Wedding Services Market Size

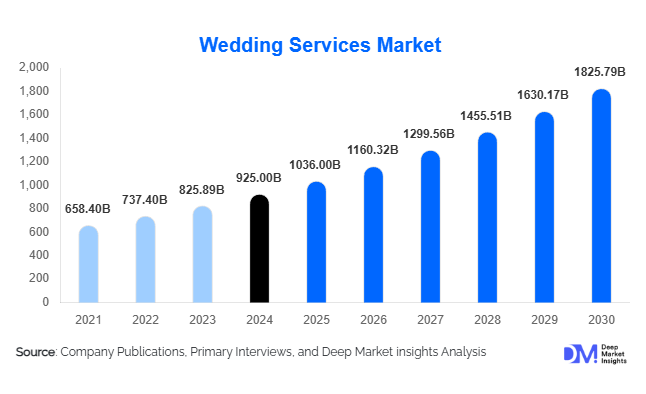

According to Deep Market Insights, the global wedding services market size was valued at USD 925.00 billion in 2024 and is projected to grow from USD 1,036.00 billion in 2025 to reach USD 1,825.79 billion by 2030, expanding at a CAGR of 12.0% during the forecast period (2025–2030). The wedding services market growth is primarily driven by the rising preference for personalized, experiential, and destination weddings; expanding disposable incomes across emerging economies; and the rapid adoption of digital planning and booking platforms, transforming how couples plan, book, and execute weddings worldwide.

Key Market Insights

- Asia-Pacific dominates the global wedding services market, accounting for over 41% of total revenue in 2024, driven by high wedding frequency, cultural significance, and growing disposable incomes.

- Local wedding services remain the largest segment, representing around 75% of the global market in 2024, though destination weddings are growing fastest in value terms.

- Digital and hybrid wedding planning platforms are reshaping vendor engagement, budgeting, and event coordination, especially among tech-savvy millennials and Gen Z couples.

- Photography and videography services account for nearly 35% of service revenues, supported by social media demand and immersive content creation trends.

- India, China, and the UAE are emerging as global hubs for luxury and destination weddings, backed by hospitality expansion and government tourism initiatives.

- Sustainability, personalization, and immersive guest experiences are key differentiators in the competitive landscape, leading to increased spend per wedding.

Latest Market Trends

Digitalization of Wedding Planning and Vendor Services

The digital transformation of the wedding industry is accelerating. Online platforms and mobile apps now handle everything from venue selection and vendor booking to guest list management and live-streaming. Couples increasingly prefer hybrid models, using online tools for planning while relying on offline partners for execution. Artificial intelligence (AI) is being integrated for budget optimization, vendor recommendations, and guest personalization. Virtual venue tours and 3D visualization technologies allow couples to experience setups before finalizing decisions. This digital shift enhances transparency, reduces planning time, and expands the global reach of service providers.

Rise of Sustainable and Experience-Driven Weddings

Environmental awareness is reshaping wedding choices. Couples are prioritizing sustainable décor, locally sourced catering, eco-friendly invitations, and waste reduction. Experience-driven weddings, such as cultural immersion, interactive entertainment, and storytelling themes, are replacing traditional ceremonies. Venues offering carbon-neutral or zero-waste packages are seeing higher demand. Planners who combine sustainability with luxury, integrating cultural authenticity and unique guest experiences, are creating long-term brand value in an increasingly conscious market.

Wedding Services Market Drivers

Rising Disposable Income and Premiumization of Weddings

Global income growth, particularly in Asia-Pacific and the Middle East, is driving higher spending on weddings. Couples are investing more in décor, entertainment, and luxury venues. In countries such as India and China, weddings are seen as major social and cultural events, often spanning several days and involving extensive service requirements. Premiumization trends, such as luxury resorts, bespoke décor, and celebrity wedding planners, are elevating the industry’s value proposition and driving revenue growth.

Growth of Destination Weddings

Destination weddings have evolved from niche to mainstream, appealing to couples seeking exclusivity and memorable experiences. Countries such as Thailand, Italy, Greece, the Maldives, and the UAE are leading venues for global destination weddings. Governments are supporting this trend by simplifying visa processes and investing in hospitality infrastructure. The surge in international travel post-pandemic has further revived this segment, making it one of the fastest-growing opportunities within the market.

Technology and Social Media Influence

Social media platforms like Instagram, Pinterest, and TikTok significantly influence modern wedding aesthetics. Couples use these platforms to plan, share, and document their celebrations, amplifying demand for professional photography, cinematography, and stylized décor. This “influencer effect” not only drives visual-centric services but also pushes vendors to innovate in presentation, lighting, and production value, resulting in an overall uplift in market demand and pricing power.

Market Restraints

Economic Volatility and Rising Costs

Inflation, currency fluctuations, and higher commodity prices, particularly for food, décor materials, and logistics, are pressuring margins for service providers. While premium consumers continue to spend, mid-tier and budget weddings are scaling back, affecting volume growth. Economic downturns or uncertainties can delay or reduce wedding expenditures, particularly in developed economies.

Regulatory and Logistical Complexities in Destination Weddings

Destination weddings often face challenges related to cross-border logistics, licensing, customs clearance for décor materials, and coordination among international vendors. Differences in legal marriage requirements, travel restrictions, and environmental regulations can delay or complicate planning. Providers entering this segment must build cross-national expertise and partnerships to manage these complexities efficiently.

