Carpet Floor Mats Market Size

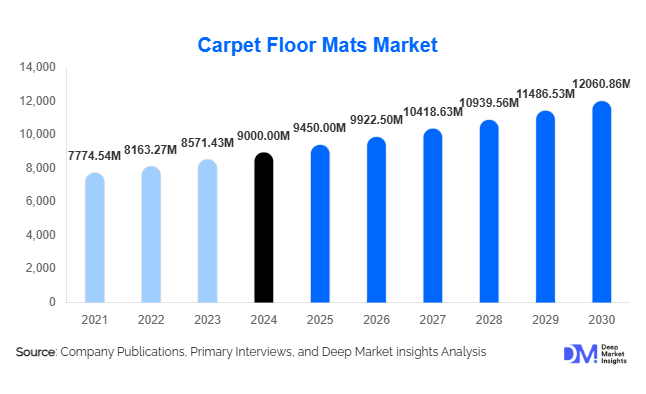

According to Deep Market Insights, the global carpet floor mats market size was valued at USD 9,000 million in 2024 and is projected to grow from USD 9,450.00 million in 2025 to reach USD 12,060.86 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for durable, aesthetic, and hygienic floor coverings across residential, commercial, and automotive segments, rising construction and renovation activity globally, and innovations in eco-friendly, customizable, and smart floor mats.

Key Market Insights

- Rising sustainability awareness is driving demand for eco-friendly carpet mats, with consumers seeking mats made from recycled fibers, low-VOC materials, and biodegradable backing solutions.

- Commercial applications dominate the market, especially in offices, retail spaces, and hospitality, due to high foot traffic, branding opportunities, and aesthetic considerations.

- Asia-Pacific is emerging as the fastest-growing region, led by India and China, where rapid urbanization and rising middle-class spending are fueling demand.

- Online retail and e-commerce channels are expanding rapidly, enabling customized, premium, and direct-to-consumer mat sales.

- Automotive interior demand for carpet mats is growing, driven by aftermarket customization and OEM integration.

- Technological adoption, including smart mats with sensors, anti-microbial coatings, and modular designs, is creating differentiated offerings for end-users.

Latest Market Trends

Sustainability and Eco-Friendly Mats

Manufacturers are increasingly producing mats from recycled nylon, wool blends, and other environmentally friendly materials. Eco-certifications and low-VOC processes are becoming important buying criteria for commercial, residential, and automotive customers. Companies are also integrating recycling and take-back programs to promote circular economy practices. Sustainable carpet mats appeal particularly to environmentally conscious consumers and businesses looking to comply with green building certifications such as LEED and WELL.

Smart and Customizable Flooring Solutions

The market is witnessing innovations in smart mats, including moisture sensors, anti-microbial treatments, ergonomic anti-fatigue designs, and modular tiles for flexible commercial spaces. Custom branding and bespoke shapes for corporate entrances, hospitality, and automotive interiors are gaining traction. Online platforms allow consumers to order tailored mats, expanding reach and supporting higher-margin products.

Carpet Floor Mats Market Drivers

Construction and Renovation Growth

Rising commercial and residential construction, along with the refurbishment of existing buildings, is driving demand for carpet floor mats. High foot traffic areas such as lobbies, offices, and retail outlets require durable, visually appealing mats, stimulating both volume and premium product adoption. Renovation projects in Europe and North America are particularly supporting replacement mat sales.

Automotive Interior Expansion

Increased focus on vehicle aesthetics and interior comfort is fueling carpet mat demand in OEM and aftermarket segments. Rising vehicle ownership in emerging markets and customization trends are further accelerating growth. Luxury and branded mats in high-end vehicles contribute to premium segment revenue.

Rising Consumer Spending and E-Commerce Penetration

Higher disposable income, home improvement trends, and awareness of hygiene and aesthetics are driving residential demand. E-commerce adoption enables direct-to-consumer sales, faster delivery, and customization, contributing to overall market growth and adoption of premium and specialty mats.

Market Restraints

Competition from Alternative Flooring

Carpet floor mats face competition from vinyl mats, rubber mats, and hard flooring solutions. In some commercial and residential spaces, these alternatives reduce the need for separate carpet mats, limiting market expansion.

Raw Material Price Volatility

Synthetic fibers such as nylon, polypropylene, and polyester are sensitive to fluctuations in petroleum-based raw material costs. Rising input costs can impact manufacturing margins and constrain investment in product innovations or capacity expansion.

