Winter Wear Market Size

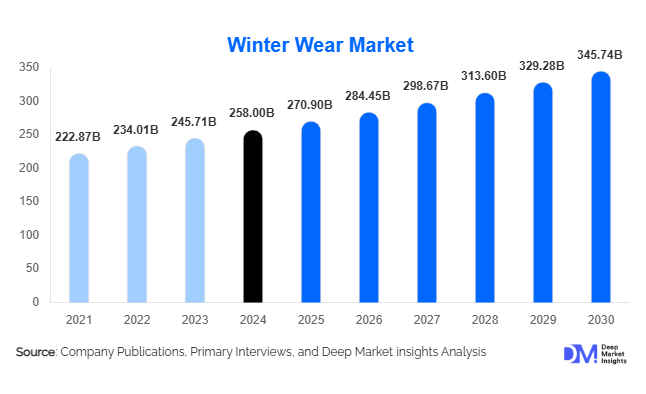

According to Deep Market Insights, the global winter wear market size was valued at USD 258 billion in 2024 and is projected to grow from USD 270.9 billion in 2025 to reach USD 345.74 billion by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030).. The growth of the winter wear market is primarily driven by the rising demand for fashion-forward cold-weather apparel, advancements in thermal insulation technology, and the expanding e-commerce retail landscape across emerging and developed economies.

Key Market Insights

- Global demand is shifting toward multifunctional, stylish, and performance-based winter apparel that combines comfort, fashion, and advanced insulation properties.

- Asia-Pacific dominates global market growth with rising middle-class income, growing winter tourism, and accelerated online retail penetration in China and India.

- Women’s winter wear remains the leading consumer segment, accounting for nearly 44% of global market share in 2024, driven by fashion trends and a variety of product offerings.

- Jackets, coats, and blazers represent the largest product category, contributing about 41.6% of the total market value in 2024.

- Man-made fabrics such as polyester, nylon, and technical blends dominate due to superior durability, insulation, and cost efficiency, accounting for approximately 48.5% of total material usage.

- Online retail channels are transforming sales dynamics, holding nearly 58% of the global market in 2024 and reshaping consumer access to seasonal apparel.

What are the latest trends in the winter wear market?

Eco-Friendly and Sustainable Winter Apparel

Consumers are increasingly demanding eco-conscious winter wear made from recycled polyester, organic cotton, and traceable down alternatives. Brands are integrating circular economy principles through take-back schemes, upcycling, and biodegradable insulation technologies. Sustainable manufacturing, transparent supply chains, and cruelty-free certifications are becoming standard for premium winter wear collections. This shift aligns with global sustainability movements and consumer desire for ethical fashion choices, especially in Europe and North America.

Smart and Heated Apparel Integration

Technological innovation is redefining the winter wear market. Smart jackets and heated apparel equipped with rechargeable batteries, temperature sensors, and app-based control systems are gaining popularity. Integration of graphene-based or aerogel insulation materials enhances warmth without bulk, making smart winter wear a growing sub-segment among tech-savvy consumers. Wearable technology partnerships and fashion-tech collaborations are fostering this evolution, especially within high-end and performance-oriented categories.

What are the key drivers in the winter wear market?

Rising Consumer Spending on Cold-Weather Lifestyle

Higher disposable incomes and increasing participation in outdoor winter activities such as skiing, snowboarding, and alpine tourism are driving sales of specialized and fashionable cold-weather gear. Consumers now view winter apparel as a lifestyle statement rather than a mere seasonal necessity, further elevating market demand for premium outerwear and accessories.

Technological Advancements in Fabric and Insulation

Continuous innovation in thermal fabrics, such as lightweight synthetic insulation, waterproof membranes, and moisture-wicking fibers, has expanded winter wear functionality. The development of hybrid materials blending natural and synthetic fibers provides warmth, breathability, and durability, appealing to both performance and fashion segments globally.

Rapid Expansion of E-Commerce and Omni-Channel Retail

Digital retail platforms have significantly increased accessibility and variety in winter wear. Advanced sizing tools, AR-based fitting rooms, and virtual product visualization have improved online shopping confidence. Direct-to-consumer (DTC) models allow brands to offer seasonal promotions and reach untapped markets, fueling steady sales growth in emerging economies.

What are the restraints for the global market?

Seasonal Demand and Climate Variability

The market’s seasonality poses inventory and cash-flow challenges. Unpredictable winters and global warming trends can reduce demand, leading to markdowns and overstock issues for retailers. Climate irregularities, particularly in Europe and North America, continue to impact overall sales consistency year to year.

