Data Center Battery Market Size

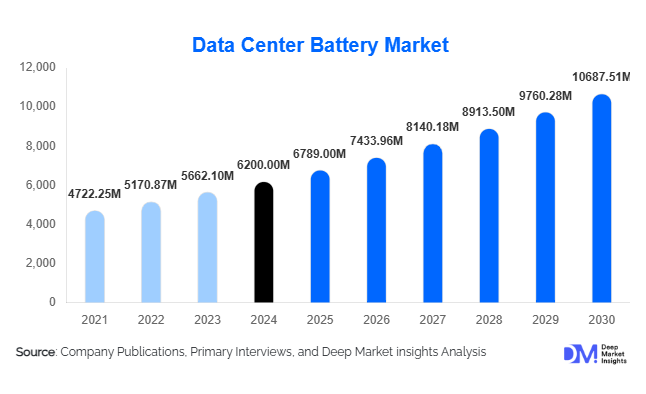

According to Deep Market Insights, the global data center battery market size was valued at USD 6,200 million in 2024 and is projected to grow from USD 6,789.00 million in 2025 to reach USD 10,687.51 million by 2030, expanding at a CAGR of 9.5% during the forecast period (2025–2030). The market growth is primarily driven by the rising demand for uninterrupted power supply in hyperscale and cloud data centers, increasing adoption of lithium-ion battery technologies, and the integration of renewable energy solutions for sustainable data center operations.

Key Market Insights

- Lithium-ion batteries are rapidly gaining adoption due to higher energy density, longer lifespan, and reduced maintenance, particularly in modern high-capacity data centers.

- Valve-regulated lead-acid (VRLA) batteries continue to dominate owing to their proven reliability, cost-effectiveness, and widespread deployment in legacy and mid-sized data centers.

- North America holds a significant share of the market, led by the U.S. and Canada, driven by concentrated data center infrastructure and cloud services demand.

- Asia-Pacific is the fastest-growing region, fueled by hyperscale data center expansion in China, India, and Japan, along with rising digital adoption and IT investments.

- Integration with renewable energy systems is reshaping demand, with hybrid battery setups reducing reliance on diesel generators and supporting carbon-neutral data center goals.

- Technological innovation in battery management, modular design, and smart monitoring is enhancing reliability and attracting enterprise adoption worldwide.

Latest Market Trends

Shift Toward Lithium-Ion and Advanced Battery Technologies

The data center battery market is witnessing a strong transition from traditional VRLA batteries to lithium-ion (Li-ion) and other advanced chemistries. Li-ion batteries provide higher energy efficiency, longer operational life, and lower total cost of ownership, making them particularly suitable for hyperscale and cloud data centers. Modular and scalable Li-ion solutions are enabling operators to optimize energy storage and reduce footprint requirements. Emerging battery technologies, including flow batteries and LFP-based solutions, are also being piloted for large-scale deployments, emphasizing safety and sustainability.

Integration with Renewable Energy and Hybrid Systems

Data centers are increasingly integrating battery storage with solar and wind power to support green operations and reduce carbon emissions. This trend is particularly pronounced in Europe, North America, and APAC, where governments provide incentives for sustainable energy adoption. Hybrid systems combining battery storage and renewable energy enable an uninterrupted power supply while lowering reliance on fossil fuel-based generators. Companies are also investing in AI-driven energy management systems to optimize battery usage, enhance efficiency, and monitor health in real time.

Data Center Battery Market Drivers

Expansion of Hyperscale and Cloud Data Centers

The exponential growth of cloud computing, edge computing, and hyperscale data centers globally is a major driver. These facilities require highly reliable and scalable battery backup solutions to prevent downtime, which can result in significant financial losses. Cloud service providers are increasingly investing in lithium-ion and advanced VRLA battery systems to support growing data traffic and high uptime requirements.

Focus on Sustainability and Green Data Centers

Rising ESG mandates and corporate sustainability goals are driving the adoption of batteries integrated with renewable energy. Green data centers prioritize low-carbon and energy-efficient solutions, making lithium-ion and hybrid battery systems essential. Governments in Europe, APAC, and North America are providing incentives for energy-efficient infrastructure, further accelerating the adoption of battery backup solutions.

