Baby Swaddling Market Size

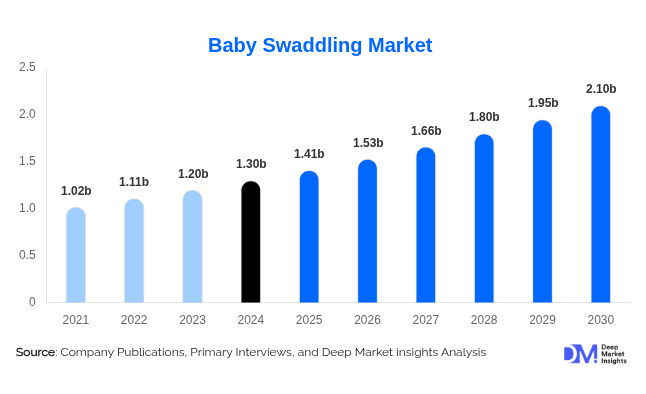

The global baby swaddling market size was valued at USD 1.3 billion in 2024 and is projected to grow from USD 1.41 billion in 2025 to USD 2.1 billion by 2030, exhibiting a CAGR of 8.4% during the forecast period (2025–2030).

The global baby swaddling market is witnessing steady growth, driven by rising awareness around infant sleep safety, increasing birth rates in developing regions, and evolving consumer expectations around comfort and design. Pediatric health authorities globally recognise swaddling as an effective method to calm infants. This endorsement has resulted in a surge in demand for ergonomically designed and secure swaddling products. Moreover, modern parents are looking for easy-to-use, sustainable, and multifunctional swaddles, leading to innovations like temperature-regulating fabrics, stretchable bamboo blends, and swaddle sacks with adjustable Velcro or zipper systems, driving market growth.

Key Market Insights

- Swaddle sacks with fasteners are set to reach USD 620 million, dominating developed markets due to safety, ergonomic design, and ease of use.

- Cotton leads as the preferred material globally, driven by breathability, hypoallergenic properties, and dominance in warm regions like India and Southeast Asia.

- Online retail is the fastest-growing channel with a projected CAGR of 10.3%, led by platforms like Amazon, FirstCry, and D2C brands.

- North America will lead the market in 2025 at USD 540 million, supported by high disposable income and awareness of safe sleep practices.

- Europe’s market will reach USD 370 million in 2025, driven by demand for organic materials and strong boutique and e-commerce networks.

Latest Market Trends

Innovation in product design

The market is evolving rapidly with design innovations to enhance comfort, safety, and usability. Modern swaddles now feature ergonomic tailoring that mimics the natural fetal position, promoting better sleep and reduced startle reflex in newborns. Brands are also integrating temperature-regulating fabrics such as bamboo-cotton blends and Outlast® technology to prevent overheating, one of the major concerns linked to infant sleep safety. Furthermore, advancements in fastenings, such as silent Velcro, two-way zippers, and adjustable wings, provide easier diaper access and reduce nighttime disturbances. Companies like Nested Bean and Halo Innovations are leading this shift by introducing sleep-tracking sensors, app integration, and safer sleep certifications.

Celebrity and influencer branding

Celebrity endorsements and influencer-led marketing campaigns have become pivotal in shaping consumer preferences in the baby swaddling market. Millennial and Gen Z parents are heavily influenced by social media platforms such as Instagram, TikTok, and YouTube. Brands strategically collaborate with parenting influencers and celebrity moms to create authentic and relatable product experiences. For instance, when high-profile personalities like Chrissy Teigen or Kylie Jenner share posts featuring specific swaddle brands, it often leads to a sharp uptick in sales and brand recognition. Companies like Aden + Anais have built strong followings through partnerships with popular mommy bloggers and healthcare professionals. This trend enhances brand loyalty, expands digital reach, and plays a crucial role in consumer decision-making in a competitive market.

Baby Swaddling Market Drivers

Increased focus on infant sleep safety

One of the most significant factors driving the baby swaddling market growth is the emphasis on infant sleep safety. Swaddling is increasingly endorsed by pediatric associations in the U.S., Canada, the UK, and Australia for its role in reducing spontaneous movements and the startle reflex in newborns, helping infants sleep more peacefully. The American Academy of Paediatrics (AAP)recommends swaddling under safe sleep guidelines, provided the infant is always on their back.

- For example, in January 2025, hospitals in South Korea and the UAE began distributing standardised swaddle kits as part of maternity discharge packages, citing improvements in infant sleep patterns and parent satisfaction.

Brands like Love To DreamandSwaddleMe have launched easy-zip swaddle pods that align with safe sleep protocols, offering ease of use for new parents.

