Camcorders Market Size

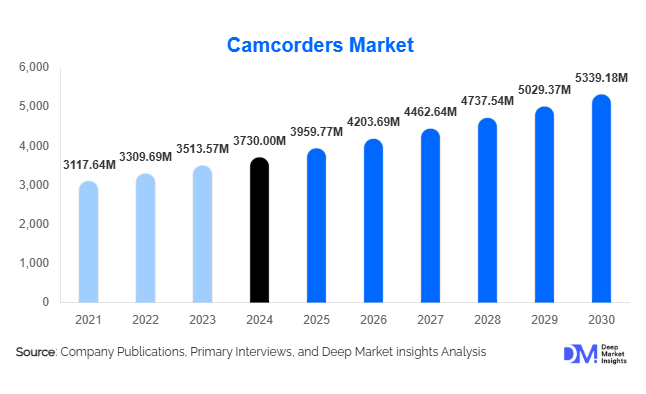

According to Deep Market Insights, the global Camcorders Market size was valued at USD 3,730 million in 2024 and is projected to grow from USD 3,959.77 million in 2025 to reach USD 5,339.18 million by 2030, expanding at a CAGR of 6.16% during the forecast period (2025–2030). The camcorders market growth is primarily driven by rising demand for high-quality video content from professional broadcasters and content creators, technology refresh cycles (4K and higher resolutions, improved low-light sensors, and stabilization), and expanding institutional procurement for public safety and corporate AV applications.

Key Market Insights

- Premiumization of market value: While entry-level unit volumes decline due to smartphone substitution, market value is concentrating in prosumer and professional segments (4K+, large sensors), boosting overall revenue.

- Live streaming & OTT production are increasing procurement: Broadcasters, streaming platforms, and corporate studios are upgrading field capture and multi-camera kits to support high-quality live and on-demand content.

- APAC and North America lead value and growth in different ways: Japan and the U.S. drive high-value purchases and exports, while India and Southeast Asia deliver the fastest percentage growth in units and mid-range demand.

- Software and services are becoming differentiators: On-device AI, cloud ingestion, remote management, and subscription bundles are enabling vendors to capture recurring revenue and higher margins.

- Specialized segments (action, body-worn, 360°) are resilient: These niches offset declines at the low-end consumer camcorder category and create diversified revenue streams.

- Distribution remains hybrid: High-value purchases still favor offline demonstration and B2B direct sales, while online channels dominate entry and mid-tier conversions.

Latest Market Trends

4K and-beyond Standardization and Sensor Upsizing

4K capture has become the de facto standard across prosumer and professional tiers, pushing manufacturers to adopt larger sensors and advanced image pipelines to improve low-light performance and dynamic range. This shift increases ASPs and drives replacement cycles in broadcasting and indie filmmaking. High-end buyers are evaluating 6K–8K options for cinematic workflows and future-proofing content production.

Integrated Live-Streaming & IP Workflows

Camcorders increasingly offer native RTMP/NDI outputs, low-latency encoding, and 5G-enabled contribution. Integration with IP-based production workflows simplifies live multi-camera streaming and remote contribution for news, sports, and corporate events. Vendors that provide end-to-end compatibility with switching, cloud ingest, and remote management tools are gaining traction in institutional procurement.

AI & Cloud Enhancements

On-device AI features such as auto-framing, subject tracking, automatic metadata tagging, and scene detection are reducing post-production time and creating new monetization opportunities via software and service subscriptions. Cloud-assisted workflows for immediate upload, remote monitoring, and metadata-driven asset management are increasingly expected by enterprise buyers and busy content creators.

Camcorders Market Drivers

Rising Professional & Prosumer Content Production

Growth in streaming platforms, e-sports broadcasting, digital agencies, and creator monetization has elevated demand for reliable, high-quality capture gear. Production houses and seasoned creators invest in multi-camera rigs and prosumer/pro cameras to meet audience expectations for high-fidelity video and low-latency live streams.

Technological Advancements Elevating Product Value

Improvements in sensor technology, codecs (efficient H.265/HEVC, AV1 experimentation), stabilization systems, and connectivity have increased the utility and lifespan of modern camcorders. These enhancements encourage upgrades and justify higher ASPs, supporting market revenue growth even if unit sales in entry segments decline.

Institutional & Government Procurement

Public safety (body-worn systems), educational institutions, broadcasters, and corporate AV groups continue to procure camcorders as part of larger AV and evidence-management projects. Tender-based purchases, long service contracts, and multi-unit buys create stable demand for mid-to-high tier devices.

Market Restraints

Smartphone Substitution at Consumer Entry Levels

Smartphones have largely displaced basic consumer camcorders for casual video capture, exerting downward pressure on unit volume in low-price tiers. This substitution forces manufacturers to pursue premiumization or niche product strategies.

Complexity of IP & Standards Integration

Transitioning to IP workflows (NDI, SMPTE standards, secure streaming) adds integration complexity and increases the total cost of ownership for smaller studios and SMBs lacking in-house technical resources. Unless vendors offer turnkey solutions, this can slow the adoption of higher-value cameras.