Technological Advancements in Battery Storage

Advances in battery chemistry, modular design, and smart energy management systems are enhancing the reliability, efficiency, and lifespan of battery installations. These innovations allow data centers to reduce maintenance costs, optimize energy usage, and scale capacity as demand grows. Battery monitoring systems, predictive analytics, and remote diagnostics are becoming standard features for modern data center batteries, supporting operational continuity and lower downtime risk.

Market Restraints

High Initial Capital Expenditure

Installation of advanced battery systems, particularly lithium-ion, requires significant upfront investment. Smaller data centers or enterprises may be hesitant to adopt these high-cost solutions, potentially slowing market penetration. The cost barrier is compounded for large-scale deployments requiring high-capacity battery banks and associated monitoring infrastructure.

Raw Material Price Volatility

The cost of key battery materials such as lithium, lead, and nickel fluctuates due to supply-demand imbalances and geopolitical factors. This volatility impacts production costs and pricing, particularly in price-sensitive markets, and may temporarily restrain the adoption of new battery technologies in certain regions.

Data Center Battery Market Opportunities

Growing Adoption of Lithium-Ion Batteries

Lithium-ion battery solutions offer longer lifespan, reduced maintenance, and higher efficiency, creating an opportunity for existing players to expand product portfolios and capture premium market segments. Companies investing in research and development of safer and more energy-dense chemistries, such as Lithium Iron Phosphate (LFP), can differentiate their offerings and gain long-term contracts with hyperscale operators.

Integration with Renewable Energy Systems

The push for green data centers is opening avenues for hybrid battery storage solutions integrated with solar and wind power. These systems reduce dependence on diesel generators and align with sustainability mandates. Government incentives in Europe, North America, and APAC further support adoption, enabling battery providers to offer value-added solutions to eco-conscious data center operators.

Emerging Regional Demand in APAC and MEA

Rapid digital infrastructure expansion in Asia-Pacific, the Middle East, and LATAM is creating high demand for reliable battery backup systems. Countries like India, China, the UAE, and Brazil are investing heavily in new data center projects. Early entrants in these regions can establish strategic partnerships and long-term contracts, capturing significant market share as digital adoption accelerates.

Product Type Insights

Valve-Regulated Lead-Acid (VRLA) batteries continue to dominate the data center battery market, capturing approximately 55% of the global market share in 2024. This dominance is primarily due to their affordability, proven reliability, and widespread deployment in traditional and mid-sized data centers. Their low upfront cost and established supply chain infrastructure make VRLA batteries a preferred choice for enterprises seeking cost-effective backup solutions. Lithium-ion (Li-ion) batteries, however, are the fastest-growing segment, driven by the increasing prevalence of hyperscale and cloud data centers, which require high-density energy storage, rapid charge-discharge cycles, and minimal maintenance. Li-ion batteries also support sustainable and green operations, aligning with corporate ESG initiatives. Nickel-Cadmium (Ni-Cd) batteries and emerging flow battery technologies cater to niche segments, including mission-critical infrastructure, telecom towers, and hybrid renewable systems, where extended life cycles, safety, and resilience against extreme temperatures are critical. The rapid adoption of Li-ion is expected to continue as costs decrease, technological efficiency improves, and the demand for high-capacity, modular battery systems grows globally.

Application Insights

The Uninterruptible Power Supply (UPS) systems segment remains the largest application for data center batteries, accounting for nearly 60% of the global market in 2024. The growth of this segment is driven by the critical need for uninterrupted operations in hyperscale data centers, cloud computing hubs, and edge facilities. Li-ion UPS systems are increasingly replacing VRLA units due to their superior energy density, longer operational life, and reduced maintenance requirements, which help data centers achieve operational efficiency and cost savings. Telecom and cloud backup applications are also witnessing strong growth, propelled by the expansion of 5G infrastructure, increased data traffic, and the proliferation of AI and IoT applications. Furthermore, hybrid energy storage systems that integrate batteries with renewable energy sources, such as solar or wind, are emerging as a key growth area, particularly in regions emphasizing carbon neutrality and green data center initiatives. These hybrid solutions not only improve reliability but also provide operational cost optimization and compliance with regulatory sustainability mandates.

