Capture Card Market Size

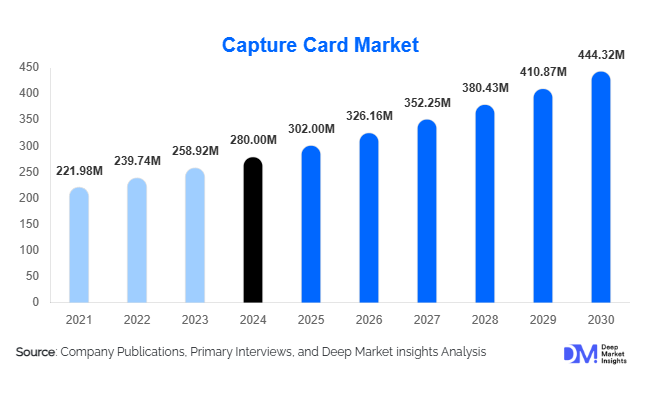

According to Deep Market Insights, the global capture card market size was valued at USD 280.00 million in 2024 and is projected to grow from USD 302.40 million in 2025 to reach USD 444.32 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). The market growth is primarily driven by the increasing demand for high-quality video capture and streaming solutions across gaming, professional broadcasting, content creation, and healthcare applications. Rising adoption of high-resolution video, technological advancements in capture devices, and the proliferation of live streaming platforms are further fueling market expansion.

Key Market Insights

- Gaming and live streaming continue to dominate capture card usage, driven by professional and amateur content creators seeking high-quality, reliable recording solutions.

- Technological advancements, including 4K and 8K resolution support, AI-assisted video processing, and improved compression technologies, are enhancing device performance and appeal.

- North America dominates the market, with the U.S. leading demand due to a high concentration of gamers, streamers, and professional broadcasters.

- Asia-Pacific is the fastest-growing region, fueled by rising digital content consumption, internet penetration, and an expanding gaming and esports community in China and India.

- Europe maintains steady growth, particularly in Germany and the UK, supported by professional broadcasting demand and high-quality content creation requirements.

- Emerging applications in healthcare and education, such as medical imaging digitization and online learning content capture, are opening new avenues for market growth.

What are the latest trends in the capture card market?

High-Resolution and Multi-Platform Integration

Capture cards are increasingly supporting 4K and 8K video resolutions to meet professional streaming and broadcasting standards. Multi-platform compatibility, including PCs, gaming consoles, and mobile devices, is becoming a standard feature, enabling seamless integration for content creators. Demand for devices that combine high frame rates with low latency is rising, particularly in competitive gaming and esports. This trend encourages manufacturers to innovate with superior encoding technologies, GPU acceleration, and optimized hardware for multi-device setups, catering to professional-grade content creation needs.

AI and VR-Enabled Video Capture

Emerging technologies such as AI-assisted video processing and VR integration are transforming the capture card market. AI capabilities enable automated scene detection, object tracking, and real-time video optimization, reducing post-production effort. VR support facilitates immersive content creation, particularly for gaming, simulation, and educational applications. Manufacturers are incorporating these features to differentiate products, enhance user experience, and attract tech-savvy content creators looking for advanced video capture solutions.

What are the key drivers in the capture card market?

Expansion of Content Creation and Live Streaming

The rapid rise of platforms like Twitch, YouTube, and TikTok has fueled demand for capture cards. Streamers and content creators require high-quality video capture solutions for professional-grade streaming and video production. The increasing popularity of gaming and esports events is further accelerating adoption, with both amateur and professional gamers seeking reliable hardware for live broadcasting.

Advancements in Video Resolution and Compression

Technological developments in 4K and 8K video resolutions, along with improved video compression techniques, have increased the efficiency and quality of capture devices. These advancements allow users to produce higher-quality content without demanding excessive storage or bandwidth, making capture cards more appealing across both consumer and professional segments.

Integration with Gaming Consoles and PCs

Capture cards are now widely compatible with a variety of gaming consoles and personal computers, expanding their user base. The ability to record and stream gameplay across multiple platforms drives adoption in the gaming industry, which remains one of the largest end-use segments for capture cards globally.

What are the restraints for the global market?

