Wireless Router Market Size

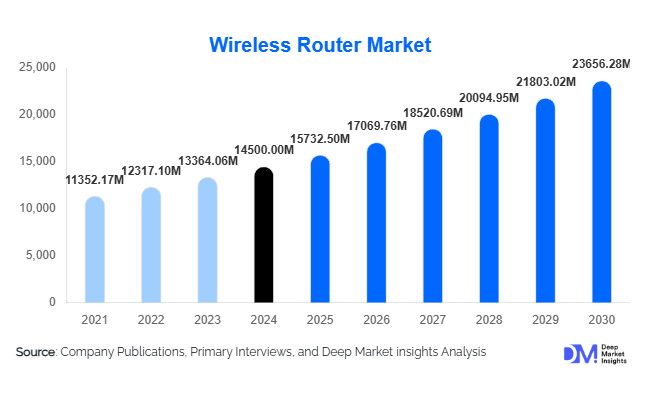

According to Deep Market Insights, the global wireless router market size was valued at USD 14,500 million in 2024 and is projected to grow from USD 15,732.5 million in 2025 to reach USD 23,656.28 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The market growth is primarily driven by the rising adoption of high-speed broadband, the proliferation of connected devices and smart homes, and rapid technological evolution toward Wi-Fi 6, 6E, and Wi-Fi 7 standards.

Key Market Insights

- Wi-Fi 6 and Wi-Fi 7 upgrades are transforming the router ecosystem, creating premium product segments with higher margins for manufacturers and ISPs.

- Mesh and tri-band routers are gaining mainstream adoption as households seek seamless, high-coverage connectivity for streaming, gaming, and remote work.

- Asia-Pacific leads the global wireless router market, accounting for roughly 34% of the 2024 market value, supported by surging broadband penetration and expanding middle-class demand.

- Residential applications dominate demand, representing more than 55% of total market revenues in 2024, with replacement and upgrade cycles driving volume growth.

- Price competition in entry-level routers continues to pressure margins, prompting vendors to differentiate through performance, software, and design.

- Government initiatives and private CapEx in broadband infrastructure across India, China, and Latin America are spurring next-phase router deployments.

What are the latest trends in the wireless router market?

Migration Toward Wi-Fi 6E and Wi-Fi 7 Standards

Consumers and enterprises are rapidly upgrading to the latest Wi-Fi standards, which offer multi-gigabit speeds, low latency, and enhanced spectrum efficiency. Wi-Fi 6 and 6E routers have become the benchmark for premium connectivity, while Wi-Fi 7 models are entering the consumer and enterprise segments from 2024 onward. Manufacturers are introducing AI-driven network optimization, smart QoS, and app-based network management as differentiators. This migration not only fuels new device sales but also allows vendors to upsell higher-margin tri-band and mesh routers equipped for future bandwidth demands.

Mesh Networking Becomes the New Standard for Homes

Mesh Wi-Fi systems, offering multiple nodes for complete home coverage, are transitioning from niche premium products to mainstream solutions. Consumers are prioritizing uninterrupted connectivity over raw speed, driving adoption of self-configuring, AI-optimized mesh routers. The trend is reinforced by hybrid work culture and the exponential growth in connected IoT devices, with vendors like TP-Link, Netgear, and ASUS leading global shipments in 2024. Mesh technology has effectively redefined the home-networking experience, enabling consistent signal strength and minimal dead zones across larger premises.

Service-Provider Bundled CPE and Managed Wi-Fi Solutions

Telecom and broadband service providers are increasingly bundling premium routers with subscription plans to deliver “managed Wi-Fi” experiences. Operators are deploying Wi-Fi 6/6E CPE (customer premises equipment) to differentiate offerings and enhance customer retention. This creates long-term supply opportunities for router OEMs through direct B2B contracts, especially in high-growth markets such as India, Brazil, and Southeast Asia. Cloud-based management and remote diagnostics are also becoming standard, signaling a shift from hardware-only sales toward service-driven router ecosystems.

