international adoption trends.

| By Component | By Solution Type | By Deployment Type | By Organization Size | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 40% of the 2024 DCIM market. The U.S. and Canada dominate due to advanced IT infrastructure, extensive hyperscale data centers, and sustainability-focused regulations. Regional growth is driven by enterprises prioritizing AI-enabled DCIM solutions, predictive analytics, and energy optimization to reduce operational costs and ensure compliance with environmental mandates. The rapid adoption of cloud-based services, coupled with government incentives for green data centers, supports continuous market expansion.

Europe

Europe holds 25% market share, led by Germany, the U.K., and France. Growth is propelled by strict regulatory frameworks, energy efficiency mandates, and widespread cloud adoption. Key drivers include the need for sustainable energy management, predictive analytics for operational optimization, and integration of advanced monitoring tools. Additionally, European enterprises are increasingly adopting hybrid and edge DCIM solutions to manage distributed data centers while complying with EU energy and ESG standards, boosting regional demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China, India, and Japan leading adoption at a CAGR of 10% during 2025–2030. Drivers include rapid industrial digitalization, government-backed investments in smart data centers, and expanding cloud infrastructure. Hyperscale and edge data center deployments, coupled with rising energy costs and the adoption of AI-driven DCIM solutions, further fuel growth. Emerging digital services in India and China, as well as e-commerce and fintech expansion, are contributing to accelerated regional demand.

Latin America

Brazil and Mexico lead DCIM adoption in Latin America. Market growth is driven by expanding banking, telecom, and cloud infrastructure, as well as government initiatives to modernize IT ecosystems. Enterprises are increasingly implementing DCIM to optimize energy efficiency, reduce downtime, and support growing digital and e-commerce operations. Outsourcing trends and the expansion of international data center service providers are also key growth enablers.

Middle East & Africa

Africa remains a hub for traditional data centers, while the Middle East, led by the UAE and Saudi Arabia, is investing heavily in smart city initiatives and digital infrastructure. Drivers for regional growth include government-backed digital transformation programs, high-income populations demanding reliable IT services, adoption of AI-enabled and cloud-based DCIM solutions, and the development of energy-efficient data centers. These factors collectively support operational optimization and energy management across enterprise and government-run facilities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the DCIM Market

- Schneider Electric

- Vertiv

- Nlyte Software

- Sunbird Software

- Siemens

- ABB

- Eaton

- Huawei

- Cisco Systems

- IBM

- Panduit

- Raritan (Legrand)

- Geist

- Delta Electronics

- ABB Power Solutions

Recent Developments

- In May 2025, Schneider Electric launched a new AI-driven DCIM platform integrating predictive analytics for energy optimization across hyperscale data centers.

- In April 2025, Vertiv expanded cloud-based DCIM services in APAC, targeting SMEs and mid-sized enterprises with scalable subscription models.

- In February 2025, Nlyte Software introduced enhanced sustainability reporting tools for global compliance, enabling enterprises to monitor carbon emissions and optimize energy usage.