Data Center GPU Market Size

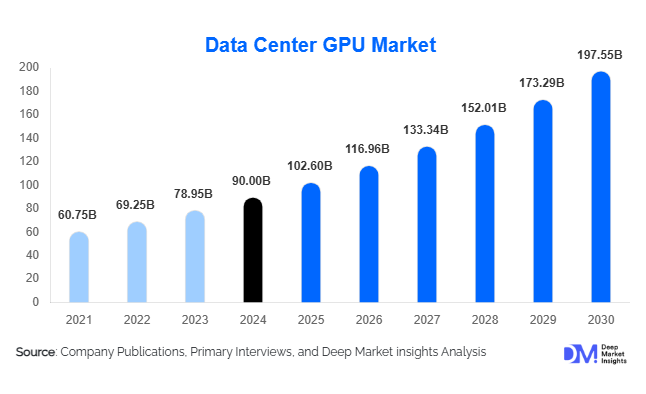

According to Deep Market Insights, the global data center GPU market size was valued at USD 90 billion in 2024 and is projected to grow from USD 102.60 billion in 2025 to reach USD 197.55 billion by 2030, expanding at a CAGR of 14% during the forecast period (2025–2030). The market growth is primarily driven by the surging demand for AI and machine learning workloads, the rapid expansion of hyperscale cloud data centers, and technological advancements in GPU architecture and ecosystem integration.

Key Market Insights

- Cloud and hyperscale deployment models dominate, as enterprises and CSPs increasingly prefer GPU-as-a-Service and on-demand compute infrastructure.

- Generative AI and large language models are driving demand for high-performance GPU clusters, especially for training and inference workloads in enterprise and cloud data centers.

- North America leads the global market, driven by major hyperscale cloud providers, established AI research hubs, and mature data center infrastructure.

- Asia-Pacific is the fastest-growing region, fueled by government AI initiatives, rapid enterprise adoption, and expanding cloud infrastructure in China, India, and Southeast Asia.

- Technological innovations in GPUs, including multi-GPU architectures, tensor cores, and high-bandwidth memory, are enabling new AI and HPC workloads.

- Enterprise and government investments in AI-ready data centers are creating strong opportunities for GPU hardware and system integration companies globally.

Latest Market Trends

Rise of AI-Driven GPU Workloads

The adoption of artificial intelligence, machine learning, and deep learning workloads is propelling the demand for data center GPUs. Organizations are increasingly deploying GPUs to accelerate model training and inference, especially for generative AI, large language models, and predictive analytics. Hyperscale cloud operators are expanding GPU clusters to meet enterprise demand for on-demand GPU services. Enterprises in healthcare, automotive, finance, and media are upgrading in-house GPU infrastructure to run complex AI algorithms, boosting market growth. The demand for AI-capable GPUs is driving a trend toward high-density, energy-efficient, and modular data center deployments.

Technological Advancements in GPU Infrastructure

Innovations in GPU architecture, including tensor cores, multi-chip modules, and high-bandwidth memory (HBM), are increasing performance per watt and lowering latency. Software ecosystem enhancements such as CUDA, ROCm, and AI frameworks facilitate easier adoption of GPU compute. GPU virtualization, cloud bursting, and hybrid deployment models are also emerging, enabling scalable, cost-efficient solutions for enterprises and hyperscale providers. These technological developments enhance the usability of GPUs for both HPC and AI workloads, reinforcing their centrality in modern data centers.

Data Center GPU Market Drivers

Growing AI and ML Adoption

AI and ML adoption across industries is the primary growth driver for data center GPUs. Large-scale model training, including generative AI and predictive analytics, requires high-density GPU infrastructure capable of parallel computation and high memory bandwidth. Enterprises are increasingly integrating AI into core operations, from healthcare diagnostics to autonomous driving simulation, generating consistent demand for high-performance GPUs in data centers.

Hyperscale Cloud Expansion

Hyperscale cloud providers such as AWS, Google Cloud, and Microsoft Azure are investing heavily in GPU-enabled infrastructure to serve enterprise and developer AI workloads. The proliferation of GPU-as-a-Service models allows customers to access high-performance compute without large upfront CAPEX, driving both cloud GPU adoption and overall market growth. Additionally, enterprises are leveraging hybrid cloud models, combining on-premises GPU infrastructure with cloud bursting to scale compute as needed.

