Artichoke Extract Market Size

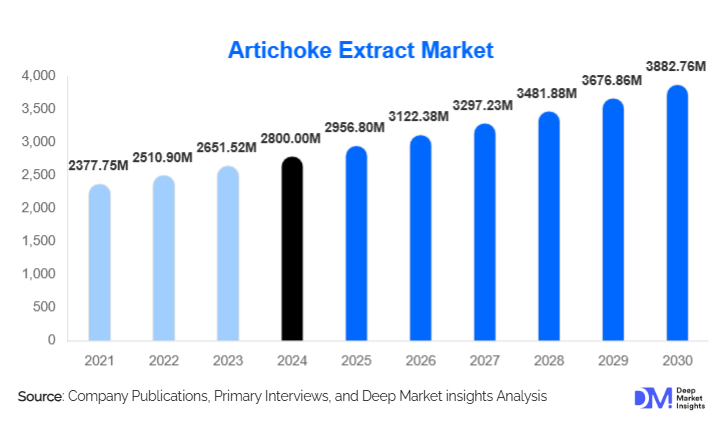

According to Deep Market Insights, the global artichoke extract market size was valued at USD 2,800 million in 2024 and is projected to grow from USD 2,956.8 million in 2025 to reach USD 3,882.76 million by 2030, expanding at a CAGR of 5.6% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for natural and plant-based ingredients in dietary supplements, functional foods, and cosmetics, increased awareness of artichoke’s therapeutic benefits, and technological advancements in extraction methods, improving bioactive yield and product quality.

Key Market Insights

- Powder forms dominate the product type segment, due to versatility in supplements, functional foods, and beverages, accounting for approximately 60% of the market in 2024.

- Dietary supplements are the leading application, leveraging artichoke extract’s liver support, cholesterol-lowering, and digestive health benefits.

- Europe remains the largest regional market, driven by strong artichoke agriculture in Italy and Spain and established nutraceutical industries.

- Asia-Pacific is the fastest-growing region, fueled by increasing health awareness, expanding middle-class wealth, and rising demand for herbal supplements in China, India, and Japan.

- Technological integration, including green extraction methods and bioavailability-enhancing techniques, is improving product quality and creating differentiation.

- Export-driven demand is rising, with Mediterranean producers supplying artichoke extract to North America, Europe, and emerging markets.

What are the latest trends in the artichoke extract market?

Clean-Label and Functional Ingredient Adoption

Consumers are increasingly seeking natural, plant-based, and clean-label ingredients in supplements, food & beverages, and cosmetics. Artichoke extract’s well-documented health benefits make it a preferred choice for nutraceutical manufacturers and functional food producers. The trend is reinforced by increasing consumer interest in liver health, digestion support, and cholesterol management.

Green and Advanced Extraction Technologies

Manufacturers are adopting sustainable extraction technologies such as supercritical CO₂, ultrasonic, and enzyme-assisted methods. These innovations enhance bioactive concentration, reduce solvent use, and improve overall product quality. Sustainable extraction also allows companies to align with eco-conscious consumer demands while maintaining cost efficiency.

Integration in Cosmetics and Personal Care

Artichoke extract is increasingly used in cosmetic and personal care products for its antioxidant and anti-aging properties. Skincare formulations incorporating artichoke extract are gaining popularity, reflecting a convergence between the nutraceutical and cosmetic industries, which is driving market diversification and premiumization.

What are the key drivers in the artichoke extract market?

Rising Health and Wellness Awareness

Global consumers are showing heightened interest in preventive health and wellness, favoring natural ingredients with scientific backing. Artichoke extract is leveraged in supplements and functional foods for liver support, cholesterol management, and digestive health, making awareness of its benefits a key growth driver.

Expansion of Nutraceutical and Functional Food Industries

The growing global nutraceutical and functional food industries are increasing demand for high-quality botanical extracts. Artichoke extract is incorporated into capsules, tablets, functional powders, and beverages, boosting its adoption across multiple product lines.

