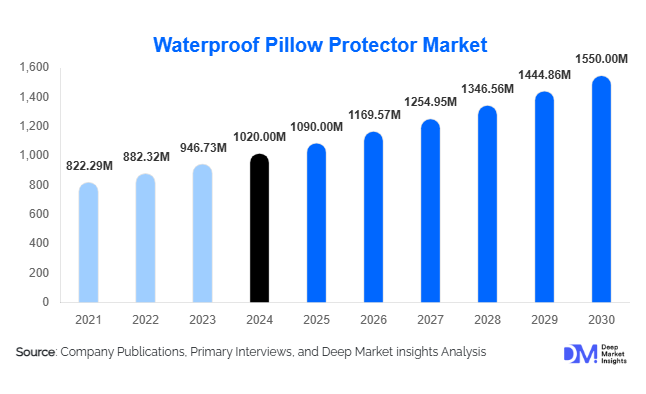

Waterproof Pillow Protector Market Size

According to Deep Market Insights, the global waterproof pillow protector market size was valued at USD 1,020 million in 2024 and is projected to grow from USD 1,090 million in 2025 to reach USD 1,550 million by 2030, expanding at a CAGR of 7.3% during the forecast period (2025–2030). The waterproof pillow protector market growth is primarily driven by the rising demand for allergen-free bedding, growing awareness regarding hygiene and sleep health, and increasing adoption of premium bedding accessories across residential, hospitality, and healthcare sectors.

Key Market Insights

- Rising focus on sleep hygiene and health-conscious consumer behavior is accelerating the adoption of waterproof pillow protectors worldwide.

- Hotels and healthcare institutions are increasing the use of waterproof bedding solutions to maintain sanitation and extend product life.

- Asia-Pacific dominates production due to large textile manufacturing bases in China, India, and Bangladesh.

- North America leads in consumption owing to high awareness of dust mite protection and hypoallergenic bedding.

- Eco-friendly and sustainable materials such as bamboo-derived viscose and organic cotton are reshaping product innovation.

- E-commerce expansion and D2C brands are significantly improving market accessibility and customization options.

Latest Market Trends

Sustainable and Eco-Friendly Material Adoption

Manufacturers are increasingly turning toward sustainable materials like organic cotton, bamboo fibers, and Tencel for waterproof pillow protectors. These eco-conscious alternatives are gaining traction among consumers seeking non-toxic, breathable, and biodegradable bedding solutions. Brands are integrating plant-based polyurethane laminates and OEKO-TEX certified fabrics to minimize environmental impact. This trend is also reinforced by growing government regulations promoting sustainable textile production and rising consumer preference for green-certified bedding products.

Smart Textile Integration and Advanced Functionalities

Technological innovation is introducing smart fabrics with features such as temperature regulation, antimicrobial coatings, and moisture-wicking technology. Waterproof pillow protectors embedded with silver-ion protection or microencapsulated aloe vera treatments are emerging as premium offerings. Additionally, advancements in TPU (thermoplastic polyurethane) membrane technology are enhancing comfort, breathability, and noise reduction — improving consumer satisfaction in both residential and institutional use cases.

Waterproof Pillow Protector Market Drivers

Growing Health and Hygiene Awareness

Heightened awareness of allergies, asthma, and skin sensitivities is driving demand for bedding products that prevent dust mites, bacteria, and liquid penetration. Post-pandemic hygiene consciousness has significantly influenced household and hospitality purchasing patterns, with waterproof pillow protectors becoming a staple for maintaining cleaner sleep environments. Hospitals and eldercare facilities are also adopting these protectors to ensure sanitary conditions and reduce the spread of infections.

Expansion of Hospitality and Healthcare Infrastructure

The rapid expansion of hotels, serviced apartments, and healthcare centers worldwide is boosting large-scale adoption of waterproof pillow protectors. These sectors require durable, easy-to-clean, and long-lasting bedding solutions to maintain hygiene standards and lower replacement costs. Partnerships between hospitality chains and bedding manufacturers are further supporting product innovation tailored to institutional needs, such as high-frequency wash compatibility and enhanced liquid resistance.

Market Restraints

Environmental Concerns Regarding Synthetic Materials

While polyurethane and polyester-based waterproof protectors offer strong functionality, they raise environmental sustainability concerns due to their non-biodegradable nature. The disposal and recycling challenges associated with synthetic materials are prompting criticism and regulatory scrutiny, particularly in developed markets with stringent eco-compliance standards.