Camcorders Market Opportunities

Subscription & Rental Models for Professional Gear

Rental houses and subscription (hardware-as-a-service) models lower barriers to entry for high-cost professional equipment, broadening the buyer base among independent creators, smaller production houses, and corporate teams. Vendors can partner with rental networks or directly offer subscription services to capture recurring revenue and improve utilization of high-margin units.

Growth in Public Safety & Evidence-Grade Devices

Law enforcement and emergency services require hardened body-worn and vehicle-mounted camcorders with encrypted storage and tamper-evident chains of custody. Meeting compliance and evidence-management requirements creates long-term procurement contracts and opportunities for integrated software services.

AI-Enabled Workflow Monetization

Providing on-device AI (auto-tagging, speech-to-text, scene detection) and cloud workflows (asset management, instant ingest) enables vendors to upsell software subscriptions and managed services. This integration increases stickiness and drives margin expansion beyond one-time hardware sales.

Product Type Insights

Professional/broadcast camcorders account for a leading share of market value due to high ASPs and institutional purchases, followed by prosumer/hybrid models that balance advanced features and portability for creators. Action & POV camcorders and body-worn devices occupy distinct niches with strong growth potential, especially in sports, law enforcement, and adventure filming, while entry-level consumer camcorders have contracted under smartphone competition.

Application Insights

Broadcasting & news, live events, and film/cinematography remain the highest-value applications because of multi-camera deployments and service contracts. Corporate/education (hybrid events and remote learning), the creator economy (vlogging and streaming), and public safety (body-worn / tactical capture) are fast-growing applications. Emerging uses include drone/inspection-mounted camcorders, immersive 360° capture for training/real estate, and live commerce production.

Distribution Channel Insights

High-value camcorders and multi-unit purchases typically flow through B2B direct channels and specialist retailers where demos and service agreements matter. Online retail (brand stores and marketplaces) dominates consumer and prosumer conversions thanks to price transparency and convenience. Rental houses and pro-services are critical channels for accessing intermittent professional demand and expanding user adoption in cost-sensitive segments.

Buyer Profile Insights

Key buyers include broadcasters and media houses (high-value, institutional procurement), content creators and small production companies (prosumer buys and multi-camera kits), law enforcement and government agencies (body-worn/tactical purchases), and corporate/education buyers (AV deployments). Each buyer group values different feature sets, reliability, and IP compatibility for broadcasters, compactness and autofocus for creators, and evidence security for public safety.

| By Product Type | By Resolution / Performance Tier | By Technology / Feature Set | By Distribution Channel | By End-Use / Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is a leading market by value due to significant broadcaster budgets, high OTT penetration, an active rental ecosystem, and large numbers of professional content creators. The U.S., in particular, drives demand for premium broadcast and prosumer equipment, while Canada contributes through media production and public safety procurement.

Europe

Europe shows stable demand from public broadcasters, independent film production, and corporate AV projects. The UK, Germany, and France are the largest buyers, with increasing interest in IP workflows and eco-conscious procurement for long lifecycle equipment.

Asia-Pacific

APAC is the largest regional share by combined manufacturing and buyer value. Japan provides high-value domestic demand and major OEM production; China supports large domestic streaming ecosystems and manufacturing; India and Southeast Asia are the fastest-growing markets in percentage terms, driven by creator adoption and expanding event production.

Latin America

Growth is driven by rising creator communities and gradual corporate AV investment. Affluent buyers in Brazil and Mexico are upgrading to prosumer and professional kits, but macroeconomic constraints moderate short-term expansion.

Middle East & Africa

Selective high-value purchases for events and broadcasting in Gulf states and established media hubs in South Africa drive demand. Africa is both a destination for professional video production and a region where body-worn and ruggedized units see growing institutional adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Camcorders Market

- Sony Group Corporation

- Canon Inc.

- Panasonic Corporation

- JVCKENWOOD Corporation (JVC)

- GoPro, Inc.

- DJI (SZ DJI Technology Co., Ltd.)

- Blackmagic Design Pty Ltd.

- RED Digital Cinema

- Nikon Corporation

- ARRI (Arnold & Richter Cine Technik GmbH)

- Ikegami Tsushinki Co., Ltd.

- Grass Valley (Belden)

- Fujifilm Holdings Corporation

- Hitachi Kokusai Electric

- Samsung Electronics (specialized modules / professional segments)

Recent Developments

- 2024–2025 product refreshes: Major OEMs released new prosumer and professional models emphasizing 4K/6K capture, improved low-light sensors, and integrated streaming capabilities, meeting increased demand for live contribution and remote workflows.

- Partnerships for cloud workflows: Several camera manufacturers announced collaborations with cloud and AI vendors to provide on-device metadata tagging, instant ingest, and remote management suites for enterprise customers.

- Growth of rental and subscription offerings: The industry has seen an uptick in rental partnerships and subscription-based access to high-end camera kits, helping smaller creators and SMBs access professional gear without large upfront CapEx.