What are the key drivers in the wireless router market?

Expanding Broadband Infrastructure and Multi-Gigabit Internet Access

Global investment in fiber-optic and 5G networks has accelerated broadband speeds, necessitating routers capable of handling multi-gigabit data throughput. As households subscribe to 1 Gbps and above, the demand for compatible routers is surging. Governments are subsidizing rural broadband expansion, particularly in APAC and LATAM, further fueling router sales. The infrastructure wave directly translates into sustained router replacement and upgrade cycles.

Proliferation of Connected Devices and Smart Homes

The number of connected devices per household surpassed 15 units on average in 2024, spanning smart TVs, IoT appliances, and security systems. The rise of AI-enabled and voice-controlled devices is intensifying bandwidth requirements. Consumers are prioritizing reliable Wi-Fi coverage across multiple rooms, propelling growth in dual-band, tri-band, and mesh routers. The smart-home ecosystem continues to be a structural growth driver, intertwining router demand with IoT innovation.

Technological Evolution and Premiumization

Continuous advancement in router technology, including MU-MIMO, OFDMA, beamforming, and multi-gig Ethernet, has elevated router functionality from commodity hardware to intelligent home-network hubs. Premiumization is visible in the increasing share of Wi-Fi 6E and Wi-Fi 7 routers. The integration of mobile-app management, security software, and cloud control fosters ecosystem lock-in, supporting recurring revenue models and higher ASPs (average selling prices).

What are the restraints for the global market?

Price Erosion and Commoditization

Intense competition among OEMs, particularly from cost-efficient Asian manufacturers, has caused rapid price erosion in entry-level routers. Consumers in emerging markets are highly price-sensitive, limiting the ability of brands to sustain margins. This commoditization forces manufacturers to differentiate through premium designs, firmware updates, and bundled services to maintain profitability.

Market Saturation in Developed Economies

In mature markets such as North America and Western Europe, broadband penetration already exceeds 90%, leading to elongated router replacement cycles. Economic headwinds and consumer reluctance to upgrade functioning devices further constrain growth. To offset saturation, vendors are focusing on enterprise, SMB, and managed Wi-Fi opportunities.

What are the key opportunities in the wireless router industry?

Next-Generation Wi-Fi 7 Adoption

The rollout of Wi-Fi 7 routers presents a significant growth opportunity. Offering speeds beyond 30 Gbps and enhanced latency control, Wi-Fi 7 will become central to AR/VR, 4K/8K streaming, and gaming. Manufacturers pioneering early-adoption products stand to capture premium market share and strengthen relationships with service providers planning high-speed CPE deployments.

Smart-Home and IoT Integration

Integrating routers into broader smart-home ecosystems presents untapped potential. Devices with built-in IoT controllers, Zigbee, Matter, and Thread support allow users to centralize home automation through one hub. This trend not only increases router relevance but also fosters recurring revenue streams via software subscriptions and ecosystem integration.

Emerging-Market Expansion and Digital-Inclusion Programs

Government-backed broadband initiatives in India, Brazil, Indonesia, and Africa are catalyzing first-time router adoption. Public–private partnerships promoting rural internet access and FWA (fixed wireless access) will unlock new addressable markets for router vendors. Affordable dual-band and mesh models customized for emerging-market conditions offer a substantial entry opportunity for both incumbents and new entrants.

Product Type Insights

90-Ball Bingo remains the dominant product format worldwide, contributing approximately 44% of total market revenue in 2024. Its enduring popularity stems from well-established gameplay mechanics, community-driven appeal, and large multiplayer rooms that facilitate high-value jackpots and social engagement. The format continues to thrive in markets such as the U.K., Spain, and Australia, where traditional bingo halls have successfully transitioned to online environments. Steady user engagement, frequent prize pools, and brand familiarity underpin the segment’s leadership.

