Adaptogenic Drinks Market Size

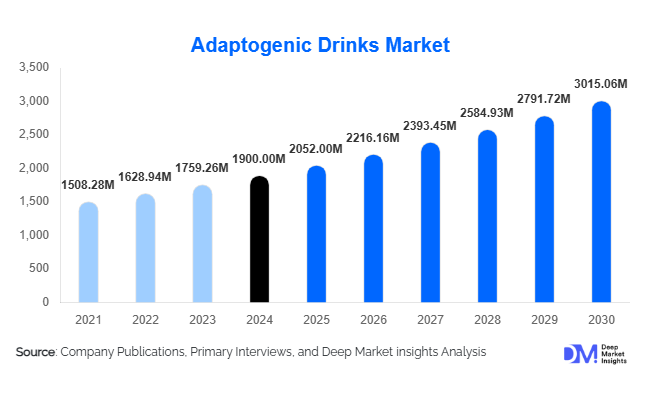

According to Deep Market Insights, the global adaptogenic drinks market size was valued at USD 1,900 million in 2024 and is projected to grow from USD 2,052 million in 2025 to reach USD 3,015.06 million by 2030, expanding at a CAGR of 8% during the forecast period (2025–2030). The adaptogenic drinks market growth is primarily driven by rising consumer awareness of mental wellness, immunity enhancement, stress reduction, and the increasing popularity of functional beverages infused with herbs, medicinal mushrooms, and botanicals.

Key Market Insights

- Ready-to-Drink (RTD) adaptogenic beverages dominate due to convenience, portability, and premium formulations targeting busy health-conscious consumers.

- Online retail and e-commerce channels are expanding rapidly, enabling wider accessibility, subscription-based models, and personalized nutrition offerings.

- North America leads the market, driven by U.S. and Canadian demand for clean-label, functional beverages with cognitive and stress-relief benefits.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes, urbanization, and traditional herbal knowledge in India, China, and Japan.

- Consumer preference for organic, sugar-free, and clean-label products is shaping product innovation and premiumization strategies globally.

- Export-driven growth is significant, with APAC countries supplying adaptogenic ingredients and beverages to North America and Europe.

What are the latest trends in the adaptogenic drinks market?

Functional Beverage Innovation

Manufacturers are increasingly blending adaptogens with other functional ingredients such as probiotics, collagen, and CBD to enhance appeal and efficacy. Ready-to-Drink (RTD) tonics, powdered mixes, and mushroom-infused beverages are gaining traction. These innovations cater to diverse consumer preferences, including cognitive health, energy, and stress management, while positioning adaptogenic drinks as lifestyle beverages beyond traditional herbal remedies.

Digital and Personalized Nutrition Platforms

Adoption of e-commerce, AI-based personalized nutrition apps, and subscription models is reshaping consumer engagement. Customers can now select adaptogenic drinks tailored to stress levels, activity, and health goals. Data-driven insights help companies optimize product offerings, pricing, and marketing campaigns. Social media influence and influencer marketing are amplifying brand visibility, particularly among millennials and Gen Z consumers who seek premium and wellness-oriented beverages.

What are the key drivers in the adaptogenic drinks market?

Rising Mental Wellness and Stress-Relief Awareness

Globally, increasing stress, anxiety, and fatigue are driving consumers toward natural remedies. Adaptogenic herbs like Ashwagandha, Rhodiola, and Reishi mushrooms are recognized for supporting cognitive health and stress resilience. This has boosted the adoption of functional beverages with adaptogenic properties, particularly in North America and Europe.

Growing Fitness and Sports Nutrition Adoption

Fitness enthusiasts and athletes are incorporating adaptogenic drinks for pre-workout energy, stamina, and recovery. The combination of functional ingredients with natural adaptogens makes these beverages appealing in gyms, sports facilities, and wellness centers, supporting broader market expansion.

Shift Toward Clean-Label and Organic Products

Consumer preference for plant-based, organic, and sugar-free beverages is accelerating demand. Products emphasizing natural ingredients and verified functional claims now account for more than 60% of global adaptogenic drink sales, reflecting a broader trend in health-conscious consumption.

What are the restraints for the global market?