Rising Raw Material and Production Costs

Premium fabrics such as down, wool, and high-performance synthetics are increasingly expensive due to supply chain disruptions and rising energy costs. Manufacturers face shrinking margins, especially in budget segments, as material price volatility limits competitive pricing flexibility across global markets.

What are the key opportunities in the winter wear industry?

Emerging Market Expansion

Rapid urbanization and rising disposable incomes in Asia-Pacific, Latin America, and parts of Africa present untapped growth potential. Consumers in these regions are beginning to adopt winter wear not only for function but also for fashion, especially due to exposure to global trends via e-commerce and travel.

Material Innovation and Smart Textiles

The integration of advanced materials such as aerogel insulation, recycled synthetics, and nanotechnology-based fabrics offers immense opportunity for differentiation. Smart textiles with heating elements, adaptive insulation, and climate-responsive fabrics are paving the way for new premium product lines.

Sustainable Manufacturing and Circular Economy Models

Brands that emphasize eco-friendly practices such as carbon-neutral production, traceable sourcing, and garment recycling are gaining favor with eco-conscious consumers. Investments in closed-loop supply chains and green labeling are expected to enhance brand loyalty and profit margins in the coming years.

Product Type Insights

Jackets, coats, and blazers dominate the global winter wear product landscape, accounting for approximately 41.6% of total market value in 2024. Their leadership stems from a combination of versatility, durability, and broad applicability across diverse climates, from temperate urban regions to severe cold zones. Product innovation continues to reinforce this dominance, with brands investing in lightweight insulation technologies, breathable yet waterproof outer shells, and integrated smart-heating systems. The growing popularity of hybrid outerwear, blending fashion aesthetics with technical performance, is further expanding this category’s reach among both urban professionals and outdoor enthusiasts. Other rapidly growing product categories include sweaters, hoodies, and thermal base layers, which are benefiting from the global shift toward comfort-driven, layered fashion. The trend toward athleisure and casual outerwear has also amplified demand for multipurpose garments that balance warmth, flexibility, and style for both indoor and outdoor use.

Consumer Insights

Women’s winter wear continues to lead the consumer segment, capturing approximately 44% of the market in 2024. This dominance is driven by higher fashion turnover, diverse style preferences, and expanding participation of women in the global workforce, which influences seasonal wardrobe renewal. The segment benefits from a wide product portfolio encompassing luxury fashion, functional outerwear, and fast-fashion categories. Men’s winter wear follows closely, supported by rising demand for performance-oriented apparel such as insulated jackets, corporate overcoats, and outdoor adventure gear. The children’s winter wear category, though smaller in market volume, is projected to record the fastest CAGR through 2030, driven by parental emphasis on safety, comfort, and premium materials like hypoallergenic down and organic cotton blends. Additionally, growing marketing of “mini-me” collections, adult-inspired styles tailored for children, is boosting segmental growth across premium and mid-tier brands.

Material Insights

Man-made and synthetic fabrics hold a commanding share of nearly 48.5% of the global market, favored for their cost-efficiency, superior thermal insulation, and easy maintenance. Advanced synthetics such as polyester blends, nylon shells, and microfleece linings are widely adopted across mass-market and performance wear categories. The sustainability trend has spurred strong uptake of recycled polyester (rPET) and bio-based synthetics derived from renewable sources, as major brands commit to reducing carbon footprints. In contrast, natural fibers like wool, cashmere, and down remain integral to luxury and heritage winter wear lines, prized for their comfort, breathability, and timeless appeal. A significant market trend is the rise of hybrid materials that combine synthetic durability with natural softness, providing improved thermal regulation and reduced environmental impact, a key differentiator in premium and eco-conscious collections.

Distribution Channel Insights

Online retail dominates the global winter wear distribution landscape, accounting for nearly 58% of sales in 2024. The rapid expansion of e-commerce platforms, digital fashion marketplaces, and direct-to-consumer (D2C) websites has made winter wear more accessible to consumers worldwide. Advanced online fitting technologies, augmented reality try-on tools, and integrated sustainability filters are transforming consumer buying behavior. Moreover, online-exclusive launches and influencer-driven marketing campaigns have boosted brand visibility, particularly among younger demographics. Despite the digital surge, offline channels such as specialty boutiques and department stores maintain relevance by offering personalized shopping experiences, premium fittings, and immediate product availability. The rise of hybrid retail formats, including “click-and-collect” services and pop-up experiential stores, highlights the growing importance of omnichannel strategies that merge digital convenience with in-store engagement.