75-Ball and 80-Ball Bingo formats are witnessing rapid adoption across North America and Asia. Their shorter gameplay cycles, faster round completions, and enhanced interactivity appeal to younger digital audiences seeking quick entertainment. These variants are also easier to integrate with mobile-first designs and social gaming elements, making them a favorite among app developers targeting Gen Z and millennial players. Niche formats such as Pattern and 30-Ball Bingo are emerging within social media gaming ecosystems, offering casual, micro-session gameplay and fostering viral engagement through influencer-led streaming and gamified leaderboards.

Platform Insights

Mobile applications dominate the online bingo landscape, accounting for approximately 60–65% of global revenue in 2024. This dominance is driven by the ubiquity of smartphones, improved in-app payment systems, and the rise of push-based engagement tools. Features such as real-time chat rooms, loyalty rewards, and social sharing options have turned mobile bingo into an interactive entertainment experience rather than a traditional gambling format. Furthermore, app-based ecosystems allow developers to launch live tournaments, influencer-hosted events, and cross-promotional campaigns, driving retention and monetization.

Web-based desktop platforms maintain relevance, particularly in mature markets like Europe and North America, where legacy user bases prefer traditional interfaces. Meanwhile, tablet-based play is gaining momentum among older demographics (ages 50+) who favor larger screens and simplified navigation. The convergence of these platforms through cross-device login systems and cloud synchronization has created a more integrated and user-centric ecosystem, enabling seamless gameplay across devices.

Business Model Insights

Pay-to-Play models remain the revenue backbone of the global online bingo industry, holding the largest market share in 2024. The model’s success lies in its ability to deliver stable cash flows, predictable ARPU (Average Revenue per User), and a consistent player base. Users in regulated markets are more inclined toward this structure, which ensures transparent payouts and compliance with gambling frameworks.

The Freemium model is growing rapidly, attracting new entrants through free participation, social engagement, and optional paid upgrades. It effectively bridges casual and serious players, enabling operators to expand user bases while experimenting with monetization through virtual goods and premium boosts. The Hybrid monetization approach, which blends in-app purchases, subscription passes, and advertisement placements, is emerging as the most sustainable revenue model globally. This approach allows operators to optimize both engagement and profitability, ensuring resilience against regulatory changes or user churn.

Demographic Insights

The 40+ age group currently represents the largest revenue-contributing demographic, accounting for approximately 45% of the global market in 2024. This segment benefits from higher discretionary spending power, brand loyalty, and a preference for social yet low-stress entertainment formats. Mature players also contribute to higher ARPU through participation in premium events and in-app purchases.

However, the 18–25 age group has emerged as the fastest-growing demographic segment, supported by gamified play, real-time streaming, and social integration. The introduction of dynamic UI designs, animated rooms, and influencer-hosted bingo sessions is driving youth engagement, especially across mobile ecosystems. Developers are increasingly tailoring game experiences with vibrant graphics, short sessions, and microtransaction features to cater to the entertainment consumption patterns of Gen Z and millennials.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe continues to lead the global online bingo market, accounting for approximately 46–48% of total revenue in 2024. The region’s leadership is underpinned by a well-regulated online gaming environment, strong consumer trust, and deep cultural familiarity with bingo as a social activity. The U.K., Spain, and Italy serve as major hubs, supported by structured licensing systems, responsible gaming regulations, and digital payment infrastructure.

Growth in Europe is driven by increasing mobile gaming penetration, the introduction of AI-driven personalization in gaming platforms, and cross-brand collaborations between online casinos and media companies. Furthermore, the European Union’s focus on digital entertainment innovation and data protection transparency ensures a stable and sustainable market environment. The shift toward eco-conscious and socially responsible gaming models is another emerging trend, particularly in Western Europe.

