Data Center Accelerator Market Size

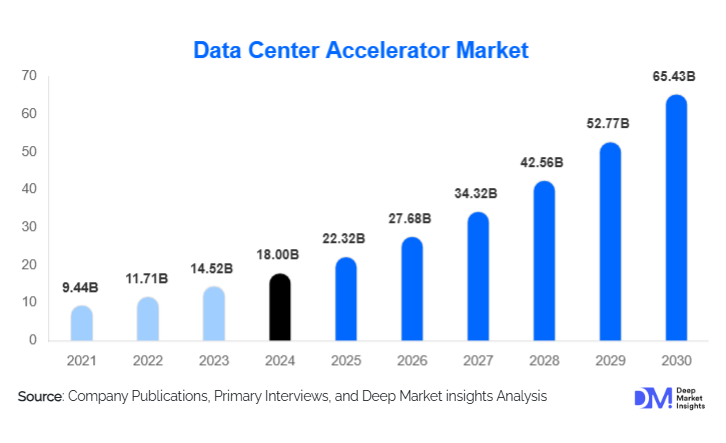

According to Deep Market Insights, the global Data Center Accelerator Market was valued at approximately USD 18.0 billion in 2024 and is projected to grow from around USD 22.32 billion in 2025 to reach USD 65.43 billion by 2030, expanding at a CAGR of 24% during the forecast period (2025–2030). The market growth is primarily driven by the rising adoption of AI/ML workloads, accelerated expansion of hyperscale and cloud data-centres, and the need for high-performance, energy-efficient computing accelerators in modern infrastructure.

Key Market Insights

- Graphics Processing Units (GPUs) dominate the processor-type segment, owing to their robust ecosystem, maturity of software frameworks, and wide applicability in deep learning, training, and inference workloads.

- Cloud data-centres are the principal deployment segment, capturing the largest share as enterprises, hyperscalers, and telecom operators increasingly embed accelerators to handle high-throughput AI and analytics tasks.

- Deep learning training remains the leading application, as large-scale neural network models and generative AI drive heavy compute demand, favouring accelerator-rich architectures.

- IT & Telecom is the largest end-use industry, due to extensive investment in data-centres, hyperscale cloud infrastructure, and accelerated workloads in telecom networks.

- North America holds the largest regional share (37% in 2024), supported by large cloud providers, advanced AI infrastructure, and mature accelerator adoption.

- Asia-Pacific is emerging as the fastest-growing region, led by China, India, South Korea, and Southeast Asia, a expanding cloud, AI, 5G/edge infrastructure, and data-centre build-outs.

What are the latest trends in the Data Center Accelerator Market?

Heterogeneous Architectures & Custom Accelerators

Accelerator deployments are shifting from standard GPU-only architectures toward heterogeneous stacks incorporating GPUs, FPGAs, ASICs, and DPUs. This transition reflects the need for workload-specific acceleration, higher performance per watt, and differentiation. Hyperscalers and large enterprises are increasingly designing or partnering on custom accelerators tailored for AI training, inference, and emerging workloads. This trend is enabling vendors to offer vertically integrated systems (hardware + software + interconnect) and new entrant opportunities to serve niche application domains.

Edge and On-Premises Accelerator Adoption

While cloud data-centres remain dominant, growth in edge computing, enterprise on-premises deployments, and latency-sensitive applications is raising demand for accelerators beyond the data-centre core. Telecom operators deploying 5G/edge-cloud, industrial IoT sites, autonomous vehicles, and real-time analytics nodes are integrating accelerators to process data closer to the source. This decentralised adoption is broadening the market and creating tailored form-factors (blade/rack modules, on-edge server accelerators) suited to constrained power and thermal environments.

What are the key drivers in the Data Center Accelerator Market?

Rapid Growth of AI/ML and Deep-Learning Workloads

The proliferation of artificial intelligence (AI), machine learning (ML), and deep-learning workloads is a primary driver of accelerator adoption. Training large neural networks, inference at scale, recommendation engines, and real-time analytics workloads demand performance far beyond what general-purpose CPUs can deliver. As a result, data-centre operators and cloud providers are investing heavily in accelerator-rich infrastructure to handle these compute-intensive tasks.

Hyperscale Cloud Infrastructure Expansion

Growth in hyperscale cloud data-centres, accelerated migration of enterprise workloads to the cloud, and the rise of AI-as-a-service are driving large-scale deployment of accelerators. Cloud operators refresh hardware frequently, integrate accelerators across server clusters, and support high volumes of accelerated compute, thereby boosting demand significantly.

Energy Efficiency and Performance-per-Watt Imperatives

Accelerators offer significantly improved performance-per-watt compared with traditional CPUs, especially for parallel workloads such as AI training, inference, and analytics. With rising power costs, sustainability mandates, and cooling constraints in large data-centres, operators are adopting accelerators to meet throughput demands while managing total cost of ownership and energy budgets.

