Yoga Clothing Market Size

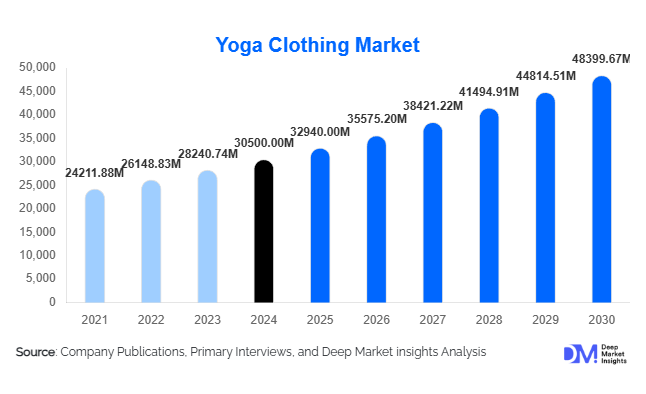

According to Deep Market Insights, the global yoga clothing market size was valued at USD 30,500 million in 2024 and is projected to grow from USD 32,940.0 million in 2025 to reach USD 48,399.67 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). The yoga clothing market growth is primarily driven by increasing wellness and fitness awareness, expanding athleisure usage of yoga apparel beyond studios, and accelerating penetration of online and global distribution channels.

Key Market Insights

- Yoga clothing is evolving from niche-studio use into everyday athleisure wear, with bottoms (leggings, yoga pants) dominating product types and the crossover usage expanding market reach.

- Mass-market tiers account for the bulk of sales, yet the premium and sustainable segments are growing faster, offering higher margins and brand differentiation.

- North America leads in value share, driven by strong wellness culture, high per-capita spending, and established brand presence, while Asia-Pacific emerges as the fastest-growing region.

- Online distribution is gaining rapid share, as brands leverage direct-to-consumer models, e-commerce platforms, and globafulfillmentnt to reach new markets.

- Sustainable materials and advanced fabric technologies are becoming key differentiators; rs, consumers increasingly demand eco-friendly, performance-oriented, and stylish yoga apparel.

- Men’s and youth segments are under-penetrated and represent clear growth opportunities, as yoga participation expands across genders and age groups.

What are the latest trends in the yoga clothing market?

Demographic Expansion into Men, Youth & Adaptive Sizing

Traditionally dominated by women, the yoga clothing market is now seeing rising interest from men, younger consumers, and those seeking adaptive sizing. As male yoga participation increases globally and youth fitness culture takes off, brands are launching collections tailored for these segments (masculine fits, youth-friendly prints, inclusive sizing). This demographic diversification expands the addressable market beyond the traditional female-yogi base and allows brands to tap into previously underserved sub-segments. Inclusive sizing and adaptive apparel also open new niches and align with broader lifestyle and wellness trends.

Regional Growth & Emerging Market Penetration

Emerging geographies, such as India, China, Southeast Asia, Latin America, and parts of the Middle East/Africa, are offering strong growth tailwinds. Urbanization, rising disposable incomes, growing health-and-wellness mindsets, and increasing e-commerce access are driving demand upward. Brands that localize their products, distribution, and marketing for regional preferences and cultural contexts are gaining an early-mover advantage. At the same time, manufacturing and supply-chain diversification (to Vietnam, Bangladesh, India) supports global expansion and margin optimization.

Fabric & Technology Innovation, Sustainability, and Athleisure Crossover

Consumers are increasingly discerning about both functionality and sustainability. Apparel fabrics now incorporate moisture-wicking, four-way stretch, compression, and seamless construction, while recycled and bio-based fibers are gaining prominence. The blurring of lines between workout and everyday wear (athleisure) means yoga clothing must satisfy both performance and style criteria. Brands investing in these areas not only differentiate themselves but also command premium pricing, build customer loyalty, and hedge against raw-material cost & regulatory risks. The push for circular design, take-back programs, and transparency also broadens brand appeal.

What are the key drivers in the yoga clothing market?

Rising Health & Wellness Consciousness

Increasing global emphasis on physical and mental well-being, especially post-pandemic, has driven many to yoga as a low-barrier, inclusive fitness and mindfulness activity. As yoga participation expands across age groups, geographies, and fitness levels, demand for specialized clothing that supports flexibility, breathability, and comfort rises. Consumers seek garments that perform in class and transition to everyday life, bolstering the yoga clothing market.

The Athleisure Trend & Usage Expansion Beyond Studios

Yoga apparel is no longer confined to the mat. Its adoption as lifestyle wear means products are worn during errands, casual outings, or even remote working. This expanded usage increases purchase frequency and broadens the consumer base. Especially for bottoms such as leggings, demand is high not only from yoga practitioners but from general active-wear and fashion-conscious consumers as well. This crossover strengthens volume growth and value generation.

