Broadcasting & Cable TV Market Size

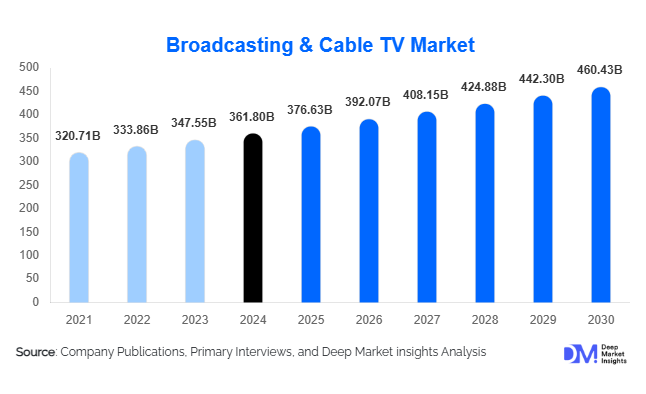

According to Deep Market Insights, the global broadcasting & cable TV market size was valued at USD 361.8 billion in 2024 and is projected to grow from USD 376.63 billion in 2025 to reach USD 460.43 billion by 2030, expanding at a CAGR of 4.1% during the forecast period (2025–2030). Growth is driven by rising broadband infrastructure, technological convergence between broadcasting and digital IP delivery, and increasing demand for live sports, news, and regional entertainment content across emerging markets.

Key Market Insights

- Satellite TV continues to lead the broadcasting technology segment, accounting for more than 42 % of the global market share in 2024, driven by wide geographic reach and established DTH subscriber bases.

- Advertising remains the primary revenue channel, contributing around 75 % of total revenues in 2024 as television continues to be a dominant medium for brand campaigns and live event coverage.

- North America dominates the global market with approximately 42 % share in 2024, supported by advanced infrastructure and high ARPU levels.

- Asia-Pacific is the fastest-growing region, expanding at a 6-7 % CAGR on the back of rising pay-TV penetration and broadband rollout in China and India.

- Technological modernization and hybrid delivery models (broadcast + IPTV + OTT integration) are reshaping industry competitiveness.

- Digital transition programs and government investments in DTT and broadband are enhancing accessibility in developing regions.

Latest Market Trends

Hybrid Broadcast-Broadband Delivery Gaining Momentum

Global operators are transitioning from traditional cable and satellite networks to hybrid models that combine broadcast efficiency with broadband interactivity. IPTV and streaming-integrated platforms now offer on-demand libraries, multi-screen access, and interactive advertising capabilities. The hybrid trend is accelerating as telecom operators bundle TV with broadband and voice services, creating new value propositions and recurring revenue opportunities. This evolution is also enabling personalized content recommendations and dynamic ad insertion, bridging the gap between linear broadcasting and digital streaming experiences.

Localized Content and Regional Channel Expansion

Broadcasters are increasingly investing in localized programming to capture regional audiences and enhance engagement. In emerging markets such as India, Indonesia, and Nigeria, vernacular-language channels and region-specific news or entertainment content have become major growth drivers. Localized content strategies not only boost subscription uptake but also attract regional advertisers. This trend is expected to strengthen as cable and satellite providers collaborate with domestic production houses to expand channel portfolios and integrate local OTT offerings.

Broadcasting & Cable TV Market Drivers

Broadband Infrastructure and IP Delivery Expansion

Rapid improvements in global broadband connectivity are enabling more efficient IPTV and hybrid service delivery. Fiber-to-home penetration and 5G rollout are supporting seamless HD and 4K broadcasting. Telecom and cable operators are leveraging this connectivity to deliver bundled TV services, which is a major growth driver across both developed and developing markets.

Growing Demand for Live and Premium Content

Live sports, global events, and breaking news remain the strongest revenue generators for broadcast networks. Despite OTT competition, television still commands high viewership for real-time content. Premium broadcasting rights for sports leagues and entertainment events continue to attract advertisers and subscribers, sustaining profitability for major players.

Digital Transition in Emerging Economies

Analog-to-digital migration programs, particularly across Asia, Latin America, and Africa, are expanding market access. Governments are actively supporting digital terrestrial TV (DTT) and satellite broadcasting to reach rural populations, driving new subscriber growth and modernization investments.

Market Restraints

Cord-Cutting and OTT Competition

The proliferation of streaming services has accelerated cord-cutting, particularly in mature markets such as the U.S. and Western Europe. Consumers seeking flexible, on-demand content are reducing dependence on linear TV subscriptions, which has slowed growth in traditional cable and satellite revenues.

