Weighted Blanket Market Size

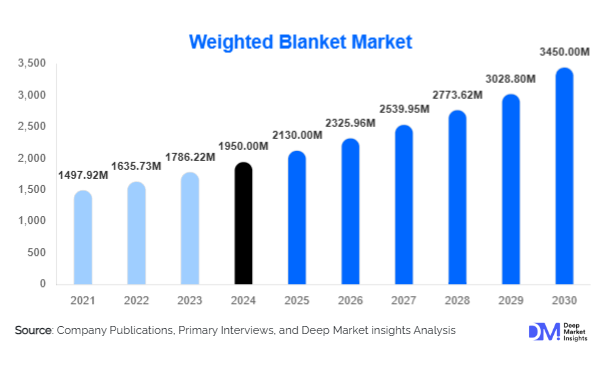

According to Deep Market Insights, the global weighted blanket market size was valued at USD 1,950 million in 2024 and is projected to grow from USD 2,130 million in 2025 to reach USD 3,450 million by 2030, expanding at a CAGR of 9.2% during the forecast period (2025-2030). The market growth is primarily driven by rising awareness of mental health and sleep disorders, growing consumer preference for comfort and therapeutic bedding, and increased adoption of weighted blankets across residential, healthcare, and wellness sectors worldwide.

Key Market Insights

- Weighted blankets are increasingly adopted for mental health and sleep therapy, addressing stress, anxiety, and insomnia, which is fueling demand across both healthcare and residential segments.

- Innovative materials and customizable products such as cotton, bamboo, and glass bead fillings are helping manufacturers cater to diverse consumer preferences globally.

- North America dominates the market, led by the U.S., due to high awareness, premium product adoption, and strong e-commerce penetration.

- Asia-Pacific is the fastest-growing region, with China and India showing strong adoption driven by urbanization, rising disposable income, and mental wellness awareness.

- Online retail is reshaping distribution, providing direct-to-consumer access, product customization, and broader availability in previously underserved regions.

- Technological integration and sustainable products, including smart blankets and eco-friendly fillings, are driving premiumization and innovation in the market.

What are the latest trends in the weighted blanket market?

Rise of Therapeutic & Mental Health Applications

Weighted blankets are increasingly recognized for their therapeutic benefits. Hospitals, clinics, and wellness centers are integrating weighted blankets into treatment protocols for stress, anxiety, and insomnia. Deep pressure stimulation, provided by weighted blankets, has been shown to reduce cortisol levels, improve sleep quality, and enhance overall well-being. The shift toward preventive and wellness-focused healthcare is encouraging both residential and institutional adoption, creating a strong market pull for high-quality, therapeutic blankets.

Customization and Material Innovation

Manufacturers are offering a variety of materials, including cotton, bamboo, polyester, and blends, as well as different weights ranging from 2 kg to over 10 kg. Glass bead fillings are increasingly preferred over plastic pellets due to better durability and even weight distribution. Eco-friendly and hypoallergenic options are gaining traction among health-conscious and environmentally aware consumers. Customization options, such as choice of size, weight, and fabric, are helping brands differentiate in a competitive market.

What are the key drivers in the weighted blanket market?

Growing Awareness of Mental Health and Sleep Disorders

The rising prevalence of anxiety, stress, and insomnia worldwide has increased demand for weighted blankets as effective non-pharmaceutical solutions. Consumers are increasingly seeking products that offer relaxation, comfort, and therapeutic benefits, driving growth across residential and healthcare applications.

Expanding E-commerce and Direct-to-Consumer Channels

The proliferation of online retail platforms has made weighted blankets accessible globally. Consumers can easily compare products, read reviews, and customize their choices, contributing to rapid adoption. E-commerce also allows brands to reach emerging markets with limited offline retail presence.

Premiumization and Material Innovation

Manufacturers are leveraging innovations in fillings, fabrics, and smart integrations to target premium segments. High-quality materials like glass beads, bamboo fibers, and hypoallergenic fabrics attract health-conscious consumers and justify higher price points, enhancing profitability and market growth.

What are the restraints for the global market?

High Cost of Premium Products

Weighted blankets, especially those made with glass beads or eco-friendly fabrics, are relatively expensive, limiting penetration in price-sensitive markets. High costs can deter potential buyers in developing regions, slowing growth in emerging economies.

