Wooden Furniture Lacquer Market Size

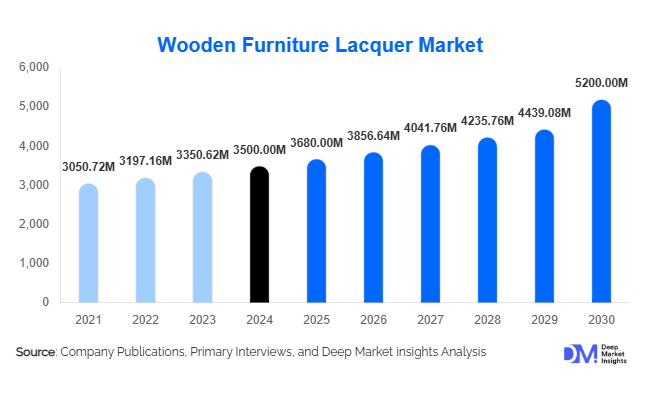

According to Deep Market Insights, the global wooden furniture lacquer market size was valued at USD 3,500 million in 2024 and is projected to grow from USD 3,680 million in 2025 to reach USD 5,200 million by 2033, expanding at a CAGR of 4.8% during the forecast period (2025–2033). The market growth is primarily driven by rising consumer demand for high-quality, durable furniture finishes, the adoption of eco-friendly water-based lacquers, and technological advancements in application methods that improve efficiency and aesthetic appeal.

Key Market Insights

- Water-based and low-VOC lacquers are gaining prominence, driven by regulatory compliance and increasing environmental awareness among consumers.

- Spray application methods dominate globally, offering superior coverage and efficiency for both residential and commercial furniture production.

- Residential furniture is the largest end-use segment, accounting for approximately 60% of the global market in 2024, fueled by rising urbanization and disposable income.

- North America and Europe collectively account for more than 55% of the market share, with strong demand for premium furniture finishes in the U.S., Canada, Germany, and Italy.

- Asia-Pacific is the fastest-growing region, led by China and India, driven by urbanization, rising middle-class income, and expanding furniture manufacturing sectors.

- Technological adoption in application techniques such as automated spray systems, UV-curable lacquers, and faster-drying formulations is enhancing productivity and quality.

Latest Market Trends

Eco-Friendly and Water-Based Lacquers

There is a clear trend toward the adoption of environmentally friendly, low-VOC, and water-based lacquer products. Manufacturers are reformulating traditional solvent-based lacquers to meet regulatory standards while appealing to environmentally conscious consumers. This trend has accelerated in Europe and North America, where stringent environmental regulations are in place. Companies are marketing these lacquers as safer for indoor use and sustainable for long-term furniture protection, gaining traction across residential and commercial segments.

Technological Advancements in Application

Emerging automated spray and finishing technologies are revolutionizing the application process. UV-cured lacquers, electrostatic spraying systems, and robotic finishing units reduce drying times and ensure uniform coating quality, minimizing waste. These advancements are particularly attractive for high-volume commercial furniture manufacturers and luxury furniture producers aiming for premium finishes. Additionally, digital control systems allow precise customization of lacquer thickness and gloss, enhancing product differentiation in competitive markets.

Wooden Furniture Lacquer Market Drivers

Rising Demand for Aesthetic and Durable Furniture

Consumers increasingly prioritize well-finished, durable wooden furniture that combines aesthetic appeal with long-lasting protection. This trend is boosting demand for high-performance lacquers capable of resisting scratches, moisture, and UV exposure. The growing focus on interior design and home renovation further contributes to increased consumption of quality lacquers, particularly in urbanized regions.

Growth of Residential and Commercial Furniture Sectors

The expansion of residential housing, office spaces, and hospitality establishments is creating consistent demand for lacquered furniture. The real estate boom in emerging economies, coupled with rising disposable income in developed regions, is driving manufacturers to produce more lacquered furniture, resulting in higher consumption of lacquer products.

Adoption of Advanced Lacquer Technologies

Innovations in lacquer formulations, such as UV-curable and water-based coatings, are enhancing drying efficiency, reducing environmental impact, and providing superior surface quality. Manufacturers adopting these technologies are gaining a competitive edge by meeting both regulatory standards and consumer expectations for high-quality finishes.

Market Restraints

Fluctuating Raw Material Prices

Raw materials like resins, solvents, and pigments are subject to global price volatility. This increases production costs for lacquer manufacturers and may limit profitability, particularly for small and medium-sized enterprises operating on thin margins.