High Operational and Content Acquisition Costs

Broadcasting infrastructure requires heavy capital expenditure for network upgrades, while securing exclusive content rights—especially for sports and entertainment—entails high licensing costs. These factors compress profit margins, particularly for mid-tier and regional operators competing with global OTT platforms.

Broadcasting & Cable TV Market Opportunities

Expansion into Emerging Markets

Rising incomes, urbanization, and broadband penetration in Asia-Pacific, Latin America, and Africa present significant opportunities. Localized channel line-ups, affordable subscription tiers, and hybrid DTT/IPTV services can unlock millions of new households. Countries such as India and Indonesia, with digital migration policies, are particularly attractive for network expansion.

Technological Convergence and Data-Driven Advertising

Integration of AI-based analytics and targeted advertising is transforming the value chain. Advanced viewer data enables personalized ad placements and dynamic pricing, boosting advertising ROI. Operators investing in data-driven ad tech platforms can offset declining traditional ad revenues and attract new advertisers seeking measurable results.

Premium Live Content and Event Broadcasting

Securing rights for global sports leagues, entertainment awards, and cultural events continues to offer lucrative opportunities. As streaming and traditional broadcasting converge, partnerships for co-distribution and simulcasting of major live events can significantly enhance viewership and revenue.

Technology & Platform Insights

Satellite TV remains the largest technology segment, accounting for about 42 % of total revenue in 2024. Its widespread coverage and reliability in regions lacking fiber infrastructure ensure strong subscriber retention. However, IPTV is the fastest-growing sub-segment, expanding at over 6 % CAGR due to telecom-driven bundled offerings and migration toward on-demand content ecosystems.

Revenue Channel Insights

Advertising revenue dominates the market with nearly a 75 % share in 2024. Television continues to be a high-impact medium for advertisers, especially during live sports and national broadcasts. Subscription-based revenues remain stable in developed markets but are gaining traction in emerging regions through affordable DTH and cable packages.

End-Use Insights

The residential household segment accounts for the majority of demand, driven by bundled broadband-TV packages and regional language channels. The commercial segment, including hotels, public venues, and hospitality chains, is expanding through IPTV installations and customized content delivery. Export-driven demand for syndicated programming and global sports broadcasts is also contributing to revenue diversification.

| By Technology | By Revenue Model | By Content Type | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America commands around 42 % of global market revenue in 2024, led by the United States. The region’s high ARPU, strong advertiser base, and mature cable/satellite infrastructure underpin its dominance. However, cord-cutting is moderating growth, compelling operators to integrate streaming and IPTV services.

Europe

Europe holds approximately a 20 – 25 % share, with the U.K., Germany, and France leading. Transition to IPTV and consolidation among broadcasters are key trends. Despite stable demand, the region faces margin pressure from streaming alternatives and stricter regulatory frameworks for content and data privacy.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for roughly a 25 % share in 2024. India alone represents 6 % of the global market (USD 22 billion). Expanding broadband access, rising middle-class populations, and multilingual content strategies drive strong growth, particularly in India, China, and Southeast Asia.

Latin America

Representing about 8 % of the global market, Latin America’s growth is driven by pay-TV uptake in Brazil, Mexico, and Argentina. Operators are localizing content and partnering with telecoms to improve accessibility and affordability.

Middle East & Africa

MEA contributes roughly 7 % of global revenues but is expected to post above-average growth through 2030. Government-supported digital TV initiatives and rising urbanization in countries like Saudi Arabia, the UAE, and South Africa are fostering rapid expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Broadcasting & Cable TV Market

- Comcast Corporation

- Charter Communications Inc.

- The Walt Disney Company

- AT&T Inc.

- Liberty Global plc

- Sky Group Limited

- Bell Canada Enterprises (BCE)

- Rogers Communications Inc.

- Foxtel Group (Australia)

- Canal+ Group (France)

- BT Group plc

- Vodafone Group plc

- Dish Network Corporation

- Altice USA Inc.

- Cox Communications Inc.

Recent Developments

- In June 2025, Comcast announced a multi-billion-dollar upgrade program to expand its hybrid fiber-coax network and roll out next-generation IPTV services across the U.S.

- In May 2025, Liberty Global launched its pan-European streaming platform, integrating linear TV, VOD, and cloud DVR services under a single subscription model.

- In April 2025, India’s Ministry of Information & Broadcasting approved new incentives for local set-top box manufacturing under the “Make in India” initiative to support the country’s cable TV infrastructure expansion.