Limited Awareness in Emerging Regions

Many consumers in Asia-Pacific, Latin America, and Africa are still unfamiliar with weighted blankets. Limited education and exposure to the product act as barriers to adoption, restricting market expansion outside developed regions.

What are the key opportunities in the weighted blanket industry?

Expansion in the Mental Health & Wellness Sector

Healthcare and wellness centers represent a growing opportunity. Hospitals, stress clinics, and wellness resorts are increasingly incorporating weighted blankets into therapeutic and relaxation programs. Collaborations with healthcare providers can help position weighted blankets as clinically recommended solutions for insomnia and anxiety management.

Smart Bedding and Technological Integration

The integration of smart technologies, such as temperature-regulating fabrics and sleep monitoring sensors, allows manufacturers to offer premium, differentiated products. Technology-enhanced weighted blankets appeal to younger, tech-savvy consumers seeking personalized wellness solutions.

Geographic Expansion in Emerging Markets

Asia-Pacific and Latin America offer untapped potential. Urban populations in China, India, and Brazil are increasingly seeking wellness products, with e-commerce enabling easy access. Localized marketing and affordable options can accelerate adoption in these regions.

Product Type Insights

Cotton weighted blankets dominate the market, accounting for approximately 35% of the global share in 2024. Consumers prefer natural fabrics for comfort, durability, and ease of maintenance. Polyester blankets follow closely, offering affordability and ease of cleaning. Bamboo and other eco-friendly options are gaining traction among premium and health-conscious buyers, reflecting increasing consumer preference for sustainable and hypoallergenic products.

Filling Material Insights

Glass bead-filled blankets are the most popular, holding 42% of the global market. They provide even weight distribution, durability, and a premium feel, driving adoption in both residential and therapeutic applications. Plastic pellets and natural fillings are niche segments, catering to cost-sensitive and eco-conscious buyers, respectively.

Distribution Channel Insights

Online retail channels account for 40% of market share and are growing rapidly. E-commerce platforms provide convenient access, product reviews, and customization options. Offline stores, including specialty bedding shops and department stores, remain significant for consumers seeking tactile evaluation and premium experiences.

End-Use Insights

Residential applications dominate with a 65% market share in 2024, driven by growing awareness of sleep quality and mental health. Healthcare and therapeutic centers are emerging as fast-growing segments, while hospitality and wellness industries are exploring weighted blankets for premium guest experiences. Export-driven demand is rising, particularly from North America and Europe, where wellness tourism is fueling adoption.

| By Product Type | By Filling Material | By Weight Category | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest market, representing 45% of global demand in 2024. The U.S. leads due to high consumer awareness, adoption of premium products, and e-commerce penetration. Canada shows steady growth, driven by wellness trends and mental health initiatives.

Europe

Europe accounts for 25% of the market, led by Germany, the U.K., and France. Rising disposable income and a strong wellness culture support demand. Eco-friendly and therapeutic products are particularly popular, aligning with European preferences for sustainable and health-focused goods.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China, India, and Japan leading adoption. Urbanization, rising incomes, and awareness of wellness products are driving market expansion. E-commerce penetration and social media marketing further accelerate growth in these countries.

Latin America

Brazil, Mexico, and Argentina are gradually adopting weighted blankets, primarily for residential and wellness applications. Affluent consumers are showing growing interest in lifestyle and therapeutic products.

Middle East & Africa

While overall demand is moderate, high-income populations in the UAE, Saudi Arabia, and South Africa are driving premium adoption. Intra-African sales are also increasing, particularly in urban centers with rising interest in wellness products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Weighted Blanket Market

- Gravity Blankets

- Mosaic Weighted Blankets

- Quility

- YnM

- Brookstone

- Harkla

- Baloo Living

- Bearaby

- SensaCalm

- Layla Sleep

- Weighted Comfort

- Huggaroo

- Sleep Innovations

- Chill-Its

- Nest Bedding

Recent Developments

- In June 2025, Gravity Blankets launched a new line of eco-friendly bamboo and glass bead blankets targeting health-conscious consumers in North America and Europe.

- In April 2025, Brookstone expanded its online distribution channels to Asia-Pacific, leveraging local e-commerce platforms for wider reach.

- In March 2025, Bearaby introduced a smart weighted blanket integrating sleep tracking sensors and temperature-regulating fabrics, aimed at premium wellness segments.