Wood Restaurant Furniture Market Size

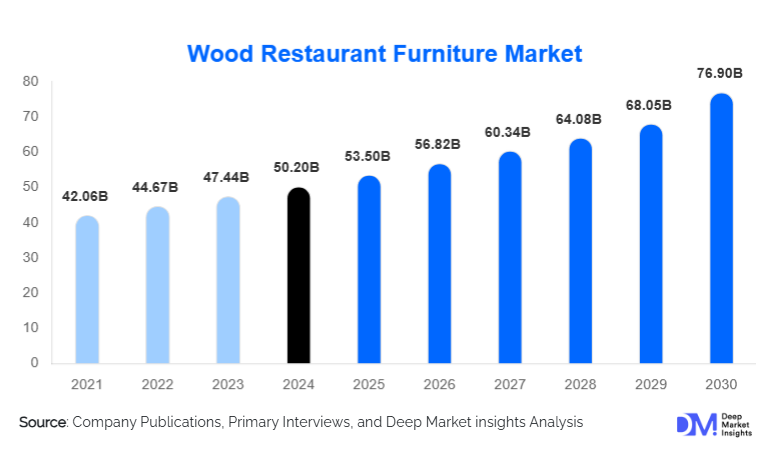

According to Deep Market Insights, the global wood restaurant furniture market was valued at USD 50.2 billion in 2024 and is projected to grow from USD 53.5 billion in 2025 to reach USD 76.9 billion by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). Growth in the market is being driven by the expansion of the global hospitality industry, increasing consumer focus on design-led restaurant interiors, and rising preference for sustainable and premium wood materials in commercial furniture.

Key Market Insights

- Demand for sustainable and certified wood furniture is rapidly increasing, as restaurants and hotels adopt eco-friendly sourcing and green interior design practices.

- Asia-Pacific leads global demand with strong restaurant construction, tourism recovery, and growth of mid-range dining establishments.

- Solid hardwood furniture holds the largest material share, owing to superior durability, longevity, and aesthetic appeal in premium dining spaces.

- Mid-range restaurant furniture dominates sales, balancing cost efficiency with design flexibility for fast-growing casual dining chains.

- Customization and themed interiors are reshaping buying patterns, with restaurants seeking bespoke furniture to enhance brand identity and ambiance.

- Technological advancements in furniture design and finishing (CNC machining, low-VOC coatings, digital configuration tools) are improving productivity and sustainability outcomes.

What are the latest trends in the wood restaurant furniture market?

Eco-Conscious Materials and Circular Design

Wood restaurant furniture manufacturers are increasingly adopting sustainable practicessourcing FSC- or PEFC-certified timber, using reclaimed wood, and implementing closed-loop production systems to minimize waste. Restaurants are leveraging these eco-credentials to strengthen brand value and align with environmentally responsible customers. Circular design principles, such as modular furniture for easy repair or refurbishment, are gaining prominence. Reclaimed and rustic finishes that emphasize authenticity and sustainability are trending across cafés, bistros, and boutique hotels. This sustainable shift also supports compliance with regional regulations on responsible sourcing and emission control.

Customization and Themed Dining Concepts

Restaurants are prioritizing personalized interiors that reflect unique brand stories. Furniture producers are responding by offering design-on-demand, flexible modular seating, and tailored wood finishes. Bespoke booths, local wood varieties, and hybrid designs (wood-plus-metal or upholstered wood) are increasingly common. Digital configuration platforms and 3D visualization tools now allow restaurant owners to preview layouts and finishes before purchase, shortening design cycles and improving customer experience. Themed furniture for ethnic cuisines, farm-to-table, or industrial-chic décor is also gaining traction globally.

