Water Sink Market Size

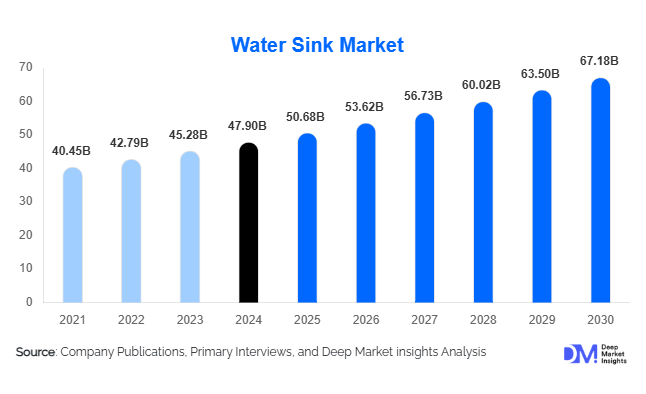

According to Deep Market Insights, the global water sink market size was valued at USD 47.9 billion in 2024 and is projected to grow from USD 50.68 billion in 2025 to reach USD 67.18 billion by 2030, expanding at a CAGR of 5.8% during the forecast period (2025–2030). The market growth is primarily driven by the increasing pace of urbanization, rapid residential and commercial construction, rising demand for modern kitchen and bathroom fixtures, and growing consumer preference for aesthetic and sustainable interior designs.

Key Market Insights

- Rising construction and renovation activities in both residential and commercial sectors are fueling the demand for innovative and durable water sink products globally.

- Material innovation, including stainless steel, ceramic, quartz, and composite granite sinks, is broadening product variety and boosting market competitiveness.

- Smart sinks featuring touchless faucets, water-saving sensors, and anti-bacterial coatings are gaining traction, particularly in premium households and hospitality establishments.

- Asia-Pacific dominates global production and consumption, driven by rapid infrastructure growth and expanding middle-class housing demand.

- Europe remains a key innovation hub, focusing on sustainable materials, eco-friendly manufacturing, and high-end designer sinks.

- North America continues to lead in technological integration and remodeling projects, especially in luxury kitchen and bathroom renovations.

Latest Market Trends

Smart and Touchless Sink Technologies

The integration of smart technologies into water sinks is transforming modern households and commercial spaces. Touchless faucet systems, temperature-regulated sinks, and app-controlled water monitoring are becoming popular among tech-savvy consumers. These features enhance hygiene, conserve water, and elevate convenience factors that are particularly appealing in post-pandemic interior design trends. Leading manufacturers are incorporating IoT-enabled systems that track water usage and detect leaks, promoting sustainability and reducing operational costs in commercial kitchens and public washrooms.

Eco-Friendly and Sustainable Materials

Environmental awareness and stringent building codes are driving the adoption of sustainable sink materials such as recycled stainless steel, bio-resins, and natural stone composites. Manufacturers are shifting toward low-emission production processes and recyclable packaging to align with global green building certifications. Consumers increasingly favor sinks that combine durability with minimal environmental impact, encouraging brands to market eco-certified collections. This sustainability trend aligns with broader circular economy goals in the construction and home improvement industries.

Water Sink Market Drivers

Rising Residential and Commercial Construction

Rapid urbanization and expanding real estate developments worldwide are major drivers of the water sink market. The growing number of housing projects, kitchen remodels, and bathroom upgrades across emerging economies like China, India, and Indonesia is fueling sustained demand. In developed markets, home renovation activities, particularly kitchen redesigns and luxury bathroom installations, continue to support market growth. Commercial segments such as hotels, hospitals, restaurants, and offices are also contributing significantly through continuous refurbishment and design upgrades.

Increasing Consumer Focus on Design and Functionality

Modern consumers are increasingly viewing sinks as integral elements of interior aesthetics. Demand for stylish, ergonomic, and multi-functional sink designs has surged, leading to greater experimentation with shapes, colors, and surface finishes. The popularity of undermount, farmhouse, and double-bowl sinks reflects this trend. Manufacturers are also introducing noise-reduction coatings, heat-resistant materials, and space-saving sink models to meet evolving customer preferences. Design-oriented customization options are creating opportunities in the premium home improvement segment.

Market Restraints

High Material and Installation Costs

The high cost of premium materials such as granite, quartz, and ceramic composites, combined with expensive installation and plumbing requirements, limits market accessibility for cost-sensitive consumers. Additionally, the need for skilled labor and customized fitting increases total ownership costs, especially in developing regions. Price volatility of raw materials like stainless steel and resins also poses a challenge to manufacturers’ profitability.

