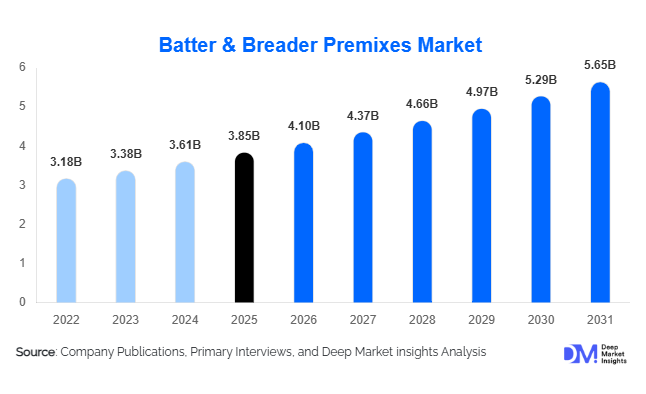

Batter & Breader Premixes Market Size

According to Deep Market Insights, the global batter & breader premixes market size was valued at USD 3.85 billion in 2025 and is projected to grow from USD 4.10 billion in 2026 to reach USD 5.65 billion by 2031, expanding at a CAGR of 6.6% during the forecast period (2026–2031). Market growth is driven by the rapid expansion of the global processed food industry, increasing consumption of coated and fried foods, and rising demand from quick service restaurants (QSRs) and industrial food processors for consistent, high-performance coating solutions.

Key Market Insights

- Breader premixes dominate global demand, driven by strong preference for crunchy textures and visual appeal in poultry and seafood products.

- Poultry-based applications account for the largest share, supported by global growth in fried chicken, nuggets, and value-added poultry products.

- Industrial food processors remain the largest end-use segment, benefiting from operational efficiency and standardized quality offered by premix solutions.

- Asia-Pacific is the fastest-growing region, fueled by food processing expansion in China, India, Japan, and Southeast Asia.

- Clean-label, gluten-free, and alternative grain formulations are gaining traction, particularly in North America and Europe.

- Technological innovation in extrusion and adhesion systems is enabling premium and customized premix solutions.

What are the latest trends in the batter & breader premixes market?

Rising Demand for Customized and Functional Premixes

Food manufacturers and QSR chains are increasingly adopting customized batter and breader premixes tailored to specific applications, equipment, and regional taste profiles. Functional attributes such as improved adhesion, reduced oil absorption, enhanced crispiness, and freeze-thaw stability are becoming standard requirements. This trend is particularly prominent among large poultry and seafood processors seeking product differentiation and consistent sensory outcomes across multiple geographies.

Growth of Clean-Label and Alternative Ingredient Solutions

Clean-label reformulation is reshaping the market, with growing demand for premixes free from artificial additives, phosphates, and allergens. Rice-based, corn-based, and multigrain breaders are increasingly replacing traditional wheat-only formulations, while gluten-free premixes are witnessing strong growth in retail and foodservice channels. Manufacturers are also incorporating natural seasonings and functional fibers to enhance nutritional profiles without compromising performance.

What are the key drivers in the batter & breader premixes market?

Expansion of the Global QSR and Frozen Food Industry

The rapid growth of QSR chains and frozen food consumption remains the primary driver of market expansion. Coated products such as fried chicken, fish fillets, and vegetable snacks form core menu offerings for global QSR brands. Batter and breader premixes enable consistent quality, faster preparation, and scalable operations, making them indispensable for high-volume foodservice applications.

Increasing Demand for Convenience and Ready-to-Cook Foods

Urbanization and changing consumer lifestyles are driving demand for ready-to-cook and ready-to-eat food products. Industrial food processors increasingly rely on premix systems to streamline production, reduce labor dependency, and ensure uniform taste and texture. This trend is particularly strong in Asia-Pacific and Latin America, where consumption of frozen and chilled foods is accelerating.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuating prices of key raw materials such as wheat, corn, rice, and specialty grains pose a challenge for premix manufacturers. Volatile agricultural commodity markets directly impact production costs and margin stability, often leading to frequent price adjustments and contract renegotiations with customers.

Regulatory and Labeling Compliance Complexity

Stringent food safety regulations, allergen labeling requirements, and clean-label standards vary significantly across regions. Compliance with these evolving regulations increases formulation complexity and R&D costs, particularly for manufacturers operating across multiple international markets.

What are the key opportunities in the batter & breader premixes industry?

Growth of Plant-Based and Alternative Protein Applications

The global shift toward plant-based diets is creating new opportunities for batter and breader premix suppliers. Plant-based meat and seafood analogs require specialized coating systems to replicate traditional crunch and mouthfeel. Customized premixes for soy, pea, mushroom, and mycoprotein-based products are emerging as a high-growth, high-margin segment.

Regional Flavor Localization and Premiumization

Rising demand for region-specific flavors presents opportunities for localized premix development. Asian spicy coatings, Middle Eastern herb blends, and Latin American seasoned breaders are gaining popularity. Premiumization through artisanal crumb structures and specialty coatings is further supporting revenue growth, particularly in developed markets.

