Data Center Fabric Market Size

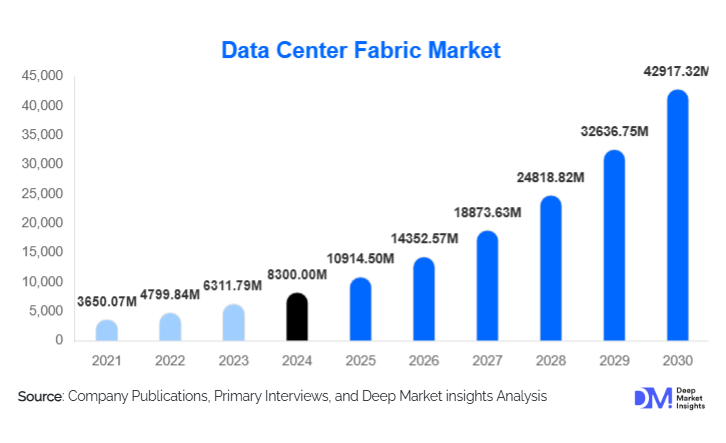

According to Deep Market Insights, the global data center fabric market size was valued at USD 8,300.00 million in 2024 and is projected to grow from USD 10,914.50 million in 2025 to reach USD 42,917.32 million by 2030, expanding at a CAGR of 31.50% during the forecast period (2025–2030). The growth of the data center fabric market is primarily driven by the exponential rise in cloud computing, increasing adoption of artificial intelligence (AI) and big data analytics, and the rapid proliferation of edge and hyperscale data centers across major economies.

Key Market Insights

- Data center fabrics are transforming network architectures by replacing legacy three-tier topologies with scalable, low-latency leaf–spine and hyperconverged designs.

- Cloud service providers (CSPs) and hyperscale operators dominate demand, accounting for more than half of global deployments in 2024.

- North America leads the global market, contributing nearly 40% of total revenue, while Asia-Pacific emerges as the fastest-growing region through 2030.

- Software-defined networking (SDN), automation, and open-fabric technologies are reshaping data center connectivity, management, and orchestration.

- Service-led offerings, such as managed fabrics and integration services, are witnessing double-digit growth as enterprises seek turnkey deployment models.

- Rising AI/ML and 5G workloads are accelerating demand for high-bandwidth, ultra-low-latency interconnects globally.

What are the latest trends in the Data Center Fabric Market?

Expansion of Edge and Multi-Cloud Fabrics

As organizations transition toward distributed digital ecosystems, data center fabric technologies are extending beyond core facilities to encompass hybrid, multi-cloud, and edge environments. Modern enterprises demand consistent, automated, and software-driven networking across dispersed infrastructures. Vendors are responding with programmable fabrics that support policy-based management, workload mobility, and low-latency interconnectivity. This trend is especially visible in emerging economies, where regional data localization regulations and the rollout of 5G edge sites are propelling large-scale fabric deployments.

Integration of AI and Automation for Network Optimization

Artificial intelligence and machine learning are increasingly being integrated into fabric controllers and management software. Predictive analytics, self-healing networks, and autonomous performance tuning are reducing manual intervention, improving uptime, and enabling adaptive resource allocation. This automation trend not only enhances operational efficiency but also addresses the skills shortage in network administration, allowing enterprises to scale infrastructure dynamically to match evolving workloads.

What are the key drivers in the Data Center Fabric Market?

Surging Cloud and Hyperscale Infrastructure Investments

The explosion of cloud computing and hyperscale data center development remains the single largest driver for data center fabric adoption. Global cloud service providers, including AWS, Microsoft Azure, Google Cloud, Alibaba, and Oracle, continue to build and expand facilities worldwide, deploying highly efficient fabrics to manage east-west traffic and support multi-tenant scalability. These architectures deliver low latency and high bandwidth, which are critical for AI training, analytics, and large-scale storage replication.

Migration from Legacy Networks to Leaf–Spine and Hyperconverged Fabrics

Traditional three-tier network topologies are increasingly being replaced by flatter, leaf–spine fabrics that enhance throughput and simplify management. Enterprises are adopting hyperconverged fabrics integrating compute, storage, and networking within unified platforms, improving resource utilization and agility. This transition enables flexible scaling and automation, making fabrics a cornerstone for hybrid and private cloud modernization strategies.

Emergence of Edge and 5G-Driven Data Centers

The proliferation of IoT, autonomous systems, and real-time analytics is accelerating the deployment of distributed edge data centers. These require compact yet high-performance fabrics that connect regional nodes to cloud cores with minimal latency. Telecom operators are also investing heavily in fabric-based architectures to manage 5G and upcoming 6G network traffic efficiently. This convergence of telecom and data center infrastructure represents a major growth vector for the fabric market.

What are the restraints for the global market?

High Initial Capital and Integration Costs

Building or upgrading data centers with modern fabric architectures demands substantial investment in advanced switches, controllers, and orchestration platforms. Integration with legacy systems remains technically challenging and expensive, limiting adoption among small and mid-sized enterprises. Implementation complexity and the need for skilled personnel further increase operational costs, particularly in developing regions.

