Wireless Printer Market Size

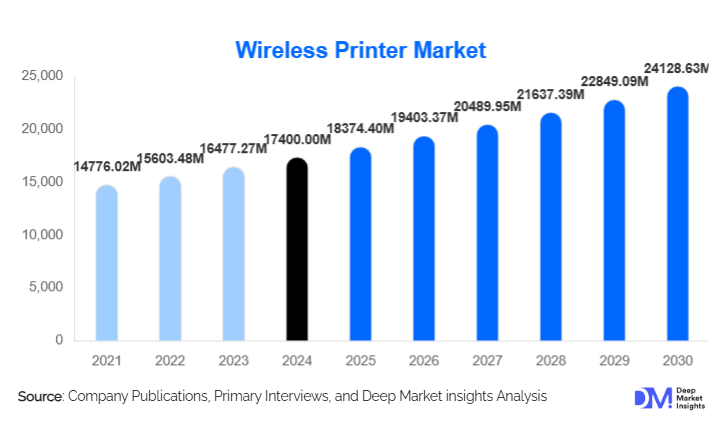

According to Deep Market Insights, the global wireless printer market size was valued at USD 17,400 million in 2024 and is projected to grow from USD 18,374.4 million in 2025 to reach USD 24,128.63 million by 2030, expanding at a CAGR of 5.6% during the forecast period (2025–2030). The wireless printer market growth is primarily driven by the widespread adoption of hybrid work environments, accelerated digital transformation across enterprises, and rapid expansion of cloud- and mobile-based printing ecosystems.

Key Market Insights

- Multifunction wireless inkjet printers dominate the market, accounting for over half of global revenue due to their affordability, versatility, and suitability for both home and office use.

- Wi-Fi-enabled wireless printers hold the largest connectivity share, driven by compatibility with multi-device environments and widespread adoption in commercial offices.

- North America leads the global market with strong enterprise IT spending and a mature digital infrastructure supporting cloud printing adoption.

- Asia-Pacific is the fastest-growing region, propelled by rising SME formation, home-office setups, and expanding digital penetration across India, China, and Southeast Asia.

- Security-focused wireless printers are gaining traction as enterprises prioritize encrypted printing, identity management, and secure remote workflows.

- Growing demand for mobile and cloud-integrated printing is reshaping the competitive landscape, encouraging OEMs to integrate app-based controls and managed print services.

What are the latest trends in the wireless printer market?

Cloud-Integrated and Mobile-First Printing Expands Rapidly

Wireless printing is increasingly shifting toward cloud-managed ecosystems. Users can now send print jobs remotely, authenticate through mobile apps, and manage consumables digitally. Cloud printing platforms are becoming essential for enterprises looking to streamline workflows and enable office mobility. Hybrid and remote employees are driving demand for printers that integrate with Google Cloud Print alternatives, OEM cloud suites, and corporate identity management systems. Meanwhile, mobile-first users, particularly in Asia-Pacific, are adopting printers optimized for smartphone-based control, reflecting a broader transition to app-centric connectivity in office equipment.

Eco-Efficient and Low-Cost Printing Technologies

Ink-tank printers, duplex-enabled systems, and energy-efficient wireless printers are witnessing rapid adoption as businesses seek to reduce operational costs. Eco-tank models significantly lower cost per page and appeal to both SMEs and households with high printing volumes. Manufacturers are integrating automated sleep modes, recyclable cartridges, and eco-certified materials to align with sustainability mandates. This trend supports long-term cost optimization and compliance with environmental regulations, especially in Europe and North America.

What are the key drivers in the wireless printer market?

Hybrid Work and Remote Productivity Fuel Printer Adoption

The surge in hybrid and remote work arrangements has significantly boosted the need for wireless printers that support multifunctional capabilities and seamless connectivity. Employees require flexible devices that integrate with personal laptops, tablets, and smartphones, and enterprises are investing in distributed print infrastructures to support decentralized teams. This shift has led to a sustained increase in home-office printer purchases and upgrades to enterprise wireless printer fleets.

Advancements in Wireless Connectivity Technology

Rapid evolution in wireless standards, including Wi-Fi 6, faster Bluetooth protocols, and encrypted wireless transmissions, is enhancing print speeds, signal reliability, and device compatibility. These improvements reduce connectivity failures and enable multi-user environments to function efficiently. Enterprises and consumers alike are upgrading older wired systems to leverage these enhanced wireless capabilities, driving consistent market expansion.

Growing Adoption of Cloud and Mobile Printing

The rise of cloud computing and mobile-centric workflows has significantly accelerated wireless printer deployment. Users increasingly print from cloud storage platforms, remote locations, and mobile devices without relying on dedicated print drivers. OEMs are integrating cloud management dashboards, app-based controls, and remote diagnostics, features increasingly attractive to both SMEs and large enterprises aiming to modernize document workflows.

What are the restraints for the global market?

Security and Data Privacy Concerns

As wireless printers become integrated into corporate networks, concerns over data breaches, intercepted print jobs, and firmware vulnerabilities have increased. Enterprises in regulated sectors, such as healthcare, government, and finance, face stringent compliance requirements that make wireless migration challenging. Without robust encryption, secure boot processes, and authentication controls, adoption rates may slow in security-sensitive environments.

High Total Cost of Ownership and Consumable Expenses

Despite declining hardware prices, ink and toner costs remain a significant restraint, particularly for high-volume users and cost-sensitive SMEs. Wireless multifunction printers often require premium consumables, firmware updates, and maintenance cycles that raise long-term ownership costs. Prolonged replacement cycles in mature markets also reduce annual hardware sales, putting pressure on OEMs to innovate and differentiate.

