Data Center Asset Management Market Size

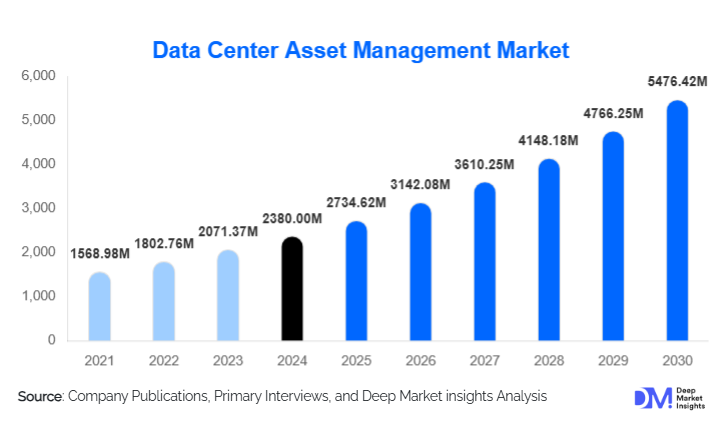

According to Deep Market Insights, the global data center asset management market size was valued at USD 2,380.00 million in 2024 and is projected to grow from USD 2,734.62 million in 2025 to reach USD 5,476.42 million by 2030, expanding at a CAGR of 14.9% during the forecast period (2025–2030). The market’s growth is driven by the rapid expansion of hyperscale and edge data centers, rising demand for real-time visibility across physical and virtual assets, and increasing focus on energy efficiency, predictive maintenance, and regulatory compliance.

Key Market Insights

- Software solutions dominate the market, accounting for over 70% of total revenue due to rising adoption of intelligent asset tracking, analytics, and lifecycle management platforms.

- On-premise deployment remains the leading model, driven by hyperscalers and regulated industries prioritizing security, customization, and low-latency operation.

- North America leads the global market, driven by a dense concentration of hyperscale data centers and mature adoption of DCIM and DCAM tools.

- Asia-Pacific is the fastest-growing region, fueled by large-scale investments in cloud, 5G, and digital infrastructure across China, India, and Southeast Asia.

- IT & Telecom is the largest end-use segment, supported by increasing data center buildouts, edge deployments, and network modernization.

- AI-driven asset analytics and digital twin technologies are transforming asset lifecycle management, predictive maintenance, and capacity forecasting.

What are the latest trends in the data center asset management market?

AI-Driven Predictive Maintenance and Digital Twins

AI, machine learning, and digital twin modeling are redefining how operators monitor and manage infrastructure. Predictive algorithms can now anticipate equipment failures, identify thermal anomalies, and optimize maintenance schedules. This shift reduces downtime, lowers operational expenses, and enhances asset lifespan. Digital twins simulate entire data center environments, enabling operators to forecast capacity needs, test layout changes, and optimize power and cooling usage, all without interrupting real-world operations. Vendors are increasingly packaging AI modules as premium add-ons, giving rise to intelligent, autonomous asset management ecosystems.

Sustainability and Energy Optimization Platforms

With data centers consuming rising levels of global energy, sustainability is emerging as a core market trend. Asset management platforms now integrate real-time monitoring of PUE (Power Usage Effectiveness), carbon emissions tracking, and AI-based cooling optimization. Operators are using these tools to meet ESG reporting requirements, control energy costs, and comply with government standards on environmental performance. Green initiatives, including renewable-powered data centers and energy-efficient cooling architectures, are directly influencing demand for advanced DCAM solutions capable of tracking and optimizing energy-heavy assets.

What are the key drivers in the data center asset management market?

Expansion of Hyperscale and Edge Data Centers

Hyperscalers and telecom operators are rapidly expanding data center footprints to support cloud computing, AI workloads, IoT, and 5G applications. This expansion creates greater operational complexity and increases the need for centralized asset visibility, automated inventory tracking, and real-time monitoring. DCAM platforms help operators manage thousands of distributed assets across both large hyperscale campuses and smaller edge facilities. As edge computing proliferates, lightweight, cloud-native asset management tools are becoming essential to ensuring uptime and efficiency across geographically dispersed sites.

Increasing Compliance and Security Requirements

Enterprises face rising regulatory scrutiny related to data privacy, hardware tracking, auditability, and lifecycle control. Data center asset management solutions help address these mandates by providing traceability, change management logs, and comprehensive audit trails for physical and virtual assets. Sectors such as BFSI, healthcare, and government are adopting DCAM platforms at an accelerated rate to ensure compliance with stringent data governance frameworks and to mitigate the risk of asset-related security breaches.

What are the restraints for the global market?

High Deployment and Integration Costs

Implementing DCAM software, along with tagging hardware, sensors, integration modules, and staff training, can be costly. Smaller enterprises may struggle with the required upfront investment and ongoing service fees, which can include customization, API integrations, and system upgrades. The complexity of integrating DCAM solutions with legacy IT infrastructure and older DCIM platforms adds further cost and time barriers, slowing adoption among organizations with limited technical resources.

Legacy Infrastructure and Siloed Systems

Many data centers operate with fragmented monitoring tools and legacy systems that lack modern automation capabilities. Integrating DCAM solutions into these environments can be challenging, often requiring extensive reconfiguration or replacement of outdated hardware. These limitations may restrict the deployment scope or lead to partial implementations, reducing the effectiveness of asset tracking and lifecycle visibility.