Growth of Online Channels & Direct-to-Consumer Brand Expansion

Digital commerce and brand-owned direct-to-consumer (D2C) models have empowered yoga-apparel brands to reach consumers globally with lower overheads, personalized experiences, virtual fitting, social-media marketing, and faster product cycles. The growth of e-commerce, especially in emerging markets, is amplifying reach, reducing reliance on traditional retail networks, and enabling global scale. This has been a key enabler of market growth for new entrants and agile brands. Restraints

Raw-Material Price Volatility & Supply Chain Disruptions

Yoga apparel often utilizes synthetic performance fabrics (polyester, nylon, spandex) or specialty blends. Price fluctuations in petroleum-derived inputs, global shipping/logistics disruptions (e.g., container shortages), labor cost inflation, and trade-tariff uncertainties squeeze margins. When manufacturers cannot pass on costs, pricing competitiveness suffers. For new entrants and smaller brands, supply-chain disruption remains a significant barrier.

Saturation & Intense Competition in Mature Markets

In markets such as North America and Western Europe, the yoga-apparel segment is highly competitive, with many legacy active-wear brands, premium niche specialists, fast-fashion entrants, and private-label offerings vying for share. This leads to margin pressure, product-differentiation challenges, commoditization of lower-tier products, and slower growth. To succeed, brands must innovate, target niche segments, or expand in emerging geographies rather than rely purely on volume in mature markets.

What are the key opportunities in the yoga clothing industry?

Tailored Collections for Men, Youth & Adaptive Apparel

The fastest-expanding segments are beyond the traditional female yoga practitioner, namely, men, youth, and inclusive/adaptive sizing. Brands that design products for male participants (adjusted cuts, gender-neutral colors, performance cues), develop youth‐friendly lines (school/club wellness programs, or inclusive sizing (plus sizes, adaptive apparel) can meaningfully grow their addressable market. This demographic expansion offers a first-mover advantage, lower competition, and stronger brand loyalty.

Emerging-Market Penetration in Asia-Pacific, Latin America & Middle East/Africa

Emerging geographies present high-growth opportunities in regions such as India, China, Southeast Asia, Brazil, Mexico, GCC countries, and Africa. Rising urban middle-class incomes, smartphone/e-commerce penetration, and growing health/wellness awareness combine to accelerate yoga‐apparel demand. Brands that customize products, localize distribution and marketing, establish regional fulfillment, and navigate regional logistics/tariffs can build strong growth trajectories and diversify from saturated mature regions.

Innovation in Performance Fabrics, Sustainable Materials & Circular Business Models

There is a clear opportunity for brands to invest in high-performance technical fabrics (moisture-wicking, anti-odor, compression, smart textile integration), as well as sustainable materials (recycled PET, bio-based fibers, low-impact dyes) and circular models (take-back, resale, rental). These innovations enable premium pricing, strengthen brand differentiation, and align with regulatory/supply chain pressures (e.g., rising cost of raw materials, ESG-compliance). Brands that lead in sustainability and tech can capture the premium end-tier, defend margin, and future-proof business.

Product Type Insights

The Bottoms segment, which includes leggings, yoga pants, and capris, dominates the global yoga clothing market, accounting for approximately 47% of total market value in 2024. This leadership is attributed to the indispensable role that yoga bottoms play in ensuring stretch, flexibility, and performance comfort during practice. Furthermore, their integration into the broader athleisure lifestyle has propelled them from purely functional garments to fashion staples worn throughout daily life.

Driven by the increasing popularity of high-waist and seamless designs, alongside sustainable fabric innovation such as recycled polyester and bamboo blends, the bottoms category continues to be a cornerstone of product portfolios for leading brands like Lululemon, Nike, and Alo Yoga. Meanwhile, the Tops segment, comprising tank tops, sports bras, and long-sleeved tees, is witnessing accelerated growth, supported by the trend toward studio-to-street versatility, color-matching sets, and influencer-driven fashion pairings. Premium one-piece sets and outerwear (jackets, wraps, hoodies) remain smaller in total value share but exhibit rapid double-digit growth as the fusion of performance apparel and fashion deepens. Collectively, innovation in stretch technology, moisture-wicking fabrics, and gender-neutral designs is expected to further diversify product offerings, creating sustained demand through 2030.

End-Use Insights

The end-use spectrum for yoga clothing has expanded far beyond traditional studio environments. While yoga studios remain an essential channel, the market is now propelled by the athleisure and lifestyle wear segment, which has evolved into the fastest-growing end-use category globally. Consumers increasingly integrate yoga apparel into their everyday wardrobes, influenced by comfort-focused dressing and the rising cultural acceptance of casual wear in workplaces and social settings. This segment’s rapid expansion is also supported by frequent product replacement cycles and social media–driven fashion dynamics.

Other major contributors include home and virtual practice segments, amplified by digital fitness platforms and hybrid working lifestyles, and corporate wellness programs, where yoga sessions are being adopted as part of employee well-being initiatives. The inclusion of men’s and youth demographics represents an emerging frontier, with participation growth in male-oriented yoga classes and university fitness programs. Moreover, export-driven demand plays a crucial role: manufacturing hubs in Asia, including India, Vietnam, and Bangladesh, are key suppliers of yoga apparel for global markets, particularly to North America and Europe. As sustainable sourcing, performance innovation, and inclusive designs gain traction, end-use diversification will remain a defining trend of this market’s evolution.

| By Product Type | By End-Use | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest regional market, commanding approximately 32.5% of global market value in 2024, equivalent to about USD 10.1 billion. The United States leads this dominance, supported by a highly developed wellness ecosystem, high disposable income levels, and widespread adoption of athleisure as everyday wear. The region benefits from a robust retail network, both physical and digital, coupled with brand loyalty toward premium players such as Lululemon, Nike, and Athleta.

