Wet Grinders Market Size

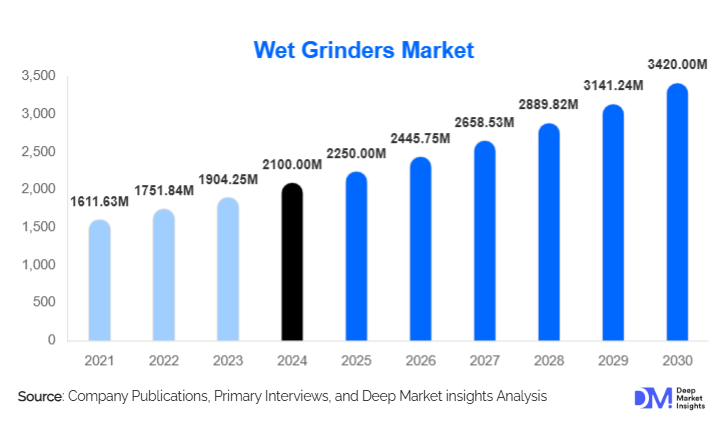

According to Deep Market Insights, the global wet grinders market size was valued at USD 2,100 million in 2024 and is projected to grow from USD 2,250 million in 2025 to reach USD 3,420 million by 2030, expanding at a CAGR of 8.7% during the forecast period (2025–2030). The growth of the wet grinders market is driven by rising demand for convenient and energy-efficient kitchen appliances, growing adoption of smart and automated grinding technologies, and increasing penetration in both residential and commercial segments across developing economies.

Key Market Insights

- Rising adoption of smart kitchen appliances is driving the demand for technologically advanced wet grinders with automation, noise reduction, and energy-efficient features.

- Commercial foodservice expansion, including restaurants, canteens, and cloud kitchens, is fueling the need for high-capacity industrial wet grinders.

- India dominates the global market, accounting for over 55% of total revenue share due to strong domestic manufacturing and cultural reliance on traditional food processing.

- Asia-Pacific remains the fastest-growing region, supported by urbanization, rising disposable incomes, and increasing adoption of home cooking appliances.

- Product innovations such as tilting and tabletop designs, stainless steel drums, and digital control panels are reshaping user convenience and aesthetics.

- E-commerce channels continue to expand product reach, offering competitive pricing, digital promotions, and direct-to-consumer accessibility.

Latest Market Trends

Smart and IoT-Enabled Wet Grinders Gaining Momentum

Manufacturers are integrating Internet of Things (IoT) technologies into wet grinders, allowing users to monitor and control operations via mobile apps. Smart sensors for load detection, auto shut-off, and customized grinding presets are becoming mainstream. These innovations cater to tech-savvy urban consumers seeking convenience and efficiency in food preparation. The trend aligns with the broader movement toward smart kitchens, where connected appliances enhance energy management, safety, and automation.

Rising Demand for Compact and Aesthetic Designs

With urban living spaces becoming smaller, compact tabletop and tilting wet grinders are witnessing higher adoption. Consumers increasingly prefer appliances that balance functionality and visual appeal. Manufacturers are focusing on sleek, modern designs with durable materials, improved ergonomics, and reduced noise levels. The integration of transparent lids, LED indicators, and customizable colors is further driving premiumization in the segment.

Wet Grinders Market Drivers

Growing Preference for Home-Cooked and Traditional Foods

The resurgence of home cooking and traditional cuisine, particularly in India and Southeast Asia, is fueling demand for wet grinders. Consumers are seeking appliances that deliver authentic texture and taste in dishes such as dosa, idli, chutney, and batters. The trend is amplified by rising health consciousness and preference for freshly prepared food over processed alternatives. Wet grinders remain integral to these culinary traditions, ensuring consistent grinding quality and nutrient retention.

Expansion of Commercial Kitchens and Food Processing Units

The increasing number of restaurants, cloud kitchens, and food manufacturing units is boosting demand for commercial wet grinders. These high-capacity machines are essential for large-scale batter and paste preparation. Manufacturers are developing energy-efficient and heavy-duty grinders with enhanced motor durability and easy maintenance to cater to institutional and industrial clients. The commercial segment also benefits from government initiatives promoting local food processing and small-scale enterprises.

