Single Dose Laundry Detergent Cap Market Size

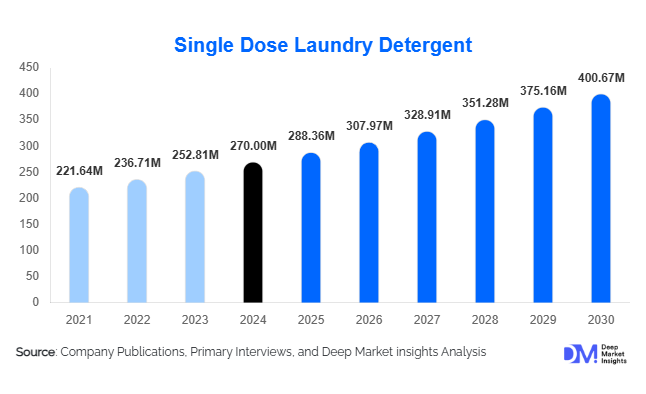

According to Deep Market Insights, the global single-dose laundry detergent cap market size was valued at USD 270 million in 2024 and is projected to grow from USD 288.36 million in 2025 to reach USD 400.67 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer demand for convenience, precise dosing, and eco-friendly laundry solutions, along with technological innovations in packaging and rising adoption in emerging markets.

Key Market Insights

- Consumer preference is shifting towards pre-measured, eco-friendly detergent caps, as households seek convenience, reduced detergent wastage, and minimal environmental impact.

- Technological advancements in packaging, such as dissolvable caps, biodegradable materials, and smart sensor-enabled products, are differentiating offerings in a competitive market.

- Household end-use segment dominates, driven by smaller family sizes, urbanization, and demand for easy-to-use laundry solutions.

- Asia-Pacific is emerging as the fastest-growing regional market, led by rising disposable incomes and increasing urban adoption in China and India.

- North America and Europe remain mature markets, with strong adoption due to environmental consciousness and willingness to pay for convenience-oriented premium products.

- Export demand is rising, with major trade flows from the U.S., Germany, and China to other regions, reflecting global consumer adoption.

Latest Market Trends

Eco-Friendly and Biodegradable Detergent Caps

Manufacturers are increasingly focusing on sustainability by introducing detergent caps made from biodegradable or recyclable materials. This trend is driven by rising consumer awareness of environmental impact and global regulatory encouragement. Biodegradable caps not only appeal to eco-conscious households but also differentiate brands in an increasingly competitive market. Companies are also exploring water-soluble films and compostable packaging to further reduce environmental footprints.

Technological Innovations in Product Design

Smart and innovative packaging solutions, including dissolvable pods, color-indicating capsules, and sensor-integrated designs, are transforming the market. These technologies improve user convenience, ensure precise dosing, and reduce waste. Additionally, the development of bio-based formulations allows effective cleaning at lower temperatures, aligning with energy-saving and sustainable practices. Companies adopting these technologies are capturing higher market share through premium positioning and differentiation.

Market Drivers

Convenience and Ease of Use

The primary driver is the demand for convenience in household chores. Single-dose detergent caps offer pre-measured quantities, reducing the effort and time required for laundry. This is particularly attractive to smaller households, working professionals, and urban populations seeking simple solutions for efficient laundry management.

Sustainability Concerns

Environmental awareness has fueled demand for products with low ecological impact. Biodegradable and recyclable caps, along with formulations effective in cold water, meet the growing consumer preference for eco-friendly solutions, encouraging adoption globally.

Advances in Packaging Technology

Innovative packaging technologies, such as water-soluble films and dissolvable capsules, enable better performance, convenience, and eco-friendliness. These developments allow manufacturers to differentiate products and command premium pricing while supporting sustainability trends.

Market Restraints

High Production Costs

The production of advanced detergent caps, particularly biodegradable or smart pods, involves higher manufacturing costs. This can increase retail prices, potentially limiting adoption in price-sensitive regions.

Regulatory Complexity

Varying safety, packaging, and environmental regulations across regions create challenges for manufacturers. Compliance increases operational costs and may slow market expansion in certain territories.

Market Opportunities

Emerging Market Expansion

Rapid urbanization and a growing middle class in Asia-Pacific and Latin America are creating new demand. Companies can tap these markets by introducing affordable, convenient, and eco-friendly detergent caps tailored to local consumer preferences.

Integration of Smart Packaging

Smart technologies such as sensor-based dosing indicators and water-soluble films are gaining traction. Incorporating these innovations presents an opportunity to enhance user experience and differentiate products, particularly in mature markets seeking convenience and technological sophistication.

Sustainability-Driven Product Differentiation

Developing biodegradable and environmentally-friendly detergent caps enables manufacturers to appeal to eco-conscious consumers. This strategy not only supports sustainability goals but also strengthens brand positioning and allows entry into premium market segments.

Product Type Insights

Bio detergent caps dominate due to their superior cleaning performance and energy-saving benefits. In 2024, they accounted for approximately 60% of the global market. Non-bio caps are popular among consumers with sensitive skin, representing 40% of the market. The trend toward bio-based formulations is supported by higher efficacy at low temperatures, appealing to environmentally conscious households.

Application Insights

The household segment holds the largest share, driven by convenience and ease of use. Commercial adoption is growing in hotels, laundromats, and laundry service providers seeking consistent cleaning results and operational efficiency. The increasing rise of online laundry services is further expanding commercial demand, creating export-driven opportunities for manufacturers.

Distribution Channel Insights

Retail stores remain a key distribution channel, though online sales are rapidly growing due to convenience and direct-to-consumer engagement. E-commerce platforms enable easy access to product comparisons, reviews, and bulk purchases. Multi-channel strategies, including supermarkets, hypermarkets, and specialized cleaning product stores, ensure broad reach, while subscription models are emerging as a recurring revenue source.

| By Product Type | By Application / End-Use | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

The U.S. leads in adoption, supported by consumer preference for convenience and sustainable products. North America accounted for roughly 30% of the global market in 2024. High awareness, premium product adoption, and strong retail networks support sustained growth.

Europe

Germany and the U.K. dominate demand in Europe, representing 28% of the market in 2024. Eco-conscious consumers and stringent environmental regulations drive growth. Biodegradable and recyclable product lines are gaining significant traction in these countries.

Asia-Pacific

China and India are the fastest-growing markets, driven by urbanization, increasing disposable incomes, and rising awareness of convenient laundry solutions. The region presents immense opportunities for both premium and affordable detergent caps, with projected double-digit growth rates.

Latin America

Brazil and Mexico show increasing adoption due to growing middle-class households and urban lifestyles. While overall market share is smaller compared to North America and Europe, growth potential remains high.

Middle East & Africa

South Africa and the UAE are the leading adopters. Demand is driven by urbanization and modern retail expansion. The region is gradually embracing eco-friendly and convenient products, contributing to overall market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Single Dose Laundry Detergent Cap Market

- Procter & Gamble

- Unilever

- Henkel

- Reckitt Benckiser

- Church & Dwight

- SC Johnson

- Godrej Consumer Products

- LG Household & Health Care

- Amway

- Clorox

- Ajanta

- Nirma

- Hindustan Unilever

- Seventh Generation

- OxiClean

Recent Developments

- In March 2025, Procter & Gamble launched a new line of biodegradable detergent caps in Europe, expanding its eco-friendly portfolio.

- In January 2025, Henkel introduced smart dissolvable pods with optimized dosing sensors for U.S. households, improving user convenience and reducing waste.

- In November 2024, Unilever expanded its single-dose laundry detergent range in India, targeting urban households with both bio and non-bio variants.