What are the key opportunities in the wireless printer industry?

Expansion Opportunities in Emerging Markets

Rapid digitalization and SME proliferation across Asia-Pacific, Latin America, and the Middle East present significant market expansion opportunities. Consumers in these regions increasingly prefer low-cost multifunction wireless printers, while enterprises seek scalable, cloud-managed solutions. Localized manufacturing, service networks, and affordability-focused models can help OEMs achieve rapid penetration.

Secure Enterprise-Grade Wireless Printing

Security-focused wireless printers, equipped with encrypted print pipelines, identity verification, secure firmware, and remote monitoring, are becoming essential for corporate and government users. OEMs that lead in this segment can tap into high-value contracts across regulated industries. This opportunity is further amplified by global cybersecurity regulations and rising corporate investments in secure IT infrastructure.

Growth of Managed Print Services & Subscription Models

The shift toward subscription-based print infrastructures is creating new revenue opportunities. Print-as-a-service models bundle hardware, ink/toner replenishment, maintenance, and cloud management into predictable monthly fees. As enterprises modernize document workflows and seek cost transparency, MPS adoption is expected to accelerate, favoring OEMs with advanced cloud and analytics capabilities.

Product Type Insights

Multifunction inkjet wireless printers dominate the market, capturing over 55% of the 2024 share due to their versatility and affordability. Laser wireless printers maintain strong adoption in enterprise environments, especially monochrome laser MFPs used for high-volume, secure printing. Thermal and mobile wireless printers are expanding rapidly in logistics, retail, and field services, segments prioritizing compact, portable solutions. Ink-tank wireless printers, known for low per-page costs, are particularly popular in emerging markets and among heavy-duty home-office users.

Application Insights

Commercial and enterprise applications represent the largest demand segment, accounting for 45% of global revenue as organizations modernize office infrastructure and adopt mobile/cloud workflows. Home-office printing is the fastest-growing application, driven by remote work adoption and rising consumer preference for multifunction wireless units. Education, government, and field-service sectors are increasing wireless printer procurement to support mobile device usage, digital classrooms, and on-the-go documentation. Portable wireless thermal printers are gaining ground in logistics and e-commerce last-mile delivery operations.

Distribution Channel Insights

Offline retail channels held the largest share (55%) in 2024, as consumers prefer in-store evaluation of printer quality, compatibility, and cost of consumables. However, online channels are growing rapidly, driven by transparent pricing, wider product availability, and platform-driven promotions. Direct B2B sales and subscription-based managed print services are expanding among enterprises seeking predictable costs and centralized fleet management. OEM websites and D2C platforms are improving digital configurators and remote-assistance tools to enhance customer acquisition.

End-User Insights

Enterprises remain the largest end-user category, adopting wireless printers to support distributed teams and modern IT architectures. Home-office users form the fastest-growing segment, fueled by global hybrid work adoption. Educational institutions increasingly deploy wireless MFPs to support student mobility and digital assignments. Retail, logistics, and industrial field services continue to adopt compact wireless printers to enable mobile receipts, labeling, and documentation. Healthcare applications are expanding in clinics and labs where secure wireless documentation is required.

| By Product Type | By Connectivity Type | By Functionality | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the wireless printer market with approximately 36% share in 2024. The U.S. drives the majority of demand due to advanced enterprise IT environments, strong consumer purchasing power, and widespread hybrid work adoption. Canada follows with rising demand in SMBs and educational institutions. The region’s strong cloud ecosystem and focus on secure printing support consistent market expansion.

Europe

Europe accounts for roughly 25% of the global market, with Germany, the U.K., and France as key contributors. The region emphasizes secure, eco-efficient printers aligned with data privacy mandates and sustainability goals. Enterprises are heavily investing in wireless multifunction devices as part of digital automation initiatives. Remote-work trends continue to drive residential printer upgrades.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at a pace exceeding the global average through 2030. Rising home-office adoption, SME growth, and cost-sensitive consumer behavior drive demand for ink-tank and multifunction wireless devices. China and India are central growth engines, while Japan, South Korea, and Southeast Asia continue to advance mobile-first printing adoption.

Latin America

Latin America shows a growing demand led by Brazil and Mexico, though the market remains cost-sensitive. SMEs increasingly adopt mid-range wireless multifunction printers to support digital business operations. Improving broadband infrastructure and rising e-commerce penetration support gradual market expansion.

Middle East & Africa

MEA shows rising adoption in GCC countries, UAE, Saudi Arabia, Qatar, due to digital government initiatives, high corporate IT investments, and hybrid-work transitions. Africa demonstrates gradual growth supported by educational modernization and SME digital enablement, though infrastructure constraints limit faster penetration.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wireless Printer Market

- HP Inc.

- Canon Inc.

- Seiko Epson Corporation

- Brother Industries Ltd.

- Xerox Corporation

- Ricoh Company Ltd.

- Lexmark International

- Kyocera Document Solutions

- Konica Minolta

- Oki Electric Industry

- Dell Technologies

- Sharp Corporation

- Toshiba Corporation

- Panasonic Corporation

- Samsung Electronics

Recent Developments

- In 2025, leading OEMs expanded cloud-printing platforms with enhanced mobile app integration to support hybrid workforces and decentralized print management.

- In late 2024, major players introduced secure enterprise-grade wireless printers featuring encrypted pipelines, identity recognition, and AI-driven remote diagnostics.

- In 2025, manufacturers launched new energy-efficient ink-tank wireless printers targeting emerging markets, offering up to 70% lower printing costs.