Water Scooter Market Size

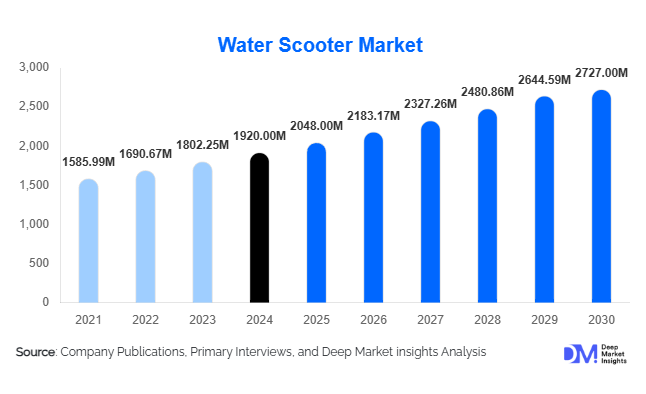

According to Deep Market Insights, the global water scooter market size was valued at USD 1,920 million in 2024 and is projected to grow from USD 2,048 million in 2025 to reach USD 2,727 million by 2030, expanding at a CAGR of 6.6% during the forecast period (2025–2030). The market’s growth is driven by the rising popularity of recreational water sports, technological advancements in propulsion and battery systems, and increasing integration of water scooters into tourism and commercial rental ecosystems across the globe.

Key Market Insights

- Water sports and adventure tourism are major demand catalysts, particularly in coastal and island economies investing in leisure infrastructure.

- Fuel-operated scooters currently dominate the propulsion segment, but electric and hybrid models are the fastest-growing subcategory due to environmental regulations and consumer preferences.

- Commercial rental applications account for nearly half of global demand, as resorts and marinas adopt fleet-based water scooter offerings.

- North America leads the global market with a share of around 34 % in 2024, followed by Europe and Asia-Pacific.

- Asia-Pacific is the fastest-growing region, supported by surging tourism, expanding middle-class income, and new water-sport infrastructure in countries such as India, China, and Indonesia.

- Technological innovation, including improved batteries, IoT-based safety tracking, and AI-enhanced navigation, continues to redefine user experience and operational safety.

Latest Market Trends

Electrification and Eco-Friendly Propulsion

The global shift toward sustainability is reshaping the water scooter industry. Manufacturers are investing heavily in electric and hybrid propulsion systems to reduce emissions and noise pollution. Lightweight lithium-ion batteries and sealed waterproof electronics are enhancing performance, while extended runtime and rapid charging capabilities are improving the feasibility of electric scooters for both personal and rental applications. Several countries in Europe and the Asia-Pacific are introducing incentives and port-side charging facilities to accelerate the transition toward eco-friendly models, reinforcing the long-term sustainability of the sector.

Rise of Rental and Subscription-Based Models

Resorts, marinas, and adventure tourism operators are increasingly adopting rental or subscription-based models to make water scooters accessible without ownership barriers. This trend aligns with the broader experience economy, where tourists prefer on-demand leisure activities. Operators are leveraging digital booking platforms, GPS tracking, and integrated payment systems to streamline fleet management and enhance customer convenience. These business models are expanding rapidly in North America, the Mediterranean, and Southeast Asia, offering recurring revenue opportunities for manufacturers and rental operators alike.

Integration of Smart Features and Safety Enhancements

Modern water scooters are equipped with intelligent control systems, GPS-based geofencing, and emergency cut-off switches to ensure operational safety. Connectivity features such as smartphone apps and remote diagnostics enable real-time performance tracking and predictive maintenance. Premium models now offer modular design, underwater cameras, and stability sensors, appealing to both recreational users and professional operators. The integration of AI and IoT technologies is transforming water scooters into smart, connected mobility devices for marine environments.

Water Scooter Market Drivers

Growing Recreational and Adventure Tourism

The global rise in water-based tourism and recreational activities, particularly in beach, island, and lake destinations, is a key driver for water scooter demand. Expanding adventure tourism in Asia-Pacific, North America, and Europe has led resorts and rental agencies to diversify offerings with personal watercraft. Governments in coastal economies are also investing in marinas and leisure infrastructure, further supporting the adoption of water scooters for both personal and commercial recreation.