Technological Advancements in Extraction and Formulation

Advancements in extraction methods and formulation technologies, such as nanoencapsulation and green extraction, are enhancing bioactive content, stability, and bioavailability. This trend enables manufacturers to create differentiated products with higher efficacy, catering to premium and health-conscious consumers.

What are the restraints for the global market?

Raw Material Supply Volatility

Artichoke cultivation is concentrated in Mediterranean regions, making the market vulnerable to climate variations, agricultural risks, and geopolitical factors. Fluctuations in raw material availability and cost may limit production and affect pricing stability for manufacturers.

Regulatory and Clinical Validation Challenges

Stringent regulatory requirements for health claims and herbal supplements necessitate extensive clinical validation. Smaller companies may face challenges in substantiating claims for liver support or cholesterol management, slowing market expansion in regulated regions.

What are the key opportunities in the artichoke extract industry?

Personalized and Functional Formulations

Integration of artichoke extract into personalized nutrition and combination supplements presents opportunities for differentiation. Pairing it with other botanicals or functional ingredients allows manufacturers to target specific health concerns, appealing to growing consumer demand for tailored wellness products.

Sustainable Sourcing and Green Technology Adoption

Investing in environmentally friendly cultivation and extraction methods can enhance brand value and meet consumer preferences for sustainable products. Producers leveraging organic farming, certified sourcing, and green extraction technologies can achieve premium pricing and expanded market share.

Export Expansion into Emerging Markets

Growing middle-class populations in the Asia-Pacific and Latin America, coupled with rising health awareness, provide export-driven growth opportunities. European producers are well-positioned to capitalize on these markets, particularly for dietary supplements and functional foods.

Product Type Insights

Powdered artichoke extract continues to dominate the global market due to its versatility and ease of incorporation into dietary supplements, functional foods, and beverages. Its stable shelf life and high solubility make it the preferred choice for manufacturers targeting large-scale nutraceutical and food applications. Liquid extracts are gaining traction, particularly in cosmetics, personal care, and specialty formulations, owing to their higher concentration of bioactive compounds and flexibility in topical and liquid product applications. Organic powders are increasingly sought after in premium health-focused products, reflecting rising consumer preference for natural, clean-label, and non-GMO ingredients. The growing emphasis on sustainable sourcing and eco-friendly formulations is further boosting the adoption of organic and high-quality powdered artichoke extracts.

Application Insights

Dietary supplements represent the largest and fastest-adopting application segment for artichoke extract, driven primarily by its established efficacy in supporting liver health, managing cholesterol levels, and improving digestive function. Food & beverages are emerging applications, with functional drinks, herbal teas, fortified snacks, and sauces increasingly incorporating artichoke extract as a natural health-promoting ingredient. Cosmetics and personal care applications are expanding due to the extract’s antioxidant, anti-aging, and skin-protective properties, which align with consumer demand for naturally derived skincare solutions. Pharmaceuticals continue to explore niche applications in herbal medicines for liver and digestive support, which may open new avenues for clinical validation and prescription-level products in the future.

Distribution Channel Insights

Indirect sales channels, including retail chains, health stores, and online marketplaces, currently dominate the distribution landscape, offering wide consumer accessibility and convenience. E-commerce platforms have become increasingly critical for global reach, enabling direct-to-consumer engagement, subscription models, and personalized product recommendations. Direct sales to manufacturers also play a significant role in the B2B space, particularly for large-scale nutraceutical, functional food, and cosmetic manufacturers who rely on bulk procurement of high-quality artichoke extract. The growing digital penetration, combined with rising consumer preference for convenient purchasing options, is strengthening online channels as a key driver of market growth.

