Baobab Powder Market Size

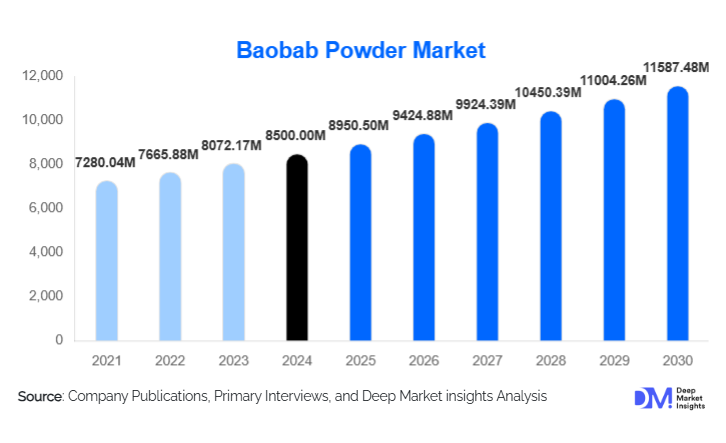

According to Deep Market Insights, the global baobab powder market size was valued at USD 8,500 million in 2024 and is projected to grow from USD 8,950.50 million in 2025 to reach USD 11,587.48 million by 2030, expanding at a CAGR of 5.3% during the forecast period (2025–2030). The market growth is primarily driven by rising global demand for plant-based superfoods, increased awareness of functional ingredients, and expanding applications across food, beverage, nutraceuticals, and cosmetic sectors.

Key Market Insights

- Baobab powder is gaining popularity as a functional superfood, owing to its high vitamin C content, fiber, and antioxidant properties, making it suitable for beverages, supplements, and clean-label foods.

- Wild-harvested and ethically sourced baobab is emerging as a premium segment, with fair-trade and organic certifications driving higher price points and consumer preference, particularly in North America and Europe.

- North America dominates the global market, with the U.S. leading demand due to high health-consciousness and strong functional beverage and supplement industries.

- Europe is a key growth region, driven by demand for clean-label, plant-based, and sustainable ingredients, alongside regulatory frameworks supporting functional foods.

- Asia-Pacific is the fastest-growing region, led by rising middle-class health awareness in India and China, boosting the adoption of baobab-enriched products.

- Technological adoption in processing and traceability, including spray-drying, freeze-drying, and blockchain-based supply chain monitoring, is enhancing nutrient retention and sourcing transparency.

What are the latest trends in the baobab powder market?

Functional Food and Beverage Innovation

Manufacturers are increasingly incorporating baobab powder into smoothies, energy drinks, immunity boosters, and functional snacks to meet the growing demand for nutrient-rich, clean-label products. Formulators are leveraging baobab’s natural vitamin C and prebiotic fiber to create beverages that appeal to health-conscious consumers. Innovative product combinations with other superfoods are being introduced to capture premium market segments, particularly in North America and Europe. Sports nutrition and hydration products are emerging as key applications due to baobab’s natural electrolytes and digestive benefits.

Sustainable and Ethical Sourcing

There is a growing emphasis on wild-harvested, organic, and fair-trade baobab powder. Companies are investing in cooperative-based sourcing models that support local African communities and ensure consistent, high-quality supply. Ethical sourcing not only strengthens brand credibility but also allows manufacturers to command premium prices in export markets. Blockchain and digital traceability solutions are being adopted to ensure transparency from harvest to final product.

What are the key drivers in the baobab powder market?

Rising Health and Wellness Consciousness

Global consumers are increasingly seeking superfoods with scientifically backed health benefits. Baobab powder, with its high antioxidant content, vitamin C, and fiber, has become a preferred ingredient in dietary supplements, functional beverages, and fortified foods. This health-conscious trend is expected to continue, driving long-term growth.

Clean-Label and Plant-Based Trends

As plant-based diets and clean-label products gain popularity, baobab powder has found broad applications due to its natural composition, minimal processing, and functional properties. It aligns with consumer demand for sustainable, nutrient-rich alternatives to synthetic additives, reinforcing its adoption across multiple food and beverage categories.

What are the restraints for the global market?

Supply Constraints and Seasonality

Baobab fruit is primarily wild-harvested in Africa, making supply subject to seasonal variations, weather conditions, and labor availability. These factors can lead to inconsistent supply, price volatility, and potential challenges in scaling production to meet growing global demand.