Product Type Insights

Breader premixes dominate the global market, accounting for approximately 58% of total revenue in 2025. Their leadership is primarily driven by their extensive use in poultry and seafood applications, where achieving a crispy texture, uniform coating, and appealing golden appearance is critical. Breader premixes also offer superior moisture retention and frying stability, making them the preferred choice for high-volume industrial processors and quick-service restaurants (QSRs).

Batter premixes account for the remaining market share and continue to witness steady demand due to their role in improving adhesion and coating pickup. Tempura-style batters, beer batters, and customized adhesion systems are increasingly adopted in seafood, vegetable, and snack applications. Additionally, specialty breaders such as panko, extruded crumbs, and seasoned coatings are gaining traction in premium, artisanal, and foodservice segments, driven by rising consumer demand for differentiated textures and gourmet-style fried foods.

Application Insights

Poultry remains the leading application segment, capturing nearly 41% of the global market share in 2025. The dominance of this segment is supported by strong global consumption of fried, baked, and ready-to-cook chicken products across QSRs, foodservice, and retail channels. Consistent demand for nuggets, tenders, wings, and fillets continues to drive high-volume usage of batter and breader premixes.

Seafood represents the second-largest application segment, driven by increasing consumption of coated fish fillets, shrimp, and seafood snacks, particularly in North America, Europe, and Asia-Pacific. Meanwhile, meat-based applications, vegetable coatings, plant-based proteins, and cheese snacks are emerging as fast-growing segments. Growth in these categories is supported by innovation in frozen foods, clean-label formulations, and the rising popularity of vegetarian and flexitarian diets.

End-Use Industry Insights

Industrial food processors account for approximately 52% of global demand in 2025, reflecting their large-scale production capabilities, standardized formulations, and long-term supply contracts with premix manufacturers. These players benefit from operational efficiency, consistent quality requirements, and increasing exports of frozen and processed foods.

Quick-service restaurants (QSRs) represent a significant end-use segment, driven by rapid global outlet expansion, menu innovation, and growing consumer preference for fried and coated food offerings. Retail consumer packs are witnessing steady growth as well, supported by rising home-cooking trends, increased availability of branded premixes, and growing penetration of modern retail and e-commerce platforms.

Distribution Channel Insights

Direct B2B sales dominate the distribution landscape, accounting for nearly 49% of total market revenue. This channel benefits from long-term relationships between premix manufacturers and industrial food processors, ensuring consistent demand volumes and customized product development.

Foodservice distributors and wholesalers play a critical role in supplying QSRs, hotels, and restaurants with ready-to-use batter and breader systems. Meanwhile, e-commerce platforms and modern retail channels are gaining importance, particularly for consumer-packaged premixes, driven by convenience, wider product visibility, and increasing online grocery adoption.

| By Product Type | By Ingredient Composition | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global market in 2025, with the United States representing the largest contributor. Regional growth is driven by high consumption of fried and frozen foods, strong penetration of QSR chains, and continuous innovation in coating systems. Increasing demand for clean-label, gluten-free, and low-oil-absorption premixes further supports market expansion across the region.

Europe

Europe holds around 22% of global demand, led by Germany, the U.K., and France. The region is characterized by a strong preference for clean-label, non-GMO, and allergen-free formulations. Rising demand for premium coatings, alongside increasing adoption of plant-based and seafood products, is fueling market growth. Regulatory emphasis on food transparency and quality standards also drives innovation in batter and breader premixes.

Asia-Pacific

Asia-Pacific represents nearly 29% of the global market and is the fastest-growing region, expanding at over 8% CAGR. Growth is supported by rapid urbanization, rising disposable incomes, and the expansion of the food processing and QSR industries. China, India, Japan, and Thailand are key demand centers, driven by increasing consumption of convenience foods, Western-style fried products, and expanding cold-chain infrastructure.

Latin America

Latin America is witnessing steady growth, led by Brazil and Mexico. The region’s expansion is driven by rising consumption of processed poultry and seafood products, increasing investments in food processing facilities, and growing presence of international QSR brands. Improving retail infrastructure and urbanization further contribute to market development.

Middle East & Africa

The Middle East & Africa region is experiencing moderate but consistent growth, supported by rising demand in Saudi Arabia, the UAE, and South Africa. Key growth drivers include rapid QSR expansion, increasing tourism, and growing investments in food manufacturing and cold storage infrastructure. Changing dietary patterns and rising demand for convenience foods are further supporting regional market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Batter & Breader Premixes Market

- Kerry Group

- Ingredion Incorporated

- ADM

- Tate & Lyle

- Cargill

- McCormick & Company

- Newly Weds Foods

- Blendtek Ingredients

- Bowman Ingredients

- Bunge

- PGP International

- House-Autry Mills

- Associated British Foods

- AGRANA Group

- Limagrain Ingredients