Dairy Blends Market Size

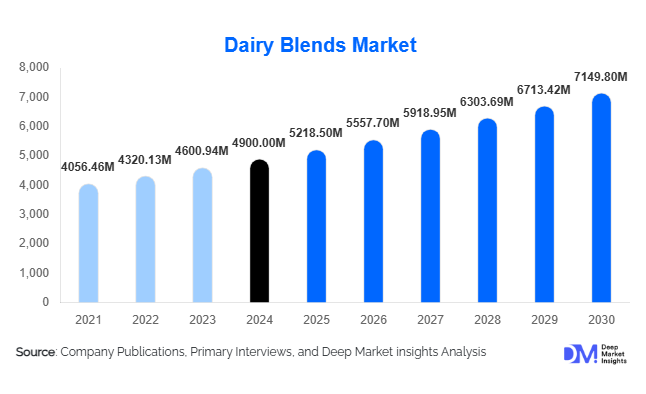

According to Deep Market Insights, the global dairy blends market size was valued at USD 4,900 million in 2024 and is projected to grow from USD 5,218.5 million in 2025 to reach USD 7,149.8 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The dairy blends market growth is primarily driven by increasing consumer preference for fortified and flavored dairy products, rising demand for convenience and ready-to-drink beverages, and the expansion of plant-based and functional dairy blends across global regions.

Key Market Insights

- Milk-based and plant-based dairy blends are gaining traction, catering to both traditional consumers and health-conscious or lactose-intolerant populations.

- Ready-to-drink liquid blends dominate, driven by busy lifestyles, urbanization, and retail penetration in supermarkets and e-commerce platforms.

- North America holds a major share, led by high consumer awareness and demand for functional and flavored products.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes, urbanization, and changing dietary habits in countries like India and China.

- Technological innovation, including fortification techniques, extended shelf-life processing, and advanced packaging, is enhancing product quality and consumer appeal.

- Functional and flavored blends are expanding end-use applications, including beverages, bakery, desserts, pediatric nutrition, and clinical dietary products.

What are the latest trends in the dairy blends market?

Rising Demand for Functional and Plant-Based Blends

Consumers increasingly seek dairy blends enriched with proteins, vitamins, minerals, and probiotics. Functional dairy blends provide health benefits, targeting children, elderly consumers, and health-conscious adults. Plant-based dairy blends, such as almond, soy, oat, and coconut mixes, are growing due to rising lactose intolerance, vegan diets, and sustainability concerns. Product innovation in this space focuses on flavor retention, nutritional enhancement, and longer shelf life to meet diverse consumer needs.

Convenience-Driven Ready-to-Drink Products

Liquid dairy blends, especially ready-to-drink formats, are gaining popularity due to urban lifestyles and time-constrained consumers. Retail-ready packaging and chilled beverages are increasingly preferred in supermarkets and convenience stores. Online grocery platforms are also facilitating growth, offering doorstep delivery, subscription models, and personalized product recommendations. Convenience, along with premiumization in flavors and fortification, is shaping the current market dynamics.

What are the key drivers in the dairy blends market?

Increasing Health and Wellness Awareness

Rising health consciousness among consumers is driving demand for fortified dairy blends, protein-rich beverages, and low-fat options. Functional blends are projected to contribute significantly to market growth, capturing ~28% of the total market in 2024. Consumers increasingly prefer blends that combine taste with nutritional benefits, stimulating innovation and premium product launches.

Growing Popularity of Flavored and Innovative Blends

Flavored blends, including chocolate, vanilla, strawberry, and exotic options, are particularly popular among children and millennials. Innovation in plant-dairy blends further attracts health-focused consumers, creating opportunities for product differentiation. The segment is expected to grow at a higher CAGR than the overall market, reflecting consumer preference for indulgent yet healthy options.

Convenience and Retail Penetration

Urbanization and busy lifestyles have boosted the consumption of ready-to-drink liquid blends, which accounted for 52% of the market in 2024. Supermarkets, hypermarkets, and e-commerce channels are key contributors to market expansion, enabling widespread accessibility and consumer convenience.

What are the restraints for the global market?

Raw Material Price Volatility

Milk, plant-based proteins, and flavoring ingredients are subject to price fluctuations due to climatic conditions, feed costs, and supply chain disruptions. This volatility increases production costs and can reduce profitability for dairy blend manufacturers.

