Commercial Washing Machines Market Size

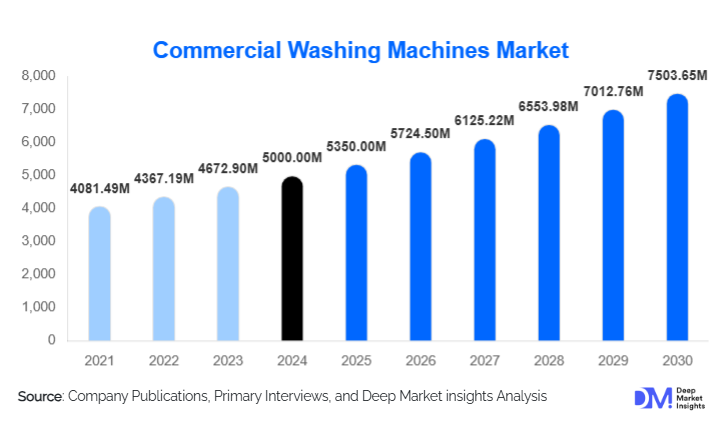

According to Deep Market Insights, the global commercial washing machines market size was valued at USD 5,000 million in 2024 and is projected to grow from USD 5,350 million in 2025 to reach USD 7,503.65 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025–2030). Growth in the commercial washing machines (CWM) market is being driven by the expansion of hospitality and healthcare infrastructure, rising demand for energy-efficient and smart laundry solutions, and the rapid adoption of automated, IoT-enabled systems that enhance operational efficiency and sustainability.

Key Market Insights

- Front-load washing machines dominate the global commercial washing machine market with nearly 45% share in 2024, owing to superior energy and water efficiency compared to top-load models.

- Asia-Pacific leads the market with about 35% share, driven by rapid hotel and healthcare infrastructure expansion across China, India, and Southeast Asia.

- Digital and IoT-enabled machines represent the fastest-growing technology segment, accounting for nearly 50% of market value in 2024 as laundries and institutions adopt predictive maintenance systems.

- Hospitality and healthcare industries remain the largest end-use sectors, collectively contributing over 50% of total market revenue in 2024.

- Smart, connected machines offering remote diagnostics, water recycling, and automated dosing are reshaping procurement priorities across laundromats and hotels.

- Rising sustainability regulations on energy and water consumption are accelerating machine replacements in North America and Europe.

What are the latest trends in the commercial washing machines market?

Adoption of Smart and IoT-Enabled Washing Systems

Commercial laundries, hospitals, and hotels are increasingly deploying IoT-connected washing machines equipped with predictive maintenance, load optimization, and real-time monitoring. These systems enhance productivity and minimize downtime, while providing operators with data analytics for water, detergent, and energy consumption. Smart connectivity also supports “machine-as-a-service” business models, allowing users to lease equipment and pay based on usage. This trend is reshaping the after-sales landscape, as OEMs derive growing revenues from cloud-based monitoring and remote servicing.

Focus on Energy and Water Efficiency

Energy-efficient models are becoming central to procurement decisions, particularly in regions where water and electricity costs are escalating. Manufacturers are integrating high-speed extraction, low-water rinse cycles, and heat-recovery systems to meet regulatory requirements. Many commercial operators in Europe and North America are upgrading to ENERGY STAR or EU Eco-design-compliant systems to reduce lifecycle costs and carbon emissions, further fueling the transition from legacy machines to advanced models.

Leasing and Service-Based Ownership Models

The emergence of leasing and subscription-based equipment models is helping small laundromats, co-living residences, and hospitals overcome high capital expenditure barriers. Manufacturers and distributors now offer maintenance-inclusive contracts and predictive servicing, enabling end-users to focus on operations rather than equipment management. This service-driven ecosystem is expanding rapidly in emerging economies where upfront investment remains a challenge.

What are the key drivers in the commercial washing machines market?

Expanding Hospitality and Healthcare Infrastructure

Rapid hotel construction, hospital modernization, and the growth of co-living spaces are generating strong demand for large-capacity, durable washing machines. As tourism and medical infrastructure investments increase across Asia, the Middle East, and Latin America, on-site laundry facilities are becoming standard. This structural expansion sustains steady annual demand for commercial washers with high throughput and reliability.

Technological Innovation and Automation

Digital control systems, programmable logic controllers (PLCs), and cloud-enabled monitoring have transformed the efficiency of commercial laundries. Automation reduces labour dependence and operational errors, while predictive analytics improve uptime. These advances are spurring replacement demand even in mature markets.

Government Regulations and Sustainability Policies

Stringent environmental and energy-efficiency regulations in Europe and North America are compelling end-users to replace older machines. Incentive programs promoting water conservation and waste-heat recovery have further boosted uptake of next-generation washers, supporting steady market expansion through 2030.