Interoperability and Vendor Fragmentation Challenges

The presence of multiple proprietary standards and protocols across vendors often leads to interoperability issues. Enterprises risk vendor lock-in or limited scalability when integrating heterogeneous equipment. The market’s fragmented ecosystem delays unified standards and slows broader adoption of open-fabric solutions, especially among cost-sensitive organizations.

What are the key opportunities in the Data Center Fabric Market?

Edge Computing and Distributed Fabric Deployments

The rise of smart cities, autonomous vehicles, and industrial IoT is creating a new class of micro-data centers that depend on high-performance fabrics. Vendors offering lightweight, modular fabric systems optimized for edge environments can capture this emerging market segment. Partnerships with telecom operators and cloud service providers are opening multi-billion-dollar opportunities in regional infrastructure build-outs.

AI-Enabled Fabric Management and Network Intelligence

As data center networks become more complex, AI-powered fabric controllers that enable real-time analytics, predictive maintenance, and dynamic optimization are in high demand. These technologies minimize downtime, automate traffic engineering, and provide granular visibility across large-scale environments, offering substantial efficiency gains for operators.

Services-Led Growth and Managed Fabric Offerings

The complexity of fabric deployment and management is giving rise to service-centric business models. Managed services, consulting, and integration solutions are enabling enterprises to modernize their networks without heavy upfront investment. Vendors providing end-to-end lifecycle support, from design to operations, stand to gain as more organizations adopt “fabric-as-a-service” approaches.

Product Type Insights

Solutions dominate the market, accounting for approximately 55% of total revenue in 2024. This includes networking switches, routers, and management software that enable high-speed, low-latency communication. Hardware upgrades, particularly Ethernet switches supporting 400G and 800G bandwidths, are fueling this segment’s leadership. Meanwhile, software-defined fabric platforms are rapidly gaining traction due to their flexibility, automation, and integration with AI analytics.

Application Insights

IT & Telecommunications represents the largest application segment, accounting for about 32% of the global market share in 2024. The rise of hyperscale and cloud infrastructure among telecom operators and ISPs is the primary growth driver. The BFSI and healthcare sectors are also experiencing strong adoption, leveraging data fabrics for real-time analytics, compliance, and secure transaction processing.

End Use Insights

Cloud Service Providers (CSPs) lead the market with a 38% share in 2024, driven by the continuous expansion of global cloud platforms such as AWS, Azure, and Google Cloud. Colocation providers and enterprise data centers follow closely, adopting fabrics to enhance agility and manage multi-tenant environments efficiently. The increasing hybrid and multi-cloud ecosystem is expected to further boost demand for fabric integration.

| By Component | By Fabric Type | By Application | By Enterprise Size | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the global data center fabric market, accounting for approximately 41% of the total market share in 2024. The region’s leadership stems from early adoption of cloud computing, AI applications, and the presence of major hyperscalers. The U.S. is the largest market, followed by Canada, with ongoing investments in AI-ready and 5G-enabled data centers driving sustained growth.

Europe

Europe holds a significant market position with major contributions from the U.K., Germany, and the Netherlands. Stringent data privacy regulations such as GDPR have led to increased data localization, boosting new data center construction. The region is witnessing growth in green data centers, where energy-efficient fabrics play a crucial role in reducing carbon footprint.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to record a CAGR of over 37% during 2025–2030. China, India, and Singapore are leading investment hubs due to surging cloud and 5G infrastructure demand. Regional hyperscalers such as Alibaba Cloud and Tencent Cloud are deploying next-generation fabrics to enhance capacity and reduce latency. India’s “Digital India” and China’s “Made in China 2025” initiatives are further accelerating market growth.

Latin America

Latin America’s data center fabric market is expanding steadily, led by Brazil, Mexico, and Chile. The region is witnessing investments in colocation and cloud facilities, primarily driven by multinational cloud providers entering the market. The growing digitization of the financial and e-commerce sectors is expected to strengthen regional demand.

Middle East & Africa

The Middle East & Africa region is witnessing rapid digital transformation with large-scale infrastructure projects in the UAE, Saudi Arabia, and South Africa. Initiatives such as “Saudi Vision 2030” are promoting smart city and cloud deployments, creating strong opportunities for fabric solutions. Africa’s emerging data center ecosystem, particularly in Nigeria and Kenya, is fostering regional adoption of high-speed networking solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Data Center Fabric Market

- Cisco Systems, Inc.

- Arista Networks, Inc.

- Hewlett Packard Enterprise (HPE)

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Dell Technologies Inc.

- IBM Corporation

- Broadcom Inc.

- Extreme Networks, Inc.

- NVIDIA Corporation

Recent Developments

- In August 2025, Cisco Systems announced the expansion of its Silicon One-powered Nexus portfolio to support AI-scale data center fabrics with 800G Ethernet switching.

- In June 2025, Arista Networks launched a new intent-based fabric automation platform designed for hybrid cloud and AI workloads.

- In March 2025, Huawei unveiled its “CloudFabric 3.0” solution focused on autonomous networking, digital twin simulation, and energy-efficient operations for hyperscale data centers.