Bioactive Ingredients Market Size

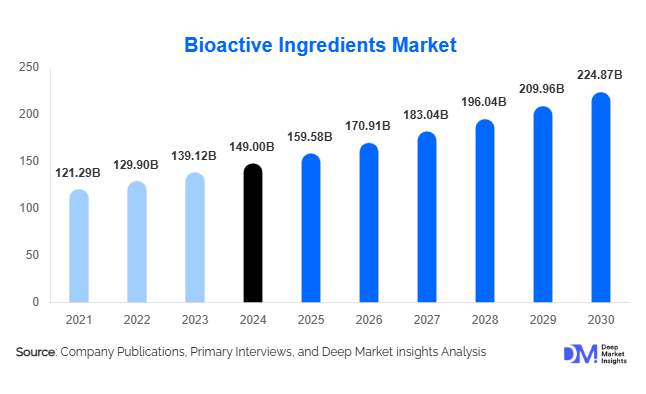

According to Deep Market Insights, the global bioactive ingredients market size was valued at USD 149 billion in 2024 and is projected to grow from USD 159.58 billion in 2025 to reach USD 224.87 billion by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). Market growth is driven by increasing consumer demand for preventive healthcare, rapid expansion of functional foods and nutraceuticals, and technological advancements in extraction methods that improve ingredient purity and bioavailability.

Key Market Insights

- Plant-based bioactive ingredients dominate the market, representing nearly 58% of the global share due to strong clean-label and natural product preferences.

- Dietary supplements remain the largest application segment, accounting for over 36% of total demand as consumers increasingly adopt daily wellness routines.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class health awareness, expanding nutraceutical penetration, and strong government support for functional food industries.

- Green and sustainable extraction technologies, including enzyme-assisted and supercritical CO₂ methods, are reshaping manufacturing strategies.

- Personalized nutrition and microbiome-targeted products are emerging as high-impact commercial opportunities.

- R&D investments are accelerating, particularly in fermentation-derived bioactives, microencapsulation, and advanced delivery systems that enhance bioavailability.

What are the latest trends in the bioactive ingredients market?

Personalized & Precision Nutrition on the Rise

Bioactive ingredient manufacturers are increasingly integrating with personalized nutrition platforms and health-tech ecosystems. Companies are formulating targeted blends based on genetic markers, gut microbiome analysis, and lifestyle profiling. Precision-oriented supplements containing probiotics, peptides, polyphenols, and specialized lipids are gaining traction as consumers seek customized health solutions. Wearables, biomarker apps, and AI-driven diet planning tools are accelerating this trend. Brands offering tailored nutrient packs and subscription-based formulations are enhancing consumer engagement and driving premium product adoption.

Expansion of Sustainable & Green Extraction Technologies

The market is witnessing rapid adoption of green extraction methods such as supercritical CO₂, ultrasound-assisted extraction, and subcritical water processing. These techniques reduce solvent usage, improve yield, and lower environmental impact. Manufacturers are investing heavily in energy-efficient processing lines to meet clean-label and sustainability demands from consumers and regulatory bodies. Green extraction is particularly influential in plant polyphenols, carotenoids, and marine bioactive categories. This shift is enabling companies to differentiate themselves with eco-certified and clean-label product lines.

What are the key drivers in the bioactive ingredients market?

Growing Health Consciousness and Preventive Healthcare Demand

Consumers worldwide are prioritizing immunity, metabolic health, gut health, and long-term wellness. This shift is fueling demand for high-value bioactives such as omega-3 fatty acids, plant antioxidants, probiotics, and dietary fibers. Functional foods infused with bioactive compounds, ranging from fortified beverages to protein bars and dairy alternatives, are becoming mainstream. Governments and healthcare institutions are also promoting nutrition-based disease prevention, further accelerating adoption.

Technological Innovations Improving Bioavailability

Advances in nano-encapsulation, controlled-release formulations, and fermentation-based production are significantly enhancing the efficacy of bioactive ingredients. Improved stability and absorption rates are enabling broader integration into food, beverages, and supplements. These innovations reduce required dosage levels, extend shelf life, and open opportunities for new product formats, including gummies, effervescent tablets, ready-to-drink beverages, and functional shots.

What are the restraints for the global market?

Regulatory Complexity and Limited Health-Claim Approvals

Stringent and inconsistent regulatory guidelines across regions, especially in the U.S., Europe, and Asia, pose challenges for companies attempting to commercialize novel ingredients. Health-claim validation requires extensive clinical research, increasing time-to-market and compliance costs. Regional differences in acceptable ingredient lists and purity standards further complicate cross-border expansion for manufacturers.

High Production Costs and Raw Material Instability

The extraction of high-purity bioactives can be cost-intensive due to reliance on specialized equipment, organic solvents, and seasonal or geographically limited raw materials. Marine-derived and rare plant-sourced ingredients are especially prone to supply fluctuations. These challenges result in volatile pricing, limit scalability for small manufacturers, and constrain competitive pricing in the end-product market.

What are the key opportunities in the bioactive ingredients industry?