The key growth drivers in North America include rising participation in yoga and Pilates classes, a surge in eco-conscious consumer preferences prompting demand for sustainable fabrics, and digital retail expansion via brand D2C channels. While the market is mature, innovation through size inclusivity, advanced compression fabrics, and celebrity collaborations continues to stimulate replacement demand and brand differentiation. The U.S. and Canada are also witnessing an increase in men’s yoga participation, offering new opportunities for product diversification.

Europe

Europe accounted for roughly 25–30% of the global yoga clothing market in 2024, driven by strong cultural affinity for wellness, fashion-forward athleisure trends, and sustainability-oriented consumer behavior. The U.K., Germany, France, Italy, and Spain remain key contributors, underpinned by extensive retail infrastructure and high awareness of eco-friendly apparel.

Major drivers in this region include environmental regulation compliance, encouraging sustainable textile use, rapid adoption of online and omni-channel retail models, and cross-category fashion collaborations between sportswear and luxury brands. Europe’s wellness tourism and urban yoga retreats further enhance apparel demand. Although the region’s growth rate is moderate due to market maturity, premiumization, and eco-innovation (e.g., organic cotton, biodegradable fibers) are expected to sustain a steady CAGR through 2030.

Asia-Pacific (APAC)

The Asia-Pacific (APAC) region is the fastest-growing yoga clothing market globally, accounting for approximately 20–25% of total market share in 2024 and projected to record a robust CAGR of 8–9% from 2025 to 2030. Key markets include China, India, Japan, South Korea, and Australia. Growth is primarily driven by rising middle-class incomes, urbanization, and the expanding popularity of yoga as both a wellness and lifestyle activity.

India’s deep-rooted yoga heritage is converging with global fashion influences, spurring demand for domestic and export-oriented brands. Meanwhile, China’s rising wellness awareness and online retail penetration have made yoga wear a mainstream lifestyle product. E-commerce giants such as Tmall, Flipkart, and Amazon are fostering easier market access for both global and local brands. Additionally, foreign investments in apparel manufacturing, coupled with government wellness initiatives such as “Fit India Movement” and “Healthy China 2030,” further accelerate market development. Sustainability, affordability, and digital retail innovation will remain the key regional growth levers.

Latin America (LATAM)

Latin America currently represents around 5–7% of global market value, with Brazil and Mexico serving as the principal markets. The region’s growth is being fueled by rising health and fitness awareness, expanding online retail penetration, and growing adoption of yoga and mindfulness practices among urban populations. Increasing gym memberships and the proliferation of wellness-focused events are introducing new consumer segments to yoga apparel.

While overall market value remains modest compared to mature economies, the acceleration of local production capabilities, the emergence of regional e-commerce players, and government-driven health campaigns are creating a favorable environment for international and domestic brands. Influencer marketing and social media fitness trends are also amplifying visibility for emerging yoga apparel labels across LATAM.

Middle East & Africa (MEA)

The Middle East and Africa (MEA) region contributes about 5–6% of global market share and represents a rapidly evolving consumer landscape. Countries such as the UAE, Saudi Arabia, South Africa, and Egypt are becoming focal points for international expansion due to their young demographics, high digital engagement, and rising female participation in sports and wellness programs.

Growth drivers include government initiatives promoting fitness and women’s sports participation (e.g., Saudi Vision 2030), expansion of luxury mall-based activewear retail, and increasing adoption of e-commerce platforms. The region’s consumers are showing strong affinity for premium and modest activewear designs, blending cultural appropriateness with global fashion influences. Although starting from a smaller base, MEA’s combination of lifestyle transformation, digital connectivity, and tourism-driven wellness demand positions it among the most promising frontier markets through 2030.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Yoga Clothing Market

- Lululemon Athletica

- Nike Inc.

- Adidas AG

- Under Armor Inc.

- Puma SE

- Athleta (Gap Inc.)

- ASICS Corporation

- Hanesbrands Inc.

- Columbia Sportswear Co.

- P.E. Nation

- Sweaty Betty

- Alo Yoga

- Prana (Columbia Sportswear)

- Manduka LLC

- Outdoor Voices

Recent Developments

- In mid-2025, multiple premium yoga-wear brands expanded into emerging markets (e.g., India and China) with store launches, local partnerships, and online-first strategies.

- In 2025–2026, manufacturing and textile firms announced investments in recycled and bio-based performance fabrics (e.g., recycled PET, seamless knitting) to support yoga-wear growth and sustainability trends.

- In early 2025, a number of yoga-apparel companies ramped up their direct-to-consumer e-commerce platforms globally, launched virtual-fitting tools, and influencer-led marketing to bolster brand engagement and reduce reliance on traditional retail channels.