Rising birth rates in emerging markets

Countries with rapidly growing populations, such as India, Nigeria, Indonesia, and Pakistan, are fuelling the demand for baby swaddles. According to national birth registries and UNICEF-affiliated demographic data, these regions collectively accounted for over 45 million births in 2024. This growing consumer base creates robust demand for affordable, mass-distributed infant care products. This demand is further supported by expanding retail networks and government maternity schemes. As urbanisation and income levels rise in Tier II and Tier III cities, low-cost swaddles are expected to become essential household items, boosting volume-driven market expansion.

Market Restraints

Short product lifecycle

One of the key challenges facing the baby swaddling market is the inherently limited usage period of swaddle products. Most swaddles are used only during the first 3–4 months of a newborn’s life. After this, the baby transitions to sleep sacks or regular blankets due to increased mobility and safety concerns. This short product lifecycle results in low repeat purchase rates, especially in developed countries with low birth rates or single-child families. The lack of product longevity still limits unit economics for premium manufacturers. Brands must therefore rely on continuous new customer acquisition, often through digital platforms or hospital tie-ups, to sustain sales momentum.

Rising raw material costs

The price volatility of key raw materials, especially organic cotton, muslin, and bamboo fibre, has put pressure on profit margins for baby swaddle manufacturers, particularly those marketing themselves as eco-friendly. Since early 2024, global cotton prices have risen due to climate-related disruptions in India and Texas. Meanwhile, the cost of bamboo textiles has increased due to processing restrictions in China’s Guangxi region. As a result, organic baby brands like Burt’s Bees Baby andMORI have had to hike product prices by up to 12%, risking affordability in emerging markets. This has created a widening price gap between sustainable and conventional swaddles.

Baby Swaddling Market Opportunities

Growth in online retail channels

E-commerce continues revolutionizing the baby swaddling market by providing seamless access to global and local brands. Online platforms account for nearly 45% of all swaddle sales, with websites like Amazon, Flipkart, Shopee, and niche D2C brands like SnuggleMe and Copper Pearl leading the charge. The surge in digital adoption, especially in emerging economies, has allowed even small-scale manufacturers to reach national audiences. Subscription models and influencer-driven campaigns are also fueling repeat engagement. As more parents turn to mobile-first shopping for convenience and variety, online retail offers a massive opportunity to scale product visibility, personalization, and loyalty programs.

Innovation in ergonomic product design

Modern parenting needs have catalysed a wave of innovation in swaddle product design. In 2025, brands are introducing temperature-sensitive fabrics, dual-layer zip systems, convertible arm-out options, and smart swaddles integrated with sleep monitors. These products enhance safety and ease of use while addressing parental anxiety around overheating or improper wrapping.

- For example, in February 2025, U.S.-based brand Nested Beanlaunched the Zen Sensor Swaddle, embedded with motion-sensing patches that monitor baby breathing and alert caregivers via an app if irregular patterns are detected. Similarly, Australia’s ErgoPouch introduced season-specific swaddles rated by TOG (Thermal Overall Grade), ensuring optimal temperature regulation.

These innovations are gaining traction in premium markets and hospital-grade applications, supporting a premiumization trend within the industry.

Product Type Insights

Swaddle Sacks with fasteners dominate the global baby swaddling market, especially in developed regions such as North America and Europe. This segment is expected to reach USD 620 million, fueled by its ergonomic benefits, safety assurances, and ease of use. Unlike traditional wraps, swaddle sacks reduce the risk of incorrect swaddling and suffocation hazards, making them popular among first-time parents and hospitals. Their zipper and Velcro features allow caregivers to wrap infants swiftly, enhancing sleep cycles. Brands like HALO, Nested Bean, and Love To Dream have responded with products featuring dual zipper designs, TOG-rated fabrics, and grow-with-baby functionality.

Material

Cotton remains the dominant material in the baby swaddling industry due to its breathability, softness, and affordability. Parents prefer cotton for its ability to regulate temperature, making it suitable for year-round use. Cotton-based swaddles account for the largest market share globally, particularly in warm climates like India, Southeast Asia, and the southern United States. Cotton is hypoallergenic and easy to wash, offering convenience for new parents. Its widespread availability and adaptability for traditional and modern swaddle designs allow manufacturers to cater to various income brackets. Companies like Aden + Anais and Mothercare continue to offer 100% cotton swaddle ranges with playful prints and gender-neutral themes.