Wedding Services Market Opportunities

Expansion of Online and Hybrid Wedding Platforms

The integration of digital technology into wedding planning is opening significant opportunities. Online portals that connect couples with verified vendors, manage budgets, and provide real-time updates are witnessing high adoption. Hybrid models, where couples use digital tools to plan but execute offline, create scalability for service providers. These platforms also offer data insights, enabling upselling and personalized recommendations, boosting overall revenue potential.

Emerging Destination Wedding Hubs

Countries across Asia-Pacific and the Middle East, including India, Indonesia, Thailand, and the UAE, are investing heavily in hospitality infrastructure to position themselves as global wedding destinations. Governments offering tax incentives and tourism campaigns, such as “Wedding in Paradise” in Indonesia and “Wed in Dubai,” are driving international visibility. These initiatives create lucrative opportunities for wedding planners, travel operators, and hospitality chains to bundle full-service packages for high-spending couples.

Sustainable and Experiential Wedding Services

Eco-friendly and personalized weddings are reshaping market dynamics. From biodegradable décor to farm-to-table catering, sustainability has become a mainstream demand. Experience-centric weddings, offering live entertainment, storytelling ceremonies, and immersive guest activities, allow providers to command premium pricing. This shift aligns with global consumer trends toward authenticity and environmental responsibility, unlocking new niches for creative service providers.

Product Type Insights

Among service categories, photography and videography services lead the market, representing approximately 35% of total revenue in 2024. The demand for high-quality content creation, live streaming, and drone videography has surged alongside social media influence. Venue and catering services follow closely, driven by the need for premium hospitality and personalized experiences. Wedding planning and coordination services are also expanding rapidly, supported by the growing complexity of multi-day and destination events.

Distribution Channel Insights

Offline bookings continue to dominate, capturing nearly 76% of global market share in 2024, reflecting couples’ preference for in-person consultations and physical venue inspections. However, online booking platforms are witnessing the fastest growth rate, driven by convenience, transparent pricing, and digital-native consumers. Hybrid models that combine virtual planning tools with offline execution are expected to become the industry standard by 2030.

Event Scale Insights

Large-scale weddings (500+ guests) hold the majority market share globally, particularly across India, China, and the Middle East, where multi-day celebrations are culturally ingrained. However, micro-weddings and elopements are rising sharply, especially in Western markets, due to cost efficiency and preference for intimate, personalized experiences. These smaller formats also enable sustainable and destination-focused celebrations, catering to millennial and Gen Z couples.

| By Service Type | By Wedding Type | By Channel Type | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents a mature but high-value wedding services market, driven by luxury destination and boutique weddings. The U.S. remains a global trendsetter, with rising adoption of hybrid and themed weddings. High disposable incomes and innovation in wedding décor and entertainment sustain steady growth. Canada and Mexico are also witnessing an uptick in cross-border and destination weddings.

Europe

Europe’s wedding services industry thrives on elegance, heritage venues, and themed luxury experiences. The U.K., Italy, France, and Spain are leading destinations for both domestic and international weddings. The region’s growth is moderate but steady, underpinned by the popularity of heritage properties, vineyards, and seaside locales. Sustainability-focused and cultural weddings are particularly gaining traction among younger couples.

Asia-Pacific

Asia-Pacific dominates the global market with a 41% share in 2024, led by India, China, Japan, and Southeast Asia. India alone represents a market of approximately USD 104 billion in 2024 and is forecast to grow at a CAGR of 14.3% through 2030. The region benefits from large populations, cultural emphasis on grand weddings, and expanding hospitality sectors. Rising disposable income and government promotion of wedding tourism (e.g., “Wed in India”) further amplify growth.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is rapidly emerging as a global hub for destination weddings, driven by luxury resorts, scenic venues, and government initiatives promoting event tourism. Africa, while smaller in market share, offers unique potential through exotic venues, safari lodges, and scenic coastal destinations, attracting international couples seeking distinctive experiences.

Latin America

Latin America is an emerging participant in the global wedding services ecosystem. Countries such as Brazil, Argentina, and Mexico are witnessing growth in wedding tourism and cross-border ceremonies. The region’s picturesque beaches and historical architecture are attracting both domestic and foreign couples, though infrastructure and marketing limitations currently cap large-scale growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wedding Services Market

- BAQAA Glamour Weddings and Events

- Augusta Cole Events

- A Charming Fête

- David Stark Design and Production

- Colin Cowie Lifestyle

- Lindsay Landman Events

- JZ Events

- Eventures Asia

- Nordic Adventure Weddings

- Elan Events by Nikki

- ByBruce Russell Luxury Weddings

- Preston Bailey Designs

- Shanqh Luxury Events (Pvt Ltd)

- Panache Events & Decor

- Marcy Blum Associates

Recent Developments

- In September 2025, BAQAA Glamour Weddings announced the launch of a “Green Luxury” wedding line featuring zero-waste décor and carbon-neutral planning packages across the UAE and Europe.

- In June 2025, Colin Cowie Lifestyle partnered with multiple luxury resorts in Bali and Mauritius to expand destination wedding offerings, integrating curated travel and hospitality services.

- In March 2025, Eventures Asia unveiled an AI-powered wedding planning platform to streamline vendor management, budgeting, and virtual guest coordination for multi-day destination weddings.