Technological Advancements in Propulsion and Safety

Innovations in propulsion, lightweight materials, and battery management systems are significantly enhancing performance and safety standards. Electric propulsion systems are reducing maintenance needs and operational costs, while high-efficiency hull designs improve maneuverability and energy consumption. Integration of digital dashboards, GPS navigation, and geofencing adds a layer of control and monitoring, making water scooters safer and more accessible to first-time users.

Rising Disposable Incomes and Expanding Middle-Class Populations

The growth of middle- and high-income groups in emerging markets such as India, China, and Brazil is increasing participation in recreational marine activities. Consumers are allocating more spending toward leisure and adventure experiences, which translates directly to demand for affordable personal watercraft and rental-based water scooters. This demographic trend is expected to sustain market momentum throughout the next decade.

Market Restraints

High Costs and Limited Infrastructure

High initial costs, combined with limited charging or refueling infrastructure in developing markets, are constraining adoption. Electric water scooters, while sustainable, face challenges related to battery life and maintenance costs. The absence of dedicated service networks and marina facilities in certain regions adds to operational constraints for both personal and commercial users.

Safety Regulations and Operational Restrictions

Stricter safety regulations, licensing requirements, and environmental restrictions across coastal and inland waterways can hinder expansion. Operators must comply with noise and speed limits, safety certifications, and insurance mandates, particularly in tourism-driven economies. These compliance costs can slow down the growth of small rental operators and deter first-time buyers in regulated markets.

Water Scooter Market Opportunities

Expansion of Tourism and Rental Ecosystems

The rapid expansion of coastal tourism and adventure water sports offers a strong growth avenue for manufacturers and rental operators. Resorts are increasingly integrating water scooters into activity portfolios, while specialized rental companies are scaling fleets in high-traffic tourist destinations. Partnerships between OEMs and resort chains can create co-branded experiences that generate recurring revenue streams and enhance visibility.

Electrification and Sustainable Innovation

With environmental sustainability at the forefront of policy and consumer demand, the transition toward electric water scooters represents one of the most significant opportunities. Manufacturers investing in R&D for longer-range batteries, solar-assisted charging, and lightweight hull composites can secure leadership positions. Sustainability certifications and zero-emission models are expected to attract eco-conscious consumers and regulatory incentives worldwide.

New Application Areas: Rescue, Military, and Surveillance

Water scooters are finding new utility in coast-guard operations, rescue missions, and underwater surveillance. Compact, high-torque models capable of maneuvering in difficult marine conditions are increasingly being adopted by public agencies. These applications present opportunities for OEMs to diversify portfolios beyond leisure markets into institutional and government contracts.

Product Type Insights

Water surface scooters lead the market, accounting for approximately 60% of global revenue in 2024. Their dominance stems from versatility, affordability, and ease of use for both private and rental customers. The growing popularity of leisure water sports, coupled with commercial rental fleets in resorts and marinas, further drives adoption. Underwater scooters serve a niche diving market, appealing to professionals and enthusiasts seeking underwater propulsion for exploration, filming, and eco-tourism. As underwater tourism and adventure diving expand, this sub-segment is expected to witness above-average growth rates in the coming years.

Propulsion Insights

Fuel-operated water scooters currently dominate the propulsion segment, contributing about 65% of total market share in 2024. Their advantages include higher speed, extended range, and established refueling infrastructure, making them ideal for commercial rentals, professional operations, and military applications. However, electric and hybrid scooters are projected to grow at the fastest rate, driven by environmental awareness, stricter regulations on emissions, noise reduction benefits, and government incentives promoting eco-friendly recreational vehicles. Advancements in marine battery technology and lightweight hull materials are enhancing electric scooter performance, making them increasingly viable for personal and commercial use.