Stringent Environmental Regulations

Compliance with regulations on VOC emissions, chemical content, and environmental safety can pose challenges for manufacturers. Reformulation of traditional solvent-based lacquers to meet these requirements increases operational costs and restricts market flexibility, especially in regions with stringent policies such as Europe and North America.

Wooden Furniture Lacquer Market Opportunities

Emerging Markets in Asia-Pacific and Latin America

Rapid urbanization, increasing disposable incomes, and expanding middle-class populations in China, India, Brazil, and Mexico create significant growth opportunities. Establishing production facilities, local distribution networks, and partnerships with furniture manufacturers can help companies capture these fast-growing markets.

Technological Integration and Automation

The adoption of automated application methods, robotic finishing systems, and digital process control presents opportunities to improve efficiency and reduce production costs. Companies investing in these technologies can enhance product quality, reduce environmental impact, and gain a competitive advantage in both residential and commercial sectors.

Expansion of Eco-Friendly Lacquer Portfolios

Developing sustainable, water-based, and low-VOC lacquers provides a strategic opportunity for market participants. With growing consumer preference for environmentally safe furniture, companies can differentiate themselves and gain market share by offering high-performance, eco-conscious lacquer products.

Product Type Insights

Water-based lacquers lead the global market, representing approximately 40% of total consumption in 2024, due to their eco-friendly properties and regulatory compliance. Solvent-based lacquers still hold significant demand in regions where drying speed and high gloss are prioritized. UV-cured lacquers are emerging as a premium segment, offering rapid drying and superior surface protection, particularly for commercial furniture manufacturing and high-end residential applications.

Application Insights

Spray application dominates globally, accounting for roughly 55% of market usage in 2024, because it ensures uniform coverage, faster processing, and efficient use of raw materials. Brush and roller applications remain relevant for small-scale or custom furniture production. Automated robotic spraying is gaining traction in large-scale manufacturing, particularly in Europe and North America.

Distribution Channel Insights

Direct sales to furniture manufacturers and distributors remain the dominant distribution channel, ensuring bulk supply and long-term contracts. E-commerce platforms and specialty retailers are expanding, enabling smaller manufacturers and DIY enthusiasts to access high-quality lacquers. B2B channels account for the majority of revenue, whereas B2C channels are emerging, particularly in urbanized regions.

End-Use Industry Insights

Residential furniture leads consumption, representing approximately 60% of the market in 2024, driven by rising home renovation and interior design trends. Commercial furniture, including offices, hotels, and restaurants, contributes significantly and is growing steadily. Export demand is rising for high-quality lacquered furniture from Europe and Asia to North America, enhancing market growth. Emerging applications include luxury furniture customization, modular furniture, and specialized coatings for smart furniture with embedded electronics.

| By Product Type | By Application Method | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

The U.S. and Canada collectively account for approximately 25% of the global market. Demand is driven by premium furniture consumption, regulatory compliance for low-VOC products, and advancements in automated application methods. Residential renovations and commercial office expansions further fuel market growth.

Europe

Europe holds roughly 30% of the market, with Germany and Italy leading due to strong furniture manufacturing traditions and stringent environmental regulations promoting eco-friendly lacquers. UV-cured and water-based products are widely adopted across commercial and residential applications.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China and India. Rapid urbanization, growing middle-class incomes, and a booming furniture manufacturing sector contribute to high demand. Expansion of local production and export-oriented manufacturing further accelerates growth.

Latin America

Brazil and Mexico are the primary markets, with growth driven by urban housing developments and rising furniture demand in commercial sectors. While currently smaller in scale, market expansion is anticipated as disposable incomes rise.

Middle East & Africa

The UAE, South Africa, and Saudi Arabia are witnessing increasing demand, particularly for high-end residential and office furniture. Infrastructure development and luxury real estate projects drive growth in lacquer consumption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wooden Furniture Lacquer Market

- AkzoNobel

- PPG Industries

- Sherwin-Williams

- BASF

- RPM International

- Nippon Paint

- Valspar

- Jotun

- Axalta Coating Systems

- Beckers Group

- Kansai Paint

- Hempel

- Masco Corporation

- Benjamin Moore

- Asian Paints

Recent Developments

- In 2025, AkzoNobel expanded its eco-friendly lacquer portfolio across Europe, introducing low-VOC water-based coatings for premium furniture manufacturers.

- In 2024, PPG Industries launched a UV-cured lacquer line with faster drying times and improved surface durability for commercial furniture production.

- In 2025, Sherwin-Williams invested in automated robotic spraying systems in its North American plants to enhance production efficiency and finish quality.