Weightlifting Belts Market Size

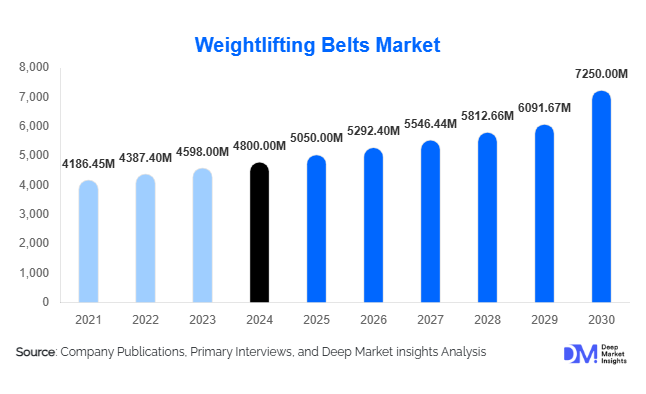

According to Deep Market Insights, the global weightlifting belts market size was valued at USD 4,800 million in 2024 and is projected to grow from USD 5,050 million in 2025 to reach USD 7,250 million by 2030, expanding at a CAGR of 4.8% during the forecast period (2025–2030). The growth of the weightlifting belts market is primarily driven by the rising popularity of strength training and functional fitness, increasing awareness about injury prevention during heavy lifting, and the expansion of premium and specialized belts tailored to both professional and recreational lifters.

Key Market Insights

- Leather belts dominate the material segment, accounting for nearly 45–50% of the global market in 2024 due to their durability, rigidity, and preference among professional powerlifters and competitive athletes.

- Online retail and e-commerce channels are becoming the fastest-growing distribution avenues, offering wider reach, customization, and direct-to-consumer sales, particularly in developed markets.

- North America holds the largest market share, with the U.S. and Canada leading demand due to high disposable income, a strong gym culture, and widespread adoption of premium belts.

- Asia-Pacific is emerging as the fastest-growing region, driven by rising middle-class affluence, urbanization, and expanding gym and home fitness penetration in India, China, and Southeast Asia.

- Technological adoption, including hybrid materials, ergonomic designs, and early integration of sensors for posture monitoring, is reshaping product offerings and enhancing user engagement.

Latest Market Trends

Premium and Discipline-Specific Belts Gaining Traction

Weightlifting belts designed for specific disciplines, such as powerlifting, Olympic lifting, CrossFit, and bodybuilding, are increasingly favored by consumers. Premium leather belts with lever or prong buckles dominate professional segments, providing maximum support for heavy lifts. Meanwhile, synthetic, Velcro, or hybrid belts are gaining popularity among recreational and home gym users due to comfort and flexibility. Brands are introducing customized belts with varying widths, thicknesses, and closure mechanisms to cater to niche segments. This trend reflects consumer demand for belts that balance safety, performance, and ergonomics while addressing different lifting disciplines.

Integration of Smart and Sustainable Features

Innovation in material and technology is shaping the market, with emerging belts incorporating sensor technology for posture monitoring, intra-abdominal pressure tracking, and lift feedback. Simultaneously, consumer demand for sustainable products is rising, prompting manufacturers to explore eco-friendly leather alternatives, recycled synthetics, and low-impact manufacturing processes. Brands investing in smart and environmentally responsible products are capturing premium segments and differentiating themselves in a competitive landscape. Sustainability and technology integration also provide opportunities for partnerships with fitness apps, gyms, and sports analytics platforms.

Weightlifting Belts Market Drivers

Increasing Fitness and Strength Training Adoption

The global rise of strength training, functional fitness, CrossFit, and bodybuilding is driving demand for weightlifting belts. Gyms, boutique fitness studios, and home gyms are proliferating, and strength training is becoming a mainstream lifestyle choice. This trend fuels adoption across both professional athletes and recreational users, creating sustained demand for belts across price tiers and materials. Moreover, the popularity of competitive lifting events, including powerlifting and strongman competitions, ensures consistent demand for high-quality belts in the professional segment.

