Wine Cabinets Market Size

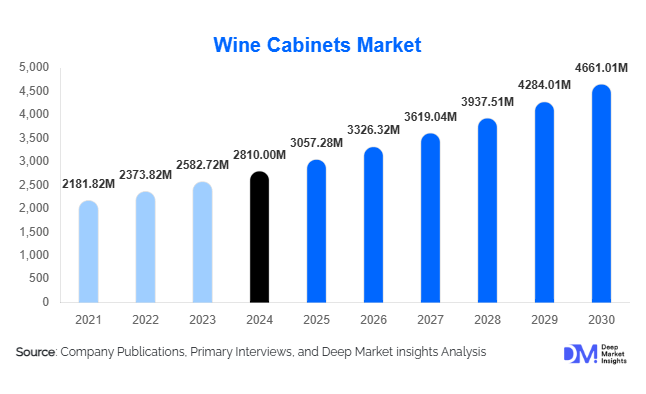

According to Deep Market Insights, the global wine cabinets market size was valued at USD 2,810 million in 2024 and is projected to grow from USD 3,057.28 million in 2025 to reach USD 4,661.01 million by 2030, expanding at a CAGR of 8.8% during the forecast period (2025–2030). The wine cabinets market growth is driven by the rising global wine consumption, increasing adoption of premium home appliances for wine storage, and growing consumer focus on preserving wine quality under optimal temperature conditions.

Key Market Insights

- Growing premiumization in home appliances is driving demand for high-end, technologically advanced wine cabinets equipped with smart temperature control, humidity regulation, and energy-efficient cooling systems.

- Residential applications dominate the market as urban households and wine enthusiasts increasingly integrate wine storage units into kitchen and living room designs.

- Commercial segments, including restaurants, hotels, and wine bars, are expanding rapidly, emphasizing aesthetic display and professional preservation standards.

- North America leads the global market due to strong wine culture, high disposable incomes, and widespread integration of luxury kitchen appliances.

- Asia-Pacific is the fastest-growing region, with China and Japan showing strong adoption of smart home systems and a growing appreciation for wine culture.

- Technological integration—including IoT-enabled monitoring, app-controlled cooling, and digital thermoregulation—is reshaping the user experience and fueling innovation in product design.

Latest Market Trends

Rise of Smart and Connected Wine Cabinets

Manufacturers are increasingly focusing on IoT-enabled wine cabinets that allow users to remotely monitor and adjust temperature, humidity, and lighting through mobile apps. These smart cabinets are gaining traction among tech-savvy consumers seeking convenience and precision in wine preservation. Integration with home automation systems like Alexa, Google Home, and Apple HomeKit is further enhancing the user experience. Brands are also introducing AI-based temperature adjustment systems that optimize conditions based on wine type and aging potential.

Design and Aesthetic Innovation

Modern wine cabinets are evolving from mere storage units to design-centric furniture pieces. Sleek, minimalistic, and customizable designs with materials such as brushed steel, smoked glass, and sustainable wood are gaining popularity. Interior LED lighting, modular shelving, and silent compressor technology are key differentiators. The integration of wine cabinets into kitchen islands, living room walls, and entertainment spaces is transforming them into both functional and decorative home accessories.

Wine Cabinets Market Drivers

Growing Global Wine Consumption

The steady increase in global wine consumption, particularly among millennials and urban consumers, is fueling demand for convenient, in-home wine storage solutions. Consumers are becoming more educated about wine preservation, leading to greater awareness of temperature and humidity control needs. Emerging wine markets such as China, India, and Southeast Asia are also contributing significantly to overall market growth.

Increasing Adoption of Premium Lifestyle Appliances

Rising disposable incomes and lifestyle upgrades are encouraging consumers to invest in premium home appliances. Wine cabinets are being positioned as both status symbols and essential equipment for wine enthusiasts. Manufacturers are capitalizing on this by offering high-end models with smart control panels, multi-zone temperature systems, and elegant finishes tailored for modern interiors.

Market Restraints

High Cost of Advanced Models

Premium wine cabinets with smart connectivity, dual cooling zones, and energy-efficient compressors are often expensive, limiting accessibility among price-sensitive consumers. High import duties on luxury home appliances in certain regions further increase the cost burden. This poses a challenge for manufacturers seeking broader market penetration, particularly in developing economies.

