Data Center as a Service Market Size

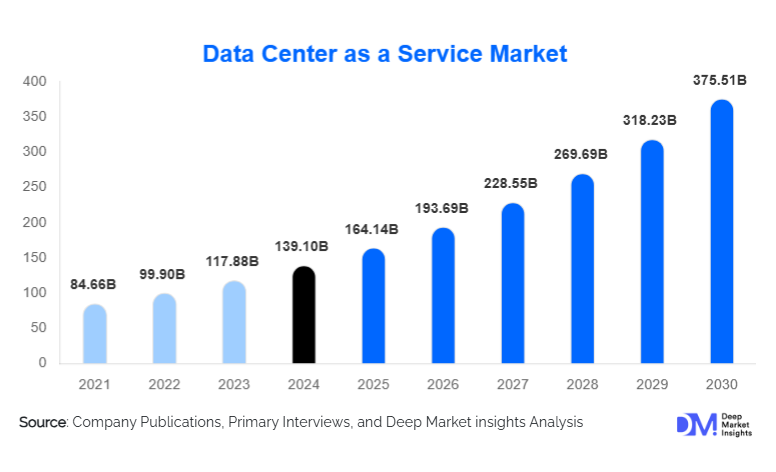

According to Deep Market Insights, the global data center as a service market size was valued at USD 139.1 billion in 2024 and is expected to reach USD 164.14 billion in 2025, before expanding further to USD 375.51 billion by 2030, growing at a robust CAGR of 18.0% during 2025–2030. The data center as a service market growth is primarily driven by escalating demand for high-performance compute and AI workloads, rapid enterprise adoption of hybrid/multi-cloud infrastructure, and the expansion of edge data centre solutions tailored to latency-sensitive applications.

Key Market Insights

- Compute-as-a-Service dominates the service mix, capturing roughly 40 % of global DCaaS revenues in 2024, reflecting the high value of GPU/CPU-intensive racks, AI workloads, and reserved capacity commitments.

- Hyperscaler-delivered public DCaaS leads deployment models, with public multi-tenant offerings accounting for 36 % of the market in 2024, driven by large-scale cloud providers and global platforms.

- North America holds the largest regional share (38 % in 2024), benefiting from strong hyperscaler presence, mature enterprise spend, and deep interconnection ecosystems.

- Asia-Pacific is the fastest-growing region, with a 30 % share in 2024 and considerable greenfield opportunities. India, China, and Southeast Asia are major growth drivers.

- Edge and telco-adjacent DCaaS is emerging strongly, meeting low-latency, distributed compute needs from 5G, IoT, and Industry 4.0 deployments.

- Sustainability and managed services are reshaping the value proposition, with providers offering renewable-powered rack capacity, carbon-reporting, and bundled operations services to differentiate.

What are the latest trends in the data center as a service market?

AI-Ready Rack Solutions Gaining Traction

DCaaS providers are increasingly offering AI-optimised infrastructure: GPU/TPU racks, high-density power/cooling, and integrated interconnect designed for large-scale model training and inference. Enterprises and service providers are choosing DCaaS over in-house builds to gain agility, reduce CAPEX, and access managed hardware. Partnerships between DCaaS operators and hardware providers (for example, liquid-cooling or direct liquid immersion) are becoming more common, enabling higher rack densities and lowered total cost of ownership. This trend accelerates the adoption of DCaaS for workloads previously confined to hyperscaler data centres.

Edge & Distributed Footprint Expansion

The shift toward edge computing, driven by 5G, IoT, autonomous vehicles, augmented reality and latency-sensitive applications, is forcing DCaaS providers to expand into micro-data centre sites and telco aggregation nodes. These smaller-form-factor sites, often deployed near metro or suburban locations, allow DCaaS operators to deliver low-latency, high-bandwidth services closer to end-users. The modular micro-data centre model plus managed services enables new revenue streams. Furthermore, telco partnerships and distributed footprints are enabling DCaaS to reach industries previously limited by central-site latency.

