Data Center Cabling Market Size

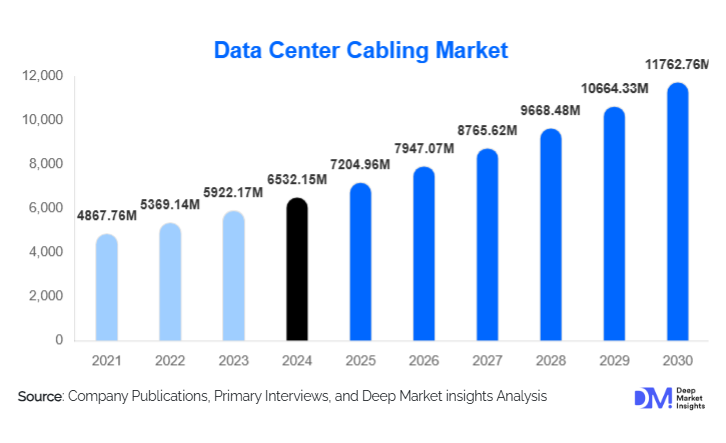

According to Deep Market Insights, the global data center cabling market size was valued at USD 6,532.15 million in 2024 and is projected to grow from USD 7,204.96 million in 2025 to reach USD 11,762.76 million by 2030, expanding at a CAGR of 10.30% during the forecast period (2025–2030). The market growth is primarily driven by rapid hyperscale data center expansion, rising adoption of high-density fiber connectivity, and increasing investments in cloud, edge, and AI-driven infrastructure modernization.

Key Market Insights

- Fiber-optic cabling dominates the market, accounting for nearly 60% of total revenues in 2024, driven by increasing demand for high-bandwidth and low-latency connections.

- Hyperscale data centers hold the largest end-user share, representing about 50% of total cabling demand worldwide.

- Asia-Pacific is the fastest-growing regional market, expected to register double-digit growth due to major digital infrastructure investments in India, China, and Southeast Asia.

- North America remains the largest market, supported by mature hyperscale ecosystems and early adoption of 400G/800G technologies.

- Modular and pre-terminated cabling systems are transforming deployment efficiency and driving new revenue streams for solution providers.

- Government-backed digital infrastructure initiatives, such as “Make in India” and “Made in China 2025,” are creating localized manufacturing and installation opportunities.

What are the latest trends in the Data Center Cabling Market?

Shift Toward Fiber-First Architectures

Global data center operators are transitioning toward fiber-first architectures to accommodate 40G, 100G, and 400G Ethernet transmission speeds. Single-mode and multimode fibers, coupled with MPO/MTP connectors, are increasingly replacing legacy copper solutions in backbone networks. This migration supports the explosive growth of data-intensive applications such as AI, cloud gaming, and analytics. Vendors are responding by offering bend-insensitive, high-density trunk cables and pre-terminated assemblies that reduce installation time and optimize space utilization within racks and conduits.

Rise of Edge and Micro Data Centers

The acceleration of 5G deployment and IoT connectivity is driving the proliferation of edge and micro data centers. These compact facilities require modular cabling systems that can be rapidly deployed in distributed environments. The demand for ruggedized, pre-terminated cables that maintain performance integrity in variable environments is surging. Edge expansion is especially pronounced in telecom and industrial automation applications, where data must be processed locally to minimize latency and bandwidth costs.

What are the key drivers in the Data Center Cabling Market?

Hyperscale and Cloud Infrastructure Expansion

Global cloud providers and colocation operators are investing heavily in hyperscale facilities, fueling massive demand for structured cabling. Each hyperscale campus requires thousands of kilometers of copper and fiber links for intra- and inter-rack connections. This infrastructure expansion directly boosts the cabling market, with North America, Europe, and Asia-Pacific witnessing major investments from AWS, Google, Microsoft, and Alibaba Cloud.

Growing Demand for High-Speed Connectivity

AI workloads, machine learning, and big data analytics are pushing networks toward higher data rates and denser interconnects. The transition to 400G and 800G Ethernet standards necessitates advanced fiber cabling solutions capable of supporting ultra-low latency and minimal signal loss. This trend is fueling a steady upgrade cycle from legacy copper and Cat 6 systems to Cat 8 and high-density optical solutions.

Adoption of Modular and Pre-Terminated Systems

Data centers increasingly prefer pre-terminated cabling systems to minimize installation time, ensure performance consistency, and simplify scaling. Modular designs allow rapid configuration changes and future-proofing against technological upgrades. This evolution from traditional field-terminated cabling toward plug-and-play assemblies represents a high-margin opportunity for manufacturers and system integrators.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in copper and fiber material prices pose a major challenge for manufacturers. Sharp increases in input costs directly affect product pricing and profit margins. Supply chain disruptions, geopolitical tensions, and logistics costs further compound this issue, particularly for global vendors reliant on transcontinental supply networks.