What are the key opportunities in the data center asset management industry?

AI-Enhanced Capacity and Lifecycle Optimization

As AI-driven analytics become more sophisticated, vendors can deliver advanced modules that optimize asset usage, predict component failures, and reduce energy consumption. These capabilities open opportunities for specialized solutions for hyperscalers, colocation providers, and edge data centers. Enhanced insights into power draw, cooling loads, and equipment utilization also support sustainability initiatives, helping operators meet carbon reduction targets.

Rapid Growth of Edge and Emerging Market Data Centers

Developing regions such as Southeast Asia, India, the Middle East, and Latin America are witnessing the rapid construction of new data center facilities. Many of these deployments lack traditional monitoring systems, offering vendors a significant opportunity to introduce cloud-based, modular DCAM platforms. Edge environments, marked by many small nodes rather than a few large sites, require simplified, scalable asset management tools, creating a new frontier for vendors focused on distributed infrastructure.

Product Type Insights

Software solutions dominate the data center asset management market, driven by the need for real-time asset tracking, predictive maintenance, workflow automation, and energy optimization. These platforms integrate seamlessly with DCIM, ITSM, and facility systems, providing unified dashboards for operators. Services, including consulting, installation, and training, represent a significant secondary segment, supporting enterprises in implementing and customizing DCAM solutions. Cloud-based software modules are rising in popularity, particularly among colocation providers and distributed edge networks requiring scalability and remote accessibility.

Application Insights

Inventory management is the largest application segment, as data centers increasingly require accurate, real-time tracking of servers, racks, cabling, power units, and virtualized resources. Capacity management and change management are fast-growing areas, helping operators forecast space, power, and cooling needs and maintain strict control of asset additions and decommissions. Energy and power management applications are gaining traction due to rising electricity costs and sustainability mandates. Additionally, predictive maintenance applications, powered by AI, are emerging as a transformative category that reduces downtime and improves operational resilience.

Distribution Channel Insights

Direct enterprise sales dominate the DCAM market, as large data center operators and hyperscalers require customized deployments with deep integration into facility and IT systems. System integrators and managed service providers play a major role, particularly in complex multi-site environments. Online platforms and SaaS delivery models are gaining momentum among colocation providers, small data centers, and distributed edge facilities seeking rapid deployment and lower capital expenditure. Strategic channel partnerships between DCAM vendors and infrastructure manufacturers, cloud service providers, and consulting firms are becoming increasingly influential in market expansion.

End-Use (Vertical) Insights

IT & Telecom is the largest and fastest-growing vertical, driven by cloud adoption, network modernization, and large-scale data center expansion. BFSI follows closely due to stringent regulatory requirements for auditability and asset security. Healthcare and government segments show strong growth trends, driven by data sensitivity and compliance. Manufacturing and industrial sectors are also increasing adoption as Industry 4.0, IoT workloads, and automation systems expand their data processing needs.

| By Component | By Deployment Mode | By Data Center Type | By Application | By End Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global data center asset management market with the highest share, driven by the presence of major hyperscalers, mature colocation markets, and advanced technological adoption. Strong regulatory frameworks, early implementation of AI-driven analytics, and high sustainability pressures support continued growth. The U.S. remains the core hub for innovation and vendor activity, while Canada is seeing rising investment in green data center infrastructure.

Europe

Europe is a major market, supported by stringent data governance regulations and strong demand for sustainable, energy-efficient data center operations. Countries such as Germany, the U.K., France, and the Netherlands are leading adopters of DCAM solutions. The emphasis on carbon-neutral data center operations and renewable energy adoption is accelerating demand for advanced asset and energy management modules.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by explosive growth in cloud services, hyperscale data center construction, and 5G deployments across China, India, Japan, and Southeast Asia. Expanding digital economies, rising enterprise IT spending, and government-backed digital infrastructure programs are creating strong demand for scalable, cloud-based asset management solutions.

Latin America

Latin America is experiencing steady growth, driven by rising data center investments in Brazil, Mexico, and Chile. Increasing cloud adoption, expansion of telecom networks, and the arrival of global hyperscalers are boosting demand for modern asset management platforms. The region remains nascent compared to North America and Europe, but offers significant long-term potential.

Middle East & Africa

MEA is an emerging market with strong momentum, particularly in the UAE, Saudi Arabia, South Africa, and Kenya. Government-backed digital transformation strategies and rising investment from global cloud operators are accelerating data center construction and modernization. Operators increasingly adopt DCAM solutions to ensure high uptime, compliance, and energy efficiency in new facilities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Data Center Asset Management Market

- Schneider Electric

- IBM Corporation

- Eaton

- Vertiv Group Corp.

- Nlyte Software

- Sunbird Software

- Device42

- Panduit Corporation

Recent Developments

- In 2024, Schneider Electric expanded its EcoStruxure IT platform with enhanced AI-based asset health monitoring and sustainability reporting tools.

- In 2024, Vertiv introduced new integrated asset management features within its data center infrastructure platform, focused on predictive maintenance and thermal optimization.

- In 2023, Device42 launched updated integration modules for cloud-native and hybrid data center environments, improving real-time asset discovery and CMDB alignment.