Distribution Channel Insights

Online retail is the fastest-growing distribution channel in the baby swaddling market, with a projected CAGR of 10.3% from 2025 to 2030. E-commerce has revolutionised accessibility to swaddle products, enabling major brands and niche startups to tap into global audiences. Platforms like Amazon, FirstCry, Babyshop, and D2C websites like Copper Pearl and Snuggle Me have widened product availability even in Tier II and Tier III cities. The convenience of online shopping, combined with customizable product filters, bundle offers, and verified reviews, enhances consumer trust and drives repeat purchases. The growth of mobile-first markets such as India, Brazil, and Indonesia further supports digital swaddle sales.

| By Product Type | By Material | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is expected to lead the baby swaddling market in 2025, with an estimated value of USD 540 million, driven by high disposable income, robust retail infrastructure, and a culture of evidence-based parenting. The region's awareness of safe sleep practices is among the highest globally, largely due to consistent efforts by health organisations such as the American Academy of Paediatrics. Retailers like Target and BuyBuy Baby offer extensive in-store and online swaddle selections. Digital platforms have amplified the influence of parenting blogs and paediatricians, educating new parents on the benefits of swaddling. With online retail gaining momentum and innovation in smart swaddles increasing, North America will continue to be a core market.

Europe

Europe represents a mature and sustainability-driven baby swaddling product market valued at USD 370 million in 2025. Germany, the UK, France, and the Netherlands are the largest consumers. European parents increasingly opt for organic and eco-friendly materials, supported by certifications such as GOTS and OEKO-TEX. Brands like Aden + Anais and Puckababy lead this segment by offering bamboo-cotton blends and biodegradable packaging. Many European hospitals now educate new parents on safe swaddling practices as part of postnatal care. The strong network of boutique baby stores and expanding e-commerce ensures product availability across urban and semi-urban areas.

Asia-Pacific

The Asia-Pacific market, valued at USD 290 million in 2025, is the fastest-growing region, driven by a rapidly expanding middle class, rising birth rates, and increasing urbanisation. Countries like India, China, and Indonesia lead regional consumption. In India, the National Health Mission’s mother-and-child welfare schemes encourage basic newborn care education, including swaddling. Domestic players like Mee Mee and Superbottoms offer affordable options for large family sizes. Baby product awareness is spreading via parenting apps like BabyChakra and MamaNet in Japan.

Latin America

Latin America's market for baby swaddling is valued at USD 60 million, driven by rising urbanisation, expanding middle-income populations, and increasing maternal care awareness. Brazil, Argentina, and Chile represent key markets. Public healthcare initiatives, like Brazil’s "Rede Cegonha" (Stork Network), promote safe childbirth and neonatal care, where swaddling is part of recommended practices. Retail chains such as Lojas Americanas and e-commerce sites like MercadoLibre are instrumental in distributing swaddle products. With further penetration into rural markets expected through government-supported programs, Latin America presents a growth-ready market.

The Middle East & Africa

The Middle East and Africa's baby swaddling market is expanding steadily, valued at USD 40 million in 2025, supported by government-led maternal health initiatives and a growing expatriate population. Countries like the UAE, Saudi Arabia, and South Africa lead regional demand. The popularity of maternity hospitals such as Danat Al Emarat in Abu Dhabi and Netcare in South Africa ensures market exposure to premium swaddle brands. Online platforms like Mumzworld and Babyshop facilitate product accessibility, even in remote areas. In Africa, organisations like Save the Children and UNICEF distribute basic cotton swaddles as part of newborn hygiene kits, particularly in Kenya and Nigeria.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The baby swaddling market exhibits a moderately fragmented structure with global giants and niche innovators coexisting. Major players like Halo Innovations, Aden + Anais, and Love To Dream focus on retail expansion, digital partnerships, and product innovation. Their business models emphasise ergonomic designs, premium organic materials, and tech-integrated swaddles catering to millennial and Gen Z parents. Simultaneously, regional players leverage affordability and local manufacturing to address price-sensitive markets.

Halo Innovations Inc. has carved a dominant position in North America with its SmartSleep product line and strategic collaborations with hospital networks and baby wellness programs. In May 2023, Halo launched the “Halo SmartSleep” system, embedding biosensors and app connectivity, cementing its leadership in the smart swaddling category.

Love To Dream has experienced rapid market penetration with its patented winged swaddle sacks, particularly across e-commerce. The brand expanded into Southeast Asia via exclusive partnerships with Shopee and Lazada, tapping into high-growth emerging economies with a preference for convenience and ergonomic designs.

Recent Developments

- July 2024- Mama Coco’s Cocoon Swaddle was named “Wrap Product of the Year” at the 2024 Baby Innovation Awards, praised for its fastener‑free, reversible design, breathable, sustainable fabrics, and hip‑healthy positioning.

- February 2024- The Ollie World relaunched its full line, Ollie® Swaddles, Alphies® sleep sacks, bibs, and expanded into burp cloths, lovies, and limited-edition crib sheets in fresh colourways (Olive, Sunset, Maunie) with moisture-wicking fabric for infant neurodevelopment support.

Key Players in the Baby Swaddling Market

- Halo Innovations Inc.

- SwaddleMe (Summer Infant Inc.)

- Aden + Anais

- Love To Dream

- Nested Bean

- The Ollie World

- Tommee Tippee

- Akasuga

- Hudson Baby

- Ziggy Baby

- Ergobaby

- Silly Billyz