Restraints

Supply Chain Constraints and High Integration Costs

High cost of accelerator systems (especially large GPU clusters or custom ASICs), complex integration (hardware, software, cooling, interconnect), and difficulties in scaling production (substrate shortages, high-bandwidth memory constraints) present challenges. These factors can slow down deployment pace and increase time-to-value for new data-centre builds.

Software Ecosystem, Standardisation and Interoperability Challenges

Accelerators often require specialised software frameworks, toolchains, and are integrated deeply into data-centre infrastructure. Differences across architectures (GPU vs FPGA vs ASIC) lead to fragmentation, higher migration costs, and longer deployment cycles. The lack of mature standards and heterogeneous environments can hamper broader enterprise adoption, especially in smaller data centers or edge contexts.

What are the key opportunities in the Data Center Accelerator Industry?

Custom and In-house Accelerator Development by Hyperscalers & Sovereign Clouds

Hyperscale cloud providers and large enterprise data-centres are increasingly investing in custom accelerator design (ASICs, NPUs, DPUs) to differentiate, gain cost-efficiencies, and manage supply-chain risk. For existing vendors and new entrants alike, opportunities lie in co-designing accelerators, licensing IP, providing modular platforms, and offering integration services. Sovereign-cloud initiatives and domestic infrastructure programs further open opportunities for localized accelerator manufacturers and IP providers.

Emerging Regions & Edge Deployment Growth

While North America leads today, major growth lies in Asia-Pacific, Latin America, and MEA. Cloud build-outs, AI infrastructure expansion, 5G/edge nodes, and enterprise digital transformation programmes in these regions are creating fresh demand for accelerator hardware. Firms that can deliver localized, power-efficient, cost-effective accelerator solutions and partner regionally will capture significant growth potential. The edge segment, in particular, allows entrants to focus on small-form-factor, low-power accelerators tailored for enterprise/telecom environments.

New Use-Cases: Large-Language Models, Real-Time Analytics, HPC-Enterprise Convergence

The explosion of large‐language models (LLMs), generative AI, real‐time analytics (video, streaming, AR/VR), and enterprise-HPC convergence is creating novel workload demands. Accelerators optimized for high memory bandwidth, low-latency interconnects, large model support, and energy efficiency are in demand. Participants who build ecosystems (hardware + software libraries + interconnect) for these converged workloads have a strong advantage. New entrants can target domain-specific accelerators (e.g., genomics, finance, industrial simulation) and provide full-stack differentiation.

Product Type Insights

Processor architectures form the foundation of the Data Center Accelerator Market. Graphics Processing Units (GPUs) dominate, accounting for approximately 44% of the 2024 market share. Their leadership stems from unmatched parallel computing capability, robust developer ecosystems such as CUDA, and established integration in AI training and inference. Field Programmable Gate Arrays (FPGAs) follow as flexible, reconfigurable accelerators, gaining popularity for adaptive, low-latency workloads. Application-Specific Integrated Circuits (ASICs) are rapidly emerging, particularly for hyperscalers developing custom chips like Google’s TPU and Amazon’s Trainium, offering superior performance per watt. Meanwhile, Data Processing Units (DPUs) and emerging AI accelerators are expanding in edge and network-intensive workloads, representing the next frontier of specialized data center acceleration.

Application Insights

Deep learning training remains the largest and most resource-intensive application within the Data Center Accelerator Market, holding nearly 60% of the global share in 2024. The exponential rise of large language models, image recognition, and generative AI has significantly boosted demand for high-throughput accelerators. Inference workloads are growing rapidly as enterprises deploy trained models into production, driving the adoption of energy-efficient and low-latency accelerators. High-Performance Computing (HPC) applications in scientific research, simulation, and weather modeling are also gaining momentum, while data analytics and edge computing represent emerging segments. The convergence of HPC and AI is redefining application architectures, pushing vendors to develop accelerators optimized for hybrid workloads across cloud and on-premises environments.

Distribution Channel Insights

The Data Center Accelerator Market operates through both direct OEM relationships and indirect distribution networks. Major hyperscalers source accelerators directly through strategic partnerships with chip manufacturers, ensuring customized hardware integration and optimized total cost of ownership. System integrators and OEMs such as Dell Technologies, Lenovo, and Hewlett Packard Enterprise serve as intermediaries for enterprise clients deploying hybrid or private data centers. Value-added resellers (VARs) and channel partners distribute accelerator modules and integrated servers across mid-market enterprises. Increasingly, cloud marketplaces and infrastructure-as-a-service (IaaS) models are becoming dominant distribution avenues, allowing customers to access accelerator resources on demand. Subscription-based and consumption-driven pricing models are transforming procurement, aligning capital expenditure with workload scaling needs.