| By Product Type | By Consumer Type | By Material Type | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America commands approximately 30% of the global market share, anchored by robust demand from the United States and Canada. The region’s prolonged winter seasons, high disposable incomes, and established preference for branded and performance-oriented apparel sustain market dominance. Key growth drivers include the surge in sustainable and locally made fashion, increasing penetration of heated and smart outerwear technologies, and the expansion of D2C channels by premium brands such as Patagonia and The North Face. The U.S. market is witnessing heightened adoption of hybrid lifestyle wear, while Canada continues to be a hub for luxury winter outerwear exports. Rising winter sports participation and a growing focus on ethically sourced materials are further propelling demand.

Europe

Europe holds around 34% of total global revenue, driven by strong consumption in Germany, the U.K., France, and the Nordic countries. The region’s well-defined winter seasons, stringent sustainability regulations, and mature fashion ecosystem make it a powerhouse for eco-conscious winter wear. European consumers show increasing preference for recycled wool, organic cotton, and responsibly sourced down, aligning with the EU’s circular economy directives. The regional market benefits from innovation in thermal textile engineering and the resurgence of heritage brands promoting “slow fashion.” Growth is further supported by high tourism inflows to colder destinations, urban outdoor trends, and premiumization in countries like Italy and Switzerland. Continued R&D in biodegradable synthetics and government-backed sustainability campaigns are set to strengthen Europe’s leadership through 2030.

Asia-Pacific

Asia-Pacific (APAC) is the fastest-growing regional market, accounting for nearly 35.4% of the global market in 2024. China remains the largest contributor, supported by robust domestic production capacity and a rapidly expanding middle class. India, with an estimated CAGR of around 7%, is emerging as a high-potential market driven by urbanization, fashion-conscious youth demographics, and aggressive online retail penetration. Japan and South Korea continue to influence regional fashion trends with their focus on functional, minimalist, and high-tech winter apparel. Meanwhile, the region’s manufacturing powerhouses — China, Bangladesh, and Vietnam — are benefiting from export-led demand and global sourcing partnerships. Government incentives for textile innovation, coupled with rapid cold-weather apparel adoption in Southeast Asia’s high-altitude regions, are further accelerating APAC growth.

Latin America

Latin America accounts for approximately 5–7% of global revenue, showing consistent growth in countries such as Brazil, Argentina, and Mexico. The region’s expansion is supported by increasing fashion awareness, expanding winter tourism, and growing retail partnerships with international brands. Rising outbound travel to colder destinations, such as Europe and North America, has fueled demand for premium winter wear, particularly among middle-income consumers. The entry of global fast-fashion players, combined with the rise of local e-commerce platforms, has improved accessibility and affordability of winter apparel. Additionally, seasonal retail campaigns and cross-border online trade with U.S. and European markets continue to drive incremental sales.

Middle East & Africa

The Middle East & Africa (MEA) region, while contributing a modest share, is witnessing a steady rise in demand for luxury and travel-driven winter wear. Countries such as the UAE, Saudi Arabia, and South Africa lead regional consumption, supported by expanding expatriate populations, outbound winter tourism, and the presence of international retail chains. High-income consumers in the Gulf are increasingly purchasing imported high-end outerwear from brands like Moncler and Canada Goose. Moreover, climate-controlled environments and the growing culture of travel to colder destinations sustain year-round demand. Africa’s southern nations are emerging as potential growth areas, with improving retail infrastructure and the gradual rise of local fashion manufacturing ecosystems.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Winter Wear Market

- VF Corporation

- Columbia Sportswear Company

- Canada Goose Holdings Inc.

- Moncler S.p.A.

- Patagonia Inc.

- H&M Hennes & Mauritz AB

- Inditex (Zara)

- Gap Inc.

- LVMH Moët Hennessy Louis Vuitton

- Arc’teryx Equipment Inc.

- Helly Hansen

- Decathlon

- Fast Retailing Co. (Uniqlo)

- Timberland (VF brand)

- The North Face (VF brand)

Recent Developments

- In June 2025, Canada Goose announced its expansion into Southeast Asia, launching flagship stores with eco-certified winter collections targeting tropical-country travelers visiting colder destinations.

- In April 2025, Columbia Sportswear unveiled its new Omni-Heat Infinity line featuring aerogel-based insulation, offering superior lightweight warmth for high-performance winter apparel.

- In February 2025, Moncler introduced its “Re-Moncler” circular fashion initiative to recycle old jackets and reduce carbon emissions across its European supply chain.