Regulatory Challenges

Compliance with food safety standards, nutritional labeling, and fortification guidelines varies across regions. Regulatory complexities can slow new product launches, increase operational costs, and act as a restraint to market expansion.

What are the key opportunities in the dairy blends market?

Expansion in Emerging Economies

Rapid urbanization and rising disposable incomes in India, China, and Southeast Asia are fueling demand for value-added dairy blends. Government initiatives promoting nutrition and dairy consumption create opportunities for both domestic and international players to capture new markets.

Innovation in Functional and Plant-Based Blends

The growing health-conscious consumer base is creating demand for protein-fortified, probiotic, low-lactose, and plant-based dairy blends. Technological advancements in processing, fortification, and flavor enhancement provide manufacturers with opportunities to diversify product offerings and command premium pricing.

E-commerce and Direct-to-Consumer Channels

Online grocery platforms and D2C models are expanding their reach to tech-savvy and urban consumers. Subscription services, personalized product offerings, and digital marketing are enabling brands to increase consumer engagement, retention, and overall market share.

Product Type Insights

Milk-based dairy blends dominate the market with a 45% share in 2024, driven by familiarity, nutrition, and wide application in beverages and food products. Plant-based blends are rapidly gaining traction due to health and sustainability trends, while flavored and functional variants continue to diversify the product portfolio, capturing health-conscious and indulgence-oriented consumer segments.

Form Insights

Liquid dairy blends hold 52% market share in 2024, leading due to convenience and ready-to-drink demand. Powdered blends are favored for bakery, confectionery, and shelf-stable applications. The trend of urban consumers preferring portable, chilled beverages continues to drive liquid blend sales, supported by modern retail channels.

Application Insights

Beverages represent the largest application segment with a 41% share in 2024, fueled by milkshakes, smoothies, and flavored drinks. Food industry applications in bakery, desserts, and sauces are expanding rapidly, while healthcare and pediatric nutrition segments are emerging growth areas due to demand for fortified products and clinical nutrition beverages.

Distribution Channel Insights

Supermarkets and hypermarkets dominate with 48% market share in 2024, benefiting from organized retail growth, product visibility, and promotional campaigns. E-commerce is a fast-growing channel, providing convenience, subscription options, and access to premium and niche products. Convenience stores and foodservice channels also contribute, particularly in urban and semi-urban regions.

| By Product Type | By Form | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 32% of the market in 2024, led by the U.S. and Canada. High consumer awareness, premiumization, and demand for functional and plant-based blends are key growth drivers. The region is expected to continue moderate growth at a 5.6% CAGR due to established infrastructure and strong retail presence.

Europe

Europe contributes 28% of the market, with Germany, France, and the U.K. as major consumers. Functional and flavored blends are driving growth, with the U.K. being the fastest-growing country at 6.1% CAGR. Sustainability and health-conscious consumption remain critical market factors.

Asia-Pacific

Asia-Pacific is the fastest-growing region at 6.5% CAGR, driven by India, China, Japan, and Australia. Rising disposable incomes, urbanization, and westernization of diets are fueling the adoption of liquid, functional, and plant-based dairy blends. Social media and online retail platforms are expanding consumer awareness and accessibility.

Middle East & Africa

MEA accounts for 7% of the market, with the UAE and Saudi Arabia leading imports of premium dairy blends. Growth is fueled by high per capita spending, foodservice expansion, and preference for imported functional products. Local production remains limited, making import-driven growth critical.

Latin America

LATAM represents 5% of the market, with Brazil and Mexico as major consumers. Urban retail expansion and increasing health awareness are driving the adoption of flavored, functional, and plant-based dairy blends. Outbound imports supplement limited domestic production, creating growth opportunities for global players.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Dairy Blends Market

- Nestlé

- Danone

- Lactalis

- FrieslandCampina

- Arla Foods

- Saputo Inc.

- Fonterra

- Amul

- Meiji Holdings

- Murray Goulburn

- Yakult Honsha

- Parmalat

- Morinaga Milk Industry

- Abbott Laboratories

- Glanbia

Recent Developments

- In 2025, Nestlé launched a new line of fortified and flavored dairy blends in North America, emphasizing protein enrichment and plant-based alternatives.

- In 2025, Danone expanded its plant-based dairy blend portfolio in Asia-Pacific, targeting growing urban health-conscious consumers in India and China.

- In 2025, FrieslandCampina upgraded its production facilities in Europe to enhance liquid blend shelf-life and expand functional beverage offerings.