Focus on Injury Prevention and Ergonomics

Awareness of lower back injuries and improper lifting techniques has led to a growing preference for supportive belts. Both competitive athletes and fitness enthusiasts use belts to improve core stability and reduce the risk of injury during heavy lifts. Compliance with competition regulations, safety certifications, and physiotherapist recommendations further reinforces belt adoption. This safety-driven demand encourages innovation in materials, design, and adjustable closure mechanisms.

Advances in Materials and Design

Modern belts employ hybrid materials, ergonomic contours, and advanced closures such as lever mechanisms to improve user comfort and performance. Manufacturers are combining leather, neoprene, nylon, and metal reinforcements to deliver belts that are durable yet lightweight and flexible. Innovations in design allow for a greater range of motion, quick adjustments, and discipline-specific support. These improvements increase adoption among both elite athletes and recreational users seeking premium performance and comfort.

Market Restraints

High Cost of Premium Belts

Leather and lever-buckle belts designed for competition-grade lifting are priced significantly higher than standard synthetic or Velcro belts. Price-sensitive consumers, particularly in emerging markets or among beginners, may opt for low-cost alternatives, limiting market penetration for premium products. High manufacturing and raw material costs, especially for leather and metal buckles, further contribute to pricing pressures.

Durability and Comfort Trade-Offs

Rigid leather belts provide strong support but require break-in periods and may reduce mobility, whereas softer synthetic belts may be comfortable but insufficient for heavy lifts. Users may experience dissatisfaction with improper sizing or design, resulting in returns or reduced repeat purchases. Supply chain challenges related to high-quality materials can exacerbate durability concerns, impacting brand perception and market growth.

Weightlifting Belts Market Opportunities

Smart and Connected Belts

Belts integrated with sensor technology and connected fitness apps offer real-time feedback on posture, intra-abdominal pressure, and lift performance. This innovation appeals to professional athletes, CrossFit enthusiasts, and tech-savvy consumers. Smart belts enable differentiation, command premium pricing, and create opportunities for partnerships with digital fitness platforms and wearable technology providers. As the wearable tech market expands, connected belts are likely to capture an increasing market share.

Sustainable and Eco-Friendly Products

Manufacturers focusing on environmentally responsible materials and processes can target environmentally conscious consumers. Eco-tanned leather, recycled synthetics, and hybrid belts with minimal environmental impact are gaining popularity. Marketing sustainability credentials, along with ergonomic design, enhances brand value and consumer loyalty. This trend also aligns with global efforts to reduce the carbon footprint of fitness equipment manufacturing.

Regional Expansion into Emerging Markets

Emerging regions in Asia-Pacific, Latin America, and the Middle East & Africa offer untapped potential. Rising disposable incomes, urbanization, and growing gym culture in countries such as India, China, and Brazil drive belt demand. Manufacturers can introduce mid-tier, affordable products, establish local production or distribution hubs, and partner with gyms and fitness influencers to accelerate market penetration. These regions are expected to exhibit higher-than-average CAGR compared to mature markets in North America and Europe.

Product Type Insights

Leather belts dominate premium and competition segments, favored for their durability, rigidity, and professional appeal. Nylon, neoprene, and hybrid belts are increasingly popular among recreational lifters, CrossFit participants, and home gym users due to comfort and flexibility. Lever-buckle belts are gaining traction in professional lifting, while Velcro belts remain widely adopted for light to moderate training. Custom sizes and discipline-specific designs are becoming a differentiator, particularly in online and D2C channels, allowing manufacturers to cater to diverse consumer needs.

Application Insights

Powerlifting and competitive lifting account for the largest application share, driven by professional athlete adoption and competition requirements. CrossFit and functional fitness represent a rapidly growing segment, leveraging lightweight and flexible belts. Bodybuilding, general fitness, and rehabilitation/physical therapy applications are emerging, reflecting growing health awareness and integration of belts into broader wellness routines. Home gym usage is expanding post-pandemic, driving volume in mid-tier belt categories. Overall, discipline-specific customization is a key driver of adoption across applications.