Price Sensitivity in Developing Regions

In price-sensitive markets, particularly in parts of Asia, Africa, and Latin America, the higher cost of quality waterproof protectors compared to regular pillow covers limits mass adoption. Low-cost alternatives with inferior waterproofing performance also pose challenges for established brands attempting to capture emerging economies.

Waterproof Pillow Protector Market Opportunities

Rising Demand for Premium and Personalized Bedding

The premium bedding segment is expanding rapidly, with consumers seeking enhanced comfort, aesthetic appeal, and long-term protection. Manufacturers are offering customizable designs, sizes, and fabric textures to meet diverse consumer preferences. Integration of branding, embroidery, and design aesthetics in pillow protectors is opening new opportunities for luxury and boutique home textile labels.

E-Commerce and Direct-to-Consumer Expansion

The digital retail revolution is creating strong growth opportunities for brands to reach global consumers directly. Online platforms allow personalized marketing, subscription-based bedding replacement models, and real-time feedback-driven product improvements. D2C brands such as Coop Home Goods, SafeRest, and LUCID have leveraged this trend to strengthen brand loyalty and enhance consumer accessibility.

Product Type Insights

The market is segmented into cotton-based, polyester-based, bamboo-based, and others. Cotton-based protectors dominate due to their comfort and breathability, while polyester variants offer cost-effective waterproofing for institutional use. Bamboo-based protectors are gaining rapid traction due to their natural antibacterial properties, moisture absorption, and eco-friendly profile. Hybrid models combining cotton and TPU membranes are becoming standard among mid- to high-end consumers.

Application Insights

Residential use remains the largest application segment, driven by consumer awareness of allergen protection and home hygiene. Hospitality and healthcare applications are expanding due to strict sanitation requirements and frequent washing cycles. Additionally, institutional buyers such as dormitories, military housing, and care homes are adopting waterproof pillow protectors to ensure durability and hygiene compliance.

Distribution Channel Insights

Online retail leads the market, with major e-commerce platforms and brand-owned websites providing easy product comparison and customization. Offline retail channels such as specialty bedding stores, supermarkets, and department stores remain vital for consumers preferring physical inspection before purchase. Subscription and D2C models are gaining momentum, supported by digital advertising and influencer-driven promotions.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America dominates the global waterproof pillow protector market, driven by high consumer awareness, strong retail infrastructure, and widespread use of hypoallergenic bedding. The U.S. accounts for the largest share, with demand bolstered by the booming home textile and hospitality sectors.

Europe

Europe represents a mature market emphasizing eco-friendly and certified textile products. Countries like Germany, the U.K., and France lead the adoption of sustainable waterproof protectors. EU sustainability directives and consumer demand for organic materials are driving continuous innovation.

Asia-Pacific

Asia-Pacific is projected to be the fastest-growing regional market, supported by expanding middle-class populations, rapid urbanization, and the presence of major textile manufacturing hubs. Rising export activity from China and India, along with increasing domestic demand for hygiene-focused bedding, continues to fuel regional growth.

Latin America

Latin America’s market is steadily growing, particularly in Brazil and Mexico, where hotel investments and health awareness campaigns are increasing in adoption. Local manufacturing expansion and partnerships with global brands are also improving regional supply capabilities.

Middle East & Africa

The Middle East and Africa market is growing at a moderate pace, driven by expanding hospitality sectors in the UAE and Saudi Arabia. Africa’s emerging healthcare infrastructure and rising import of bedding goods present new opportunities for international suppliers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Waterproof Pillow Protector Market

- Protect-A-Bed

- SafeRest

- Coop Home Goods

- LUCID

- SureGuard

- Hospitology Products

- Utopia Bedding

- Linenspa

Recent Developments

- In August 2025, SafeRest launched a new line of eco-certified bamboo waterproof protectors featuring biodegradable TPU membranes to enhance sustainability.

- In June 2025, Protect-A-Bed announced a collaboration with hospitality chains in North America to provide a large-scale supply of commercial-grade waterproof bedding solutions.

- In February 2025, Coop Home Goods introduced its “CleanSleep Series,” combining waterproof protection with silver-ion antimicrobial technology for improved hygiene and odor control.