Wireless Keyboard Market Size

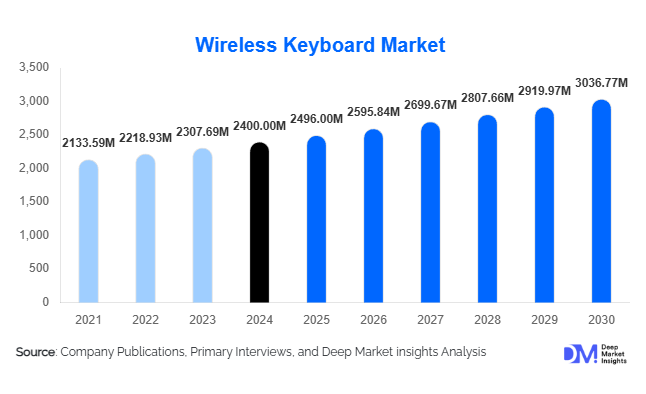

According to Deep Market Insights, the global wireless keyboard market size was valued at USD 2,400 million in 2024 and is projected to grow from USD 2,496 million in 2025 to reach USD 3,036.77 million by 2030, expanding at a CAGR of 4.0% during the forecast period (2025–2030). The wireless keyboard market growth is primarily driven by increasing adoption of remote work models, expansion of gaming and e-sports culture, and growing demand for compact, ergonomic, and high-performance peripherals.

Key Market Insights

- Bluetooth connectivity dominates the global wireless keyboard market, accounting for approximately 45% share in 2024, supported by multi-device compatibility and cross-platform usability.

- Asia-Pacific is the fastest-growing region, driven by expanding PC and gaming adoption across China, India, and Southeast Asia.

- Remote and hybrid work trends continue to propel demand for ergonomic and portable keyboards among office professionals and freelancers.

- Online retail channels lead distribution, contributing nearly 60% of market value due to growing e-commerce penetration and consumer preference for digital purchases.

- Premium wireless gaming keyboards are witnessing rapid growth as users prioritize performance, mechanical switches, RGB backlighting, and ultra-low-latency connections.

- The top five players hold around 55% of the global share, with strong brand positioning and product innovation by Logitech, Microsoft, Apple, Razer, and Corsair.

What are the latest trends in the wireless keyboard market?

Growth of Multi-Device and Ecosystem Integration

Manufacturers are designing wireless keyboards that seamlessly switch between multiple devices, including laptops, tablets, and smartphones. Integration with smart TVs, streaming devices, and home automation hubs is also becoming standard. Cross-ecosystem compatibility, low-latency Bluetooth 5.x connections, and universal USB-C charging are key differentiators. This trend aligns with consumer demand for streamlined digital workflows and enhances productivity across interconnected devices.

Rising Popularity of Ergonomic and Compact Designs

As home-office setups proliferate, demand for compact, foldable, and ergonomic keyboard layouts is rising. Tenkeyless and 60% designs have become mainstream, particularly among younger professionals and gamers who prefer portability and minimalist aesthetics. Split and tented ergonomic designs are gaining favor among health-conscious users to reduce wrist strain during prolonged typing. The trend reflects a broader shift toward comfort, space optimization, and hybrid work convenience.

Premiumization and Customization in Gaming Keyboards

Wireless mechanical gaming keyboards with customizable key switches, macro programming, and RGB lighting effects are transforming the peripheral landscape. Manufacturers such as Razer, Corsair, and Logitech are investing in ultra-low-latency RF connections and battery-efficient RGB systems. Consumers are increasingly willing to pay premium prices for performance-driven models, which now represent one of the fastest-growing product categories in the market.

What are the key drivers in the wireless keyboard market?

Expansion of Remote and Hybrid Work Culture

Global adoption of remote and hybrid work has significantly increased demand for wireless keyboards. Professionals prefer uncluttered, flexible workspaces, driving purchases of wireless peripherals that enhance mobility and aesthetics. Multi-device pairing features further boost productivity in dual-device setups combining laptops, tablets, and smartphones.

Rapid Growth of Gaming and E-Sports

The gaming segment contributes substantial value growth to the market. Wireless gaming keyboards are now viewed as essential equipment by professional and casual gamers alike, owing to low-latency connections and mechanical switch reliability. The surge in e-sports tournaments and streaming platforms continues to stimulate demand for high-end peripherals globally.

Technological Advancements in Wireless Connectivity

Improvements in Bluetooth LE, proprietary 2.4 GHz RF protocols, and rechargeable battery technology have enhanced the user experience. Latency issues, once limiting adoption, have been mitigated by modern chipsets, resulting in reliable connections and longer battery life. As wireless charging and dual-mode keyboards gain traction, the overall adoption curve is steepening across both consumer and enterprise markets.

What are the restraints for the global market?

Commoditization and Price Pressure

The standard wireless keyboard segment is increasingly commoditized, with numerous low-cost entrants from Asia flooding the market. Price sensitivity and margin erosion pose major challenges for established brands. This dynamic forces premium players to focus on differentiation through design, materials, and technology upgrades.