Technology Integration and Smart Furniture Manufacturing

Automation and precision engineering are redefining manufacturing standards. CNC cutting, robotic sanding, and AI-assisted design systems enable consistent quality and scalable customization. Environmentally safe water-based coatings, UV finishes, and anti-bacterial surface treatments are improving durability in high-traffic dining environments. Some manufacturers are also integrating technology into productswireless charging in tables, LED lighting strips, and easy-maintenance surfacesblending functionality with aesthetic appeal.

What are the key drivers in the wood restaurant furniture market?

Expansion of the Global Hospitality and Foodservice Sector

Global restaurant openings, hotel expansions, and increasing consumer dining-out frequency are primary growth drivers. Tourism recovery post-pandemic and urban lifestyle shifts in emerging economies have created sustained demand for commercial furniture installations. Chains and independent restaurants alike are investing in upgraded seating, outdoor furniture, and thematic interiors to enhance guest experience, fueling replacement cycles and new purchases.

Growing Emphasis on Design and Ambience

Dining spaces are increasingly valued as experiential environments. Consumers choose restaurants not only for food but also for visual and sensory appeal. Wood furnitureoffering warmth, natural texture, and craftsmanshipenhances this ambience better than plastic or metal alternatives. As a result, interior designers are prioritizing solid wood tables, ergonomic chairs, and customized layouts that reflect brand personality and comfort.

Shift Toward Sustainable and Certified Materials

Regulatory and consumer pressure for sustainable sourcing has boosted the use of eco-certified and reclaimed wood. Global initiatives promoting deforestation-free supply chains and carbon-neutral interiors are influencing procurement policies. Hotels and restaurant groups now mandate certification and traceability, positioning sustainability as a key growth catalyst.

What are the restraints for the global market?

Volatility in Raw Material Prices

Price fluctuations in hardwood, engineered wood panels, and finishing materialsdriven by supply-chain disruptions, tariffs, and trade restrictionscreate uncertainty for manufacturers. Cost increases often squeeze profit margins, particularly for mid-range producers competing on price-sensitive contracts.

Skilled Labor Shortages and Manufacturing Constraints

High-quality wood furniture production relies on skilled carpenters and finishing experts. Labor shortages in traditional furniture clusters across Europe and North America, coupled with rising wages in Asia, are challenging manufacturers’ ability to meet large hospitality orders quickly. Long lead times may deter clients planning time-sensitive restaurant openings or refurbishments.

What are the key opportunities in the wood restaurant furniture industry?

Sustainable and Reclaimed Wood Collections

Rising awareness of deforestation and eco-labeling standards opens vast opportunities for suppliers of reclaimed or sustainably sourced wood furniture. Manufacturers offering traceable supply chains and low-carbon production can capture higher-margin contracts from international hotel and restaurant groups committed to sustainability reporting and ESG compliance.

Customization and Design-Integrated Offerings

Providing modular, bespoke, and brand-aligned designs remains a strong opportunity. Restaurants seek furniture that communicates concept and cultural identitysuch as minimalist Scandinavian dining, rustic farmhouse décor, or Asian heritage themes. Suppliers integrating interior design consultancy, rapid prototyping, and personalized finishing services can expand their share in the mid-to-premium tiers.

Emerging Market Expansion and Urbanization

Rapid restaurant growth in Asia-Pacific, Latin America, and the Middle East is fueling new furniture demand. Localizing manufacturing, distribution, and after-sales support in these regions can reduce import costs and lead times. Rising urbanization, growing disposable incomes, and hospitality infrastructure investment create favorable long-term conditions for both global and regional producers.

Product Type Insights

Chairs accounted for approximately 47% of the global market share in 2024, representing the highest revenue contribution. They are fundamental to every dining format and are replaced more frequently than tables or booths. Chairs crafted from hardwoods like oak or teak dominate due to their durability and timeless design appeal. The demand for ergonomically optimized seating with aesthetic finishes is increasing, especially in fine dining and café chains. Tables, benches, and barstools collectively account for the remaining majority share, with growth driven by new restaurant construction and design upgrades.

