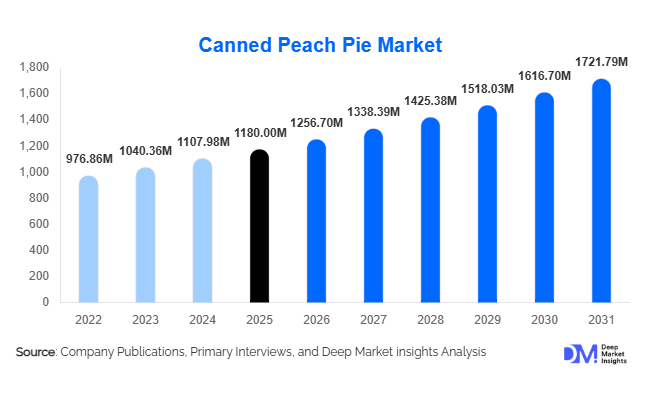

Canned Peach Pie Market Size

According to Deep Market Insights, the global canned peach pie market size was valued at USD 1,180 million in 2025 and is projected to grow from USD 1,256.70 million in 2026 to reach approximately USD 1,721.79 million by 2031, expanding at a CAGR of 6.5% during the forecast period (2026–2031). The market growth is primarily driven by rising demand for convenient, shelf-stable dessert solutions, expanding applications in commercial bakeries and foodservice, and increasing penetration of packaged desserts across emerging economies.

Key Market Insights

- Ready-to-bake canned peach pie fillings dominate global demand, driven by widespread adoption among commercial bakeries and cafés.

- Metal can packaging remains the industry standard, accounting for over half of total sales due to durability, recyclability, and long shelf life.

- North America leads global consumption, supported by strong baking culture and high penetration of packaged desserts.

- Asia-Pacific is the fastest-growing regional market, fueled by westernization of diets, retail expansion, and rising middle-class income.

- Foodservice and institutional demand is accelerating, particularly from QSRs, airline catering, and large-scale bakeries.

- Premium and clean-label products are gaining traction, driven by consumer focus on natural ingredients and reduced sugar formulations.

What are the latest trends in the canned peach pie market?

Premiumization and Clean-Label Reformulation

The canned peach pie market is witnessing a steady shift toward premium and clean-label offerings. Consumers are increasingly seeking products made with higher fruit content, reduced artificial preservatives, and simplified ingredient lists. Manufacturers are responding by introducing organic variants, low-sugar formulations, and premium glass-jar packaging aimed at health-conscious and affluent consumers. This trend is particularly strong in North America and Europe, where clean-label positioning has become a key differentiator in packaged desserts.

Growth of Foodservice and Bulk Packaging Formats

Another major trend is the expansion of bulk and industrial-grade canned peach pie fillings for foodservice and institutional use. Commercial bakeries, café chains, and quick-service restaurants prefer standardized fillings that reduce preparation time and ensure consistent taste. As global foodservice operations continue to scale, demand for large-format cans and retort pouches is rising, supporting volume-driven growth.

What are the key drivers in the canned peach pie market?

Rising Demand for Convenience Foods

Urbanization and busy lifestyles are driving sustained demand for ready-to-eat and ready-to-bake dessert products. Canned peach pie products offer extended shelf life, minimal preparation, and consistent quality, making them attractive for both households and commercial users. This driver remains particularly strong in developed markets with high dual-income households.

Expansion of Commercial Bakeries and Cafés

The rapid growth of commercial bakeries, coffee chains, and dessert cafés globally has significantly boosted demand for canned peach pie fillings. These establishments rely on shelf-stable ingredients to manage costs and reduce food waste, making canned peach pie products a preferred choice.

What are the restraints for the global market?

Health Concerns Related to Sugar Content

Growing awareness of sugar-related health issues poses a restraint for traditional canned dessert products. Consumers are increasingly moderating consumption of high-sugar foods, compelling manufacturers to invest in reformulation and alternative sweetening strategies.

Competition from Fresh and Frozen Alternatives

Fresh bakery products and frozen pie fillings present competitive pressure, especially in premium urban markets. Improvements in frozen supply chains and consumer perception of freshness limit the pricing power of canned alternatives.

What are the key opportunities in the canned peach pie industry?

Emerging Market Expansion in Asia-Pacific and Latin America

Asia-Pacific and Latin America offer significant untapped potential. Rising disposable incomes, increasing exposure to Western desserts, and rapid growth of modern retail are driving demand for packaged desserts. Localization of flavors and affordable packaging formats can accelerate adoption in these regions.