Personalized Nutrition & Microbiome-Focused Products

The shift toward individualized health optimization creates significant opportunities for new entrants and established players alike. Probiotic and prebiotic innovations, gut-focused botanical extracts, and stress-modulating adaptogens align well with microbiome science and precision nutrition frameworks. Subscription-based supplement packs and customized food products are increasing monetization potential across wellness industries.

Sustainable Sourcing and Circular Bioeconomy Models

There is substantial opportunity in sustainable sourcing, such as algae-based omega-3s, upcycled plant waste extracts, and fermentation-derived bioactives. Circular bioeconomy initiatives that convert agricultural byproducts into high-value functional ingredients are gaining industry traction. Companies that offer transparent traceability, carbon-neutral manufacturing, and eco-certified ingredients can unlock premium price segments and strengthen long-term customer loyalty.

Product Type Insights

Dietary fibers and specialty carbohydrates represent the largest product category, accounting for nearly a quarter of the global market due to widespread use in digestive health products and functional foods. Probiotics and prebiotics continue experiencing strong momentum, supported by rising microbiome research and expanding consumer awareness. Plant-derived antioxidants, polyphenols, and carotenoids are increasingly used in both supplements and beauty-from-within formulations, while omega-3 fatty acids remain essential in cardiovascular and cognitive health products. Amino acids and peptides are also gaining relevance in sports nutrition and therapeutic applications.

Application Insights

The dietary supplements segment leads global consumption, driven by daily vitamin-mineral intake trends, gut-health product adoption, and immune-support demand. Functional foods and beverages form the second-largest segment, with rapid innovation in fortified dairy alternatives, energy drinks, and nutritionally enriched snacks. Pharmaceuticals utilize bioactive ingredients for therapeutic benefits, particularly in anti-inflammatory and cardiovascular formulations. Cosmetics and personal care are integrating plant-based bioactives for anti-aging, skin repair, and UV-protection applications. Animal nutrition is an emerging segment, increasingly incorporating probiotics, peptides, and omega-3s into feed formulations to enhance animal health and productivity.

Distribution Channel Insights

Online platforms dominate distribution due to rising e-commerce penetration, subscription-driven supplement models, and increasing consumer preference for direct-to-consumer brands. Specialty stores and pharmacies maintain strong relevance, particularly for premium nutraceuticals and clinical-grade products. Supermarkets and hypermarkets are expanding their functional food and wellness aisles, making bioactive-enriched products more accessible to mainstream consumers. B2B distribution channels, supplying ingredients to food, beverage, and cosmetics manufacturers, account for a significant share of global volumes.

End-Use (Consumer/Buyer) Insights

Health-conscious adults aged 31–50 form the largest consumer segment, prioritizing preventive health, fitness, and holistic wellness. Young adults (18–30) are major buyers of sports nutrition, cognitive enhancers, and beauty-from-within supplements. Older adults (50+) drive demand for joint health, cardiovascular, and bone-support bioactives. Family purchasers increasingly buy fortified everyday foods, probiotics, and children’s nutrition products, contributing to overall market expansion.

| By Ingredient Type | By Application | By Distribution Channel | By Source |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains a leading market due to high supplement adoption rates, strong functional food innovation, and advanced R&D infrastructure. The U.S. dominates regional demand, supported by large nutraceutical brands and a highly health-aware population. Regulatory clarity through GRAS approvals continues to shape ingredient portfolios.

Europe

Europe accounted for over one-third of the global market in 2024, with robust demand from Germany, the U.K., France, and Italy. EU regulations promote standardized ingredient quality and safety, driving consumer confidence. The region is a leader in sustainable sourcing, clean-label food products, and plant-based bioactive innovation.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes, expanding middle-class demographics, and rapid supplement adoption in China and India. Japan and South Korea remain mature markets for functional foods, while Southeast Asia shows increasing interest in immunity, digestive health, and beauty-from-within products. Government initiatives promoting nutraceutical production are enhancing domestic manufacturing capacities.

Latin America

Latin America is experiencing steady growth, with Brazil and Mexico leading regional demand. Increased health awareness, urban lifestyle shifts, and the growth of local nutraceutical brands are driving product uptake. Plant-based traditional ingredients are gaining renewed commercial interest for export-oriented bioactive production.

Middle East & Africa

The region is gradually expanding, led by the UAE, Saudi Arabia, and South Africa. Growing health consciousness, rising demand for fortified foods, and expansion of premium nutrition outlets are shaping market growth. Africa’s biodiversity offers significant potential for locally sourced botanical extracts.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bioactive Ingredients Market

- Ajinomoto Co.

- BASF SE

- Archer Daniels Midland (ADM)

- Cargill Incorporated

- Roquette Frères

- Sabinsa Corporation

- Arla Foods Ingredients

- Ingredion Incorporated

- Mazza Innovation Ltd.

- FMC Corporation

Recent Developments

- In March 2025, BASF SE expanded its plant-based bioactive production facility to enhance supply for nutraceutical and personal care applications.

- In January 2025, Sabinsa launched a new clinically validated prebiotic ingredient designed to support gut microbiome diversity.

- In November 2024, ADM introduced a fermentation-based omega-3 ingredient aimed at replacing traditional fish-derived sources with a sustainable alternative.