High Cost of Advanced Capture Cards

Devices supporting high-end resolutions, such as 4K and 8K, often come with premium pricing, which can limit adoption among casual users and small content creators. The high initial investment may restrict market growth in price-sensitive regions.

Technical Complexity and Setup Challenges

The installation and configuration of capture cards can be complex, particularly for non-technical users. This technical barrier may slow adoption among casual content creators who lack familiarity with hardware setup, software integration, and compatibility troubleshooting.

What are the key opportunities in the capture card market?

Integration with AI and VR Technologies

Capture cards integrated with AI-powered features such as automated editing, object tracking, and real-time video enhancement offer significant growth opportunities. VR applications, including immersive gaming and training simulations, further expand the potential market. Early adoption of such technologies provides a competitive advantage for manufacturers seeking differentiation in a crowded market.

Emerging Market Expansion

Rapid digital infrastructure development in Asia-Pacific and Latin America is driving demand for capture cards. Rising internet penetration, growing gaming communities, and increasing online content consumption present opportunities for both established and new market entrants. Expanding distribution networks and localized marketing strategies can capture this emerging demand effectively.

Demand for High-Resolution Video Capture

The ongoing proliferation of 4K and 8K content across streaming, broadcasting, and professional video production highlights the need for high-resolution capture solutions. Manufacturers developing advanced devices that meet these quality requirements can target professional content creators and broadcasters, unlocking higher-value market segments.

Product Type Insights

PCIe capture cards dominate the market due to high-speed data transfer and reliability, particularly in professional gaming and broadcasting, holding approximately 45% of the 2024 market. USB capture cards are gaining traction for their portability and ease of use, especially among casual streamers and educational applications, accounting for around 25% of the market. External capture cards and hybrid solutions are emerging in niche segments, providing flexibility and cross-platform compatibility.

Application Insights

Gaming remains the largest application segment, with approximately 50% share of the 2024 market, driven by live streaming and esports. Professional broadcasting accounts for 20%, while medical imaging and education content capture are growing segments benefiting from high-quality video digitization requirements. Trends indicate rising demand for multi-application devices that cater to both professional and consumer use cases.

End-Use Insights

The primary end-use segments include entertainment and media, education and training, and healthcare. Entertainment and media remain the largest consumer, driven by gaming and streaming. Educational institutions are increasingly adopting capture cards for online learning content production, while healthcare utilizes these devices for telemedicine and digitized imaging. Export-driven demand is significant from North America and Europe, supplying emerging regions where local production is limited.

| Interface/Connection | Target Platform | Resolution/Latency |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global capture card market, holding approximately 35% of the 2024 share. The U.S. drives growth due to its high number of professional content creators, streamers, and esports participants. Canada contributes steadily with an increasing demand for educational and professional broadcasting applications.

Europe

Europe holds 25% of the 2024 market, with Germany and the UK as major contributors. Professional broadcasting and content creation drive adoption, while the region benefits from technological infrastructure and early adoption of high-resolution devices.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China and India. Rising gaming communities, internet penetration, and digital content creation support strong demand. Growth rates are projected above 8% CAGR during 2025–2030, reflecting emerging market expansion.

Latin America

Brazil and Mexico are leading markets, with increasing interest in gaming, streaming, and educational applications. Market growth is moderate but accelerating due to improving digital infrastructure and rising internet penetration.

Middle East & Africa

The UAE and South Africa are key markets, with growth driven by professional media and entertainment adoption. While market share is smaller compared to North America and Europe, premium adoption is increasing in high-income regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Capture Card Market

- Elgato

- AVerMedia

- Razer

- Blackmagic Design

- Magewell

- Roxio

- Mirabox

- StarTech

- IOGear

- Hauppauge

- AGPtEK

- AVerMedia Live Gamer

- Epiphan Video

- Blackbox

- Digitnow

Recent Developments

- In March 2025, Elgato launched a new 8K capture card with AI-assisted scene optimization for professional streaming and esports applications.

- In January 2025, AVerMedia introduced a compact USB capture card supporting 4K 60fps for content creators, targeting entry-level and mid-tier users.

- In December 2024, Blackmagic Design upgraded its PCIe capture line with improved compression and latency performance, enhancing its appeal for professional broadcasters.