Fluctuating Construction Demand and Supply Chain Disruptions

Market growth is vulnerable to cyclical construction trends and global economic conditions. Slowdowns in real estate investment or infrastructure development directly impact sink demand. Furthermore, supply chain disruptions, especially in raw material procurement and logistics, can delay manufacturing timelines and inflate costs. The post-pandemic rebound has exposed vulnerabilities in global supply chains, compelling manufacturers to diversify sourcing and regional production bases.

Water Sink Market Opportunities

Growth in Smart Homes and IoT Integration

The expansion of smart home ecosystems presents new growth opportunities for connected kitchen and bathroom sinks. Integration with voice assistants, app-based water usage analytics, and sensor-driven temperature control systems is expected to accelerate adoption among tech-forward consumers. Manufacturers that partner with IoT platform providers are likely to capture a significant share of this emerging segment, especially in North America and Europe.

Expansion in Emerging Economies

Emerging economies in the Asia-Pacific, the Middle East, and Africa are witnessing rapid infrastructure growth, supported by government housing initiatives and rising disposable incomes. Urban migration and the proliferation of smart city projects are driving large-scale installation of modern sinks in residential, commercial, and public facilities. The growing adoption of Western-style kitchens and bathrooms is further stimulating demand for innovative sink designs, particularly in India, Vietnam, and the Philippines.

Product Type Insights

Stainless steel sinks dominate the market due to their affordability, durability, and wide availability. Ceramic and composite sinks are gaining popularity in high-end applications for their aesthetic appeal and scratch resistance. Granite and quartz sinks represent the premium segment, preferred for their visual elegance and resilience. Additionally, smart sinks integrated with touchless and water-saving technologies are emerging as a high-growth category, particularly in commercial and luxury residential projects.

Application Insights

The residential sector accounts for the majority of water sink demand, driven by new housing developments and kitchen remodels. Commercial applications, including hotels, restaurants, hospitals, and office buildings, form the second-largest segment, emphasizing durability and hygiene. Industrial sinks are increasingly used in laboratories, workshops, and manufacturing facilities, where corrosion resistance and large-capacity handling are critical.

Distribution Channel Insights

Offline retail channels, including home improvement stores, specialty plumbing outlets, and dealer networks, remain the dominant distribution route for sinks. However, online sales through e-commerce platforms such as Amazon, Home Depot, and manufacturer-direct websites are rapidly growing. Consumers increasingly prefer online comparison tools and virtual visualization features before purchasing. Manufacturers are investing in digital marketing and augmented reality (AR) technologies to enhance the online shopping experience.

| By Product Type | By Application | By Distribution Channel | By Material Type | By Installation Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global water sink market, supported by massive construction activity and the expansion of urban housing. China, India, and Japan account for the majority of regional demand, with rapid adoption of modular kitchens and luxury bathrooms. Rising disposable incomes and government-led housing schemes further accelerate market penetration. Local manufacturing strength and cost advantages position the region as both a key consumer and production hub.

North America

North America represents a mature market characterized by high renovation spending and technological innovation. The U.S. drives regional demand with strong adoption of smart sinks, touchless faucets, and luxury kitchen upgrades. Sustainability initiatives and green building certifications are further encouraging eco-friendly sink installations. Replacement demand in aging homes also contributes significantly to market stability.

Europe

Europe remains a major innovation center, with leading brands focusing on sustainable materials, minimalist designs, and compliance with environmental regulations. Countries such as Germany, Italy, and the U.K. lead in design-driven sink manufacturing. The European consumer base strongly favors premium and eco-labeled products, creating opportunities for high-margin players emphasizing craftsmanship and durability.

Middle East & Africa

Infrastructure expansion and luxury residential developments in the UAE, Saudi Arabia, and South Africa are propelling regional demand. Rising hospitality investments and the proliferation of commercial kitchens are also stimulating the water sink market. The region is becoming a strategic target for global sink manufacturers seeking to capture long-term growth from high-value construction projects.

Latin America

Latin America shows steady growth, led by Brazil, Mexico, and Argentina. Expanding residential construction and improving consumer lifestyles are contributing to increasing sink demand. Domestic manufacturers are diversifying portfolios with modern materials and designs to meet rising consumer expectations for quality and affordability.

Company Market Share

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Water Sink Market

- Franke Holding AG

- Elkay Manufacturing Company

- Kohler Co.

- Rohl LLC

- Blanco America Inc.

- Duravit AG

- Teka Group

Recent Developments

- In August 2025, Kohler Co. unveiled a new series of smart kitchen sinks with integrated voice-activated water controls and built-in filtration systems to support sustainable water management.

- In May 2025, Franke Holding AG expanded its manufacturing facility in Switzerland to increase production capacity for composite granite sinks, emphasizing energy-efficient processes.

- In February 2025, Blanco America launched a premium collection of quartz sinks designed for modern kitchens, featuring enhanced stain resistance and contemporary styling.