Application Insights

Commercial applications, including rentals, resorts, and adventure tourism, represent roughly 50% of global demand in 2024. This segment is fueled by expanding tourism, rising coastal infrastructure, and professional applications such as rescue and patrolling. Personal/recreational ownership follows closely, driven by leisure activities and competitive pricing that make water scooters accessible to a broader consumer base. Military and rescue applications are emerging segments, with adoption supported by specialized operations, increased defense budgets, and the suitability of water scooters for rapid and covert missions.

| By Product Type | By Propulsion | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America dominates the global water scooter market, accounting for approximately 34% share in 2024 (around USD 650 million). Growth is driven by high disposable incomes, enabling consumers to invest in recreational vehicles, and a well-established tourism and water sports infrastructure. The United States leads regional demand due to extensive coastlines, a mature leisure activity culture, and an established rental ecosystem. OEMs like Yamaha and BRP maintain a strong regional presence, offering diverse product lines. Additionally, the integration of digital fleet management, GPS-enabled scooters, and smart safety features is further enhancing adoption in both recreational and commercial segments.

Europe

Europe holds about 23–25% of the global market share, with key markets including Germany, France, Italy, and Spain. Growth is fueled by a strong maritime culture, which encourages water-based recreation and sports, and increasing environmental regulations, prompting the adoption of electric and hybrid scooters. The region’s emphasis on sustainable tourism and eco-certified infrastructure supports rising demand for low-emission water scooters in resorts and adventure activities. Government incentives and subsidies for eco-friendly recreational vehicles are also accelerating the shift toward battery-operated models.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with an expected CAGR exceeding 8%, holding about 25% market share in 2024 (USD 475 million). Growth is driven by a rapidly expanding middle-class population, rising disposable incomes, and an increasing focus on leisure and adventure tourism in coastal countries such as Thailand, Indonesia, India, and Australia. Government initiatives promoting marine tourism, including “Incredible India” and “Indonesia Wonderful Tourism,” are boosting the adoption of both rental and personal water scooters. Additionally, new resorts, marinas, and water-sport operators are expanding offerings to meet rising consumer demand for recreational and adventure watercraft.

Latin America

Latin America contributes approximately a 10–12% share of the global market. Growth is fueled by increasing tourism in coastal destinations such as Brazil, Mexico, and the Caribbean. Expanding adventure and leisure tourism, coupled with foreign investments in beach resorts, is driving rental demand. However, cost barriers and limited infrastructure in certain regions constrain rapid adoption. Affordability and accessibility of personal-use scooters are expected to gradually enhance penetration across emerging Latin American markets.

Middle East & Africa

Holding around 10% of the global market share, the Middle East & Africa region is emerging as a premium market. Countries like the UAE, Saudi Arabia, and Qatar are witnessing luxury tourism growth and marina development, which is boosting demand for high-end water scooters. Africa’s coastal nations, particularly South Africa, Kenya, and Egypt, are leveraging adventure and eco-tourism initiatives. Market growth in this region is supported by rising disposable income, increasing leisure tourism, and government investments in waterfront infrastructure. Military and professional use of water scooters is also contributing to regional demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Water Scooter Market

- Bombardier Recreational Products (BRP)

- Yamaha Motor Co., Ltd.

- Kawasaki Heavy Industries Ltd.

- Dive Xtras Inc.

- SubGravity Inc.

- SUEX S.r.l.

- Torpedo Inc.

- TUSA Inc.

- Nellis Engineering Inc.

- Belassi GmbH

- Genesis Marine

- Taiga Motors

- Hison Jet Ski Co.

- Jettribe

- DiverTug

Recent Developments

- In May 2025, Yamaha Motor Co. Ltd. announced the launch of its next-generation electric WaveRunner series, integrating AI-based safety controls and modular battery packs for extended runtime.

- In April 2025, BRP introduced a hybrid Sea-Doo platform with reduced emissions and Bluetooth-enabled diagnostics, targeting premium rental fleets in Europe and North America.

- In February 2025, Taiga Motors unveiled its first mass-produced electric personal watercraft designed for both recreational and commercial operators, focusing on zero-emission performance and digital fleet monitoring.