Long Replacement Cycles in Legacy Infrastructure

Many enterprise and mid-sized data centers continue to operate with existing Cat 5e and Cat 6 cabling that meets their current performance needs. The high cost and complexity of replacing entire cabling infrastructures result in delayed upgrade cycles, especially in cost-sensitive regions. This factor limits short-term revenue realization despite strong long-term demand fundamentals.

What are the key opportunities in the Data Center Cabling Industry?

Edge Data Center Expansion

Edge and micro data centers represent a rapidly expanding frontier for cabling providers. As enterprises decentralize computing resources closer to end-users, the need for high-density, modular, and rugged cabling systems will surge. This opportunity is particularly strong in industrial automation, telecommunications, and smart city deployments where localized computing drives operational efficiency.

Transition to High-Bandwidth Fiber Solutions

The industry-wide shift from copper to fiber offers a long-term growth opportunity. The adoption of single-mode and multi-mode fiber cables, MPO/MTP connectors, and pre-terminated assemblies enables seamless migration to next-generation Ethernet standards. Vendors focusing on high-speed and low-loss fiber products can capture a significant share of upgrade-driven spending.

Regional Digital Infrastructure Initiatives

Government-backed programs across Asia-Pacific, the Middle East, and Latin America are catalyzing large-scale data center construction. Initiatives promoting digital sovereignty and smart infrastructure create strong demand for locally sourced cabling systems. Manufacturers that establish regional production bases and align with sustainability regulations will be strategically positioned to benefit.

Product Type Insights

Fiber-optic cables dominate the global market, accounting for approximately 60% of total revenue in 2024. Their ability to handle high data throughput with minimal signal degradation makes them indispensable in hyperscale and colocation facilities. Copper cabling continues to serve cost-sensitive and short-distance connections, especially in legacy enterprise environments. Category 6A and 7 cables remain prevalent, but the industry is steadily migrating toward Cat 8 to support 40G transmission speeds.

Application Insights

The data transfer and networking connectivity application accounts for nearly 70% of the total market demand. This includes intra-rack, inter-rack, and backbone connectivity, which form the foundation of data center operations. Power cabling and grounding systems make up the remainder, but are witnessing slower growth due to limited technological evolution compared to data cabling solutions.

End-Use Insights

Hyperscale data centers represent the largest end-use segment, holding approximately 50% of total demand in 2024. Colocation facilities follow closely, benefiting from the rising adoption of hybrid cloud strategies by enterprises. Edge data centers are emerging as the fastest-growing segment, fueled by 5G deployments, IoT adoption, and AI-driven real-time analytics. These developments collectively create long-term demand for high-performance cabling infrastructure across multiple verticals.

| By Cable Type | By Cable Structure | By Type of Connectivity | By Data Center Type | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the global data center cabling market with about a 35% share in 2024. The U.S. leads, supported by robust hyperscale construction activity and a rapid transition to 400G and 800G networks. Major players such as AWS, Google, and Microsoft continue to expand data center campuses across Virginia, Texas, and Ohio, ensuring sustained cabling demand.

Europe

Europe represents roughly 20% of the global market share. Strong investments in green data centers and compliance with EU sustainability standards drive demand for efficient cabling solutions. The U.K., Germany, and France remain key markets, while Scandinavia is emerging as a hub for energy-efficient hyperscale facilities.

Asia-Pacific

Asia-Pacific is the fastest-growing region, contributing 25% of the market share in 2024. Countries like China, India, Japan, and Singapore are witnessing a surge in data center construction, supported by government digitalization initiatives. India, in particular, is projected to grow at a CAGR exceeding 10% through 2030, driven by increasing colocation and cloud adoption.

Middle East & Africa

The Middle East and Africa (MEA) region accounts for 10% of the global market. GCC nations such as Saudi Arabia and the UAE are rapidly investing in cloud and colocation infrastructure. Africa is seeing growth in markets like South Africa, Kenya, and Nigeria, spurred by improved connectivity and foreign direct investment.

Latin America

Latin America holds around 10% market share, with Brazil and Mexico leading regional demand. Rising cloud adoption, data localization laws, and digital transformation initiatives are boosting investment in data centers and supporting cabling infrastructure across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Data Center Cabling Market

- CommScope

- Corning Inc.

- Panduit Corp.

- Belden Inc.

- Legrand SA

- Siemon Company

- Nexans S.A.

- Schneider Electric SE

- Furukawa Electric Co., Ltd.

- TE Connectivity Ltd.

- AFL Global

- Leviton Manufacturing Co., Inc.

- Hitachi Cable America Inc.

- Advantech Co., Ltd.

- R&M (Reichle & De-Massari AG)

Recent Developments

- In August 2025, Corning announced the expansion of its high-density optical cable manufacturing facility in North Carolina to meet rising North American demand.

- In July 2025, CommScope introduced its new SYSTIMAX 2.0 platform featuring pre-terminated Cat 8 and MPO fiber solutions designed for 800G-ready data centers.

- In May 2025, Legrand launched its “Green Data Cabling Initiative,” focusing on recyclable materials and low-carbon cabling production processes.