Hybrid & Multi-Cloud Orchestration as a Service

Enterprises now demand seamless orchestration across on-premises, private DCaaS and public cloud environments. DCaaS providers are therefore enhancing their orchestration capabilities, offering virtual interconnects, cross-connect fabrics, workload mobility, and hybrid billing options. This trend is enabling DCaaS to become a strategic backbone for enterprise IT, rather than just a hosting service. It also increases switching costs for customers and allows providers to upsell managed services and connectivity bundles.

What are the key drivers in the data center as a service market?

Hyperscaler Expansion & Cloud Growth

The massive and continued expansion by hyperscale cloud providers (such as large global cloud platforms) is directly increasing demand for DCaaS. These providers continue to invest in global campuses, high-density racks, and interconnect ecosystems. That expansion is not only for their own services but also for offering DCaaS to enterprise partners and overlay customers. This scale-driven growth creates economies of scale and availability of better pricing, which in turn stimulates broader market adoption.

Surge in AI/ML and HPC Workloads

The explosion of AI/ML workloads, model training/inference at scale, and high-performance computing (HPC) initiatives has significantly raised demand for specialist compute infrastructure, often best fulfilled via DCaaS rather than home-built facilities. Such workloads require dense power, advanced cooling, specialised interconnects and resilience. By choosing DCaaS, enterprises avoid large upfront CAPEX, benefit from managed operations, and gain faster time to scale. This is a powerful growth lever for the data center as a service market.

Enterprise Hybridisation & Data Sovereignty Needs

Enterprises increasingly adopt hybrid IT models, blending on-premises, private cloud, public cloud and DCaaS, to meet performance, compliance and latency requirements. Data sovereignty and regulatory compliance also drive demand for localised DCaaS footprints. Providers who can supply private or hybrid DCaaS solutions with local data centre presence, compliance certifications and integrated management are well-positioned. This shift from pure public cloud to hybrid and regionalised DCaaS is a core growth driver.

What are the restraints for the global market?

Power & Energy Constraints

Data centre growth is heavily dependent on reliable, cost-effective power and cooling infrastructure. In many geographies, grid limitations, high electricity tariffs, environmental regulations and issues with renewable sourcing create bottlenecks for new DCaaS deployments. These constraints can slow project timelines, raise operating costs and reduce margin potential, thereby restraining market expansion.

High Capital Intensity & Utilisation Risk

Building or upgrading data centre capacity for DCaaS is highly capital-intensive, and unless utilisation ramps quickly, revenue generation may lag. New entrants or operators in emerging regions face the challenge of filling capacity and obtaining long-term contracts. Economic headwinds, credit tightening, or slower-than-expected demand growth can reduce investment appetite. This creates a barrier to entry and slows the expansion pace.

What are the key opportunities in the DCaaS industry?

Bundled High-Value Managed & AI-Optimised Services

The market opportunity exists for DCaaS providers to move beyond “space, power and cooling” and deliver bundled, high-margin services, such as AI-stack management, GPU leasing, model hosting, high-performance interconnect and security/compliance as a service. By offering such end-to-end solutions, operators can command premium pricing, stronger customer lock-in and higher lifetime value.

Edge & Telco-Partnered DCaaS for Latency-Sensitive Applications

As 5G rolls out and IoT/industrial applications proliferate (autonomous transport, AR/VR, smart manufacturing), the need for distributed, low-latency compute grows. DCaaS providers who partner with telcos, build edge sites and offer managed services in these domains can capture fresh use cases and verticals. This is especially strong in emerging markets where greenfield edge infrastructure is still nascent.

Regional Expansion & Sovereign-Compliant DCaaS in Emerging Markets

Emerging markets, especially in Asia-Pacific, the Middle East & Africa and Latin America, are under-penetrated with high-quality DCaaS supply. Regional expansion driven by localisation regulations (data-residency laws), government digitalisation initiatives and demand from enterprises offers a significant greenfield opportunity. Providers who build regional footprints, gain certifications and form local partnerships will benefit from first-mover advantage.

Service Type Insights

Within the data center as a service market, the Compute as a Service segment dominates and is projected to continue leading due to its higher revenue per unit and growing demand from AI and cloud migration workloads. Storage as a Service, Network as a Service, Managed Services, and Professional Services are complementary segments, each addressing different enterprise needs: storage for scale/outage resilience, network for connectivity and interconnect, managed services for operations outsourcing. While storage and network segments grow steadily, compute remains the largest value driver.