Material Insights

Solid hardwood furniture captured nearly 38% of the 2024 market, making it the largest material segment globally. Restaurants prefer hardwood for its long lifespan, natural grain, and premium perception. Engineered wood and composite furniture serve cost-sensitive segments, particularly QSRs and cafeterias, while reclaimed wood is gaining traction in boutique and eco-themed dining outlets due to sustainability and rustic aesthetics.

Application Insights

Casual dining restaurants dominate demand, accounting for around 33% of market share in 2024. Their continuous refurbishment cycles and mid-range pricing needs drive repeat orders for new furniture. Cafés and bistros are emerging as the fastest-growing sub-segment, thanks to social dining and café culture expansion. Fine dining establishments, though smaller in number, are driving high-value purchases of custom and luxury wood furniture.

Distribution Channel Insights

Direct B2B contracts represent the primary distribution channel, particularly for large restaurant chains, hotels, and hospitality projects. Manufacturers collaborate with architects and interior designers for turnkey installations. Retail and showroom sales remain relevant for small independent restaurants, while online B2B marketplaces are rapidly growing, offering design catalogs, pricing transparency, and faster procurement options for small businesses and franchise owners.

| By Product Type | By Material | By Application / End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America held approximately 27% of the global market in 2024, led by the United States. A mature restaurant sector, strong design orientation, and frequent refurbishments drive steady demand. Sustainable furniture trends and preference for American hardwoods further support growth. Canada follows similar patterns, focusing on eco-certified imports and boutique restaurant renovations.

Europe

Europe commands about 23% of the global share, with Germany, the U.K., France, and Italy as major contributors. The region emphasizes design innovation, sustainability, and local craftsmanship. EU environmental directives and carbon neutrality goals encourage the use of FSC-certified woods and eco-finishes. Premium dining furniture remains strong, while outdoor furniture for café terraces is growing, particularly in southern Europe.

Asia-Pacific

Asia-Pacific leads with roughly 37% of the global market in 2024 and is the fastest-growing region (projected CAGR above 7%). China and India are major demand centers, followed by Southeast Asian economies such as Vietnam, Thailand, and Indonesia. Urbanization, tourism recovery, and the proliferation of dining chains underpin growth. Local production capacity and export competitiveness give the region a dual advantageserving domestic and overseas restaurant markets.

Latin America

Holding a modest 7% market share, Latin America shows high growth potential. Brazil and Mexico lead demand through expanding restaurant chains, café culture, and tourism development. Despite supply-chain and import challenges, local wood availability and design trends inspired by regional culture are fostering domestic manufacturing initiatives.

Middle East & Africa

The Middle East & Africa region accounts for around 6% share in 2024. Gulf countries such as the UAE, Saudi Arabia, and Qatar are investing heavily in luxury restaurants and hotels, boosting premium furniture imports. Africa’s growth is anchored in South Africa, Kenya, and Nigeria, where hospitality infrastructure and tourism expansion are increasing. Regional challenges include logistics costs and limited hardwood sourcing.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wood Restaurant Furniture Market

- Herman Miller, Inc.

- KI Furniture

- Ashley Furniture Industries

- HNI Corporation

- Interstuhl

- Steelcase Inc.

- Vitra International AG

- BSeated Global

- Virco Manufacturing Corporation

- Zhongshan Uptop Furnishings Co., Ltd.

- JS Aherne Furniture Ltd.

- MityLite, Inc.

- Grosfillex SAS

- Brunner GmbH

- Fameg Sp. z o.o.

Recent Developments

- In March 2025, Herman Miller announced the expansion of its commercial hospitality line featuring FSC-certified wood seating and tables tailored for restaurants and cafés.

- In February 2025, KI Furniture launched a new modular dining collection using reclaimed oak, optimized for high-traffic casual dining environments.

- In January 2025, Vitra introduced its “Hospitality by Design” program, integrating 3D configuration tools that allow restaurants to customize furniture layouts online before purchase.