Carpet Floor Mats Market Opportunities

Eco-Friendly and Sustainable Product Lines

There is an opportunity for manufacturers to expand eco-conscious product portfolios using recycled, biodegradable, or low-VOC materials. Aligning products with sustainability certifications and green building standards can attract premium commercial and residential customers while differentiating brands in competitive markets.

Emerging Market Expansion

Rapid urbanization and construction in Asia-Pacific, Latin America, and parts of Africa present high-growth opportunities. Establishing localized production, partnerships, or distribution networks in these regions allows companies to access underserved markets and meet rising demand for residential, commercial, and automotive mats.

Innovative and Smart Mat Solutions

Integrating features such as anti-microbial coatings, moisture detection sensors, ergonomic designs, and modular or customizable mats offers differentiation. Specialty solutions for hospitality, offices, and automotive interiors can command higher margins and tap into niche end-use segments.

Product Type Insights

Nylon carpet floor mats dominate the market, valued at approximately 35% of global sales in 2024 due to their durability, stain resistance, and suitability for high-traffic commercial and automotive applications. Tufted mats are the most widely used construction type, offering versatility across textures, designs, and price points. These products lead the market because they combine performance with aesthetic appeal and manufacturing efficiency.

Application Insights

Commercial applications, including offices, retail outlets, and hospitality spaces, represent the largest segment, accounting for 42% of the market in 2024. Residential, automotive, and industrial segments follow, with automotive mats gaining traction through aftermarket customization and OEM integration. New applications include smart mats for hygiene monitoring, anti-fatigue mats for workspaces, and branded entrance mats for hospitality and corporate environments.

Distribution Channel Insights

Online retail and e-commerce channels are expanding rapidly, enabling direct-to-consumer sales, customization, and higher-margin product offerings. Offline retail remains significant, particularly in home improvement stores and specialty flooring shops. B2B direct sales to commercial facilities and automotive OEMs represent a substantial portion of bulk demand.

End-Use Insights

Commercial facilities and automotive interiors are the fastest-growing end-use segments. Residential demand remains steady with growing interest in eco-friendly and design-oriented mats. Export-driven demand is also notable, with lower-cost manufacturing hubs in Asia supplying mats to North America, Europe, and the Middle East.

| By Material Type | By Construction / Fabrication Method | By Application / End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 32% of the global market share in 2024 (USD 2,880 million). Demand is driven by commercial refurbishment, residential home improvement, and automotive aftermarket mats. The U.S. dominates the region, with Canada also contributing to growth. E-commerce adoption and preference for premium mats support market expansion.

Europe

Europe held 28% of the global share (USD 2,520 million) in 2024. Germany, the UK, and France are major contributors due to high construction and renovation activity, demand for sustainable mats, and premium product adoption. Growth is steady, driven by green building initiatives and commercial refurbishment projects.

Asia-Pacific

APAC is the fastest-growing region, with a 23% share (USD 2,070 million) in 2024. China and India lead demand due to urbanization, rising middle-class income, automotive production, and retail expansion. Southeast Asia is also emerging as a high-growth market, supported by new commercial and residential construction.

Latin America

Latin America accounted for 5–9% of the market (USD 450–800 million) in 2024, with Brazil, Mexico, and Argentina as key contributors. Demand is driven by rising middle-class purchasing power and outbound construction/imported mat demand for commercial and automotive applications.

Middle East & Africa

MEA represents 6% (USD 540 million) in 2024. Key markets include the UAE, Saudi Arabia, and South Africa, supported by infrastructure development, hospitality, tourism, and commercial projects. The Gulf states are the fastest-growing markets within the region due to high-income populations and luxury adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Carpet Floor Mats Market

- Mohawk Industries, Inc.

- Shaw Industries Group, Inc.

- Interface, Inc.

- Milliken & Company

- Beaulieu International Group

- Tarkett S.A.

- Forbo Holding AG

- Bentley Mills, Inc.

- Durable Corporation

- Cintas Corporation

- Guardian Floor Protection

- Eagle Mat & Floor Products

- Andersen Company

- Crown Matting Technologies

- Engineered Floors LLC

Recent Developments

- In 2025, Mohawk Industries expanded its eco-friendly mat product line with recycled nylon and low-VOC backing, targeting North America and Europe.

- In 2025, Shaw Industries launched customizable modular tufted mats for commercial offices, enabling flexible floor designs and enhanced hygiene compliance.

- In 2025, Interface, Inc. introduced smart carpet mats with antimicrobial coatings and moisture-detection sensors, catering to the healthcare and hospitality sectors.