Wearable Payment Devices Market Size

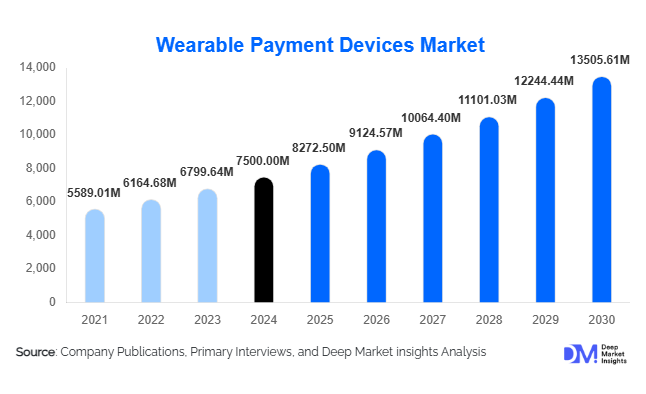

According to Deep Market Insights, the global wearable payment devices market size was valued at USD 7,500 million in 2024 and is projected to grow from USD 8,272.50 million in 2025 to reach USD 13,505.61 million by 2030, expanding at a CAGR of 10.3% during the forecast period (2025–2030). The market growth is primarily driven by the rising adoption of contactless payments, integration of payment features with smart wearable devices, and increasing demand for secure, convenient, and tech-enabled financial transactions across consumer and corporate segments.

Key Market Insights

- Smartwatches and fitness bands dominate the wearable payment devices market due to their multifunctional capabilities, integrating health tracking with seamless payment functionality.

- NFC technology remains the leading payment enabler, while emerging solutions such as BLE and biometric authentication are driving innovation and expanding adoption.

- North America leads the market, accounting for 35% of the global share, driven by high digital payment adoption, tech-savvy consumers, and early NFC infrastructure deployment.

- Asia-Pacific is the fastest-growing region, with a CAGR of 12%, driven by rising smartphone penetration, digital banking growth, and government initiatives promoting cashless economies.

- Retail and e-commerce applications are leading end-use segments, benefiting from frequent small-value transactions and integration with loyalty programs.

- Technological adoption, including biometric authentication, tokenized payments, and integration with health and fitness apps, is reshaping consumer engagement and trust.

What are the latest trends in the wearable payment devices market?

Integration with Fitness and Health Ecosystems

Wearable payment devices are increasingly combining payment functionality with health and fitness tracking. Consumers are adopting devices that monitor heart rate, steps, and other metrics while enabling seamless transactions in gyms, hospitals, and wellness centers. This convergence enhances device utility, increases adoption rates, and opens cross-selling opportunities for fintech companies and wearable manufacturers. Manufacturers are innovating by adding biometric security, AI-driven insights, and personalized financial services to create all-in-one devices that appeal to health-conscious and tech-savvy consumers.

Advancements in Security and Biometric Payments

Security is a primary focus for wearable payment devices. The market is seeing the integration of fingerprint, iris scanning, and tokenized payment systems into wearables, ensuring secure and frictionless transactions. Biometric authentication reduces fraud risk and enhances consumer confidence. Emerging devices are combining encrypted NFC and BLE technologies to provide contactless payment solutions across retail, transportation, and corporate environments, making wearables more reliable and user-friendly for a wide audience.

What are the key drivers in the wearable payment devices market?

Rising Contactless Payment Adoption

Consumer preference for touch-free transactions has accelerated the adoption of NFC-enabled wearable devices. Contactless payments accounted for nearly 60% of wearable payment transactions in 2024, driven by convenience, speed, and hygiene concerns during and after the COVID-19 pandemic. Retailers, transportation systems, and hospitality sectors are increasingly accepting wearable payments, creating a positive ecosystem for further growth.

Technological Convergence of Wearables

Smart devices are no longer limited to communication or fitness tracking; they are evolving into multifunctional tools that integrate payments, health tracking, and connectivity. This trend increases consumer engagement and adoption, as users prefer a single device capable of handling multiple aspects of daily life, including transactions.

Urbanization and Increased Disposable Income

Urban populations with higher disposable income are fueling demand for convenient, secure, and fast payment solutions. Rising e-commerce activity, subscription-based services, and smart retail initiatives are creating a fertile environment for wearable payment adoption, especially in North America and Europe.

What are the restraints for the global market?

High Device Costs

Premium wearable payment devices, including smartwatches and payment-enabled rings, remain expensive, limiting adoption in emerging economies. Price sensitivity in markets like India, Latin America, and parts of APAC can slow market penetration for high-end devices.

Data Security and Privacy Concerns

Consumers are increasingly cautious about digital transactions and personal data privacy. Breaches, cyberattacks, or perceived vulnerability in wearable payment systems can hinder adoption. Companies must invest heavily in secure protocols, tokenization, and regulatory compliance to mitigate these concerns and build consumer trust.