Innovation in GPU Architecture and Ecosystem

GPU performance improvements through multi-GPU systems, tensor cores, and enhanced interconnects, alongside mature software frameworks, are facilitating more complex AI, ML, and HPC workloads. These innovations increase GPU utilization and adoption in data centers globally, creating sustained demand for next-generation hardware and software solutions.

Market Restraints

High Infrastructure Costs

Premium data center GPUs are expensive, and deploying multi-GPU clusters requires significant investment in power, cooling, and floor space. Small and medium-sized enterprises may face barriers to adoption due to high CAPEX and operational costs. Energy and cooling infrastructure for high-density GPU servers remains a key restraint limiting market penetration.

Supply Chain and Obsolescence Risks

Rapid product obsolescence, semiconductor shortages, and geopolitical export restrictions create supply-chain challenges. Enterprises and cloud providers may delay GPU purchases, awaiting new generations, which can slow deployment and market growth.

Data Center GPU Market Opportunities

Generative AI and LLM Adoption

Generative AI and large language model workloads are expanding rapidly, creating opportunities for high-density GPU clusters. Enterprises, hyperscalers, and governments require GPUs for training and inference of large models, offering growth potential for hardware vendors and system integrators. Companies offering optimized GPU solutions for AI model fine-tuning and inference services are particularly well-positioned.

Regional Expansion and Emerging Markets

Emerging regions, including APAC, MEA, and Latin America, present white space opportunities. Government initiatives to promote AI, cloud adoption, and local data centers are driving demand for GPUs. Vendors can capitalize on these regions through partnerships, local infrastructure projects, and tailored service offerings such as edge-cloud GPU solutions.

Hybrid Cloud and GPU-as-a-Service Models

The shift toward cloud-based GPU consumption allows enterprises to scale without large capital expenditure. Hybrid models integrating on-premises GPUs with cloud bursting and edge computing are becoming increasingly attractive. Providers offering GPU-as-a-Service and managed GPU clusters can capture growing market segments, particularly in AI-intensive industries.

Deployment Model Insights

The cloud/hyperscale deployment segment dominates the data center GPU market, accounting for approximately 50% of the 2024 market. This segment is primarily driven by hyperscale cloud providers and CSPs that rapidly scale GPU infrastructure to meet growing AI, HPC, and analytics demands. Cloud deployments benefit from on-demand GPU-as-a-Service models, enabling enterprises to leverage high-performance computing without significant capital investment. The continuous adoption of next-generation GPU architectures and high-bandwidth memory solutions further reinforces the dominance of cloud/hyperscale deployments. On-premises GPU deployments are smaller in scale but steadily growing, especially among enterprises handling sensitive workloads, such as financial modeling, healthcare diagnostics, and government research, where regulatory compliance and data sovereignty are critical. Hybrid deployment models are also gaining traction, enabling enterprises to combine the flexibility of cloud with the security of on-premises infrastructure. Overall, the trend is increasingly cloud-first, with hybrid strategies complementing enterprise adoption for specialized workloads.

Function Insights

Training workloads are the leading function, representing roughly 60% of the 2024 market. The surge in AI and ML adoption, particularly for generative AI models and large-scale language models, is driving unprecedented demand for GPUs with high computational throughput and memory bandwidth. GPU clusters are essential for parallel processing and high-speed data handling required during AI model training. Inference workloads, while constituting a smaller portion of total GPU consumption, are experiencing rapid growth due to the deployment of trained models in real-time enterprise applications, cloud services, and edge computing. This expansion is facilitated by the increasing availability of specialized GPUs optimized for inference tasks, such as tensor cores and low-latency architectures. Training-focused deployments continue to lead revenue generation globally, reflecting the prioritization of AI model development in enterprise and hyperscale cloud strategies.

Application Insights

Generative AI and large language models (LLMs) represent the fastest-growing application segment, accounting for approximately 30–35% of the 2024 market. Enterprises, hyperscalers, and AI-focused startups are deploying GPU clusters for both training and inference of complex models, driving demand for high-end GPU systems with multi-chip and high-bandwidth architectures. High-performance computing (HPC) applications, including scientific simulations, climate modeling, and autonomous vehicle testing, remain significant contributors to GPU adoption but are growing at a comparatively slower pace. Data analytics applications, particularly those leveraging real-time AI and predictive modeling, also continue to adopt GPU acceleration. Overall, AI-centric applications, particularly generative AI and LLMs, are emerging as primary growth drivers globally, reshaping both enterprise IT strategies and cloud infrastructure investments.