Long Replacement Cycles and Market Saturation

In developed regions, high product quality and slower technology obsolescence result in longer replacement cycles, limiting repeat sales. Market maturity in North America and Europe constrains volume growth, compelling manufacturers to explore emerging markets and premium sub-segments for continued expansion.

What are the key opportunities in the wireless keyboard industry?

Emerging Markets Expansion

Rising PC and gaming penetration in emerging economies like India, Brazil, Indonesia, and Vietnam presents a strong opportunity for market expansion. Localized product designs, affordable pricing, and partnerships with regional distributors can unlock new consumer bases in these markets.

Integration with Smart-Home and IoT Ecosystems

Smart-device proliferation is creating opportunities for wireless keyboards that connect with TVs, media centers, and smart-home hubs. Integration with voice assistants and multi-platform device switching will allow manufacturers to expand from PC peripherals into broader lifestyle electronics ecosystems.

Growth in Premium and Gaming Segments

High-performance wireless mechanical keyboards, especially those with customizable keys, RGB backlighting, and advanced connectivity, are seeing double-digit growth. Manufacturers can leverage this trend by targeting enthusiast communities and professional e-sports markets where performance and brand loyalty command premium pricing.

Product Type Insights

By design, standard full-size wireless keyboards dominate, holding about 40% of the global market share in 2024. These models are widely used across homes and offices due to affordability and functionality. Compact and ergonomic keyboards are the fastest-growing product types, while gaming-oriented mechanical keyboards represent the highest revenue per unit, thanks to premium pricing and high replacement frequency among gamers.

Application Insights

The consumer/home segment leads the market with approximately 55% share in 2024, driven by widespread device adoption for personal computing, home offices, and entertainment. The gaming/e-sports segment is the fastest-growing application, supported by rising global e-sports participation and streaming. Educational and institutional demand is also expanding as digital learning environments proliferate in emerging markets.

Distribution Channel Insights

Online retail channels account for about 60% of market value, fueled by e-commerce growth, competitive pricing, and the availability of consumer reviews. Brand-owned websites and global marketplaces (Amazon, JD.com, Flipkart) are key growth engines. Offline retail remains significant for corporate and institutional procurement, while OEM bundling contributes to stable enterprise volumes.

End-Use Insights

Consumers remain the primary end-users of wireless keyboards, followed by commercial offices and gaming centers. The educational sector is emerging as a notable demand source due to widespread digital adoption. Export-driven demand from Asian manufacturing hubs such as China, Taiwan, and South Korea sustains supply to major importing countries like the U.S., Germany, and Japan.

| By Product Type | By Connectivity Technology | By Device Compatibility | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 28% of the global market in 2024, with the U.S. dominating due to high device penetration, strong corporate spending, and a vibrant gaming culture. Growth remains stable, underpinned by early adoption of premium wireless keyboards and ergonomic innovations.

Europe

Europe accounts for around 22% of the global share, led by Germany, the U.K., and France. The region shows a growing preference for sustainable and ergonomic keyboard models. Mature consumer bases and rising enterprise automation support steady replacement demand.

Asia-Pacific

Asia-Pacific represents roughly 30% of the global market value and is the fastest-growing region. China leads manufacturing and domestic demand, while India and Southeast Asia are recording double-digit growth due to surging PC ownership and remote work adoption. Local brands and international players are expanding production capacities to serve this rapidly evolving market.

Latin America

Latin America holds nearly 12% of the market share in 2024, led by Brazil and Mexico. Rising affordability of consumer electronics and expansion of online retail are boosting peripheral sales. Gaming and education-related purchases are growing sub-segments.

Middle East & Africa

MEA accounts for about 8% of global demand. GCC nations show strong uptake of premium wireless keyboards, supported by high disposable income and enterprise digitalization. South Africa remains a key market for consumer and educational adoption. Regional growth is expected to accelerate with broader e-commerce penetration and technology localization.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wireless Keyboard Market

- Logitech International S.A.

- Microsoft Corporation

- Apple Inc.

- Razer Inc.

- Corsair Gaming Inc.

- HP Inc.

- Dell Technologies Inc.

- Lenovo Group Limited

- ASUSTeK Computer Inc.

- SteelSeries (GN Store Nord A/S)

- Keychron Inc.

- ZAGG Inc.

- Anker Innovations Limited

- Rapoo Technology Co., Ltd.

- Targus International LLC

Recent Developments

- In March 2025, Logitech introduced its new MX Mechanical Mini Wireless Keyboard featuring Bluetooth 5.3 multi-device pairing and improved energy efficiency for hybrid work setups.

- In February 2025, Razer launched the DeathStalker V3 Pro, a low-profile wireless gaming keyboard with ultra-low latency HyperSpeed Wireless technology.

- In January 2025, Keychron expanded its factory in China to increase the output of customizable wireless mechanical keyboards targeting professional and gaming users globally.