Innovation in Sustainable Packaging

Advancements in recyclable metal cans, lightweight packaging, and retort pouches present opportunities to improve sustainability credentials while reducing logistics costs. Sustainability-driven innovation is becoming a critical factor in purchasing decisions.

Product Type Insights

Ready-to-bake canned peach pie fillings account for approximately 38% of the 2025 market, driven by strong B2B demand from bakeries and foodservice operators. Ready-to-eat canned peach pie desserts hold a significant share in household consumption, while industrial-grade bulk fillings are the fastest-growing product type due to large-scale bakery expansion.

Application Insights

Commercial bakeries and cafés represent the largest application segment, contributing nearly 34% of global demand. Household consumption remains stable, while institutional catering and QSR applications are emerging as high-growth segments due to cost efficiency and standardized dessert requirements.

Distribution Channel Insights

Supermarkets and hypermarkets dominate distribution with around 45% share of global sales, benefiting from wide product visibility and consumer trust. Online retail and direct-to-consumer channels are the fastest-growing, supported by e-commerce penetration and home delivery adoption.

Price Positioning Insights

Mass-market products dominate the canned peach pie market, accounting for approximately 60% of total market value. This leadership is primarily driven by competitive pricing, broad consumer accessibility, and high-volume sales through supermarkets, hypermarkets, and foodservice channels. These products cater to everyday consumption and bulk buyers, making them the preferred choice for both households and commercial bakeries.

The mid-premium segment is witnessing steady growth as consumers increasingly seek better taste profiles, improved fruit quality, and cleaner ingredient lists while remaining price-conscious. Meanwhile, the premium segment, though smaller in volume, is expanding at a healthy pace, supported by clean-label formulations, organic certifications, artisanal positioning, and the rise of specialty retail and gourmet bakery outlets.

Leading segment driver: The mass-market segment continues to lead due to its strong value-for-money proposition, consistent supply of raw materials, and the ability of manufacturers to achieve economies of scale while maintaining acceptable quality standards.

| By Product Formulation | By Packaging Type | By Distribution Channel | By End-Use Application | By Price Positioning |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 38% of the global canned peach pie market, with the United States representing the largest contributor. The region benefits from high per-capita consumption of desserts, a deeply rooted bakery and pie-making culture, and strong penetration of canned fruit products across retail and foodservice channels.

Regional growth drivers: Key drivers include well-established supply chains, high consumer preference for convenient dessert solutions, strong presence of commercial bakeries and quick-service restaurants, and continuous product innovation focused on reduced sugar and clean-label variants.

Europe

Europe represents nearly 30% of global demand, led by Germany, the United Kingdom, and France. The region demonstrates stable demand supported by long-standing consumption of preserved fruit products and a robust commercial bakery sector.

Regional growth drivers: Demand is reinforced by consumer preference for high-quality ingredients, strict food safety and labeling standards that enhance product trust, and the presence of premium and artisanal bakery brands. Growing interest in traditional and heritage dessert recipes also sustains market stability.

Asia-Pacific

Asia-Pacific holds around a 22% market share and is the fastest-growing region, with China and India recording growth rates exceeding 8% CAGR. Rapid urbanization and evolving consumer lifestyles are reshaping dessert consumption patterns.

Regional growth drivers: Expansion of modern retail formats, increasing adoption of Western-style bakeries, rising disposable incomes, and growing exposure to global food trends are driving demand. Additionally, the foodservice sector’s rapid growth and increasing use of canned fruits as bakery ingredients support regional acceleration.

Latin America

Latin America accounts for a smaller but steadily expanding share of the global market, with Brazil and Mexico emerging as key contributors. Consumption is largely driven by urban populations and foodservice applications.

Regional growth drivers: Rising urbanization, growing middle-class populations, increasing imports of canned fruit products, and expanding café and bakery chains are supporting market growth. Affordability and longer shelf life of canned peaches make them attractive in price-sensitive markets.

Middle East & Africa

The Middle East & Africa region exhibits steady growth, particularly across GCC countries and select African urban centers. Demand is mainly concentrated in foodservice and institutional catering segments.

Regional growth drivers: High dependence on food imports, expanding hospitality and tourism sectors, increasing number of international bakery chains, and growing institutional catering demand from hotels, airlines, and events are key factors driving regional market development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Canned Peach Pie Market

- Nestlé

- Conagra Brands

- Del Monte Foods

- General Mills

- Kraft Heinz

- Campbell Soup Company

- Bonduelle Group

- Dole Food Company

- Princes Group

- Rhodes Food Group

- Seneca Foods

- Andros Group

- Hero Group

- La Costeña

- Ardo Group