Wooden Toys Market Size

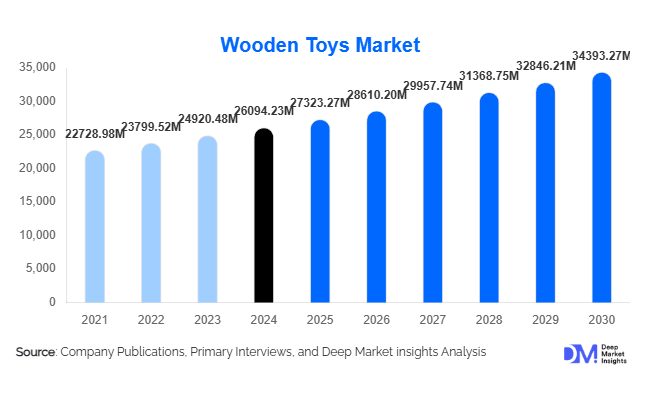

According to Deep Market Insights, the global wooden toys market size was valued at USD 26,094.23 million in 2024 and is projected to grow from USD 27,323.27 million in 2025 to reach USD 34,393.27 million by 2030, expanding at a CAGR of 4.71% during the forecast period (2025–2030). The wooden toys market growth is primarily driven by increasing consumer preference for eco-friendly and sustainable play materials, growing awareness about plastic pollution, and the rising popularity of Montessori and STEM-based educational toys among parents and educators.

Key Market Insights

- Rising demand for eco-friendly and biodegradable materials is fueling the shift toward wooden toys, especially among environmentally conscious consumers and parents.

- Educational and Montessori-inspired toys are driving market growth, promoting sensory development and creativity among children.

- Europe dominates the global wooden toys market due to strong environmental regulations and established sustainable toy brands.

- Asia-Pacific is the fastest-growing region, supported by a large child population, growing disposable incomes, and the rise of domestic wooden toy manufacturers in China and India.

- Online retail and e-commerce channels are expanding the reach of small-scale wooden toy producers to global consumers.

- Product customization and handcrafted designs are gaining traction, appealing to premium and gift-oriented segments.

What are the latest trends in the wooden toys market?

Eco-Conscious Toy Manufacturing

Manufacturers are increasingly adopting sustainable production methods, using FSC-certified wood, non-toxic paints, and recyclable packaging. This trend aligns with global efforts to reduce plastic waste and carbon footprints. Brands are marketing wooden toys as long-lasting, heirloom-quality products that contrast with mass-produced plastic alternatives. Additionally, partnerships with sustainability certification bodies and the use of renewable materials such as bamboo are reinforcing eco-friendly brand positioning.

Integration of Educational and STEM Elements

Educational toys that encourage problem-solving, fine motor skills, and cognitive development are becoming a major growth driver. Montessori and STEM-based wooden toys are gaining popularity in schools and homes. Interactive puzzles, building blocks, and mechanical assembly toys made from wood are being designed to combine fun with learning outcomes, appealing to modern parents who emphasize skill-based play.

What are the key drivers in the wooden toys market?

Rising Parental Awareness of Sustainable Play

Parents are increasingly concerned about the safety, durability, and sustainability of children’s toys. Wooden toys, being non-toxic and renewable, offer a safe and eco-conscious alternative. The global “plastic-free parenting” movement has significantly boosted wooden toy sales, especially in developed markets such as Europe and North America.

Expansion of E-Commerce and Direct-to-Consumer Models

Online platforms have revolutionized toy retail, allowing artisanal and boutique manufacturers to reach a wider audience. D2C brands focusing on sustainability are leveraging social media marketing, influencer partnerships, and personalized packaging to attract eco-conscious consumers. The availability of global shipping and localized production hubs is further supporting cross-border market growth.

What are the restraints for the global market?

High Production and Material Costs

Wooden toys are generally more expensive to produce than plastic toys due to higher raw material and craftsmanship costs. This limits market penetration in low-income regions. Additionally, fluctuations in timber prices and supply chain constraints can impact profit margins for manufacturers.