End-Use Insights

IT & cloud service providers dominate end-use demand, representing over 50% of the global market in 2024. Hyperscale cloud operators require high-density, reliable battery solutions to ensure zero downtime for critical applications and large-scale data storage. Telecommunications and financial institutions follow closely, driven by uptime-critical operations where service disruptions can result in severe financial and reputational damage. Increasingly, healthcare and government sectors are adopting high-reliability batteries for critical data centers and digital services. Emerging applications in edge computing, AI-enabled data centers, and 5G network infrastructure are creating additional avenues for battery demand. Export-driven demand is significant, especially from APAC and Europe, where data center operators import advanced battery systems from global manufacturers to support high-capacity and mission-critical operations. Overall, the growth in end-use demand is being reinforced by digital transformation, cloud adoption, and renewable energy integration, which require scalable, resilient, and energy-efficient battery solutions.

| By Battery Type | By Application | By End-User Industry | By Power Capacity |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 35% of the global market in 2024, with the U.S. and Canada as the primary contributors. The region’s growth is driven by high cloud adoption, the expansion of hyperscale data centers, and strong investment in sustainability and green operations. Lithium-ion battery integration is particularly high in Tier III and Tier IV facilities due to operational efficiency, low maintenance costs, and long lifecycle advantages. Additionally, government incentives and corporate ESG mandates encouraging green data centers are further boosting adoption. The region is also seeing growth in hybrid systems integrating renewable energy sources, which enhance both reliability and carbon neutrality objectives.

Europe

Europe held around 25% of the market in 2024, with Germany, the U.K., and France being major contributors. Market growth in this region is driven by stringent ESG regulations, strong government incentives for green energy adoption, and increasing digital transformation across enterprises. Lithium-ion battery installations are outpacing VRLA due to higher efficiency, modularity, and reduced operational costs. Europe is also witnessing the integration of hybrid energy storage systems with solar and wind generation in data centers, supporting sustainability mandates and enabling operators to achieve lower carbon footprints while maintaining operational reliability.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Japan, and South Korea. Market growth is driven by the rapid expansion of hyperscale and cloud data centers, large-scale digital infrastructure investments, and government-backed smart city and data center initiatives. Countries such as India and China are experiencing double-digit CAGR through 2030 due to rising internet penetration, cloud adoption, and the proliferation of AI, IoT, and edge computing services. Strong private-sector investments, coupled with renewable energy integration initiatives, are further accelerating demand for lithium-ion and hybrid battery systems. Government policies promoting green energy, sustainability incentives, and support for technology upgrades are significant drivers of regional adoption.

Middle East & Africa

Demand in MEA is primarily concentrated in the UAE, Saudi Arabia, and South Africa. Growth is driven by investments in cloud and telecom data centers, government digitalization initiatives, and the adoption of renewable energy solutions. Lithium-ion and hybrid battery systems are increasingly deployed to ensure reliability, reduce operational costs, and meet sustainability targets. The expansion of hyperscale and edge data centers in urban hubs, along with the rise of fintech, healthcare, and e-government services, is further fueling demand. Government incentives for energy-efficient infrastructure and partnerships with global battery providers are also contributing to the market growth.

Latin America

Latin America is an emerging market, with Brazil and Mexico leading demand. Growth is driven by increasing investments in digital infrastructure, cloud data centers, and telecom networks. The region relies heavily on imported lithium-ion and advanced VRLA battery systems to meet growing capacity requirements. Increasing adoption of hybrid and renewable-integrated battery solutions in data centers, coupled with government support for smart city initiatives, is expected to accelerate market growth. Rising digital adoption, cloud computing expansion, and the need for reliable backup systems are the primary drivers for this emerging market.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Data Center Battery Market

- ABB

- Vertiv

- East Penn Manufacturing

- Saft Groupe SA

- Hitachi Chemical Co., Ltd.

- Toshiba Corporation

- BYD Company Limited

- Exide Technologies

- Leoch International Technology

- Panasonic Corporation

- Samsung SDI

- GS Yuasa Corporation

- C&D Technologies

- Johnson Controls

- EnerSys

Recent Developments

- In January 2025, ABB launched a next-generation lithium-ion UPS battery solution targeting hyperscale data centers with enhanced efficiency and longer lifespan.

- In March 2025, Vertiv expanded its modular battery storage offerings in Europe, focusing on hybrid energy systems integrating solar and UPS support.

- In May 2025, Saft Groupe announced the commercialization of LFP-based lithium-ion batteries for critical data center backup applications, emphasizing safety and sustainability.