End-Use Insights

Cloud service providers dominate end-use demand, representing around 55% of the 2024 market. Hyperscalers such as AWS, Google Cloud, and Microsoft Azure are expanding GPU clusters to meet enterprise and developer demands for AI, analytics, and HPC workloads. Enterprises in industries such as healthcare, finance, automotive, and media are increasingly adopting GPUs to accelerate AI-driven operations, data modeling, and advanced simulations. Government agencies and research institutions are emerging as important end-users, particularly for AI research, defense applications, and high-performance scientific computing. Export-driven demand is also rising in emerging markets, where enterprises and institutions import high-end GPUs for deployment in locally expanding cloud and data center infrastructure. The convergence of AI adoption and regulatory compliance is shaping end-use priorities across sectors, highlighting cloud service providers as the central growth engine.

| By Deployment Model | By Function | By Application | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest market, accounting for approximately 40% of the 2024 market. The U.S. drives regional demand with hyperscale cloud operators, leading AI research centers, and mature enterprise adoption of GPU-based infrastructure. Government AI initiatives, such as federal research grants for HPC and AI-driven programs, along with a well-established R&D ecosystem, further accelerate adoption. The presence of major GPU manufacturers, supportive regulatory frameworks, and high data center density make North America a critical hub for both innovation and high-performance GPU deployments. Demand is additionally fueled by sectors such as finance, healthcare, and technology, which increasingly rely on AI for real-time analytics and predictive modeling.

Asia-Pacific

APAC is the fastest-growing region, with a 2024 share of roughly 25%. China, India, Japan, and South Korea are major contributors, driven by extensive government initiatives to promote AI, cloud infrastructure, and domestic semiconductor development. Enterprises across finance, automotive, healthcare, and e-commerce are accelerating AI and HPC deployments, creating substantial GPU demand. Hyperscale data center expansion by local and international providers, coupled with rising enterprise adoption of AI workloads, underpins regional growth. Investments in AI-ready campuses, edge computing infrastructure, and GPU-powered supercomputing facilities are further enhancing the market’s growth trajectory in APAC.

Europe

Europe accounts for approximately 20% of the 2024 market, led by the U.K., Germany, and France. Growth is driven by enterprise adoption of AI for analytics, HPC research, and cloud migration initiatives. Governments are promoting energy-efficient and regulatory-compliant data centers, incentivizing eco-friendly GPU deployments. Investment in AI and HPC research, particularly in scientific and industrial domains, supports GPU adoption. Strong enterprise demand for AI-driven operations, coupled with cloud provider expansion in major European hubs, reinforces Europe’s steady market growth. Sustainability initiatives and stricter data protection laws also shape the deployment strategies, favoring hybrid and on-premises solutions in sensitive sectors.

Latin America

Latin America represents roughly 7–8% of the 2024 market, with Brazil, Mexico, and Argentina as primary contributors. Regional growth is driven by the emerging adoption of cloud-based GPU services and enterprise AI initiatives. Increasing investments in IT infrastructure by private enterprises and public institutions, coupled with demand for AI-powered analytics in sectors like finance, logistics, and e-commerce, are supporting GPU adoption. Cloud service provider expansion and the gradual shift toward hybrid models further accelerate regional growth.

Middle East & Africa

MEA holds approximately 8–9% of the 2024 market. The Gulf Cooperation Council (GCC) countries, led by the UAE and Saudi Arabia, are investing heavily in AI infrastructure, cloud data centers, and GPU-enabled HPC systems. Intra-African adoption is also rising for research and industrial applications, including scientific computing, defense simulations, and AI research. Regional growth is driven by government initiatives supporting AI and technology adoption, increasing foreign investment, and the expansion of hyperscale cloud services across major metropolitan hubs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Data Center GPU Market

- NVIDIA Corporation

- Advanced Micro Devices, Inc. (AMD)

- Intel Corporation

- Google LLC

- Microsoft Corporation

- Amazon Web Services, Inc. (AWS)

- Alibaba Cloud

- IBM Corporation

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Qualcomm Technologies, Inc.

- Micron Technology, Inc.

- Super Micro Computer, Inc.

- Fujitsu Limited

- Lenovo Group Limited

Recent Developments

- In Q1 2025, NVIDIA launched its H100 Blackwell GPU architecture for hyperscale AI and HPC workloads, driving adoption among cloud providers and enterprises.

- In 2025, Intel acquired additional GPU technology firms to strengthen its data center GPU portfolio, targeting AI and HPC workloads.