What are the restraints for the global market?

High Upfront Costs and Long Replacement Cycles

Commercial washing machines involve substantial capital outlay and have long operational lifespans (8–12 years). Smaller laundries and institutions in emerging economies often delay purchases, slowing market penetration. Financing innovations are mitigating but not eliminating this restraint.

Intense Price Competition

In mature markets such as the U.S. and Western Europe, commoditization of standard machine features leads to aggressive pricing. Margins are narrowing, prompting manufacturers to differentiate through smart features and lifecycle service offerings rather than low-cost competition.

What are the key opportunities in the commercial washing machines industry?

Smart Connectivity and Predictive Maintenance

IoT integration presents a major opportunity for OEMs to deliver value-added services like predictive diagnostics and remote updates. Offering cloud-based performance dashboards enhances customer retention and supports premium pricing.

Emerging Market Expansion

Asia-Pacific, Latin America, and the Middle East & Africa present untapped potential due to rapid urbanization and infrastructure development. Establishing localized manufacturing, leasing options, and regional distribution networks will help companies capture growth in these price-sensitive but high-volume markets.

Eco-Efficient Retrofitting and Green Laundries

As sustainability becomes central to procurement, manufacturers can capitalize on retrofitting contracts, providing eco-upgrade kits, and recycled-water systems. Partnerships with governments to support resource-efficient laundries can yield long-term growth and reinforce ESG commitments.

Product Type Insights

Front-load commercial washing machines dominate the product landscape with approximately 45% market share in 2024. They offer superior water and energy efficiency and are preferred across hotels, hospitals, and large laundromats. Washer-extractors and high-capacity machines are also gaining traction in industrial settings. Top-load models continue to serve smaller facilities and developing markets, while stackable units find use in space-constrained co-living and student housing applications.

Application Insights

The hospitality sector represents around 30% of global demand, followed by healthcare (24%) and commercial laundries (20%). Rapid growth in multi-housing, educational institutions, and industrial uniform washing provides additional revenue streams. The fastest-growing applications include outsourced laundries serving hotels and hospitals, driven by cost and hygiene considerations.

Distribution Channel Insights

Direct OEM sales and authorized distributors account for the bulk of market share, supplying large institutional clients. The rise of leasing and rental models allows smaller operators to access advanced machines without upfront costs. After-sales and maintenance contracts now represent a key profit centre for major brands, particularly in mature regions.

| By Product Type | By Capacity | By Application | By End-User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for about 28% of the global market value in 2024, led by the United States. Replacement demand from hotels, hospitals, and coin-operated laundromats drives steady sales. Energy-efficiency mandates and the adoption of smart, connected machines are key regional growth factors.

Europe

Europe holds roughly a 20% share, with Germany, the U.K., and France as major contributors. Strict sustainability standards under EU Eco-design directives push upgrades to low-water, low-energy machines. Government incentives and refurbishment of existing hospitality infrastructure sustain demand.

Asia-Pacific

Asia-Pacific leads globally with about 35% market share in 2024. China dominates by volume, while India and Southeast Asia are the fastest-growing subregions. Expansion of the hotel, healthcare, and co-living sectors, coupled with growing middle-class consumption, fuels double-digit growth in machine installations.

Latin America

Latin America represents a roughly 8–10% share of the global market value. Brazil and Mexico are the key markets, supported by tourism and healthcare investments. Economic volatility can affect purchasing cycles, but modernization projects in hospitality and public hospitals sustain baseline demand.

Middle East & Africa

MEA commands a 7–8% share and is among the fastest-growing regions, led by the UAE and Saudi Arabia. Expanding luxury tourism, hospital construction, and high-end laundry facilities in the Gulf Cooperation Council are driving adoption. In Africa, rising urbanization and hotel chains entering markets like Kenya and South Africa are increasing machine demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Commercial Washing Machines Market

- Alliance Laundry Systems

- Whirlpool Corporation

- Electrolux Group

- LG Electronics

- Miele & Cie KG

- Dexter Laundry

- Fagor Industrial

- Primus Laundry

- Pellerin Milnor Corporation

- Speed Queen Company

- Wascomat

- GE Appliances

- Haier Group

- Huebsch Manufacturing

- Bowes Laundry Equipment

Recent Developments

- In March 2025, Alliance Laundry Systems introduced an AI-powered predictive maintenance suite for its UniMac line, enabling real-time fault detection and remote service scheduling.

- In February 2025, LG Electronics launched a commercial energy-efficient washer series with integrated IoT dashboards targeting the Asian hospitality market.

- In January 2025, Electrolux Group announced a USD 50 million expansion of its Thailand manufacturing facility to meet rising regional demand in APAC.