Distribution Channel Insights

Online retail dominates growth, offering direct-to-consumer sales, global reach, and customization options. E-commerce platforms allow consumers to compare sizes, materials, and reviews, supporting informed purchase decisions. Offline retail, including sporting goods stores and gym-based shops, remains important for fit and feel. Subscription-based and membership-driven sales models are emerging, particularly for premium belts, enhancing customer loyalty. Social media, influencer marketing, and digital campaigns are increasingly shaping consumer decisions across distribution channels.

End-User Insights

Fitness enthusiasts and recreational gym-goers constitute the largest volume segment, while professional athletes and competitive lifters generate higher revenue per unit. The home gym segment is expanding rapidly, driven by urbanization and post-pandemic lifestyle shifts. Rehabilitation and physical therapy applications are emerging, particularly in developed markets, reflecting increasing integration of belts into health and wellness routines. Collectively, these end-user segments are driving overall market growth, with premium belts benefiting from professional adoption and mid-tier belts capturing recreational users.

Age Group Insights

The 31–50 age group accounts for the largest revenue share, balancing disposable income with active participation in strength training. The 18–30 age group drives growth in volume, particularly in CrossFit, functional fitness, and home gym segments. The 51–65 and 65+ segments represent niche premium markets, focusing on rehabilitation, posture support, and controlled weightlifting activities. Younger consumers often prioritize digital engagement, customization, and price-conscious purchases, while older demographics value durability, comfort, and ergonomic design.

| By Product Type | By Closure Type | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest market, led by the U.S. and Canada, accounting for approximately 35–40% of global demand in 2024. High disposable income, a strong gym and competitive lifting culture, and established e-commerce penetration drive growth. Premium and lever-buckle belts are particularly popular, supported by professional competitions and recreational adoption. Customized and smart belts are increasingly adopted by tech-savvy consumers.

Europe

Europe holds around 20–25% of the global market in 2024, with Germany, the U.K., and France leading demand. Sustainability, ergonomic design, and discipline-specific belts are driving growth. Eastern Europe, particularly Poland and Romania, represents the fastest-growing sub-region, fueled by rising fitness awareness, new gym chains, and increasing disposable income.

Asia-Pacific

Asia-Pacific is emerging as the fastest-growing region, with India, China, Japan, and Southeast Asia contributing to a rapidly expanding market. Increasing middle-class affluence, urbanization, home gym adoption, and rising fitness awareness are key drivers. Mid-tier belts for recreational users and premium belts for emerging professional athletes are experiencing significant uptake. CAGR in this region is projected to exceed the global average, reaching 6–8% during the forecast period.

Latin America

Brazil, Mexico, and Argentina are leading Latin American demand. Affluent consumers increasingly prefer premium belts, while mid-tier and entry-level belts cater to recreational users. Outbound adoption of international brands is also growing. CAGR is expected to be slightly above the global average due to urbanization and rising health awareness.

Middle East & Africa

Gulf countries such as the UAE, Saudi Arabia, and Qatar are seeing rapid adoption due to high-income populations and fitness awareness. Africa remains a smaller but growing market, with increasing interest in both recreational and professional lifting. Urban centers and gyms are primary growth drivers, while e-commerce channels facilitate access to premium and specialized belts.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Weightlifting Belts Market

- Rogue Fitness

- Titan Fitness

- Harbinger

- Inzer Advance Designs

- SBD Apparel

- Iron Bull Strength

- Schiek Sports

- ProFitness

- Gymreapers

- Dark Iron Fitness

- RDX Sports

- Valeo

- Spud Inc.

- REP Fitness

- Mark Bell Sling Shot

Recent Developments

- In March 2025, Rogue Fitness launched a new series of premium lever-buckle belts with advanced hybrid leather and synthetic materials, targeting professional powerlifters and competitive athletes.

- In January 2025, Titan Fitness expanded its e-commerce operations in Asia-Pacific, introducing mid-tier belts tailored for CrossFit and recreational users.

- In December 2024, SBD Apparel partnered with fitness wearable companies to integrate posture and lift monitoring sensors into select premium belts for professional athletes.