North America

North America holds approximately 30–32% of the global market share in 2024, supported by the progressive legalization of online gambling across several U.S. states and the mainstream adoption of digital entertainment platforms. The United States and Canada are witnessing strong traction for mobile and app-based bingo, particularly through integrations with major casino and media networks. The region benefits from a robust online payment infrastructure and growing cross-industry collaborations with sports betting and streaming services.

Regional growth drivers include the expansion of social gaming ecosystems, technological innovation in cloud-based multiplayer architecture, and partnerships with entertainment IPs (such as branded bingo events). Rising consumer trust in digital payments and increased regulatory clarity are expected to fuel further adoption over the forecast period.

Asia-Pacific

Asia-Pacific (APAC) is the fastest-growing regional market, projected to expand at a CAGR of approximately 8–9% from 2025 to 2030. The region’s momentum is powered by accelerating smartphone adoption, a surge in mobile-first entertainment habits, and the emergence of locally developed gaming content. Countries like India, Japan, Australia, and the Philippines are becoming new hotspots for online bingo platforms.

Key regional growth drivers include affordable internet access, expanding digital payment infrastructure, and increasing openness to regulated online gaming. The rise of vernacular-language apps and region-specific game formats has boosted user acquisition, while partnerships with influencers and streaming platforms have expanded the player community. The growing acceptance of microtransactions and in-app currencies also supports long-term revenue scalability in APAC.

Latin America

Latin America (LATAM) currently contributes about 5–8% of global revenue, with Brazil and Mexico leading adoption. Market expansion is being accelerated by ongoing regulatory liberalization, rising disposable incomes, and increasing demand for localized entertainment. Operators entering the region are focusing on customized payment gateways, Portuguese and Spanish-language platforms, and culturally adapted marketing campaigns.

LATAM’s growth is primarily driven by digital inclusion initiatives, mobile-first gaming penetration, and partnerships with regional telecom providers. The increasing prevalence of social and free-to-play bingo formats is also introducing new players to real-money gaming ecosystems. Over the next five years, the combination of favorable demographics and mobile broadband expansion is expected to make LATAM one of the most promising emerging markets globally.

Middle East & Africa

Middle East and Africa (MEA) currently represents about 3–5% of global market share, but the region’s long-term outlook is increasingly positive. While stricter gambling laws continue to limit real-money operations, a growing number of social bingo platforms and free-to-play gaming communities are fostering engagement in digital leisure spaces.

Growth is concentrated in Gulf Cooperation Council (GCC) countries such as the UAE and Saudi Arabia, where tourism-driven entertainment projects, smartphone penetration, and youth-centric digital habits are stimulating market participation. In Africa, particularly in South Africa and Nigeria, mobile wallet adoption and social gaming apps are expanding accessibility. Over time, increasing regulatory flexibility and the popularity of gamified social platforms could unlock significant untapped potential for MEA’s online bingo ecosystem.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wireless Router Market

- TP-Link Technologies Co., Ltd.

- Cisco Systems, Inc.

- Netgear, Inc.

- ASUS Tek Computer Inc.

- D-Link Corporation

- Huawei Technologies Co., Ltd.

- Ubiquiti Inc.

- Linksys (Belkin International, Inc.)

- Xiaomi Corporation

- Tenda Technology Co., Ltd.

- ZTE Corporation

- Buffalo Inc.

- MikroTik

- TPV Technology

- Ruckus Wireless (CommScope)

Recent Developments

- In August 2025, TP-Link launched its Wi-Fi 7 Archer series routers with multi-gig Ethernet and AI-driven network optimization, targeting premium home and gaming segments.

- In June 2025, Cisco Systems expanded its Meraki cloud router portfolio to serve enterprise campuses and SMBs, introducing AI-enabled security analytics.

- In April 2025, Netgear announced new Orbi mesh routers with Wi-Fi 6E support and sustainably sourced packaging to meet environmental targets.

- In March 2025, ASUS introduced a “Pro Series” line of routers optimized for content creators and small enterprises, featuring 2.5 Gbps ports and enhanced QoS management.