Market Restraints

High Maintenance and Operational Costs

Wet grinders require regular maintenance to ensure optimal performance. The cost of spare parts, electricity consumption, and water usage can increase long-term expenses for users. Motor overheating, blade wear, and drum corrosion are common challenges that deter potential buyers, particularly in cost-sensitive markets. These operational concerns limit adoption among lower-income consumers.

Availability of Substitute Products

The growing popularity of multipurpose food processors and mixer grinders poses a threat to the wet grinders market. These substitutes offer convenience and compactness at lower prices, appealing to urban consumers with limited kitchen space. The multifunctional capability of these devices can reduce dependence on dedicated wet grinders, particularly in regions outside South Asia where traditional grinding methods are less prevalent.

Market Opportunities

Eco-Friendly and Energy-Efficient Models

The demand for sustainable kitchen appliances is creating opportunities for manufacturers to introduce eco-friendly wet grinders. Models with energy-efficient motors, low-noise operation, and recyclable materials appeal to environmentally conscious consumers. Companies investing in green certifications and energy-star rated designs can capture this emerging niche while aligning with global sustainability goals.

Rural Market Penetration and Localization

Rural electrification and rising disposable incomes are expanding the potential customer base in developing economies. Manufacturers are introducing affordable, durable, and easy-to-maintain models tailored to rural users. Localized marketing campaigns, installment-based financing, and service network expansion are expected to enhance rural adoption rates and strengthen brand loyalty in untapped regions.

Product Type Insights

Tilting wet grinders dominate the market due to their ergonomic design, allowing easy batter transfer and cleaning. Tabletop wet grinders are gaining popularity among urban households for their compactness and ease of use. Commercial wet grinders cater to restaurants and catering services, featuring higher capacities and heavy-duty construction. Manufacturers are also introducing hybrid models that combine tilting and tabletop features for added convenience.

Application Insights

Residential applications hold the majority share, driven by home cooking trends and demand for traditional food preparation. The commercial segment is expanding rapidly in hospitality, food processing, and institutional catering sectors. Specialized variants designed for continuous operation and heavy loads are increasingly in demand for industrial kitchens and bakeries.

Distribution Channel Insights

Offline retail channels, including specialty appliance stores and hypermarkets, remain dominant due to the need for in-person product demonstration and service support. However, online sales are growing at the fastest rate, supported by e-commerce platforms like Amazon, Flipkart, and regional digital retailers offering discounts, installation services, and easy returns. Direct-to-consumer (D2C) brands are also emerging, leveraging online channels to bypass intermediaries and offer competitive pricing.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds the largest share of the global wet grinders market, led by India, Sri Lanka, and Indonesia. India remains the production and consumption hub, supported by strong domestic manufacturing and established distribution networks. Rapid urbanization and rising disposable income levels are further fueling product adoption across both urban and rural households.

North America

The North American market is growing steadily, driven by increasing demand from Indian and South Asian diaspora communities. Manufacturers are introducing compact, energy-compliant models suitable for Western kitchen designs. Online retail and brand collaborations are helping expand market penetration in the U.S. and Canada.

Europe

Europe’s wet grinders market is experiencing gradual growth, with the U.K., Germany, and France leading adoption. The increasing popularity of multicultural cuisine and global cooking trends is supporting niche demand. Product imports from India and partnerships with regional distributors are enhancing accessibility.

Middle East & Africa

Countries such as the UAE, Saudi Arabia, and South Africa are witnessing rising demand for wet grinders due to the growth of Indian and Asian expatriate populations. The expansion of the foodservice sector and increasing preference for authentic ethnic dishes are further driving regional sales.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wet Grinders Market

- Elgi Ultra Appliances Pvt. Ltd.

- Butterfly Gandhimathi Appliances Ltd.

- Preethi Kitchen Appliances Pvt. Ltd.

- Panasonic Corporation

- Premier Kitchen Appliances

- Vidiem

- Bajaj Electricals Ltd.

- PVG Wet Grinders

- Orient Electric Ltd.

- TTK Prestige Ltd.

Recent Developments

- In June 2025, Elgi Ultra introduced its new range of IoT-enabled wet grinders with smart speed control and auto timer features, aimed at the premium urban segment.

- In April 2025, Butterfly Appliances launched its “EcoSmart” series with energy-efficient motors and recyclable stainless steel drums, targeting sustainability-conscious consumers.

- In February 2025, Panasonic India announced the expansion of its small appliance portfolio to include AI-assisted wet grinders designed for consistent grinding quality and minimal wastage.