Data Center Containment Market Size

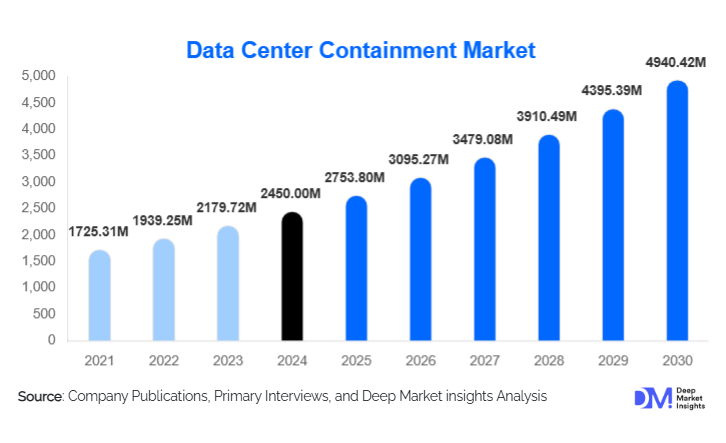

According to Deep Market Insights, the global data center containment market size was valued at USD 2,450.00 million in 2024 and is projected to grow from USD 2,753.80 million in 2025 to reach USD 4,940.42 million by 2030, expanding at a CAGR of 12.4% during the forecast period (2025–2030). Data center containment solutions are gaining momentum as operators accelerate investments in thermal optimization, increasing rack density, and sustainability-driven energy-efficiency measures. The market’s momentum is strongly supported by hyperscale expansion, colocation growth, and stricter energy-use policies across major regions.

Key Market Insights

- Hot aisle containment (HAC) systems dominate due to superior energy savings and easier retrofit integration.

- Hyperscale and colocation data centers account for the majority of new demand, driven by cloud providers and AI workloads.

- North America leads global adoption, while Asia-Pacific remains the fastest-growing region.

- Sustainability mandates are accelerating containment adoption across Europe and APAC.

- Modular aisle containment and intelligent airflow management are emerging as key technological differentiators.

What are the latest trends in the Data Center Containment Market?

AI-Optimized Cooling and Airflow Modelling

Data centers are rapidly integrating AI-driven airflow modeling tools that analyze heat maps, optimize rack layouts, and automate containment adjustments. These systems enable real-time thermal balancing, reduce mechanical cooling reliance, and support higher rack densities required for AI and HPC workloads. Vendors are embedding machine learning algorithms into containment infrastructure, such as automated dampers and adaptive containment panels, allowing data centers to dynamically respond to heat fluctuations without human intervention.

Shift Toward Modular & Tool-Less Containment Designs

Enterprises prefer modular containment systems that require minimal downtime and can be installed without structural modifications. Tool-less panel systems, magnetic mounting, and telescopic structures are becoming industry standards. This trend supports rapid data center expansion, edge deployments, and scalable colocation environments. Modular designs also reduce the total cost of ownership by enabling reuse during facility upgrades or layout changes.

What are the key drivers in the Data Center Containment Market?

Accelerating Hyperscale & Cloud Expansion

Global hyperscale operators, including cloud service providers and AI compute facilities, are deploying larger, denser data centers. These facilities demand advanced containment to achieve required energy efficiency levels, reduce cooling costs, and meet corporate sustainability goals. Hyperscale growth alone accounts for more than 50% of new containment deployments worldwide.

Energy Efficiency Regulations & Sustainability Mandates

Governments across Europe, North America, and APAC are enforcing tighter data center energy-efficiency norms. Initiatives such as the EU’s “Green Deal,” U.S. DOE efficiency programs, and Singapore’s Green Data Centre Roadmap push operators to adopt containment systems that reduce cooling energy by up to 30–40%. Sustainability certifications (LEED, BREEAM, CEEDA) further elevate demand for containment solutions.

Rising Rack Density from AI, HPC & Edge Workloads

AI training, HPC, and 5G edge infrastructures are driving rack densities beyond 20–50 kW. Containment becomes essential to maintain stable inlet temperatures, reduce hotspots, and support liquid-cooling integration. As compute density spikes globally, containment infrastructure becomes a mandatory element of data center modernization.

Key Restraints

High Initial Investment & Retrofit Complexity

While containment delivers long-term energy savings, the upfront cost of installation, especially in brownfield sites, remains a challenge. Legacy facilities face complexity in integrating modern containment into outdated rack layouts, leading to operational downtime and additional planning costs.

Limited Skilled Workforce for Advanced Cooling Designs

Engineering specialized airflow designs, building modular containment structures, and integrating intelligent cooling systems require skilled technicians. Many regions face workforce shortages, elongating deployment timelines, and slowing market expansion.