What are the key opportunities in the wearable payment devices market?

Emerging Market Expansion

Asia-Pacific and Latin America present substantial growth opportunities due to expanding smartphone penetration, rising digital banking adoption, and government initiatives promoting cashless transactions. For instance, India’s UPI ecosystem and Brazil’s fintech growth offer fertile ground for wearable payment adoption, enabling manufacturers and fintech companies to capture new consumer bases.

Integration with Health, Fitness, and Corporate Ecosystems

Wearables are increasingly integrated with fitness apps, hospital payment systems, corporate payrolls, and subscription services, offering a dual-purpose device that tracks health metrics while enabling payments. This multifunctionality drives engagement, cross-selling opportunities, and recurring usage.

Technological Innovations and Partnerships

Innovations in biometric authentication, tokenization, and AI-powered personal finance applications present opportunities for differentiation. Partnerships between wearable manufacturers, banks, fintechs, and retailers enable adoption at scale while enhancing security and user experience. Companies can leverage these collaborations to tap niche markets such as premium consumers, transportation systems, and subscription-based retail models.

Device Type Insights

Smartwatches dominate the wearable payment devices market, accounting for 45% of the 2024 market (USD 3,375 million). Their ability to combine fitness tracking, notifications, and secure payment functionality makes them highly appealing globally. Fitness bands are the second-largest segment, capturing price-sensitive users who prioritize convenience and basic transaction capabilities. Emerging devices such as payment-enabled rings and glasses are carving niche segments, targeting affluent, tech-savvy consumers looking for seamless, fashion-forward solutions.

Technology Insights

NFC-enabled devices lead the market with a 55% share, owing to global acceptance in retail, transportation, and financial institutions. BLE and RFID are gaining adoption for niche applications such as access control and corporate payments. Biometric integration and tokenization are emerging as key differentiators for premium wearables, reinforcing security and trust among consumers.

Payment Type Insights

Credit and debit card-linked payments remain the dominant payment type (50%), favored for familiarity, security, and ease of integration with banking systems. Mobile wallet-linked payments are growing rapidly in APAC, driven by smartphone penetration and government-supported digital payment initiatives. Prepaid/stored value payments and emerging cryptocurrency-linked transactions remain niche but are expected to grow as digital currency adoption increases.

End-Use Insights

Retail and e-commerce are the leading end-use segments (40%), driven by frequent transactions, integration with loyalty programs, and rapid acceptance of contactless payments. Healthcare, fitness centers, and corporate payments are emerging fast-growth areas. Transportation, hospitality, and entertainment sectors are leveraging wearable payments for ticketing, fare collection, and cashless service experiences, further expanding market reach. Export-driven demand is strong from North America and Europe, while APAC serves as a major manufacturing hub.

| By Device Type | By Technology Type | By Payment Type | By End-Use / Application |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest market, accounting for 35% of global revenue in 2024. The USA and Canada lead due to high digital payment adoption, disposable income, and early NFC infrastructure deployment. Retailers, fitness centers, and transit systems are integrating wearable payments, driving consumer adoption.

Europe

Europe accounts for 25% of the market, with Germany, the UK, and France leading demand. Strong regulatory support, high smartphone penetration, and digital banking infrastructure are fueling growth. The region is particularly receptive to biometric authentication and multifunctional wearable devices.

Asia-Pacific

APAC is the fastest-growing region (12% CAGR), driven by China, India, and Japan. Rising mobile wallet usage, cashless initiatives, and expanding e-commerce ecosystems are encouraging the adoption of wearable payments. Government initiatives such as India’s “Digital India” and China’s fintech-friendly policies are accelerating market penetration.

Middle East & Africa

Adoption is moderate but growing in the UAE, Saudi Arabia, and South Africa due to urbanization, high-income populations, and contactless payment adoption in retail and hospitality sectors. Governments are promoting cashless payments to enhance economic digitization.

Latin America

Brazil and Mexico are emerging markets with growing interest in wearable payments. Urban populations and fintech innovations drive adoption in retail, transportation, and corporate applications. Market penetration is lower than in APAC and Europe, but offers significant growth potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the Wearable Payment Devices Market

- Apple

- Samsung

- Garmin

- Huawei

- Fitbit

- Xiaomi

- Fossil

- Sony

- Oppo

- Amazfit

- Polar

- Suunto

- Withings

- Montblanc

Recent Developments

- In March 2025, Apple launched the Apple Watch Series 11 with integrated biometric payment security and expanded NFC capabilities for global contactless acceptance.

- In January 2025, Samsung introduced the Galaxy Watch 7 with enhanced BLE and tokenized payment solutions for corporate and retail applications.

- In December 2024, Garmin expanded its fitness band portfolio with payment-enabled wearables targeting emerging APAC markets, integrating mobile wallet compatibility and AI-powered health insights.