Deployment Model Insights

Public DCaaS (multi-tenant model delivered by hyperscalers) leads global deployment, enabled by scale, global footprint, and billing flexibility. Private DCaaS (dedicated footprint) continues to be important for industries with compliance or latency requirements, while Hybrid DCaaS (orchestration of public + private + on-prem) is gaining traction as enterprises seek agility and control. The hybrid model is increasingly seen as the strategic sweet spot, combining ease of consumption with enterprise governance.

End-Use Industry Insights

The IT & Telecom vertical is the largest end-user segment for DCaaS due to its inherent need for data centre capacity, interconnection, and edge deployments. Other high-volume verticals include BFSI (banking/finance) and Healthcare & Life Sciences, where compliance, data-intensive workloads, and disaster recovery needs drive adoption. Emerging application areas include media/entertainment (streaming, content creation), manufacturing (industry 4.0-driven compute), and autonomous/transport systems (requiring edge compute). These emerging segments are growing faster than the overall market and represent attractive adjacencies for DCaaS providers.

| By Service Type | By Deployment Model | By Enterprise Size | By End-Use Industry | By Region |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market for DCaaS, accounting for 38 % (USD 52.8 billion) of the global market in 2024. The region benefits from the presence of major hyperscalers, mature enterprise cloud migration, advanced interconnection ecosystems, and strong renewable-energy commitments. The United States leads by a wide margin, with Canada also growing steadily as a secondary hub. Growth in AI, edge deployments, and enterprise repatriation is further strengthening demand.

Asia-Pacific

Asia-Pacific holds around 30 % (USD 41.7 billion) of the global DCaaS market in 2024 and is the fastest-growing region. Key drivers include rapid digitalisation in China, large government cloud/data centre initiatives in India, expansion of telecommunications and edge networks in Japan, South Korea, and Southeast Asia, and increasing enterprise migration to cloud and DCaaS models. India emerges as the fastest-growing country in percentage terms due to strong investment pipelines in data centre infrastructure, policy support, and rising enterprise demand.

Europe

Europe represents approximately 18 % (USD 25.0 billion) of the 2024 market. Demand is driven by regulatory compliance (data-residency, GDPR), sustainability goals (green data centres), and strong interconnection hubs in the UK, Germany, the Netherlands, and the Nordics. Growth is steady, though not as rapid as APAC, reflecting mature infrastructure and stricter regulatory cost pressures.

Middle East & Africa

MEA holds about 6 % of the global market. Growth is accelerating, especially in the UAE, Saudi Arabia, and South Africa, driven by sovereign cloud initiatives, 5G rollout, enterprise digitalisation, and private sector investment. While overall spend is smaller today, this region offers high growth potential as infrastructure builds out.

Latin America

Latin America constitutes roughly 8 % of the global market in 2024. Brazil leads the region, followed by Mexico and Chile. Demand is spurred by cloud adoption, data-residency requirements, and hyperscaler greenfield activity. Although current absolute spend is lower than in other regions, growth is expected as enterprise digital transformation accelerates.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Data Center as a Service Market

- Amazon (AWS)

- Microsoft

- Google (GCP)

- Equinix

- Digital Realty

- NTT Ltd.

- Oracle Corporation

- Alibaba Group

- IBM Corporation

- Tencent Cloud (or major APAC provider)

- CyrusOne

- KDDI Corporation

- China Telecom

- Verizon Communications

- AT&T Inc.

Recent Developments

- In H1 2025, several major hyperscalers announced multi-billion-dollar expansions of AI-optimised campus data centres in North America and Asia-Pacific, featuring liquid-cooling and GPU-dense racks to meet escalating AI/ML demand.

- In early 2025, a consortium of DCaaS providers and energy utilities launched a renewable-power-purchase-agreement (PPA) programme to guarantee carbon-neutral data centre capacity, responding to enterprise sustainability mandates.

- In 2024, DCaaS providers accelerated edge micro-data centre roll-out, with telco partnerships announced in India and Southeast Asia to deliver low-latency infrastructure for 5G/IoT workloads.