Product Type Insights

Hot aisle containment (HAC) dominates the market, accounting for approximately 44% of the global market in 2024, due to superior energy efficiency, easier retrofit capabilities, and higher ROI for hyperscale and colocation facilities. Cold aisle containment (CAC) remains widely adopted in greenfield enterprise data centers, balancing installation cost and thermal management. Hybrid and vertical exhaust systems are gaining traction for specialized high-density AI and HPC racks, offering flexibility in airflow optimization. Modular panels, doors, and sealing systems are increasingly standard, providing scalable solutions for retrofit and new construction deployments, while reducing installation time and operational disruptions.

Application Insights

Data center containment is most widely applied in hyperscale and colocation facilities, where optimized airflow and energy savings are critical. Enterprise IT and BFSI sectors are rapidly adopting containment for both greenfield and retrofit projects to improve PUE and reduce cooling costs. Edge data centers are emerging as a new application segment, driven by 5G, IoT, and distributed computing requirements, necessitating compact and modular containment solutions. Healthcare, media & entertainment, and retail/e-commerce sectors are also integrating containment systems to support high-density compute and energy efficiency, reflecting a diversification of applications beyond traditional cloud environments.

Distribution Channel Insights

Direct sales and B2B partnerships dominate the market, as data center operators often work directly with containment vendors for customized solutions. Specialist system integrators provide design, installation, and maintenance services, especially for large hyperscale deployments. Online and digital platforms for component procurement are gaining importance for modular systems and standard panels, enabling faster procurement cycles. OEM partnerships, subscription-based monitoring, and after-sales service contracts are becoming increasingly prevalent to ensure optimal thermal performance and predictive maintenance.

End-User Insights

Cloud service providers represent the largest end-user segment, accounting for 36% of global demand in 2024, driven by rapid hyperscale expansion and high rack densities. IT & telecom follow closely, adopting containment solutions to support network densification and edge computing initiatives. BFSI, healthcare, and media industries are emerging growth sectors due to digital transformation, telemedicine, and streaming requirements. Government and enterprise sectors are gradually modernizing legacy data centers, emphasizing retrofits that enhance energy efficiency and sustainability.

Data Center Size / Age Group Insights

Hyperscale and colocation facilities (representing the 31–50kW rack density range) account for the largest share of containment adoption, combining high energy consumption with stringent cooling requirements. Mid-density enterprise data centers (18–30kW racks) are driving growth in retrofit projects, particularly in North America and Europe. Older legacy facilities with lower rack density (below 15kW) are slower adopters but represent significant retrofit potential, especially in Asia-Pacific. Edge data centers, often compact facilities under 1MW, are rapidly growing, fueled by 5G deployments and distributed computing needs.

| By Product Type | By Component | By Data Center Type | By Deployment Method | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the market with a 38% share in 2024, led by the U.S. and Canada. Strong hyperscale expansion, high electricity costs, and stringent sustainability regulations drive adoption. Cloud providers and colocation operators are retrofitting legacy facilities with containment solutions to improve PUE and reduce operational costs. Advanced thermal monitoring and AI-integrated airflow solutions are increasingly deployed in hyperscale hubs such as Northern Virginia, Silicon Valley, and Dallas-Fort Worth.

Europe

Europe holds a 27% share of the global market in 2024, driven by Germany, the UK, France, and the Netherlands. Energy efficiency regulations, sustainability mandates, and green building certifications push containment adoption. European enterprises are increasingly retrofitting existing data centers and investing in modular containment solutions to meet strict PUE and carbon emission targets.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a CAGR exceeding 11% through 2030. China, India, Singapore, and Japan lead regional growth due to hyperscale cloud expansion, AI and HPC deployments, and government incentives promoting green data centers. Singapore enforces strict cooling and PUE standards, pushing operators to adopt advanced containment systems, while India’s hyperscale development drives retrofit and greenfield installations.

Latin America

Brazil and Mexico are the primary LATAM markets, with growing cloud adoption, fintech expansion, and enterprise modernization projects. Containment adoption is focused on colocation and cloud providers serving regional demand, particularly in São Paulo, Mexico City, and Santiago.

Middle East & Africa

Saudi Arabia and the UAE are leading regional growth, supported by hyperscale, AI, and government cloud projects. South Africa drives adoption in Africa with colocation expansion. High energy costs, sustainability initiatives, and government-backed digitalization projects are accelerating containment deployment in both regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Data Center Containment Market

- Eaton Corporation

- Vertiv

- Schneider Electric

- nVent

- Subzero Engineering

- Legrand

- Panduit

- KoldLok

- Aisle Containment Solutions

- Rittal

- Polargy

- Cooler Master Data Center Solutions

- Cannon Technologies

- Belden

- AdaptivCool

Recent Developments

- In March 2025, Eaton launched an AI-driven modular hot aisle containment system, reducing cooling energy consumption by up to 35% in hyperscale deployments.

- In January 2025, Vertiv introduced retrofit containment solutions with tool-less installation for enterprise and colocation facilities, enabling faster deployment with minimal downtime.

- In December 2024, Schneider Electric expanded its containment panel portfolio to include smart airflow sensors integrated with cloud-based monitoring platforms, improving predictive cooling efficiency.