Traveler Type Insights

In the Data Center Accelerator Market context, “traveler types” can be interpreted as key end-user industries driving adoption. IT & Telecom holds the largest share at approximately 40% in 2024, led by cloud service providers, colocation operators, and telecoms deploying AI-enabled networks and 5G edge infrastructure. Healthcare and Life Sciences are rapidly growing, leveraging accelerators for genomics, medical imaging, and drug discovery. Manufacturing and Industrial sectors increasingly use accelerators for predictive maintenance, digital twins, and robotics. Financial services adopt accelerators for algorithmic trading, fraud detection, and risk modeling, while Energy and Utilities employ them for simulations and analytics. The fastest-growing end-user industries are healthcare and manufacturing, each forecasted to grow at over 26% CAGR through 2030, driven by increasing AI integration and data-heavy operational models.

Age Group Insights

Regional adoption patterns act as the “age groups” of market maturity. North America represents the most mature phase, accounting for 37% of global revenue in 2024, supported by early technology adoption, robust R&D ecosystems, and leading cloud hyperscalers. Europe sits in a mid-maturity phase, emphasizing sustainable and sovereign AI computing with active government involvement. Asia-Pacific represents the emerging, fast-growth demographic, rapidly expanding cloud infrastructure, AI start-ups, and digital transformation in enterprises, fueling significant acceleration demand. Latin America and the Middle East & Africa represent the nascent phase but are gaining momentum as they build regional data centers and attract hyperscaler investments. APAC, with an expected CAGR of over 27% from 2025–2030, is poised to surpass Europe in market share by 2028.

| By Processor Type | By Deployment Type | By Application | By End-Use Industry | By Form Factor / Hardware Format |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global Data Center Accelerator Market, driven by massive hyperscale data center investments by major players such as Amazon Web Services, Google, Meta, and Microsoft. The region’s strong AI ecosystem, rapid adoption of GPU clusters, and heavy enterprise demand for cloud-based AI services sustain its dominance. The U.S. accounts for over 85% of North American demand, while Canada’s market is expanding due to government-backed AI initiatives and new hyperscale data center construction.

Europe

Europe’s market is characterized by growing investments in digital sovereignty, AI ethics frameworks, and green data centers. Countries like Germany, the U.K., and France lead the region’s accelerator adoption, emphasizing energy-efficient infrastructure. Government-backed initiatives such as the European Chips Act are incentivizing domestic semiconductor and accelerator manufacturing. European enterprises are increasingly deploying accelerators for AI-based automation, fintech analytics, and industrial IoT applications.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to account for over 30% of global market growth by 2030. China leads regional demand, driven by large-scale data center expansions and domestic AI chip design. India is rapidly emerging with a CAGR exceeding 28%, fueled by national programs such as “Digital India” and surging investment in AI infrastructure. Japan, South Korea, and Australia represent mature sub-markets with strong enterprise and HPC deployments. The region’s growing AI talent pool and government incentives are making APAC a critical hub for future accelerator innovation.

Latin America

Latin America is witnessing early-stage but promising adoption of accelerators, particularly in Brazil and Mexico. Rising demand for AI in e-commerce, telecommunications, and banking is prompting cloud providers to localize infrastructure. Regional data center expansions in São Paulo and Mexico City are opening new opportunities for accelerator vendors, although challenges such as high energy costs and limited local fabrication capacity remain.

Middle East & Africa

The Middle East & Africa region is undergoing rapid digital transformation, led by Saudi Arabia, the UAE, and South Africa. National strategies such as “Vision 2030” and “UAE AI Strategy 2031” are fostering AI adoption and data center infrastructure investment. Large hyperscale facilities in Riyadh and Dubai are integrating GPU and ASIC clusters to power regional AI workloads. Africa’s accelerator market is smaller but expanding, supported by new colocation centers and cloud entrants in South Africa, Kenya, and Nigeria.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Data Center Accelerator Market

- NVIDIA Corporation

- Intel Corporation

- Advanced Micro Devices, Inc. (AMD)

- IBM Corporation

- Marvell Technology, Inc.

- Qualcomm Incorporated

- Micron Technology, Inc.

- Lenovo Group Ltd.

- Lattice Semiconductor Corporation

- Synopsys Inc.

- NEC Corporation

- Dell Technologies Inc.

- Huawei Technologies Co., Ltd.

- Alibaba Cloud (Alibaba Group)

- Cerebras Systems, Inc.

Recent Developments

- In May 2025, NVIDIA introduced its next-generation Blackwell GPU architecture, designed for hyperscale AI training clusters, offering a 2.5x performance improvement over previous generations.

- In April 2025, Intel announced the expansion of its Gaudi AI accelerator line, targeting enterprise AI workloads and optimizing the total cost of ownership for large model training.

- In March 2025, AMD launched its Instinct MI400 series accelerators, focusing on power efficiency and heterogeneous compute integration for data center and cloud applications.

- In February 2025, Huawei unveiled new Ascend AI processors for domestic data center deployments, supporting China’s push for self-reliant semiconductor ecosystems.

- In January 2025, Dell Technologies and Marvell partnered to co-develop accelerator-enabled servers optimized for edge and AI workloads, expanding reach into enterprise data centers.