Limited Design Flexibility Compared to Plastic Toys

While wooden toys excel in durability and sustainability, they often lack the versatility and vibrant aesthetics of plastic toys. Complex electronic or animated features are harder to integrate into wooden designs, limiting their appeal in tech-driven toy segments. This creates challenges for manufacturers aiming to compete in the digital and interactive toy space.

What are the key opportunities in the wooden toys industry?

Smart and Hybrid Wooden Toys

Innovation opportunities exist in integrating smart technology with wooden structures, such as embedded sensors, magnets, or AR-enabled components, to create interactive learning experiences. These hybrid models combine the tactile benefits of wood with digital engagement, appealing to modern, tech-aware parents and children.

Personalized and Giftable Wooden Toys

Customization options like name engraving, bespoke designs, and limited-edition collections are growing in demand, particularly in the premium and gifting segments. Artisanal manufacturers are leveraging this trend to differentiate from mass-market products and strengthen consumer emotional attachment to the brand.

Product Type Insights

Building blocks and construction toys dominate the market due to their educational value and universal appeal. Puzzles and board games are also gaining traction, especially in Europe and North America, where family-based play is emphasized. Push-and-pull toys, stacking sets, and pretend-play items remain popular among toddlers. The rise of eco-themed and animal-shaped wooden toys reflects growing interest in nature education and sustainability awareness among children.

Distribution Channel Insights

Online retail leads global sales, with platforms like Amazon, Etsy, and specialized toy websites driving product visibility. Brick-and-mortar specialty stores continue to perform well in premium segments, particularly in Europe. Supermarkets and toy chains are expanding eco-friendly product lines, while local craft markets and exhibitions serve as key sales channels for small-scale artisans. Subscription-based toy rental and recycling programs are emerging, promoting circular economy principles in the toy industry.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Europe

Europe remains the largest market for wooden toys, driven by stringent environmental standards and high consumer awareness. Countries such as Germany, the U.K., and the Netherlands lead demand due to their strong sustainability culture and preference for educational play materials. European brands like Hape, PlanToys, and Janod continue to dominate through innovative design and eco-certifications.

North America

North America shows steady growth, supported by the increasing adoption of eco-conscious lifestyles and a strong retail presence of sustainable toy brands. The U.S. market, in particular, is witnessing rising interest in Montessori-based toys and handcrafted designs. Major retailers are expanding their “green toy” portfolios, appealing to environmentally aware millennial parents.

Asia-Pacific

The Asia-Pacific region is expected to exhibit the fastest growth, led by China, India, and Japan. Local production capabilities, government support for sustainable manufacturing, and growing disposable incomes are accelerating market expansion. China, a leading wooden toy exporter, is investing in eco-friendly certifications to meet Western market standards.

Latin America

Latin America is emerging as a promising market, with increasing middle-class awareness of sustainable consumer goods. Brazil and Mexico are key growth hubs, supported by expanding retail infrastructure and online penetration. Locally produced wooden toys are also gaining popularity in regional fairs and boutique stores.

Middle East & Africa

While still a smaller segment, the Middle East and Africa are witnessing growing interest in premium and educational wooden toys. Wealthy consumer bases in the UAE and Saudi Arabia are driving imports of luxury wooden toys, while African nations are exploring local wooden toy production as part of craft-based community development programs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wooden Toys Market

- Hape International AG

- PlanToys

- Janod (Juratoys Group)

- Melissa & Doug

- Bigjigs Toys

- BRIO AB

- EverEarth

Recent Developments

- In August 2025, PlanToys launched a new line of carbon-neutral educational toys made from recycled rubberwood and organic pigments.

- In May 2025, Hape introduced its “Green Planet” collection featuring FSC-certified bamboo toys and 100% recyclable packaging.

- In February 2025, Melissa & Doug announced a partnership with the Forest Stewardship Council (FSC) to certify all its wooden toy lines by 2026.