Regulatory Hurdles and Consumer Awareness

Regulatory approval for novel food ingredients varies by region, with complex compliance requirements in Europe and North America. Additionally, consumer awareness of baobab powder remains limited in several emerging markets, which may slow penetration and restrict short-term market growth.

What are the key opportunities in the baobab powder industry?

Expansion in Functional Food and Beverage Applications

There is significant potential for baobab powder in sports nutrition, functional beverages, dietary supplements, and fortified snack products. Companies that innovate in product development, flavor pairing, and formulation can capture premium segments in North America, Europe, and Asia-Pacific. Co-branding opportunities with other superfoods and botanical ingredients further enhance growth potential.

Ethical Sourcing and Sustainability Premiums

Growing consumer demand for sustainable and ethically sourced ingredients presents an opportunity for companies to differentiate their products. Investments in community-based harvesting, fair-trade certification, and organic labeling can create market differentiation and command higher margins. Export-focused players can leverage sustainability narratives to access premium markets in developed regions.

Product Type Insights

Food-grade baobab powder dominates the market, representing approximately 65–68% of global revenue in 2024. This segment leads due to its versatility and adoption across beverages, supplements, bakery, and confectionery products. Cosmetic and nutraceutical-grade powders are growing, particularly in Europe and North America, but remain smaller in overall revenue share. Organic and wild-harvested variants are commanding premium pricing, particularly for export-oriented markets.

Application Insights

Smoothies and beverages are the largest application segment, accounting for nearly 40–45% of total market consumption. Dietary supplements are the fastest-growing segment due to rising health-consciousness and demand for prebiotic, fiber, and vitamin-rich ingredients. Bakery, confectionery, and personal care applications are expanding steadily as product developers integrate baobab powder into functional and natural formulations.

Distribution Channel Insights

Direct sales to industrial ingredient buyers account for over 50% of revenue, reflecting bulk purchases by functional food and beverage manufacturers. Retail and e-commerce channels are growing rapidly, fueled by increased consumer interest in at-home nutrition and plant-based ingredients. Distributors play a key role in emerging markets, connecting African producers with global buyers while ensuring quality and compliance.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for roughly 35–45% of the global baobab powder market. The U.S. is the largest market, supported by high health awareness, functional beverage consumption, and supplement industry growth. Demand is further driven by clean-label, sustainable, and plant-based product trends, positioning the region as a key revenue contributor.

Europe

Europe represents approximately 30–35% of global demand, led by Germany, the U.K., and France. Strong consumer preference for natural, organic, and fair-trade ingredients drives adoption. Regulatory support for functional foods and high levels of health-consciousness make Europe a significant growth market.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China and India. Increasing disposable income, rising health awareness, and the adoption of functional foods are driving demand. Market penetration is expected to expand through e-commerce and premium health and wellness brands.

Latin America

Latin America, including Brazil and Argentina, shows steady growth in both domestic and export-driven consumption. Affluent consumers are increasingly exploring functional ingredients, particularly in beverage and supplement applications.

Middle East & Africa

Africa remains the primary source of raw baobab fruit, particularly in West and Southern Africa. While local consumption is moderate, export-driven demand supports global growth. The Middle East, led by the UAE, Saudi Arabia, and Qatar, is a growing import market for premium baobab powder, fueled by health-conscious and high-income consumers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Baobab Powder Market

- Aduna Ltd.

- Baobab Foods Pty Ltd.

- Baobab Fruit Company (Senegal)

- Nexira / Afriplex

- Kuli Kuli Inc.

- EcoProducts

- Mighty Baobab

- African Baobab Alliance

- Vital Foods

- Organic Baobab Co.

- Sun Baobab Ingredients

- BioNutra

- Superfruit Ingredients Ltd.

- Earth's Own Naturals

- Plant Power Ingredients

Recent Developments

- In March 2025, Aduna Ltd. expanded its Ghanaian processing facilities to increase organic baobab powder production for export to North America and Europe.

- In February 2025, Baobab Foods Pty Ltd. launched a new line of prebiotic-functional beverages incorporating baobab powder in European and Australian markets.

- In January 2025, Nexira partnered with African cooperatives to scale fair-trade wild-harvested baobab supply, strengthening traceability and sustainability compliance.