Energy Consumption and Environmental Concerns

Wine cabinets require consistent energy for temperature regulation, leading to concerns over energy efficiency and environmental impact. As sustainability becomes a key consumer criterion, manufacturers face pressure to develop eco-friendly refrigeration technologies. Stricter government regulations on appliance energy ratings are influencing product design and compliance costs.

Wine Cabinets Market Opportunities

Expansion of Smart Home Ecosystems

The proliferation of smart home technologies presents a major opportunity for wine cabinet manufacturers. Integration with connected home platforms enables seamless management and monitoring, appealing to affluent and tech-oriented consumers. Partnerships between appliance brands and smart home solution providers are expected to enhance functionality and expand product appeal.

Growth of Commercial and Hospitality Applications

The rapid expansion of high-end restaurants, luxury hotels, and wine-tasting lounges is driving commercial demand for wine cabinets. These establishments require large-capacity, visually appealing, and efficient storage systems to maintain wine quality and enhance customer experience. Custom-built and modular designs tailored for commercial interiors are becoming increasingly popular in this segment.

Product Type Insights

Freestanding wine cabinets dominate the global market, offering flexibility in placement and a wide range of capacities. Built-in wine cabinets are gaining traction in modern kitchens and premium apartments for their seamless integration and space-saving design. Small-capacity models cater to urban consumers with limited space, while large-capacity and multi-zone units are preferred by collectors and hospitality clients seeking precise temperature zoning for different wine types.

Application Insights

The residential segment accounts for the largest market share, supported by rising wine culture and luxury kitchen remodeling trends. Commercial applications—including fine dining restaurants, bars, and hotels—are witnessing strong growth due to increased emphasis on presentation, preservation, and customer experience. Additionally, retail wine outlets and tasting rooms are adopting advanced display cabinets to attract premium buyers.

Distribution Channel Insights

Offline retail stores such as specialty appliance outlets, kitchenware showrooms, and electronics retailers remain dominant due to consumer preference for physical inspection and consultation before purchase. However, online channels are rapidly gaining momentum, driven by digital catalogs, virtual demos, and home delivery services. E-commerce platforms and direct-to-consumer brand websites are expanding their offerings, providing customizable purchasing options and after-sales services.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global wine cabinets market, with strong demand from the U.S. and Canada. The region’s mature wine culture, high purchasing power, and growing adoption of luxury home appliances contribute to dominance. Rising integration of wine storage units in smart homes and residential remodeling projects further supports market expansion.

Europe

Europe represents a significant market, driven by established wine-producing nations such as France, Italy, and Spain. High household wine consumption and a preference for premium-quality storage systems sustain steady demand. The region is also witnessing strong growth in energy-efficient and eco-certified appliances aligned with EU sustainability standards.

Asia-Pacific

Asia-Pacific is projected to register the fastest CAGR during the forecast period. Rapid urbanization, rising disposable incomes, and increasing interest in wine culture across China, Japan, Australia, and South Korea are propelling growth. The expanding middle-class segment and the rise of luxury home renovations are creating new opportunities for market players.

Latin America

Countries such as Brazil, Argentina, and Chile are emerging as promising markets due to strong domestic wine industries and growing middle-class affluence. Local manufacturers are beginning to introduce affordable, energy-efficient models tailored to regional consumer preferences.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, shows growing demand for high-end wine storage systems among expatriates and luxury hospitality venues. In Africa, South Africa’s robust wine industry and tourism sector drive localized demand for commercial wine cabinets in restaurants and wineries.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wine Cabinets Market

- Haier Group

- Liebherr

- Electrolux AB

- Danby Appliances

- EuroCave

- Perlick Corporation

- NewAir

- Avanti Products

- Whirlpool Corporation

Recent Developments

- In September 2025, Haier introduced a new range of IoT-enabled wine cabinets with AI-driven temperature adjustment and dual-zone cooling in Europe and North America.

- In July 2025, Liebherr launched an eco-friendly wine storage line featuring low-GWP refrigerants and improved energy efficiency, aligned with EU environmental standards.

- In May 2025, Electrolux expanded its premium “Vintec” series with smart connectivity and customizable storage modules targeting luxury kitchen designs.