Data Center Chillers Market Size

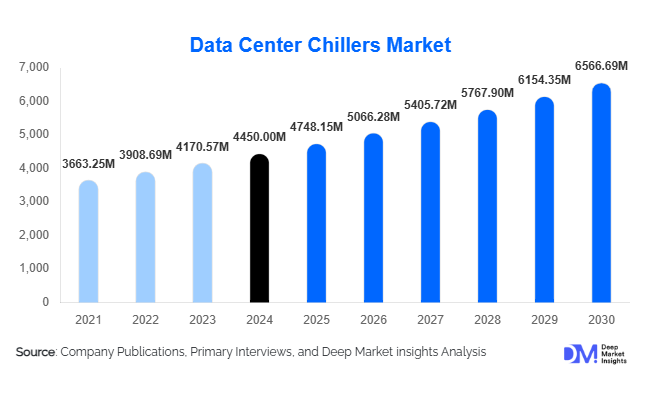

According to Deep Market Insights, the global data center chillers market size was valued at USD 4,450 million in 2024 and is projected to grow from USD 4,748.15 million in 2025 to reach USD 6,566.69 million by 2030, expanding at a CAGR of 6.7% during the forecast period (2025–2030). The growth of the market is primarily driven by the increasing construction of hyperscale and cloud data centers, rising adoption of energy-efficient and IoT-enabled cooling solutions, and the global demand for resilient data center operations capable of handling surging digital traffic.

Key Market Insights

- Water-cooled chillers dominate the market, owing to higher efficiency and scalability for large data centers, representing 42% of the 2024 market.

- Mid-capacity chillers (100–500 tons) account for 38% of global demand, balancing enterprise-level cooling needs with operational efficiency.

- Chilled water systems are the preferred cooling type, making up 45% of the 2024 market due to uniform temperature control and compatibility with modular facility designs.

- IT & cloud data centers remain the largest end-use segment, contributing 50% of total market demand, driven by cloud adoption and hyperscale infrastructure expansion.

- Asia-Pacific is the fastest-growing region, led by China, India, and Japan, as digital infrastructure investments surge.

- Technological integration, including AI-enabled predictive maintenance and IoT-based monitoring, is improving operational efficiency and reducing downtime for large-scale data centers.

Latest Market Trends

Energy-Efficient and Smart Chillers

Data center operators are increasingly adopting energy-efficient chillers to reduce operational costs and comply with environmental regulations. AI-enabled predictive maintenance, IoT monitoring, and advanced analytics are improving system uptime and reliability. Smart chillers can dynamically adjust cooling based on server load, enhancing energy savings. Adoption of low-GWP refrigerants and water-side economization further contributes to sustainability objectives.

Modular and Scalable Cooling Solutions

To address fluctuating IT loads and rapid expansion, modular chiller systems are gaining popularity. These systems allow for incremental capacity addition, minimizing capital expenditure while supporting high-density racks and hyperscale facilities. This trend appeals to colocation providers and cloud operators who require flexible and future-proof cooling infrastructure.

Data Center Chillers Market Drivers

Rapid Growth of Data Center Infrastructure

The expansion of hyperscale, colocation, and enterprise data centers is the primary market driver. North America, Europe, and APAC lead in new facility construction, increasing demand for reliable, high-capacity chillers. The surge in cloud computing, AI workloads, and big data analytics is directly contributing to this growth.

Stringent Energy Efficiency Regulations

Global energy regulations, including EU Ecodesign directives and U.S. DOE standards, encourage data center operators to adopt energy-efficient chillers. Compliance with these mandates is accelerating retrofitting and modernization projects, driving market expansion.

Technological Advancements

Integration of AI, IoT, and automation in chillers enables predictive maintenance, energy optimization, and real-time monitoring. These innovations reduce operational costs, prevent downtime, and increase reliability, making advanced chillers attractive to data center operators worldwide.

Market Restraints

High Capital Expenditure

Advanced water-cooled and absorption chillers require significant upfront investment. Small-scale operators may find it cost-prohibitive, limiting widespread adoption of high-efficiency systems.

Challenges in Retrofitting Legacy Facilities

Integrating modern chiller systems into older data centers often requires extensive redesign and infrastructure upgrades. This complexity slows adoption in legacy facilities, representing a key market restraint.

Data Center Chillers Market Opportunities

Hyperscale and Cloud Data Center Expansion

The surge in hyperscale cloud facilities presents opportunities for chiller manufacturers to supply high-capacity, scalable cooling systems. Emerging markets such as APAC and the Middle East are particularly attractive due to rapid digital infrastructure growth.

Integration of AI and IoT Technologies

Vendors integrating smart, IoT-enabled chillers can provide predictive maintenance, real-time monitoring, and adaptive cooling. These solutions enhance energy efficiency, reduce downtime, and improve operational reliability, creating differentiation in a competitive market.

Government Initiatives and Industrial Investments

Programs such as India’s “Make in India” and China’s “Made in China 2025” are promoting local manufacturing of high-tech equipment, including chillers. Additionally, public and private data center investments create opportunities for participation in large-scale infrastructure projects.

Product Type Insights

Among the various chiller types, water-cooled chillers dominate the global data center chillers market due to their superior efficiency and scalability in large-scale data center deployments. These chillers are particularly favored in hyperscale cloud facilities, colocation centers, and industrial data centers where high-density racks generate substantial heat loads. Water-cooled systems account for 42% of the 2024 market share, reflecting their continued preference in energy-intensive operations. Air-cooled chillers remain a preferred choice for mid-sized facilities, primarily due to their lower capital expenditure, simpler installation requirements, and reduced operational complexity. Meanwhile, absorption chillers are gaining traction as energy-optimized and sustainable solutions, particularly in regions and facilities emphasizing environmental compliance, low-carbon operations, and the use of alternative heat sources. The increasing focus on energy efficiency, combined with rising electricity costs, continues to drive adoption of water-cooled and absorption chillers in new construction and retrofit projects.