End-Use Insights

Dietary supplements remain the primary end-use driver, accounting for a significant share of the market due to sustained consumer demand for liver, digestive, and cholesterol health support. Functional foods and beverages are rapidly emerging segments, with fortified teas, functional drinks, and snack formulations incorporating artichoke extract to cater to health-conscious consumers. Cosmetics and personal care applications are witnessing the fastest growth, driven by increasing consumer awareness of antioxidant and anti-aging benefits, premium product positioning, and a shift toward naturally derived skincare ingredients. Export-driven demand is notable in North America, Europe, and the Asia-Pacific region, where high-value nutraceutical and functional food manufacturers are sourcing artichoke extract from Mediterranean producers to meet rising consumer demand.

| By Product Type | By Application | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is a major market for artichoke extract, particularly in the U.S., where dietary supplements dominate consumption. Growth in this region is driven by rising health awareness, an expanding nutraceutical industry, and the growing prevalence of lifestyle-related health issues such as digestive disorders and high cholesterol. Online sales channels and e-commerce penetration further facilitate easy access for consumers. The region accounted for approximately 30–35% of the global market in 2024. Key drivers include a large base of health-conscious millennials and Gen X consumers, increasing interest in preventive healthcare, and regulatory support for herbal supplement formulations that meet FDA compliance standards.

Europe

Europe leads the global market, with Italy and Spain serving as key producers due to favorable climatic conditions for artichoke cultivation and well-established agribusiness infrastructure. Dietary supplements and nutraceutical applications dominate, with consumers demonstrating a strong preference for natural, herbal, and organic formulations. Europe accounted for roughly 35–40% of the market in 2024. Drivers for growth include increasing adoption of functional foods, stringent quality and sustainability certifications that enhance consumer trust, rising awareness of liver and digestive health, and expansion of health-conscious urban populations. Additionally, strong export infrastructure allows Europe to supply premium artichoke extract to emerging markets, reinforcing its leadership position.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China, India, and Japan emerging as key markets. Growth is fueled by rising disposable income, increasing health and wellness awareness, rapid expansion of the nutraceutical industry, and rising demand for functional foods and supplements. Dietary supplements, fortified foods, and premium functional beverages are the main applications in this region. Exports from European producers are a significant contributor to growth, with companies leveraging high-quality, sustainably sourced products. Regional growth drivers include government initiatives promoting herbal and natural products, increasing consumer preference for preventive healthcare, and expanding online retail penetration, facilitating easier access to premium nutraceuticals.

Latin America

Latin America, led by Brazil and Mexico, is an emerging market for artichoke extract. Rising health consciousness, growing affluence, and a trend toward natural dietary supplements and functional foods are driving market expansion. Imports from Europe and North America form a significant share of the supply chain. Growth drivers include increasing prevalence of lifestyle-related health issues, rising awareness of herbal supplement benefits, and gradual development of e-commerce channels for nutraceutical products. Additionally, urbanization and changing dietary patterns are contributing to higher adoption of functional ingredients in food and beverages.

Middle East & Africa

The Middle East, particularly the UAE, Saudi Arabia, and Qatar, represents an emerging consumer region for artichoke extract. Africa remains primarily a production hub, with countries such as Italy and Spain exporting to the region. Regional growth is supported by rising health awareness, increasing disposable income, adoption of preventive healthcare practices, and demand for natural and herbal supplements in premium dietary and cosmetic applications. The expanding e-commerce landscape in the Middle East also facilitates access to imported nutraceuticals, while government initiatives encouraging wellness and herbal product adoption further drive growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Artichoke Extract Market

- Croda International Plc

- iHerb LLC

- Now Health Group

- Enzymedica

- Jarrow Formulas Inc.

- Nature’s Way Products LLC

- Gaia Herbs Inc.

- Bio-Botanica Inc.

- Nutricost

- Indena S.p.A.

- Naturalin Bio-Resources Co., Ltd.

- Martin Bauer Group

- Bulk Supplements

- Jiaherb Inc.

- Nutra Green Biotechnology Co. Ltd.

Recent Developments

- In May 2025, Croda International expanded its green extraction facility in Europe to increase sustainable artichoke extract production.

- In April 2025, Enzymedica launched a new line of high-potency artichoke extract supplements targeting liver health.

- In February 2025, Gaia Herbs introduced organic artichoke extract powders optimized for functional beverage formulations.