High Cost of Ingredients

Premium adaptogenic herbs and medicinal mushrooms increase production costs, making beverages less accessible in price-sensitive regions. High retail prices limit penetration in emerging markets such as LATAM and parts of APAC.

Regulatory and Health Claim Challenges

Health claim approvals vary by region, particularly in the EU and North America. Compliance costs and delayed approvals can slow new product launches and restrict the marketing of functional benefits, affecting growth.

What are the key opportunities in the adaptogenic drinks industry?

Expansion into Emerging Markets

Growing urbanization and wellness awareness in APAC and LATAM create significant opportunities. Localized flavors and culturally relevant product formulations can enhance market penetration and adoption.

Integration of Technology & Digital Platforms

AI-based personalization, subscription models, and wellness apps enable companies to deliver tailored adaptogenic drink solutions. Digital engagement facilitates better marketing, consumer insights, and brand loyalty.

Government & Policy Support for Wellness and Nutraceuticals

Initiatives promoting herbal medicine and preventive healthcare in India, China, and Europe incentivize the production and distribution of adaptogenic beverages. Regulatory support for functional claims can enhance consumer trust and market growth.

Product Type Insights

Ready-to-Drink (RTD) adaptogenic drinks dominate the market with a 40% share in 2024 due to convenience and premium formulations. Functional beverages and herbal tonics also capture significant demand, particularly among health-conscious and fitness-oriented consumers. Powdered mixes are gaining traction as versatile options for at-home preparation, appealing to younger demographics and digital-savvy customers.

Application Insights

Health & wellness consumption is the largest application, accounting for 50% of demand globally. The fitness & sports nutrition segment is the fastest-growing, with consumers seeking energy, stamina, and recovery benefits. Emerging applications include beauty & personal care beverages for skin and anti-aging benefits. Export-driven demand from APAC to North America and Europe is significant, particularly for premium adaptogenic formulations.

Distribution Channel Insights

Online retail dominates, offering subscriptions, direct-to-consumer models, and AI-powered personalization. Supermarkets and health stores remain important, especially in mature markets. Pharmacies and convenience stores cater to localized demand, while specialty wellness cafes and gyms are emerging channels targeting fitness and beauty-conscious consumers.

| By Product Type | By Form | By Distribution Channel | By End-Use Industry | By Ingredient Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest market share at 35% in 2024, led by U.S. and Canadian consumers who prefer clean-label, functional beverages. E-commerce adoption and wellness trends support growth, with RTD formats particularly popular.

Europe

Europe accounts for 25% of the market, with Germany, the UK, and France leading demand. Consumers favor organic, plant-based, and functional beverages, creating a strong market for premium adaptogenic drinks.

Asia-Pacific

APAC is the fastest-growing region with an 11% CAGR, driven by India, China, Japan, and South Korea. Urbanization, rising incomes, and traditional herbal knowledge are boosting adoption. India and China also serve as key exporters of adaptogenic ingredients.

Latin America

Brazil, Argentina, and Mexico are emerging markets with moderate growth. Demand is price-sensitive, but increasing awareness of health and wellness beverages is driving adoption, particularly in premium and mid-range segments.

Middle East & Africa

UAE and South Africa are primary markets, with growing adoption in urban wellness cafes and retail outlets. In Africa, local production of adaptogenic herbs is increasing, supporting both domestic consumption and exports.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Adaptogenic Drinks Market

- Hain Celestial Group

- GT’s Living Foods

- Four Sigmatic

- REBBL

- Amway

- Sun Potion

- Moon Juice

- Organic India

- Gaia Herbs

- LifeAid Beverage

- Buddha Teas

- Jarrow Formulas

- The Good Drink Company

- Life Extension

- Dynamic Health

Recent Developments

- In May 2025, Four Sigmatic expanded its product portfolio with new mushroom-infused adaptogenic beverages targeting North American fitness consumers.

- In April 2025, REBBL launched a subscription-based personalized adaptogenic tonic service, integrating digital wellness assessments for targeted product recommendations.

- In February 2025, Organic India introduced new Ashwagandha and Rhodiola RTD beverages in European markets, aligning with rising demand for organic, stress-relief drinks.