Application Insights

The IT & cloud data center segment is the leading application, representing 50% of total market demand. These facilities require continuous, reliable, and scalable cooling solutions to manage high-density server racks and mission-critical operations. Colocation facilities, telecom centers, and industrial data centers also contribute significantly, particularly in APAC and MEA regions, where new infrastructure developments are accelerating. Emerging applications, such as edge computing hubs and high-performance computing (HPC) facilities for AI and analytics, are creating additional demand for specialized, precise cooling solutions. Growth in these applications is fueled by increasing adoption of AI, IoT, cloud services, and big data analytics, which necessitate highly reliable and energy-efficient cooling systems to maintain operational performance while minimizing downtime.

Distribution Channel Insights

Direct sales dominate large-scale chiller installations, enabling manufacturers to offer turnkey solutions, integrated maintenance contracts, and after-sales support. This model is particularly relevant for hyperscale and enterprise facilities requiring custom configurations. Distributors are primarily leveraged for mid-sized facilities, providing localized availability and technical support. The increasing integration of online platforms for product configuration, real-time monitoring, and remote maintenance is enhancing reach and operational efficiency, enabling faster adoption of smart and IoT-enabled chillers. These digital channels also support predictive maintenance and energy optimization services, improving lifecycle management for customers.

End-Use Insights

The IT & cloud data center segment is the fastest-growing end-use market, driven by hyperscale cloud adoption, increasing digital workloads, and expanding colocation services. Colocation facilities are experiencing steady growth due to their flexibility and demand from smaller enterprises. Telecom data centers are adopting high-efficiency chillers to maintain network reliability and uptime. Emerging applications, such as AI research centers and edge data hubs, are contributing to market expansion in APAC and MEA, where international technology firms are investing in new facilities. Export-driven demand is particularly notable in these regions, driven by global hyperscale operators seeking high-performance and energy-efficient cooling solutions.

| By Type | By Capacity | By Cooling Type | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 30% of the 2024 market. The U.S. leads the region due to hyperscale cloud facility construction, advanced enterprise data centers, and stringent energy efficiency regulations. Canada is experiencing steady growth, particularly in colocation and edge data centers, supported by government incentives for energy-efficient IT infrastructure. Regional demand is driven by the presence of major cloud service providers, high adoption of AI and big data analytics, and continuous upgrades to hyperscale and modular data centers. Investments in energy-efficient water-cooled chillers and smart building automation systems further accelerate regional growth.

Europe

Europe holds approximately 28% of the 2024 market, with Germany, the U.K., and France leading demand. Growth is driven by regulatory compliance with energy efficiency standards, carbon reduction mandates, and government support for sustainable data center operations. Germany emphasizes green and sustainable facilities, the U.K. focuses on colocation and edge data hubs, while France combines cloud expansion with modernization of existing facilities. Strong digitization initiatives, robust cloud adoption, and the shift toward renewable energy-powered data centers are key drivers for segment growth in water-cooled and absorption chillers across the region.

Asia-Pacific (APAC)

APAC is the fastest-growing region, with a projected CAGR of 8%. China leads due to government-backed cloud initiatives and large-scale hyperscale data center projects. India is witnessing rapid growth driven by industrial digitization, government cloud infrastructure programs, and investments in IT parks. Japan demonstrates steady adoption in hyperscale and industrial data centers. Key growth drivers include expanding cloud services, rising internet penetration, and strong demand for energy-efficient, water-cooled chillers in high-density facilities. The trend toward edge computing and AI research centers in APAC further fuels regional demand.

Middle East & Africa (MEA)

MEA growth is fueled by smart city projects, new hyperscale and enterprise data centers, and the adoption of cloud services. UAE, Saudi Arabia, and South Africa are primary markets, driven by high-income populations, strategic government investments, and partnerships with global cloud operators. Water-cooled and absorption chillers are increasingly preferred for large-scale and energy-optimized facilities. Regional demand is supported by rapid urbanization, government incentives for digital infrastructure, and the expansion of telecom and colocation services.

Latin America (LATAM)

Brazil leads LATAM, followed by Argentina and Mexico, representing a moderate share of the global market. Growth is primarily driven by enterprise and colocation data centers requiring energy-efficient chillers. Drivers include regional cloud adoption, rising digital infrastructure investments, and modernization of legacy IT facilities. Increasing private sector investments and government initiatives to support industrial digitization are expected to further boost regional demand for water-cooled and air-cooled chillers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Data Center Chillers Market

- Carrier Global Corporation

- Johnson Controls

- Trane Technologies

- Daikin Industries

- Mitsubishi Electric

- Hitachi

- York (Johnson Controls)

- GEA Group

- LG Electronics

- Emerson Electric

- Siemens

- Schneider Electric

- Fujitsu General

- Ingersoll Rand

- Alfa Laval

Recent Developments

- In May 2025, Carrier Global Corporation introduced IoT-enabled chillers for hyperscale data centers, improving predictive maintenance and energy efficiency.

- In March 2025, Johnson Controls launched modular water-cooled chillers designed for mid-capacity colocation centers in APAC.

- In January 2025, Mitsubishi Electric expanded its advanced absorption chiller portfolio for energy-optimized data centers in Europe and the Middle East.